Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Munson wins $25,000 grant from New York State Council on the Arts

UTICA, N.Y. — The New York State Council on the Arts (NYSCA) recently awarded Munson a $25,000 grant to support the arts and culture sector.

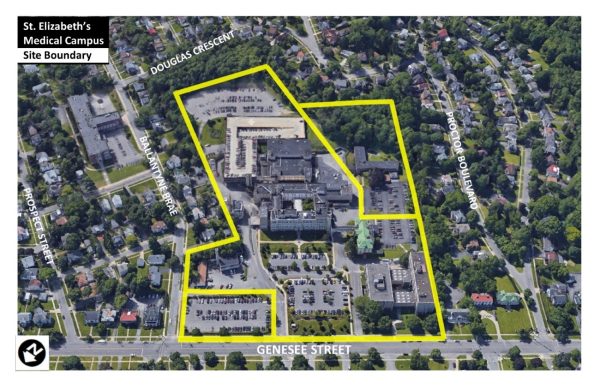

MVHS seeks interest for redevelopment of former St. Elizabeth Medical Center campus

UTICA, N.Y. — Mohawk Valley Health System (MVHS) in Utica wants to hear from qualified developers who are interested in redeveloping the former St. Elizabeth Medical Center (SEMC) campus, a 21.3 acre site located on Genesee Street in Utica. MVHS has issued a request for expressions of interest (RFEI) for the project. The health system

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

UTICA, N.Y. — Mohawk Valley Health System (MVHS) in Utica wants to hear from qualified developers who are interested in redeveloping the former St. Elizabeth Medical Center (SEMC) campus, a 21.3 acre site located on Genesee Street in Utica.

MVHS has issued a request for expressions of interest (RFEI) for the project. The health system says the question deadline is Jan. 19, 2026 and the proposal-submission deadline is Feb. 2, 2026.

Following submission, selected respondents will be invited to participate in interviews and site tours, with developer selection anticipated later in 2026.

“The RFEI marks a major milestone in the long-planned transformation of the former hospital campus and builds upon extensive community engagement, planning and environmental review,” MVHS said in a Dec. 22 announcement.

The redevelopment vision calls for a predominantly residential project that will deliver much-needed market-rate housing while preserving the historic character of the site and enhancing the surrounding South Utica neighborhood.

“This RFEI represents an exciting next step for the St. Elizabeth campus and for the City of Utica,” Dr. William LeCates, president and CEO of MVHS, said. “Through a collaborative planning process with the City of Utica, community partners and local stakeholders, we have established a thoughtful vision for redevelopment. We now look forward to engaging with experienced developers who share that vision and can help bring it to life.”

The full RFEI is available online.

Also, supporting planning documents are available through the City of Utica’s website.

New York’s minimum wage set for another increase on Jan. 1

ALBANY, N.Y. — The state’s minimum wage is set to go up again on Thursday, Jan. 1, 2026, marking the third straight year of increases

Trade Design Build formally opens community art hub

ULYSSES, N.Y. — Trade Design Build, an architecture and construction firm in the Ithaca area, recently unveiled a community art gallery. It’s part of a

Finger Lakes Land Trust hits milestone of conserving 35,000 acres

ITHACA, N.Y. — The Finger Lakes Land Trust (FLLT) of Ithaca announced it has reached the “major milestone” of having conserved 35,000 acres across the

Viewpoint: Year-End Tax and Financial-Planning Strategies

The end of the year is nearly here, but there’s still time to take a closer look at your financial picture and make the most of tax-planning opportunities before the calendar turns to 2026. Thoughtful year-end planning can reduce your current tax bill, position you for long-term growth, and help ensure your wealth is transferred

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The end of the year is nearly here, but there’s still time to take a closer look at your financial picture and make the most of tax-planning opportunities before the calendar turns to 2026. Thoughtful year-end planning can reduce your current tax bill, position you for long-term growth, and help ensure your wealth is transferred efficiently to future generations.

Here are 10 practical tax and financial-planning strategies to consider before 2025 ends.

1. Consider a Roth IRA Conversion

A Roth IRA conversion allows you to move pre-tax retirement assets into a Roth IRA, where future growth and qualified withdrawals are tax-free. While the converted amount is taxable in the year of conversion, doing so during a year of lower income or when market values are down can be especially advantageous. Additionally, the next presidential administration could raise income-tax rates, so paying taxes now at potentially lower rates may be beneficial. Roth IRAs are not subject to required minimum distributions (RMDs), which can help reduce future taxable income and potential Medicare IRMAA (income-related monthly adjustment amount) surcharges. Partial conversions can also help you manage tax brackets. Tax-free Roth accounts can be particularly valuable to heirs who must withdraw inherited funds within 10 years. If you have a taxable estate, paying the income tax for them saves estate tax, yet isn’t a taxable gift.

