Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Colgate University unveils Peter’s Glen landscape corridor

HAMILTON, N.Y. — Colgate University announced it has opened its new Peter’s Glen, a 2.5-acre landscape corridor made possible by the philanthropy of 1965 graduate

Syracuse University Chancellor Syverud to step down in June 2026

SYRACUSE, N.Y. — Syracuse University Chancellor Kent Syverud plans to step down as chancellor and president in June 2026, after 13 years in the job.

Rebranded Sapphire Recruitment moves to Syracuse Inner Harbor

SYRACUSE, N.Y. — Sapphire Recruitment, which was formerly known as CPS Recruitment, has moved to the building known as Iron Pier at 720 Van Rensselaer St. in Syracuse’s Inner Harbor area. It held a formal-opening event on Tuesday morning. The company had been operating at 904 7th North St. in the town of Salina. In

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE, N.Y. — Sapphire Recruitment, which was formerly known as CPS Recruitment, has moved to the building known as Iron Pier at 720 Van Rensselaer St. in Syracuse’s Inner Harbor area.

It held a formal-opening event on Tuesday morning. The company had been operating at 904 7th North St. in the town of Salina.

In the firm’s announcement, Susan Crossett, CEO of Sapphire Recruitment, emphasizes that the rebrand goes beyond a name change.

“We’ve built a reputation on trust, adaptability, and deep local expertise,” Crossett said. “Sapphire Recruitment represents our forward-thinking approach and our commitment to being a true partner in the success of both employers and job seekers.”

Sapphire Recruitment also used its announcement to explain the rebrand, saying, “This rebrand represents a natural evolution — an opportunity to reinforce what has always set the company apart. Sapphire Recruitment is all about shaping futures for both industry and community at large. This transition allows us to build on our strengths, expand reach, and continue making meaningful connections between businesses and professionals.”

The new name “reflects the depth of their experience and the value of long-term partnerships. A sapphire takes millions of years to form, just like the relationships and expertise Sapphire Recruitment has built over the past 35 years,” per the Sapphire announcement.

In a separate announcement, COR Development Company sees the rebranded Sapphire’s move to the Syracuse Inner Harbor as “further establishing the area as a growing economic hub and premier destination for innovation and business growth.”

It joins a lineup of tenants that include Meier’s Creek Brewing Company, 315 Beauty Bar, Delmonico Insurance, and Café Blue.

Sapphire Recruitment is one of the largest independently owned, full-service staffing and recruitment firms in the Syracuse area and upstate New York. Established in 1989, the firm is a certified Women Owned Business (WBE).

New York SBDC presents awards to small businesses in Watertown, Camillus, and Oswego

The New York State Small Business Development Center (NY SBDC) on Friday presented statewide awards to businesses in Camillus, Oswego, and Watertown. The NY SBDC

Madison County awarded $10 million ConnectALL grant

WAMPSVILLE, N.Y. — Madison County will use a nearly $10 million grant to bring broadband Internet service to unserved residents in the southern part of

CenterState CEO names director of industry partnerships for construction

SYRACUSE, N.Y. — CenterState CEO recently appointed Danielle Szabo as director of industry partnerships for construction, a newly created position. In this role, Szabo is responsible for managing industry-focused workforce-development activities, especially within the construction industry. The goal is to help companies grow while creating career pathways for unemployed and underemployed Central New Yorkers, the

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE, N.Y. — CenterState CEO recently appointed Danielle Szabo as director of industry partnerships for construction, a newly created position.

In this role, Szabo is responsible for managing industry-focused workforce-development activities, especially within the construction industry. The goal is to help companies grow while creating career pathways for unemployed and underemployed Central New Yorkers, the regional economic-development organization said in an announcement.

Szabo comes to CenterState CEO from Ithaca Area Economic Development, where she served as director of workforce innovation for the last three years, according to her LinkedIn profile. In that role, Szabo collaborated with employers, educational partners, and community-based organizations to address workforce needs of key sector businesses in Ithaca and Tompkins County. That included designing and implementing initiatives to improve career awareness and creating inclusive pathways and programs to support area employers.

