Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Bousquet Holstein PLLC has appointed TAYLOR M. NUNEZ to the firm’s 2020 Summer Associate program. She is entering her final year as a candidate for a Juris Doctorate (JD) degree at Syracuse University College of Law and as a candidate for Master of Public Administration (MPA) degree at the Syracuse University Maxwell School of Citizenship […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Bousquet Holstein PLLC has appointed TAYLOR M. NUNEZ to the firm’s 2020 Summer Associate program. She is entering her final year as a candidate for a Juris Doctorate (JD) degree at Syracuse University College of Law and as a candidate for Master of Public Administration (MPA) degree at the Syracuse University Maxwell School of Citizenship and Public Affairs. Nunez is a 2016 graduate of Syracuse University College of Arts and Sciences with a bachelor’s degree in political science and history. At Syracuse University, she serves as editorial member of the Syracuse Law Review and was honored with the CALI Award for Property and the Law Dean’s Scholarship. She has been active in the Women Law Students Association and served as secretary in 2019-2020. Nunez is also an Academic Success Fellow at the College of Law’s Office of Student Affairs, instructing first-year law students on important legal study skills in the first-year torts and property classes. She has served as a legal extern at Vera House and for Judge Matthew J. Doran, Onondaga County Court. As an undergraduate, Nunez volunteered with the Hiscock Legal Aid Society Family Court Program and Appeals Program.

Bousquet Holstein PLLC has appointed TAYLOR M. NUNEZ to the firm’s 2020 Summer Associate program. She is entering her final year as a candidate for a Juris Doctorate (JD) degree at Syracuse University College of Law and as a candidate for Master of Public Administration (MPA) degree at the Syracuse University Maxwell School of Citizenship and Public Affairs. Nunez is a 2016 graduate of Syracuse University College of Arts and Sciences with a bachelor’s degree in political science and history. At Syracuse University, she serves as editorial member of the Syracuse Law Review and was honored with the CALI Award for Property and the Law Dean’s Scholarship. She has been active in the Women Law Students Association and served as secretary in 2019-2020. Nunez is also an Academic Success Fellow at the College of Law’s Office of Student Affairs, instructing first-year law students on important legal study skills in the first-year torts and property classes. She has served as a legal extern at Vera House and for Judge Matthew J. Doran, Onondaga County Court. As an undergraduate, Nunez volunteered with the Hiscock Legal Aid Society Family Court Program and Appeals Program.

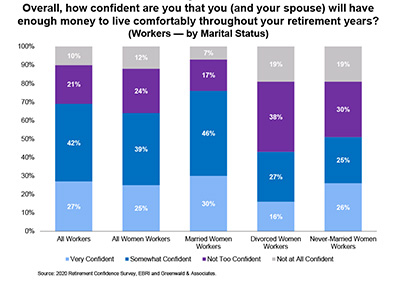

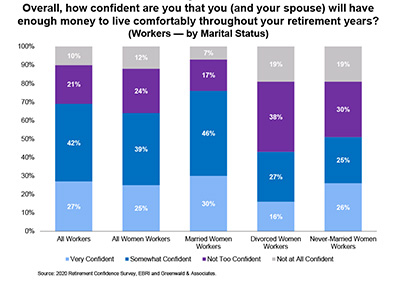

Survey: Unmarried women are less confident about their retirement prospects

Unmarried women had lower levels of retirement confidence than their married counterparts and were more likely to have fewer resources and be less prepared for retirement. That’s according to a new study that the Washington, D.C.–based Employee Benefit Research Institute (EBRI) conducted. The EBRI is a private, nonpartisan, nonprofit research institute based in Washington, D.C., that

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Unmarried women had lower levels of retirement confidence than their married counterparts and were more likely to have fewer resources and be less prepared for retirement.

Unmarried women had lower levels of retirement confidence than their married counterparts and were more likely to have fewer resources and be less prepared for retirement.

That’s according to a new study that the Washington, D.C.–based Employee Benefit Research Institute (EBRI) conducted.

The EBRI is a private, nonpartisan, nonprofit research institute based in Washington, D.C., that focuses on health, savings, retirement, and financial security issues.

The study finds 76 percent of married women express being very or somewhat confident they will have enough money to live comfortably throughout their retirement years, with only 43 percent of divorced women workers and 51 percent of never-married women workers sharing this confidence.

EBRI and Greenwald & Associates recently conducted the Retirement Confidence Survey (RCS) to measure attitudes toward, preparations for, and understanding of the various issues and products for retirement by American workers and retirees.

