Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Upstate nonprofits win Excellus 2025 Health Equity Innovation grant awards

Rochester–based health insurer Excellus BlueCross BlueShield says a total of 22 Upstate nonprofit organizations have received 2025 Health Equity Innovation Awards. Excellus describes the grants as an annual-funding opportunity that supports nonprofit organizations working to eliminate health disparities and improve health outcomes across upstate New York. Twenty-two nonprofit organizations in the Central New York/Southern Tier, […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Rochester–based health insurer Excellus BlueCross BlueShield says a total of 22 Upstate nonprofit organizations have received 2025 Health Equity Innovation Awards.

Excellus describes the grants as an annual-funding opportunity that supports nonprofit organizations working to eliminate health disparities and improve health outcomes across upstate New York.

Twenty-two nonprofit organizations in the Central New York/Southern Tier, Rochester, and Utica/North Country regions were chosen from a competitive pool of nearly 300 applicants.

The selected organizations are leading efforts to “close gaps in care through innovative, community-driven solutions tailored to the unique needs of the people they serve,” per the Excellus announcement.

Focus areas for funding in each region were strategically identified through community needs assessments, which helped pinpoint the most pressing health challenges and disparities affecting local populations, the health insurer noted.

The Health Equity Innovation Awards will help advance a wide range of initiatives, including community-centered mental health and wellness programs; community-based chronic disease prevention and education; maternal and child-health support services; food access and nutrition initiatives; and workforce development and training in health-related fields.

Regional recipients, projects

CENTRAL NEW YORK REGION

• A Tiny Home for Good – Lead Freedom House, which renovates a Syracuse property to provide free, temporary housing for families during lead remediation.

• InterFaith Works – Telehealth education for older adults expands workshops and one-on-one support to help seniors use telehealth and improve access to care.

• Ithaca Health Alliance – Behavioral-health consultant program, which launches free clinic program offering quick triage and short-term counseling, linking patients to ongoing mental-health care.

• Oswego Health Foundation – Online prenatal education provides free virtual classes on pregnancy, postpartum care, breastfeeding, and infant safety to overcome rural access barriers.

• Restoreforlife, Inc. – Healing through the arts, which uses creative expression and guided circles to help families build coping skills, resilience, and emotional wellness.

• The Public Broadcasting Council of Central New York, Inc. (WCNY) – Behind the Woman career challenge, which connects Syracuse high school students with mentors for hands-on health career learning, hospital shadowing, and research projects.

• United Way – Healthy Start, Safe Home, a program that embeds navigators and peer advocates in high-risk neighborhoods to improve maternal and early childhood health through education and resources.

UTICA REGION

• Bassett Medical Center – Bassett Cancer Institute partnership, which provides medically tailored meals to cancer patients in Otsego County, addressing food insecurity and improving health outcomes.

• Madison County Rural Health Council – Mental health first aid trainings that offer evidence-based training for schools, community groups, and healthcare settings to identify and respond to mental health challenges, reducing stigma and improving access.

• Mohawk Valley Resource Center for Refugees – Healthy Pathways nutrition program that delivers culturally responsive nutrition education, cooking demonstrations, and strategies for healthy eating to 500 refugees and immigrants.

• St. Lawrence Health Foundation – Living in Balance, which is a peer-led initiative and supports recovery from substance use through peer-led groups and the Living in Balance curriculum, helping participants build coping skills and resilience.

SOUTHERN TIER REGION

• Binghamton Philharmonic Inc. – Social prescribing program, which offers complimentary concert tickets through healthcare partnerships to reduce isolation and improve health for the IDD (intellectual and developmental disabilities) community.

• Broome County Council of Churches – Greater Good Grocery mobile market bus that operates an ADA (Americans with Disabilities Act)-accessible mobile market bus to deliver affordable, healthy food to residents in county food deserts.

• Catholic Charities of Tompkins/Tioga – Tioga Fresh mobile café that provides free meals and groceries to more than 3,000 rural residents, reducing food insecurity and connecting families to health resources.

