Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Shineman Foundation awards Crouse Health $150K grant for NICU renovation project

SYRACUSE, N.Y. — The Richard S. Shineman Foundation of Oswego has awarded Crouse Health a $150,000 grant to help pay for the renovation and expansion

Destiny USA says motor coach visits increased 11 percent in 2019

SYRACUSE, N.Y. — Destiny USA announced that it generated an 11 percent increase in motor coach visits in 2019, compared to the year before. Motor

Oneida County woman accused of stealing more than $3,000 from her employer

SYLVAN BEACH, N.Y. — New York State Police in Sylvan Beach on Thursday arrested 22-year-old Shania A. Leonard, of Blossvale, for 3rd degree grand larceny

KeyCorp to pay cash dividend of 18.5 cents a share in March

KeyCorp (NYSE: KEY) — parent of KeyBank, the No. 2 bank ranked by deposit market share in the 16-county Central New York area — has declared a quarterly cash dividend of 18.5 cents per share of its common stock for the first quarter of 2020. The dividend is payable on March 13, to shareholders of

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

KeyCorp (NYSE: KEY) — parent of KeyBank, the No. 2 bank ranked by deposit market share in the 16-county Central New York area — has declared a quarterly cash dividend of 18.5 cents per share of its common stock for the first quarter of 2020.

The dividend is payable on March 13, to shareholders of record as of the close of business on March 3.

Headquartered in Cleveland, Ohio, Key is one of the nation’s largest bank-based financial services companies, with assets of $146.7 billion as of Sept. 30, 2019. Its roots trace back 190 years to Albany.

In the 16-county CNY region, KeyBank had 66 branches and $4.6 billion in deposits, good for a 15.07 percent market share, according to the latest FDIC statistics as of last June 30.

Syracuse Stamping Company leases space

DeWITT — Syracuse Stamping Company recently leased 8,800 square feet at the industrial warehouse located at 6299 Meade Road in DeWitt. Gary Cottet and Patrick Hillery of Cushman & Wakefield/Pyramid Brokerage Company exclusively marketed the property and represented the owner Benjamin Ridley in this lease transaction. Founded in 1908, the Syracuse Stamping Co., based at

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

DeWITT — Syracuse Stamping Company recently leased 8,800 square feet at the industrial warehouse located at 6299 Meade Road in DeWitt.

Gary Cottet and Patrick Hillery of Cushman & Wakefield/Pyramid Brokerage Company exclusively marketed the property and represented the owner Benjamin Ridley in this lease transaction.

Founded in 1908, the Syracuse Stamping Co., based at 1054 South Clinton St. in Syracuse, says it manufactures garage-door hardware, gate faucets, and inked-ribbon spools.

The company produces a complete line of garage-door rollers, hinges, pulleys and forks, bearings, handles, operator-plate brackets, top brackets, bottom brackets, clips, and rolling-door hardware. The gate faucets the firm makes are specially designed for fast dispensing of non-flammable viscous liquids from storage containers. Syracuse Stamping Co. manufactures a full-line of metal, plastic, and composite inked-ribbon spools, as well as a variety of sizes of clips and strips.

Delta Engineers uses acquisition to open Syracuse-area office, add services

Delta Engineers, Architects, & Land Surveyors, DPC (Delta), which is based in Broome County, has wanted to open an office in the Syracuse area for quite some time. The firm has worked with Syracuse University and other clients in the Syracuse area. “[Such an office] would allow us to further establish that market penetration,” says Anthony Paniccia,

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Delta Engineers, Architects, & Land Surveyors, DPC (Delta), which is based in Broome County, has wanted to open an office in the Syracuse area for quite some time.

The firm has worked with Syracuse University and other clients in the Syracuse area.

“[Such an office] would allow us to further establish that market penetration,” says Anthony Paniccia, president & CEO of Endwell–based Delta Engineers.