The RCS is now in its 30th year, EBRI said. Greenwald & Associates is a Washington, D.C.–based public-opinion and market-research firm.

The report released June 8 titled, “Retirement Confidence Survey: Attitudes Toward Retirement by Women of Different Marital Statuses” examines the RCS results for women, since they face “particular challenges” in preparing for retirement — from “lower average earnings to higher likelihoods of taking time out of the labor force for raising children.”

Furthermore, women have longer life expectancies and are often younger than their spouses, “potentially” leaving them with more years in retirement. This study explores RCS findings across the array of possible marital statuses of workers and retirees, and their perceived and actual retirement prospects.

Other retirement aspects

Divorced and never-married women workers also had lower confidence in other aspects related to retirement.

In particular, 43 percent of never-married women workers were very or somewhat confident in knowing how much money they need to save by retirement to live comfortably in retirement compared with 47 percent of divorced women workers and 69 percent of married women workers.

When it came to feeling confident in choosing the right retirement products and investments for their situation, just 44 percent of divorced women workers were confident compared to 48 percent of never- married women workers and 69 percent of married women workers.

Given the disparities in retirement confidence among women of differing marital statuses, it “isn’t surprising” that the level of assets held by them is “substantially” different, EBRI said.

The divorced women workers were “markedly” more likely to have fewer assets, as 72 percent had less than $25,000 in assets compared to 54 percent of never-married women workers and 31 percent for married women workers.

Furthermore, debt was more likely to be a problem for divorced and never-married women workers, where 74 percent and 67 percent, respectively, considered debt a problem compared with 56 percent of married women.

Retirees

The survey also focuses on retirees and paints a “particularly grim” picture of divorced and widowed women retirees compared with married women retirees. One in 10 married women retirees has less than $1,000 in savings and investments, but more than half of divorced women retirees and nearly a third of widowed women retirees have such a minimal amount.

To lower the chances of this type of outcome, Craig Copeland, senior research associate at EBRI and author of the report, said the survey results indicate that women in differing situations could benefit from receiving more “specialized” information and assistance with retirement preparations and everyday financial issues.

“The approaches currently being used do not appear to be as effective for unmarried women workers, likely due to the resulting financial and life-circumstance upheaval of a divorce or death of a spouse. Employers may want to develop new targeted messages, methods, or materials to better reach these groups, in order to increase the chances of unmarried women having a financially successful retirement. Help from the financial sector in general could also be beneficial, as many of the unmarried women need help outside of employment,” said Copeland.

How To Protect Retirement Savings In These Uncertain Times

The COVID-19 pandemic is causing millions of Americans to worry about their retirement savings and investments. Stocks are riding a roller coaster and the recent $2 trillion stimulus bill passed by Congress potentially means larger tax bills down the road to help pay for it. [Despite the recent strong rebound], the stock market could be

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The COVID-19 pandemic is causing millions of Americans to worry about their retirement savings and investments. Stocks are riding a roller coaster and the recent $2 trillion stimulus bill passed by Congress potentially means larger tax bills down the road to help pay for it.

[Despite the recent strong rebound], the stock market could be a wild ride going forward, which is a big reason people should seek more certainty in their planning.

And when the federal government dumped trillions of dollars on top of what was already a significant deficit, and with indications that more trillions are coming our way, you need to ask yourself, “When is the reckoning day on those packages?”

It will come during your retirement; personal-income tax will go up in the future. Protecting yourself from that reckoning means being able to diversify your assets from tax exposure.

I offer these tips to protect retirement money in the wake of COVID-19:

• Rely on a Roth IRA. It’s prudent to consider a Roth conversion to protect yourself from the inevitable tax increases heading our way to pay for the COVID-19 bailouts. One advantage of the Roth: It’s a retirement-savings account allowing your money to grow tax-free. It’s funded by your after-tax dollars, meaning you’ve already paid taxes on the money you put into it. In return, when you withdraw after age 59 ½ or in retirement, you pay no taxes, not even for the earnings on your investments.

• Beware of the bond market. In the past, many financial advisors recommended an asset mix of 80 percent in stocks and 20 percent in bonds for people who were investing over the long term. Then, as people got nearer to retirement, they would allocate more to bonds because of their stability. That idea has shifted. From where we are right now, there is no place but up for interest rates in the bond market. So that’s not the place for people to be in if they’re retirees, because bonds are not paying anything now, and the ones that have decent yield are at risk of cratering on you.