• Family Enrichment Network Inc. – Help Me Grow, which promotes developmental screening and connects families to care, strengthening early childhood systems and school readiness.

• Rural Health Network of SCNY Inc. – Produce-prescription program, which is a card-technology pilot and expands a long-standing produce-prescription program with a card-based system to improve access to fresh food for patients with chronic conditions.

VIEWPOINT: Snowbirds Beware: The Ins & Outs of Nonresident Income & Estate Tax

It’s that time of year again, when snowbirds break out their suitcases and make plans to flee the Empire State for warmer weather. Anyone who has experienced New York winters can appreciate the desire to avoid the back-breaking shoveling, frozen eyelashes, and wind-burned cheeks of a typical New York January and February. While weather is

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

It’s that time of year again, when snowbirds break out their suitcases and make plans to flee the Empire State for warmer weather. Anyone who has experienced New York winters can appreciate the desire to avoid the back-breaking shoveling, frozen eyelashes, and wind-burned cheeks of a typical New York January and February. While weather is certainly one incentive to fly away to southern climes, many snowbirds head south for an additional reason — to establish or maintain residency in another state for tax purposes.

This article provides an overview of New York income and estate taxation rules for nonresidents. While changes in the law have somewhat reduced the impact of New York’s estate tax, the opportunity to further reduce New York income taxes remains a strong motivator to establish residency outside the state.

Personal Income Taxation of Nonresidents

New York residents are taxed by the state on all income from all sources, with the highest tax rate being 10.9 percent. In contrast, nonresidents are only subject to personal income tax on income from New York sources. New York source income is defined as the sum of the income, gain, losses, and deductions derived from or connected with New York sources, for example, income from owning New York real or tangible property, or from services or business carried on within the state. An individual who can establish legal residency outside New York, however, will only be obligated to report and pay tax on income actually generated in the Empire State. Whether a taxpayer is determined to be a New York resident may have a significant impact on the assets that are taxed and the tax that may be owed.

a. Defining Residency

New York’s tax laws are aimed at thwarting wealthy people who maintain homes in New York and spend the majority of their time here, but still claim non-residency status. New York’s Tax Law provides for two separate analyses to determine residency — domicile and statutory residence. A taxpayer determined to be domiciled in New York will pay state tax on all income regardless of the source. A taxpayer not domiciled in New York will still be taxed as a New York domiciliary if he or she is determined to be a “statutory resident.” Only if taxpayers can establish by clear and convincing evidence that they are neither domiciled in New York nor a statutory resident will they be taxed only on income actually generated in this state, likely saving a significant amount of money.

i) Domicile

While in everyday language “residence” and “domicile” are used interchangeably, they have different legal meanings. “Domicile” is the place individuals intends to be their permanent home — where they intend to return after being away. A person can have several residences at a time, but only one domicile.

New York’s Tax Department offers five primary factors to determine domicile: (1) Home: use and maintenance of a New York residence; (2) Active Business Involvement: employment relating to compensation derived in the year under review; (3) Time: where the individual spent time during the year; (4) “Near and Dear”: the location of items that have significant sentimental or other value to the individual; and (5) Family Connections: a bond that draws a person back to a location, such as where minor children attend school.

Other factors state auditors may consider include addresses on financial records, location and registration of automobiles, voter registration, and location of safe deposit boxes. There are also “non-factors” that will not be considered, such as where the taxpayer’s will is probated, location of bank accounts, charitable contributions to organizations within the state, and volunteering for nonprofit organizations.

ii) Statutory Resident

A taxpayer not domiciled in New York may still be subject to taxation as a resident if the taxpayer: (1) maintains a permanent place of abode in New York; and (2) spends more than 183 days in the state. This test is what often trips up taxpayers who keep a New York house after moving to a warmer and more tax-friendly state, compelling them to carefully keep track of the number of days they spend in New York.