In her new position at CenterState CEO, Szabo is also co-leading the Syracuse Build initiative and its replication in three counties while overseeing workforce-development strategies and employer engagement in advanced manufacturing and other high-tech industries.

Szabo has more than 17 years of experience in the nonprofit, workforce, and economic-development sectors with a focus on social justice and economic inclusion. That includes previously working at CenterState CEO as director of programming for its Work Train initiative from 2009-2019, per her LinkedIn page. Szabo also has previously worked at Cayuga Economic Development Agency.

Development work starts on new fire station on Binghamton’s north side

BINGHAMTON, N.Y. — Work is underway on a project to develop a new fire station on the north side of Binghamton. Built in 1960, the current north side fire station at 39 West State St. is nearing the end of its useful life, the office Binghamton Mayor Jared Kraham said. It’s estimated that repairs to

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

BINGHAMTON, N.Y. — Work is underway on a project to develop a new fire station on the north side of Binghamton.

Built in 1960, the current north side fire station at 39 West State St. is nearing the end of its useful life, the office Binghamton Mayor Jared Kraham said. It’s estimated that repairs to the building would cost millions of dollars.

“We’re advancing plans to create a neighborhood anchor and state-of-the-art public safety facility — the North Side deserves it,” Kraham said in the announcement. “With a multi-year approach, we’ll work to secure state and federal grants to ease the burden on Binghamton taxpayers. From new fire apparatus to facilities, this administration is steadfast in our support of first responders and the lifesaving work they do.”

Kraham first announced plans to build a new fire station to serve the city’s north side last fall in his 2025 budget address, his office noted.

Following a public request for qualifications process this past spring, the City of Binghamton hired CPL of Vestal to provide professional design services for the predevelopment portion of the north side fire-station project.

In June, Binghamton City Council authorized Kraham to enter into an agreement with CPL for predevelopment services, expected to cost $100,000. CPL will work with the Binghamton Fire Department and other city officials on building and site programming, site selection, and conceptual design of the new facility.

A task force from the fire department — including Chief Alan Gardiner, Assistant Chief Thomas Edwards, and Captain David Holleran — is helping the predevelopment team in studying emergency response time and call volume data to make a data-driven decision regarding the location of the new station, the City of Binghamton said.

The work will also support the city in preparing competitive grant applications to fund the final design and construction of the new station, per the announcement.

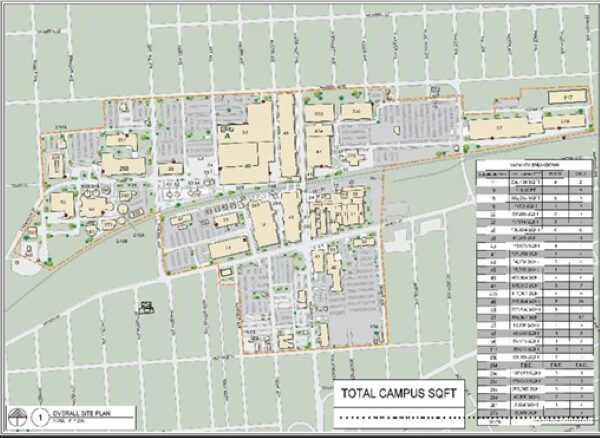

The Agency to develop a master plan for the Huron campus in Endicott

ENDICOTT, N.Y. — The Agency on Thursday announced the development of a master facilities plan to guide the “modernization and revitalization” of the Huron campus

Grants available for women-owned businesses in Oneida, Herkimer counties

CLINTON, N.Y. — Women–owned businesses in Oneida and Herkimer counties have until the end of September to apply for grant funding worth $5,000, with a total of five awards available. The Women’s Fund of Herkimer and Oneida Counties in cooperation with Baird Private Wealth Management and the Griffiss Institute are sponsoring the “Women Investing in

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

CLINTON, N.Y. — Women–owned businesses in Oneida and Herkimer counties have until the end of September to apply for grant funding worth $5,000, with a total of five awards available.