In the middle part of 2019, a company that deals with mergers and acquisitions alerted Delta Engineers that Terrestrial Environmental Specialists, Inc. (TES) wanted to join a larger firm.

Paniccia spoke with Steve Gido of Rusk O’Brien Gido + Partners, LLC, which advises architecture, engineering, planning and environmental consulting firms. It has offices near Boston, Massachusetts; Washington, D.C.; and in Las Vegas, Nevada.

The discussions with TES started in mid-2019 and progressed during the fall, according to Paniccia, who spoke with CNYBJ on Jan. 21.

Delta earlier this month announced it has acquired TES in a deal that became effective Jan. 10. The firm didn’t release any financial terms of the agreement.

Previously based in Phoenix in Oswego County, TES staff members have moved to a new Delta office at 6700 Thompson Road, Suite 1 in DeWitt. TES is now operating under the Delta brand.

In the deal, Delta adds TES’s six employees, increasing the Delta employee count to 150, Kim Collavo, marketing manager at Delta, tells CNYBJ. The firm operates four offices in New York state and one in Maryland. Besides Endwell and DeWitt, its other two Empire State locations are in Vernon and Schenectady.

Getting acquainted

Paniccia notes that Delta was familiar with TES but didn’t recall having worked with the firm in the last decade. Delta has worked with other consultants that provide services that are similar to the ones that TES offers.

“We do know they have a very good reputation and they have stability in their firm … and wanted to relocate to [the] Syracuse [area],” says Paniccia.

Stephen Sheridan, who prior to the acquisition was a principal with TES, says he wasn’t familiar with Delta Engineers prior to the start of acquisition discussions.

Sheridan and Bernard Carr, another of the TES former principals, met with Delta’s Paniccia in the spring of 2019.

Adding services

TES ecological services will “expand the existing portfolio of Delta and enhance the breadth of consulting expertise” available to the client rosters of each firm, Delta says.

Sheridan, who serves as Delta’s Syracuse office director and director of the firm’s ecological science services group, explains what the group focuses on.

“We specialize primarily in wetlands, but we also [handle] endangered and threatened species, [and] vegetation inventories. We work from local residential developers to commercial developers to the mining industry and utility industry,” says Sheridan, who spoke with CNYBJ on Jan. 20.

“All of those services are what Delta did not provide [for its clients],” Paniccia adds.

TES was founded in 1975 in response to state and federal legislation related to the nuclear industry. The firm now specializes in natural resource and ecological services with emphasis on wetland delineation, wetland mitigation, and ecological inventories.

It also provides related services such as environmental-impact statements, wildlife-habitat restoration, plant and water quality studies, and subject-matter expertise for court proceedings.

Upstate University Hospital opens adolescent psychiatric unit

SYRACUSE — Upstate University Hospital has opened its first inpatient unit for adolescents requiring acute psychiatric care. It will focus on the treatment of children 12 to 17 years of age. The hospital expects the average length of their stay to last five to seven days. After a formal ribbon-cutting event on Jan. 17, the

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE — Upstate University Hospital has opened its first inpatient unit for adolescents requiring acute psychiatric care.

It will focus on the treatment of children 12 to 17 years of age. The hospital expects the average length of their stay to last five to seven days.

After a formal ribbon-cutting event on Jan. 17, the unit officially opened Jan. 21, Kathleen Froio, manager of media relations at Upstate Medical University, tells CNYBJ.

Upstate University Hospital will staff the eight-bed unit with child and adolescent psychiatrists, nurses, and mental-health therapists.

The total cost to build the unit is $3.8 million, partially funded by capital dollars from Upstate, in addition to support from the Advocates for Upstate and the Upstate Foundation.

An increase in the number of inpatient adolescent psychiatric beds in Central New York was one of 17 recommendations included in the final report of the youth mental health task force that U.S. Rep. John Katko (R–Camillus) and New York State Assemblyman William Magnarelli (D–Syracuse) created in April 2015.