New York’s Tax Law considers “permanent place of abode” to mean a residence taxpayers maintain, whether they own it or not, that is suitable for year-round use. The definition generally includes a dwelling place owned or leased by the taxpayer’s spouse, but not a camp or cottage that is suitable and used solely for vacations. A life estate interest in a New York home may also be considered a permanent place of abode under New York tax laws.

If the taxpayer seeking non-resident status is found to have a permanent place of abode in New York, the next step is to determine whether the individual spent more than 183 days in the state during the relevant tax year. Importantly, New York courts have held that for this purpose, “day” is defined as any part of a day, not 24 hours. A taxpayer who fails to satisfy both tests will be considered a statutory resident and will be taxed by New York on all sources of income for the entire year, just like a full-time resident, even if the taxpayer’s domicile changed during the year. By contrast, a taxpayer who does not have a New York domicile and is not a statutory resident will only pay income tax to New York on New York source income.

Estate Tax for Nonresidents

Both the federal government and New York State impose tax on the transfer of assets owned by a deceased person at the time of his/her death if the value of those assets exceeds certain thresholds. Over the last decade, substantial changes have been made to the estate-tax exclusion amount on both the federal and state levels. As a result of the “One Big Beautiful Bill Act”, the federal estate-tax exclusion permanently increased this year to $15 million, indexed for inflation, for decedents dying and gifts made after Dec. 31, 2025. The New York estate-tax exclusion amount as of Jan. 1, 2025 is $7,160,000. While these changes mean that fewer New Yorkers are concerned about estate tax at death, wealthier snowbirds who maintain property in the Empire State may still face filing requirements and nonresident estate tax.

Under Section 952(a) of New York’s Tax Law, estate tax applies to the estate of any “individual who at his or her death was a resident of New York State.” Unlike the rules governing income tax, however, the estate-tax regulations do not define “resident.” Notwithstanding, courts faced with these issues will consider many of the same facts and circumstances.

An analysis of the type of assets owned by a nonresident is necessary to determine whether an estate-tax return must be filed. The determination is based on whether the decedent’s estate includes real or tangible personal property located in the state and, under Tax Law § 971 (a)(2), whether the federal gross estate plus includible taxable gifts of real or tangible personal property located in the state plus intangible personal property used in a business, trade, or profession carried on in New York while the individual was a resident exceeds the New York State basic exclusion amount.

“Real property” for purposes of this analysis is defined as an interest in land, including buildings and other improvements, located in the state. “Tangible personal property” is personal property that can be physically touched and moved, such as cars, artwork, or jewelry. “Intangible property” includes money, credits, and securities within the state, except to the extent they are part of a business, trade or profession carried on in New York. Nonresidents wishing to avoid potential estate tax would be well advised to ensure that they do not own real or tangible personal property in New York.

Property with New York ties that is categorized as intangible rather than real or tangible is not subject to New York estate tax. A typical example of an intangible asset located in New York but treated as being sited outside the state for estate-tax purposes is a personal bank account maintained in New York by a Florida resident. New York’s Constitution prohibits the state from imposing estate tax on a nonresident’s intangible property even if it is located in the state.

Nonresident taxpayers seeking to avoid having to file a New York estate-tax return and potentially being taxed should consider changing the ownership of real or tangible property by creating a business entity to own such assets, Interests in a limited liability company constitute an intangible asset, so real estate held in an LLC is not includible in the nonresident’s New York estate. Similarly, stock in a subchapter S corporation holding New York real property is considered intangible, provided the corporation is engaged in business activity. Whether it makes sense to create an entity to own real or tangible property is specific to an individual taxpayer and includes considerations such as the type and value of the New York assets involved, the taxpayer’s overall net worth, and the ultimate beneficiaries of the estate.

a) Filing Requirements and Calculation of Tax

Prior to April 2014, executors of estates of nonresidents with New York real and tangible property were required to file and pay tax without the benefit of the estate-tax exclusion amount. Now, however, if the value of the total estate is less than or equal to the New York exclusion amount (currently $7,160,000), no filing is required and no tax is due. On the other hand, if the value of the federal gross estate exceeds the New York exclusion and the estate holds New York real or tangible property, the executor must file a return. New York estate tax will be due if the value of the New York situs property exceeds the exclusion. As a warning, the current rules include an add-back requirement for certain gifts made within three years of death.

