Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Elmcrest Children’s Center director to retire, successor named

Riposa brings a leadership background in nonprofit, for-profit, and government entities, including as a health-services administrator in correctional health care and, most recently, as COO

Lacona man charged with theft at Walmart in Cortlandville

CORTLANDVILLE, N.Y. — New York State Police in Homer arrested a Lacona man on June 7 after he allegedly stole more than $800 worth of

Splash Indoor Water Park Resort to open in Oswego this Friday

OSWEGO, N.Y. — Splash Indoor Water Park Resort is set to open on Friday, June 23 at 92 East First St. in the Clarion Hotel

Agri-Mark completes nearly $30 million expansion of dairy facility in North Country

CHATEAUGAY, N.Y. — Agri-Mark has completed the nearly $30 million expansion and modernization project at its cheese-manufacturing facility in Chateaugay in Franklin County. The expansion,

AmeriCU names Todd to new North Country position

FORT DRUM, N.Y. — AmeriCU Credit Union announced it has appointed Michael Todd as the new small-business relationship manager of the credit union’s North Country

ESOP Benefits for Architecture and Engineering Firms

Planning an exit strategy from your successful architecture or engineering firm can be difficult at times. While there are many options to choose from, one

Operation Oswego County, COIDA helped in the creation, retention of nearly 1,500 jobs in 2022

OSWEGO, N.Y. — Operation Oswego County (OOC) and the County of Oswego IDA (COIDA) in 2022 helped with projects that resulted in the creation or

Greater Binghamton Chamber to hold women’s expo on Thursday

BINGHAMTON, N.Y. — The Greater Binghamton Chamber of Commerce, along with title sponsor Tompkins Community Bank, will present the 2023 Women’s Conference and Expo on

People news: Herkimer College promotes Diehl to payroll staff accountant

HERKIMER, N.Y. — Herkimer County Community College announced it has appointed Lynda Diehl as payroll staff accountant, a position responsible for tracking and processing all

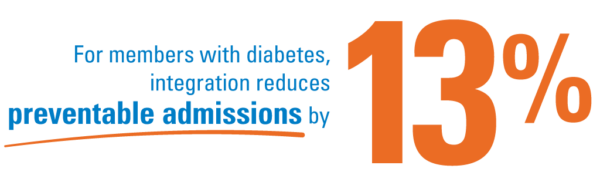

Integrated Benefits Bring Real Value

If you are concerned about health care costs, you’re not alone. A recent poll found that 58% of Americans are worried about unexpected medical bills

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.