The Women’s Fund of Herkimer and Oneida Counties in cooperation with Baird Private Wealth Management and the Griffiss Institute are sponsoring the “Women Investing in Women” grants.

Eligible businesses must be at least 51 percent women–owned and have been in existence for one year or more. The deadline for applying is Sept. 30. The application is available at www.womensfundhoc.org.

The Women’s Fund began the Women Investing in Women initiative in 2022 and has awarded 14 grants of $5,000 each, for a total of $70,000 to women–owned businesses in Oneida and Herkimer Counties.

“Supporting women-owned businesses in our area has proven to be a welcome addition to the work of The Women’s Fund,” Ellen Rainey, VP of the Women’s Fund board of directors and the committee chair for the grants, said in the announcement. “Each year the number of applicants continues to increase, and we are hoping we get an even greater response this year. Even if applicants have applied in the past and not received the grant, we encourage the women to apply again. This initiative has brought local women-owned businesses together. They are supporting and helping each other grow.”

The five grants of $5,000 will be awarded in November. Recipients may use the money for equipment, hardware/software, consulting services, training, education, and marketing.

Milwaukee, Wisconsin–based Baird Private Wealth Management, which has an office in New Hartford, is a major contributor to the grant initiative, the Women’s Fund said. Baird has been a supporter since the grant initiative began. The Griffiss Institute is also a partner.

The Women’s Fund of Herkimer and Oneida Counties is based at 2 Williams St. in Clinton. Its mission is to create economic, educational, and personal growth opportunities for women of all ages, and encourage their advancement and full participation in the community, according to its website. It is a volunteer-driven organization sustained solely by donor contributions and led by women who are committed to creating a movement to change the lives of women and girls in its area.

Agreement gives TC3 graduates a transfer path to Cornell CALS

DRYDEN, N.Y. — A new articulation agreement will provide graduates of TC3 in Dryden a direct-transfer path to the College of Agriculture and Life Sciences (CALS) at nearby Cornell University. Amy Kremenek, president of Tompkins Cortland Community College (TC3), and Benjamin Houlton, dean of Cornell’s College of Agriculture and Life Sciences, participated in an Aug.

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

DRYDEN, N.Y. — A new articulation agreement will provide graduates of TC3 in Dryden a direct-transfer path to the College of Agriculture and Life Sciences (CALS) at nearby Cornell University.

Amy Kremenek, president of Tompkins Cortland Community College (TC3), and Benjamin Houlton, dean of Cornell’s College of Agriculture and Life Sciences, participated in an Aug. 7 ceremony to sign the pact between the two institutions.

“There is a strong legacy of collaboration between TC3 and Cornell. We know that Cornell is the dream for many of our students, and this agreement formalizes what we have always known to be true: that dream can be reality,” Kremenek said in the TC3 announcement. “This creates a clear, achievable pathway for students to start strong at TC3 and earn a degree from an Ivy League university. I applaud the efforts of TC3’s faculty and am grateful to our colleagues at Cornell for creating this tremendous opportunity for our students.”

Students start in the sustainable farming and food systems program at TC3, completing coursework at the TC3 Farm that will help them learn sustainable-agriculture practices, food systems, and related business concepts. After completing their associate degree with a minimum GPA of 3.0 and a B or better in all transfer courses, they will receive priority consideration for transfer admission to CALS for the agriculture sciences bachelor’s program.

At CALS, they will work to further their knowledge and skills in areas including crop and soil sciences, animal sciences, agriculture economics, and food science, TC3 said.

“We are proud to partner with SUNY and TC3 to expand access and opportunity for New York state students,” Houlton, the Ronald P. Lynch dean of CALS, said. “This new articulation agreement reflects our Land-Grant mission and shared commitment to building strong academic pathways for students, in service of all New Yorkers. By welcoming TC3 transfer students into our community, we’re investing in the next generation of agricultural and life sciences leaders — offering them access to world-class research, hands-on learning, and real-world impact that can spark innovation and improve lives here at home and around the world.”

Through its longstanding partnership with Cornell CALS, TC3 said it plays a “vital role in preparing students for seamless transfer” into programs that advance New York’s agricultural and life-sciences sectors.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.