“The unit is a small step in addressing a critical need here in Central New York for mental health services for our youth,” Dr. Mantosh Dewan, interim president of Upstate Medical University, said. “Our commitment to this pressing need does not end with this unit’s opening. Upstate will continue to be part of the community discussion moving this important issue forward with great urgency.”

About the unit

The adolescent psychiatry inpatient unit, designed for acute admission and stabilization, will use dialectal-behavioral therapy (DBT) as the key component of treatment.

“DBT can treat patients with suicidal and self-destructive behaviors, aggression and psychiatric disorders such as depression, anxiety, and post-traumatic stress disorder,” Dr. Wanda Fremont, professor of psychiatry and vice chair of child psychiatry at Upstate Medical University, said in a statement.

Fremont also noted that 20 percent of U.S. children suffer from mental-health problems and the suicide rate among people ages 10 to 24 increased by 56 percent between 2006 and 2017.

“Suicide is now the second-leading cause of adolescent death. Research shows that DBT helps patients cope with distressing emotions leading to changes in unhealthy behaviors, lower rates of readmission and reduced suicide attempts,” said Fremont.

The 7,500-square-foot unit includes a comfort room where patients can “deescalate and reduce agitation and anxiety” with items like weighted blankets, comfortable chairs, music, muted lighting, and quiet activities. The activity room will focus on individual and group activities focusing on art therapy and music.

The unit will also have a dedicated art and recreation therapist, and two occupational therapists, Upstate said.

Whenever possible families will be included in the treatment plan for patients, with unlimited visitation during visiting hours, as family involvement is an expectation of this unit and program. Patients will have their own rooms and the unit will be locked for safety, a standard protocol for similar inpatient settings.

Patients will be discharged to outpatient child and adolescent mental-health resources in the community, including mental-health clinics and private mental-health clinicians.

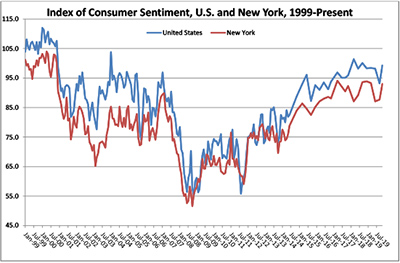

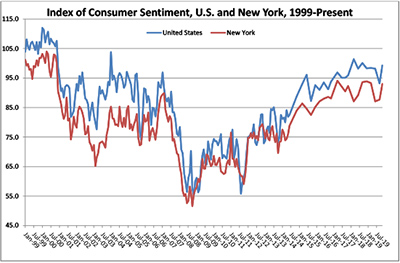

Upstate, statewide consumer sentiment climb in Q4

Consumer sentiment in upstate New York rose 7.1 points to 92.4 in the fourth quarter of 2019, up from the last measurement of 85.3 in the year’s third quarter. That’s according to the latest quarterly survey of Upstate and statewide consumer sentiment that the Siena College Research Institute (SRI) released Jan. 7. Upstate’s overall sentiment

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Consumer sentiment in upstate New York rose 7.1 points to 92.4 in the fourth quarter of 2019, up from the last measurement of 85.3 in the year’s third quarter.

Consumer sentiment in upstate New York rose 7.1 points to 92.4 in the fourth quarter of 2019, up from the last measurement of 85.3 in the year’s third quarter.

That’s according to the latest quarterly survey of Upstate and statewide consumer sentiment that the Siena College Research Institute (SRI) released Jan. 7.

Upstate’s overall sentiment of 92.4 was 0.6 points below the statewide consumer-sentiment level of 93.0, which rose 5.3 points from the third quarter.

The statewide figure was 6.3 points lower than the fourth-quarter figure of 99.3 for U.S. consumer sentiment, which rose 6.1 points from the third-quarter reading generated from the University of Michigan’s consumer-sentiment index.