Regardless of the level of wealth and income, snowbirds are advised to consider their tax plans before packing their bags. Taxpayers may want to deploy strategies such as transferring or restructuring New York assets, reducing New York source income and implementing snowbird calendars. With forethought, clients can steer clear of the snowbanks of New York taxation.

Jaime J. Hunsicker is a partner in the Elder Law & Special Needs, Tax, Family Business Succession Planning and Trusts & Estates Practices of Hancock Estabrook, LLP. Contact her at: jhunsicker@hancocklaw.com.

Author’s note: Marion Hancock Fish, also a partner at Hancock Estabrook, co-authored an earlier version of this article.

OPINION: Supporting N.Y.’s Disability Community Benefits Us All

The Office of the New York State Comptroller [recently] issued an encouraging report indicating labor-force participation for working-age individuals with disabilities rose 4.6 percentage points between 2019 and 2024. This is welcome news, and I am glad to see initiatives aimed at increasing participation from the disability community have made an impact. However, more work

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The Office of the New York State Comptroller [recently] issued an encouraging report indicating labor-force participation for working-age individuals with disabilities rose 4.6 percentage points between 2019 and 2024. This is welcome news, and I am glad to see initiatives aimed at increasing participation from the disability community have made an impact. However, more work is needed if we are going to make New York a national leader in supporting and employing these incredible individuals.

According to the report, the national average workforce-participation rate for those aged 16 years and older with a disability jumped more than 5 percentage points during the period measured in the comptroller’s report. Overall, New York’s workforce-participation rate for those with disabilities, 28.8 percent, trailed the national average of 32.3 percent. While it is great to see New York make some progress, we must continue looking for ways to ensure all New Yorkers have a fair chance to achieve their career-oriented goals.

Outside of the obvious intrinsic value of supporting the disability community, there are tremendous benefits to improving its workforce participation. One study found companies that “actively employ and support people with disabilities” earned more revenue, profit, and net income than industry peers. They were also measured to be 25 percent more productive per employee than other businesses without similar initiatives.

As such, the members of the Assembly Minority Conference have been fierce advocates for the disability community. We have introduced legislation that would help boost the wages of aides working with people with developmental disabilities (A.172, Angelino); increase tuition rates for Special Act and 853 Schools (A.2413, Ra); establish programs for students interested in working with the disability community (A.6507, Tannousis); review state policies related to transportation (A.6372, Palmesano); and ensure a residential transition conference is held when an individual with disabilities will be transferred from one program to another (A.8982, Giglio).

Personally, I was proud to support Oswego Industries Inc., which is a tremendous asset and resource for the community, to find ways to mitigate challenges to the disability community during the COVID-19 pandemic. We are also fortunate to have The Arc of Oswego County, another incredible organization full of dedicated and compassionate individuals who understand the needs of all New Yorkers, supporting this mission. Partnerships like these help strengthen the resilience of our communities and our workforce, and I am looking forward to continuing to find new ways to bolster these important public-private connections.

There is much to celebrate, and any progress is better than none. But there is still a lot of room to grow. We must continue to advocate for a stronger, more inclusive workforce. We must fight for the economic security and prosperity of all New Yorkers, and we must do it with compassion and vigor. I look forward to building on the successes enumerated in the comptroller’s report, and together, we will make New York’s workforce stronger and more productive than ever.

William (Will) A. Barclay, 56, Republican, is the New York Assembly minority leader and represents the 120th New York Assembly District, which encompasses all of Oswego County, as well as parts of Jefferson and Cayuga counties.