• Consider a fixed annuity or fixed-index annuity. A fixed annuity is a contract between the consumer and an insurance provider. With a fixed annuity, the insurance company guarantees growth of your principal and a minimum interest rate. It provides a way to save money over the long term, allowing interest to accumulate tax-deferred typically at a higher rate of interest than CDs. A fixed-index annuity also is a tax-deferred, long-term savings option that provides principal protection in a down market. Returns are based on the performance of an underlying index. It gives you more growth potential than a fixed annuity and safety and security unlike investment in the stock market. That can happen through the performance of the index, and the annuity can periodically lock in gains so the value does not decline if the index performs negatively.

• Consider a cash-value life insurance policy. An appropriately structured cash-value life insurance policy can be index-based, which gives you the potential of good growth in the savings. If you have that growing for a reasonable amount of time, you can get that cash value out tax-free to take care of things during your lifetime. It could have a higher rate of return than in a bank, and it grows tax-deferred.

These are highly uncertain times, and planning for as much certainty as you can is crucial. This crisis does provide an opportunity for Americans to take a deep look at their retirement plan and be better prepared for unanticipated emergencies, while also protecting their long-term security.

Greg DuPont is founder of DuPont Wealth Solutions (www.dupontwealth.com). He has been serving clients as an estate and tax planning attorney in Ohio since 1992. A certified financial planner, he’s also been in wealth management for the past 14 years.

How To Retool Your Retirement Plan In The Midst Of COVID-19

The coronavirus pandemic has hit the economy hard, and people who are nearing retirement or already retired are feeling the stress. COVID-19 has caused a lot of retirees and those approaching retirement to rethink their plan for retirement. Falling interest rates, massive volatility in the stock market, and stifled economic growth are having a massive effect

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The coronavirus pandemic has hit the economy hard, and people who are nearing retirement or already retired are feeling the stress.

COVID-19 has caused a lot of retirees and those approaching retirement to rethink their plan for retirement. Falling interest rates, massive volatility in the stock market, and stifled economic growth are having a massive effect on psychology.

A plan created years ago may not be as efficient when interest rates were much higher and the economy was in better shape. Stress testing your current retirement plan adapted to the post-COVID-19 world can show if you are positioned to weather this storm or in need of an update.

I suggest the following tips to re-evaluate a retirement plan and perhaps retool it to withstand the effects of COVID-19.

Take precise inventory of expenses. Sometimes people don’t realize how much they are actually spending. When they lay it out, they are shocked. For accurate retirement-income planning you must have good data to understand where the money goes each month — everything it takes to live, plus discretionary expenses. A dollar saved is a dollar earned and is more important now that ever.

Check asset location and effects on taxes. Tax planning in retirement is critical to understand. It’s about knowing how the different accounts are taxed in conjunction with other income streams like Social Security benefits, rental income, pensions, etc. A savings account will be taxed differently than a Roth IRA, which will be different than a 401(k), or SEP IRA. Another important point to remember is that dividends, interest, and capital gains may not be taxed equally, some can be taxed as high as your ordinary tax rate, and some may be completely tax free. Income-tax planning in retirement will expose any tax-planning missteps.

Bridge the retirement-income gap. It’s important to tailor retirement plans for the inevitable costs of aging and some health-related costs. Income diversification ensures a strong, well-built plan. If you have an income shortfall in retirement, where will that come from? It may make sense to use a variety of income sources like dividends, capital gains, and income from an annuity.

Re-assess your risk tolerance. Some investors may have been complacent over the past year; markets kept going up and nobody worries about markets going up. COVID-19 changed that, not only is there more inherent risk in the stock market, but because of the zero interest-rate policy enacted by the Federal Reserve, interest-rate risk is high. When rates move back up, bond prices will go down. This has also caused more risk-taking, because the interest rates are so low on bonds of all maturities and when you take inflation into account, you are actually going backwards.

Ask these questions. Does fear of loss or stability keep you up at night? At this stage of your life, how much risk do you need to achieve your goals? Failing to plan is planning for failure. This applies to all aspects of life, including retirement.

Holistic financial planning for retirement ensures all parts of the financial plan are working together — investments, taxes, estate planning, etc. The pandemic has made the picture murky for some in retirement, but an updated retirement roadmap will allow you to get to your retirement destination with clarity.

Dennis Notchick, a certified financial planner for Stratos Wealth Advisors (www.dn.stratoswealthadvisors.com), has been serving high net-worth families and business owners since 2008. A certified financial planner since 2010, Notchick has been published or mentioned in numerous online financial publications, including The Wall Street Journal, CNBC, and TheStreet.