2. Harvest Investment Losses

Tax-loss harvesting involves selling securities at a loss in taxable (non-retirement) accounts to offset capital gains elsewhere in your portfolio. If losses exceed gains, up to $3,000 can be deducted against ordinary income. Remaining losses carry forward to future years. This strategy can help improve tax efficiency.

3. Maximize Employer Retirement Plan Contributions

For those ages 60–63, 2025 offers enhanced catch-up contribution opportunities. The catch-up limit for 401(k), 403(b), and 457(b) plans increases to $11,250, while SIMPLE IRA catch-up contributions rise to $5,250. Taking full advantage of these limits can significantly boost retirement savings while reducing current taxable income.

4. Use Backdoor or Mega Roth Strategies

High-income earners who are ineligible to contribute directly to a Roth IRA may still benefit from a backdoor Roth strategy. This involves making a nondeductible IRA contribution and then converting it to a Roth IRA, a strategy that works best when you have no other pre-tax IRA-type account balances. If your employer plan allows after-tax contributions and in-plan Roth conversions, a Mega Roth strategy may allow you to move even larger amounts into Roth accounts.

5. Maximize Your FSA and HSA Benefits

If you participate in a flexible spending account (FSA), review whether your plan has a “use-it-or-lose-it” provision and spend remaining funds before year-end if necessary. For health savings accounts (HSAs), consider paying current medical expenses out of pocket and allowing your HSA to grow tax-free. Keep receipts for unreimbursed expenses, which can be reimbursed tax-free in the future.

6. Use a Donor-Advised Fund (DAF)

A donor-advised fund (DAF) allows you to make a charitable contribution and receive an immediate tax deduction while retaining flexibility over when and where grants are distributed in the future. Bunching multiple years of charitable giving into one year can help exceed the standard deduction, maximizing tax benefits. DAFs can also be a powerful way to involve family members in philanthropy by naming them as successor advisors.

7. Make Qualified Charitable Distributions (QCDs)

If you are age 70½ or older, you can donate up to $108,000 per person in 2025 directly from your IRA or inherited IRA to qualified charities. These qualified charitable distributions (QCDs) can count toward your RMD, but are excluded from taxable income. That can help reduce adjusted gross income and taxable income for the related tax impacts. Note that QCDs cannot be made to donor-advised funds or private foundations.

8. Be Strategic with Charitable Contributions

Consider accelerating charitable gifts planned for 2026 into 2025 to avoid the new 0.5 percent adjusted gross income (AGI) floor on deductions scheduled to take effect in 2026. Under the One Big Beautiful Bill Act (OBBBA), 2026 will also have an itemized deduction phase-out for those in the top 37 percent tax bracket, effectively bringing the tax savings on your itemized deductions down to 35 percent. Donating appreciated securities instead of cash gives you the double tax benefit of avoiding capital-gains tax while still receiving a full fair-market-value deduction. These gifts can be made directly to charities or to a DAF for added flexibility.

9. Make Annual Exclusion Gifts

In 2025, you can gift up to $19,000 per recipient ($38,000 for married couples electing gift splitting or gifting from a joint account) without using any lifetime estate-tax exemption. You can also make unlimited gifts by paying for medical or educational expenses directly to the institution for anyone you wish. Annual gifting can reduce your taxable estate while helping loved ones with education, housing, or health-care expenses. You may also consider funding IRAs, Roth IRAs, or HSAs for family members who are eligible for contributions.

10. Contribute to 529 College Savings Plans

New York residents can deduct up to $5,000 per taxpayer, $10,000 per couple, for contributions to New York State 529 plans, even if the funds are immediately withdrawn to pay qualified education expenses. Contributions must be made by year-end, and distributions must occur in the same year as the expense is incurred. For those looking to accelerate savings, a lump-sum contribution of up to $95,000 using the five-year averaging gift-tax election can jumpstart long-term growth.

Year-end planning isn’t just about minimizing taxes; it’s about making informed decisions that align with your broader goals. Thoughtful year-end planning can help you enter 2026 with confidence and possibly save you some money on taxes.

Cindi Turoski is a partner in The Bonadio Group’s Tax Service Line and a member of the firm’s Estate and Trust Team. With more than 30 years of deep tax and financial-planning experience, she provides consultative services to a wide variety of clients, further specializing in closely held business owners.