OPINION: Pro-Inflation Democrats Oppose Trump’s Plan To Help Farmers Boost Production

“The reason farmers need relief at all is largely because Donald Trump betrayed them and decimated their businesses with his disastrous tariffs.” That was Senate Minority Leader Chuck Schumer (D-N.Y) making a speech on the Senate floor on Dec. 8 opposing President Donald Trump’s $12 billion Farmer Bridge Assistance (FBA) Program. The program is actually

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

“The reason farmers need relief at all is largely because Donald Trump betrayed them and decimated their businesses with his disastrous tariffs.” That was Senate Minority Leader Chuck Schumer (D-N.Y) making a speech on the Senate floor on Dec. 8 opposing President Donald Trump’s $12 billion Farmer Bridge Assistance (FBA) Program.

The program is actually a response to unfair trade practices, subsidies, dumping, and tariffs from abroad that have hurt U.S. farmers and other industries for decades that were in place long before President Trump’s second term even began, but who’s counting?

For years, trade partners have waged a trade war on the U.S., but we had forgotten how to fight back, until Trump delivered us the most pro-American trade agenda in modern history. The FBA is an important component of the Make America Great Again agenda that puts America first by putting American farmers first.

The program is virtually identical to the $28 billion 2018-2019 Market Facilitation Program, and both are authorized by Congress under 15 U.S. Code Sec. 714c, the Commodity Credit Corporation Charter Act, to make direct payments to farmers who are harmed by foreign trade practices and barriers. The Commodity Credit Corp. was established by Congress to “Support the prices of agricultural commodities (other than tobacco) through loans, purchases, payments, and other operations.”

Congress has the long-settled power now delegated to all presidents to spend money via the Commodity Credit Corp. that it also had the power to create on agriculture and other industries to support the general welfare, to regulate international trade — trade subsidies are used globally to create trade advantage — and ultimately to protect national security by preventing agricultural depressions (historically, those have led to the collapse of governments). And this is one of the manners in which it chose to do so.

That is the power of the purse that Congress has authorized presidents to use — and President Trump is now wisely putting the money to use just as he did during his first administration to support his America First trade agenda by increasing domestic supplies. Many aspects of the New Deal were struck down, but spending money on farmers wasn’t one of them.

In practice, the payments should make it easier for farmers to boost production and help bring food prices down in the wake of the Covid and post-Covid expansion of the money supply and simultaneous contraction of global production that fueled the inflation seen since 2021 and 2022 that is still being felt by the American people.

Like all other countries, we desperately need to boost production. However, people have also forgotten the temporary global supply chain crisis price shock caused by the pandemic and the pandemic response that led to the inflation in the first place. They don’t remember that shutting down the country has years-long consequences, and this is one of them.

Americans for Limited Government has long supported a zero-for-zero approach for agricultural subsidies. That is, when other countries stop subsidizing their exports, then maybe we will, too. But there is no agreement to do that, and so today, subsidies are the cost of doing business.

If you just went back to Joe Biden’s tariff levels, all the foreign farm subsidies would still be there, hurting our ability to boost domestic production and bring down prices. Biden was wasting the Commodity Credit Corp. on fighting climate change, and doing nothing to bring down food prices or even advance the U.S. trade position. And overall, Biden was restricting farm production with his environmental rules and via environmental, social, and governance investors to restrict supplies and drive prices up. President Trump, once again, has corrected that problem.

Every day the president’s critics in Congress failingly try to knock down his trade program. Think about it: Providing farmers relief was a program created by Franklin Delano Roosevelt, and now the Democratic leader of the Senate is blasting the Republican president for using it.

The framing of this issue to serve some failed globalist, liberal, free-trade narrative that trade-adjustment assistance is somehow a response to U.S. tariffs is wrong. It’s the opposite; farmer relief is a response to foreign tariffs and non-tariff trade barriers Congress has long since granted the president the authority to regulate international trade via the Necessary and Proper Clause to counter with tariffs, sanctions, subsidies, and everything else that strong, sovereign countries have utilized for centuries.

One of the ways foreign governments exert a trade advantage, particularly in agriculture, is via subsidies. President Trump is restoring the U.S. trade position globally versus our competitors. We must be able to control the domestic food supply and push prices down. No serious person would object to that.