Owner of Buffalo accounting firm named NYSSCPA president

Edward L. Arcara, CPA, owner of Edward L. Arcara, CPA PC, which has three offices in Western New York, began his one-year term as board president of the New York State Society of CPAs (NYSSCPA) on June 1, the Society announced. He is the 101st president of the NYSSCPA, which was founded in 1897, and

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Edward L. Arcara, CPA, owner of Edward L. Arcara, CPA PC, which has three offices in Western New York, began his one-year term as board president of the New York State Society of CPAs (NYSSCPA) on June 1, the Society announced.

Edward L. Arcara, CPA, owner of Edward L. Arcara, CPA PC, which has three offices in Western New York, began his one-year term as board president of the New York State Society of CPAs (NYSSCPA) on June 1, the Society announced.

He is the 101st president of the NYSSCPA, which was founded in 1897, and third president of the NYSSCPA from the Western New York region. He replaces Ita M. Rahilly, tax partner with the firm of RBT CPAs, LLP in Newburgh, who had served as NYSSCPA president for the 2019-2020 term.

During his term, Arcara says he plans to strengthen relationships with New York State legislators and regulators and to diversify the NYSSCPA membership to better reflect society.

“We are taking a local focus to ensure that incoming members reflect the makeup of our great state. We will be working with colleges and universities to do this work and help to create an equal playing field and an inclusive profession,” Arcara said in a statement.

Arcara will also continue the Society’s work to help firms provide comprehensive resources to their clients, in light of the COVID-19 pandemic that has disrupted the state and the nation, while continuing to move the accounting profession forward.

Arcara previously served on the NYSSCPA’s board as a director-at-large. He also was chair of the tax division oversight committee, and as a member of the audit, awards, continuity of practice, member benefits, nominating, and small firms practice management committees. He joined the NYSSCPA in 1986 and is a member of the Buffalo Chapter, for which he served as president, vice president, secretary, and treasurer.

Arcara’s accounting firm is based at 465 Franklin St. in Buffalo and serves over 1,200 individuals and 250 businesses from its three offices. Its services include financial preparation (reviews & compilations), tax preparation and consulting, financial planning, full-service payroll processing, and tax-audit representation.

Tompkins Financial names tax, accounting expert to board of directors

ITHACA — Tompkins Financial Corp. announced it has recently added Ita M. Rahilly to its board of directors. She will continue as a director of Tompkins Financial’s affiliate, Tompkins Mahopac Bank, where she has served since 2018. Rahilly has served as a tax partner with the firm of RBT CPAs, LLP in Newburgh since January

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ITHACA — Tompkins Financial Corp. announced it has recently added Ita M. Rahilly to its board of directors.

ITHACA — Tompkins Financial Corp. announced it has recently added Ita M. Rahilly to its board of directors.

She will continue as a director of Tompkins Financial’s affiliate, Tompkins Mahopac Bank, where she has served since 2018.

Rahilly has served as a tax partner with the firm of RBT CPAs, LLP in Newburgh since January 2005. She is the partner in charge of the firm’s tax division, where she assists closely-held businesses and their shareholders and high-net-worth individuals.

“We believe Ita’s qualifications to sit on our Board of Directors include her 25 years of experience dealing with financial and accounting matters for complex organizations. She has acquired a deep understanding of the Hudson Valley business environment during her years of working with commercial clients in the region, and I look forward to working with her on the Tompkins Financial board,” Steve Romaine, president and CEO of Tompkins Financial, said in a statement.

Ithaca–based Tompkins Financial (NYSE: TMP) is a financial services company serving the Central New York, Western New York, and Hudson Valley regions of New York, as well as Southeastern Pennsylvania. It is the parent company of Tompkins Trust Company, Tompkins Bank of Castile, Tompkins Mahopac Bank, Tompkins VIST Bank, Tompkins Insurance Agencies, Inc., and Tompkins Financial Advisors, which offers wealth-management services.

Broome County Council of Churches to use federal funding to build food market

BINGHAMTON, N.Y. — The Broome County Council of Churches will use $150,000 in federal funding for construction of a food market on the north side

Broome County playgrounds, courts, fields, and beaches reopen

BINGHAMTON, N.Y. — Broome County playgrounds, basketball courts, and athletics fields reopened on Friday, June 12, after County Executive Jason Garnar lifted an emergency order

Cazenovia College to start fall semester early so it can end by Thanksgiving

CAZENOVIA, N.Y. — Cazenovia College on Thursday announced that it’s planning for a fall 2020 academic calendar that will begin a week earlier with in-person

Destiny USA food and beverage tenants ask to be able to reopen in phase 3

SYRACUSE, N.Y. — A total of 41 food and beverage businesses at Destiny USA on Friday demanded New York State let them reopen under phase

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.