Consumer sentiment, both nationally and in New York state, is at or within a couple of points of the highest readings we’ve seen in the last 10 years, Don Levy, director of the Siena College Research Institute (SRI), said in the SRI report.

“The decade dawned with consumers pessimistic and reluctant to spend. By the end of 2014, New Yorkers had crossed the breakeven point and displayed growing optimism and now for the last three years, consumers have been strongly optimistic. Today’s index reading is 17 points above the breakeven point, 9 points above the end of 2014 and over 27 points higher than where the decade began. We still have serious concerns, but it is helpful to look back,” said Levy.

In the fourth quarter of 2019, buying plans were up 3.6 percentage points since the third-quarter measurement to 52.4 percent for consumer electronics; and up 0.5 points to 11.1 percent for homes.

Buying plans fell 5 percentage points to 21.6 percent for cars and trucks, declined 0.7 points for furniture, and dipped 0.1 points to 25.2 percent for major home improvements.

“Buying plans remain strong and are up between 17 and 63 percent from 2014, and for cars, homes, furniture and home repairs, between 75 and 177 percent since the end of 2019,” said Levy.

Gas and food prices

In SRI’s quarterly analysis of gas and food prices, 42 percent of upstate New York respondents said the price of gas was having a serious impact on their monthly budgets, up from 41 percent in the third quarter but down from 49 percent in the second quarter.

In addition, 41 percent of statewide respondents said the price of gas was having a serious impact on their monthly spending plans, up from 40 percent in the third quarter but down from 43 percent in the second quarter.

When asked about food prices, 56 percent of upstate respondents indicated the price of groceries was having a serious impact on their finances, unchanged from the third quarter and down from 57 percent in the second quarter.

At the same time, 58 percent of statewide respondents indicated the price of food was having a serious impact on their monthly finances, down from 60 percent in the third quarter and 64 percent in the second quarter.

“Concern over gasoline prices and food costs have varied across the decade with average concern over gas prices affecting 46 percent and food affecting 63 percent. Today, worries over affording those staples are below the decade average but above the lows of 27 percent for gas and 52 percent for food,” Levy said.

SRI conducted its survey of consumer sentiment between Nov. 19 and Nov. 22 by telephone calls to 402 New York resident adults via landline and cell phones and 400 responses drawn from a proprietary online panel of New Yorkers.

It has an overall margin of error of plus or minus 3.6 percentage points, according to SRI.

Ansco Lofts development in Binghamton includes residential, commercial space

BINGHAMTON — The Ansco Lofts, a development located at the site of the former Ansco Camera Factory in Binghamton, has opened following a $25 million renovation project. Paulus Development of Syracuse renovated the property into a mixed-use development that offers 100 new lofts and nearly 35,000 square feet of commercial space on the building’s ground

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

BINGHAMTON — The Ansco Lofts, a development located at the site of the former Ansco Camera Factory in Binghamton, has opened following a $25 million renovation project.

Paulus Development of Syracuse renovated the property into a mixed-use development that offers 100 new lofts and nearly 35,000 square feet of commercial space on the building’s ground floor, the Community Preservation Corp. announced.

Paulus Development is a Syracuse–based, real-estate development and management firm. The Community Preservation Corporation (CPC) is a nonprofit affordable housing and community revitalization finance company. CPC is based in New York City and operates a regional office in Syracuse.

Hueber-Breuer Construction Co. Inc. of Syracuse and Empire State Development (ESD) were also involved in the project.

CPC provided a nearly $20 million construction loan for the redevelopment. Empire State Development provided a $2 million Southern Tier Soaring Upstate Revitalization Initiative grant, and the project received an equity investment from Chase Community Equity, as the project qualified for federal and state historic rehabilitation tax credits.

CPC serves communities throughout New York state, providing construction financing for all types of multi-family housing, including units involved in downtown revitalization, adaptive reuse, affordable and supportive housing, acquisition and rehabilitation of distressed properties, and ground-up construction.