President Trump’s commitment to agriculture is one of the ways farmers will be able to afford to boost domestic production and reduce food prices. Everyone against boosting production is pro-inflation.

Fortunately, President Trump is teaching the next generation of leaders how to run a country. You can thank him later.

Robert Romano is the executive director of Americans for Limited Government, a conservative 501(c)(4) nonprofit organization that says it is dedicated to restoring constitutionally limited government, allowing individuals to pursue life, liberty, and happiness.

Ask Rusty: About Tax Filing Status and Medicare

Dear Rusty: I’m trying to figure out if I should change my IRS filing status to “Married – Filing Jointly” prior to getting reviewed for my Medicare Part B and Part D. My current IRS status is “Married – Filing Single” and I noticed this filing status is more stringent. I will be turning age

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Dear Rusty: I’m trying to figure out if I should change my IRS filing status to “Married – Filing Jointly” prior to getting reviewed for my Medicare Part B and Part D. My current IRS status is “Married – Filing Single” and I noticed this filing status is more stringent. I will be turning age 62 soon and I have read that Medicare will review my income two years prior to turning 65. Any input would be appreciated.

Signed: Uncertain Senior

Dear Uncertain: Your IRS tax filing status has no bearing on your eligibility for Medicare Part B (coverage for outpatient health-care services) or Medicare Part D (insurance coverage for prescription drugs). Medicare is an individual health care program, so enrolling in Medicare provides coverage for you (only), not your spouse (your spouse’s Medicare eligibility will be individually evaluated).

What your IRS filing status may affect is the amount of your Medicare Part B and Part D premiums. There is a Medicare provision called IRMAA (income-related monthly adjustment amount), which sets the income thresholds on which your Medicare premiums are based, and those thresholds are different if you file your income tax as a single, or as “married/filing jointly.” The IRMAA thresholds can change annually, and there is no way to yet determine what they will be when you are able to enroll in Medicare at age 65 (they are currently $106,000 if you file as a single, and $212,000 if you file your taxes as “married/jointly”).

If your “provisional income” (your combined income from all sources) exceeds the threshold for your filing status, you will pay higher (than standard) Medicare Part B and Part D premiums. If your income is lower than the threshold, you will pay only whatever the standard Medicare Part B premium is for the year you start Medicare, and there will be no supplemental premium for your Part D coverage. For information, the IRMAA supplements are progressive — that is, the more you exceed the threshold by, the higher your IRMAA premium supplement will be. To see the current IRMAA thresholds and supplements (again, these will likely change when you are eligible for Medicare), visit: www.cms.gov/newsroom/fact-sheets/2025-medicare-parts-b-premiums-and-deductibles.

You are correct that your Medicare premium, when you enroll, will be determined by your total income from two years prior. So, if you plan to enroll in Medicare at age 65 (sometime in 2028), it is your 2026 income which will determine your Part B and Part D premiums, and that income will be defined by your 2026 income-tax return. Note, too, that Medicare premiums are reevaluated each year, based upon your IRS income-tax return from two years prior.

FYI, there are advantages to filing your income tax as “married/jointly” (compared to married/filing separately), and those are best evaluated by your tax advisor (we are not tax advisors here at the AMAC Foundation). And while it’s true that the IRMAA thresholds are higher when you file as “married/jointly,” it’s also true that your total income as a married couple will be used when determining your IRMAA premiums for Medicare. So, once again, it is probably best to consult with a qualified income-tax advisor for guidance on whether it is best, financially, for you to change how you file your income tax in 2026, considering that you will be enrolling in Medicare in 2028.

One final thing: If you are still working and have “creditable” health-care coverage from your employer (“creditable” is a group plan with at least 20 participants), then you can delay enrolling in Medicare until your employer coverage ends (thus temporarily avoiding the Medicare premiums). In other words, if you have creditable health-care coverage from an employer, you don’t have to enroll in Medicare immediately at age 65.

Russell Gloor is a national Social Security advisor at the AMAC Foundation, the nonprofit arm of the Association of Mature American Citizens (AMAC). The 2.4-million-member AMAC says it is a senior advocacy organization. Send your questions to: ssadvisor@amacfoundation.org.

Author’s note: This article is intended for information purposes only and does not represent legal or financial guidance. It presents the opinions and interpretations of the AMAC Foundation’s staff, trained, and accredited by the National Social Security Association (NSSA). The NSSA and the AMAC Foundation and its staff are not affiliated with or endorsed by the Social Security Administration (SSA) or any other governmental entity.

Binghamton submits DRI funding project ideas for Clinton Street

BINGHAMTON, N.Y. — The City of Binghamton’s local planning committee (LPC) for the state’s Downtown Revitalization Initiative (DRI) has submitted its project proposal for Clinton

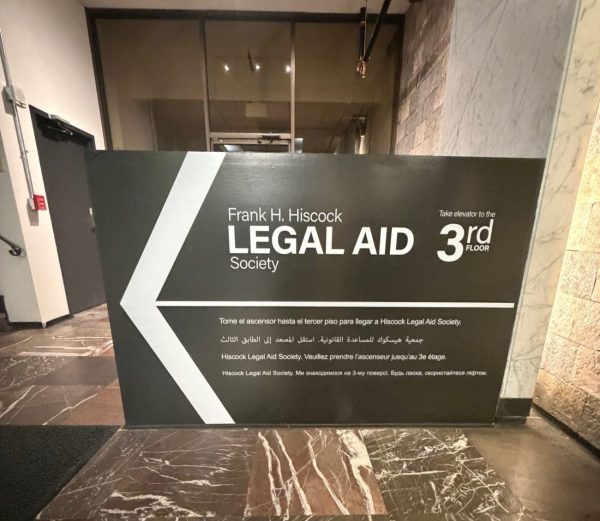

Hiscock Legal Aid Society to provide misdemeanor defense services in Syracuse City Court

SYRACUSE, N.Y. — The Hiscock Legal Aid Society (HLA) on Thursday said it’s been awarded a multi-year contract to provide legal representation for misdemeanor and violation cases in Syracuse City Court. HLA sees the contract award as “significantly expanding the organization’s capacity to serve individuals in Syracuse,” per its announcement. The contract will enable HLA

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE, N.Y. — The Hiscock Legal Aid Society (HLA) on Thursday said it’s been awarded a multi-year contract to provide legal representation for misdemeanor and violation cases in Syracuse City Court.

HLA sees the contract award as “significantly expanding the organization’s capacity to serve individuals in Syracuse,” per its announcement.

The contract will enable HLA to establish the misdemeanor-defense program and represent defendants in misdemeanor and violation proceedings in Syracuse City Court, from arraignment through final disposition.

To implement the new program, HLA will add 17 total staff members, including 11 attorneys. The organization expects to begin handling cases with initial staff this spring, with operations scaling throughout the fall to reach full capacity, HLA said.

This expansion brings HLA’s total annual operating budget to just over $15 million and increases the organization’s total staff to 117 people, 76 of whom are attorneys — making HLA “one of the largest legal aid providers in Central New York.”

“This contract represents a transformational moment for justice in our community,” Gregory Dewan, executive director of Hiscock Legal Aid Society, said in the announcement. “By adding this critical misdemeanor defense capacity, we’re strengthening the constitutional promise of equal justice under the law for thousands of people who face criminal charges each year.”

City of Utica seeks workers for Val Bialas Ski Hill, targeting late January opening

UTICA, N.Y. — The City of Utica is seeking workers for the Val Bialas Ski Hill, which targeting an opening date in late January. The

Would Your Nonprofit Be Prepared to Handle an Audit?

Although some may see them as a headache, audits play a very important purpose in the operation of a nonprofit. For starters, audits are designed

National Grid says its iconic downtown Syracuse building is set for multi-year restoration project

SYRACUSE, N.Y. — National Grid (NYSE: NGG) says its nearly 100-year-old art deco building at 300 Erie Boulevard West in Syracuse is undergoing a multi-year

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.