About Ansco Camera Factory

The building was opened in 1928 by the General Cigar Company and purchased in 1937 by the Ansco Camera Factory, which operated from the building until 1977. The Ansco Camera Factory was placed on the National Register of Historic Places in 2012. The redevelopment of the factory preserved its “historic, recognizable” features including its “custom oversized” factory windows, steel beams, and building signage.

“The former Ansco Camera Factory is one of many buildings in this community with great history,” Matthew Paulus, president of Paulus Development, said in a statement. “Not only have thousands of people in this community worked at this building over the course of its life, but it has also served as the manufacturing hub for two of the most notable industries in Binghamton history. When we learned about this great history, we wanted to help preserve and chronicle it for the community. For us, as a community developer, that meant going the path of a public-private partnership and using historic preservation. We are grateful for the opportunity to come into this community and preserve this building and for all the public and private institutions that have played major roles in helping us make this project come to fruition.”

Adirondack North Country Association appoints three new board members

The new members are: J. Daniel Mohr, executive VP and chief financial officer at Utica–based Adirondack Bank; Kevin Richardson, executive VP of sales and operations at Sackets Harbor–based Agbotic Inc.; and Noah Shaw, a partner with Buffalo–based Hodgson Russ Attorneys LLP and co-chair of the firm’s renewable-energy practice, working from its Saratoga Springs office. The

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The new members are: J. Daniel Mohr, executive VP and chief financial officer at Utica–based Adirondack Bank; Kevin Richardson, executive VP of sales and operations at Sackets Harbor–based Agbotic Inc.; and Noah Shaw, a partner with Buffalo–based Hodgson Russ Attorneys LLP and co-chair of the firm’s renewable-energy practice, working from its Saratoga Springs office.

The three new board members join ANCA as the regional economic-development nonprofit begins implementing its new five-year strategic plan. The plan, which the organization will roll out in February, will support new and existing programs in ANCA’s 14-county service area that advance clean-energy adoption and energy savings, expand local food access and markets, provide support and development opportunities for small businesses and entrepreneurs, and advocate for North Country residents, businesses, and communities at the state and federal levels.

“ANCA’s strategic plan is ambitious, based on our vision — a New Economy that works for all — and our mission to build prosperity across Northern New York,” Kate Fish, the nonprofit’s executive director, said in a statement. “Dan, Kevin and Noah bring a wide range of experience to the ANCA team though their work in the small business, agriculture and clean energy sectors. Their combined knowledge and experience will help inform our strategies moving forward.”

The new members

Mohr, who took on his current role at Adirondack Bank in 2017, has more than 20 years of senior-level financial and operational-management experience in banking. He holds a bachelor’s degree in accounting from Binghamton University. Mohr was born and raised in Binghamton and now lives in Utica.

Richardson is co-founder of Agbotic, a venture-backed leader in the ag tech sector. Agbotic builds year-round, organic, and environmentally restorative “SmartFarms” that utilize robotics with machine learning and artificial intelligence. The company’s first SmartFarm project is located in Sackets Harbor.

“Agbotic has been fortunate to work with ANCA over the last several years through their farm to school and clean energy initiatives,” Richardson said. “ANCA’s mission is spot on with their focus on creating strong systems for local food, agriculture, small businesses and renewable energy. I feel my own interest and experience in these areas will complement and strengthen ANCA’s programs and networks.”

Shaw comes to the ANCA board with more than 17 years of experience in law and legal advising with private law firms as well as state and federal agencies. Prior to Hodgson Russ, he served as general counsel and board secretary for the New York State Energy Research and Development Authority (NYSERDA). Shaw also worked as senior advisor to the general counsel for the U.S. Department of Energy during the Obama administration.

“ANCA continues to be on the leading edge of clean-energy outreach in the North Country region,” Shaw said. “I’m excited to lend my own passion for the North Country and energy policy to the board as ANCA and partners bring clean energy planning and programming into the next decade.”

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.