Newly approved New York State energy plan takes all-of-the above approach

ALBANY, N.Y. — New York’s energy planning board on Dec. 16 voted unanimously to approve the more than 1,050-page state energy plan. The plan includes

G.A. Braun of Cicero is now operating under new ownership

CICERO — G.A. Braun of Cicero, a supplier in the North American laundry-equipment market, has a new owner. Jensen North America, a subsidiary of the Jensen-Group, acquired G.A. Braun. The deal closed on Dec. 1, J.B. Werner, former CEO of G.A. Braun, told CNYBJ in a Dec. 9 email. G.A. Braun is located at 79

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

CICERO — G.A. Braun of Cicero, a supplier in the North American laundry-equipment market, has a new owner.

Jensen North America, a subsidiary of the Jensen-Group, acquired G.A. Braun. The deal closed on Dec. 1, J.B. Werner, former CEO of G.A. Braun, told CNYBJ in a Dec. 9 email.

G.A. Braun is located at 79 General Irwin Blvd., off East Taft Road, in the town of Cicero. Jensen-Group is headquartered in Wetteren, Belgium. Neither company released financial details of the acquisition agreement.

With the acquisition, Jensen-Group expands its manufacturing footprint, product portfolio, and service network across North America. The firm calls it a “significant milestone” in its growth strategy.

In the transaction, Jensen acquired Braun’s production facility, and both brands will continue to co-exist. It will allow both Jensen and Braun to “preserve what makes each brand unique, while joining forces to deliver even greater value, innovation, and support to customers across North America,” per the announcement on the Braun website.

The newly founded company Jensen Braun LLC acquired the assets of G.A. Braun. Under the new structure, Jensen North America will manage both Jensen Braun LLC in Cicero and Jensen USA in Panama City, Florida.

Braun employs about 230 people, including about 210 employees at its local plant, per Werner’s email to CNYBJ.

“After many successful years in the laundry industry, I am proud to see Braun become part of the JENSEN team,” Werner, the former G.A. Braun top executive, said in the acquisition announcement. “We share the same values: customer focus, reliability, and a passion for building long-term partnerships. I am confident that our employees and customers are in very good hands and will benefit from the global strength and expertise of the JENSEN-GROUP.”

Werner is now working as a consultant to the new organization, Jensen-Braun, LLC, he told CNYBJ.

SU’s Orange Business Angel Network to begin in spring 2026

SYRACUSE — The Orange Business Angel Network (OBAN) at Syracuse University (SU) is a student-led experiential learning program that will provide hands-on startup investment experience for students while connecting SU-affiliated entrepreneurs with seed funding and mentorship. The program will begin in the spring of 2026 with an inaugural class of about 15 students and a

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE — The Orange Business Angel Network (OBAN) at Syracuse University (SU) is a student-led experiential learning program that will provide hands-on startup investment experience for students while connecting SU-affiliated entrepreneurs with seed funding and mentorship.

The program will begin in the spring of 2026 with an inaugural class of about 15 students and a founding cohort of angel investors, per the Dec. 2 announcement that SU’s Martin J. Whitman School of Management made about OBAN’s launch.

OBAN places students at the center of “real investment activity,” SU said. Selected students will conduct “professional-level due diligence” on actual startups, organize pitch events, and facilitate the connections between entrepreneurs and accredited angel investors, all while earning academic credit through a three-credit course.

Students will conduct the due diligence that investors use to make their decisions and help in deal flow while allowing the angel to make their own investment decisions.

“OBAN represents the next evolution in entrepreneurship and experiential education at Whitman,” Alex McKelvie, dean of the Whitman School of Management, said in the announcement. “We are giving our students authentic responsibility in the angel investment process, preparing them to lead in entrepreneurial finance or informed founder roles. For the Whitman School, this program strengthens our position to grow into a top 25 business school while building critical connections for our students and alumni within the Syracuse University network. It is yet another commitment by Whitman to experiential programs, which is central to our education.”

Three OBAN groups

Within OBAN, three groups of selectively chosen, SU-affiliated participants will make up the network, “ensuring the brightest students, most promising ventures and supportive angels are involved,” per the announcement.

Whitman students in the program will learn angel investing fundamentals through direct practice, conducting market research, analyzing financials, and organizing pitch sessions. The course will be taught by Whitman professor Jeffrey Gish, who brings experience in both angel investing and entrepreneurship education.

Investors accredited with the U.S. Securities and Exchange Commission (SEC) can join as angels of the network. As a key part of the program is including successful university alumni in the classroom, these “supportive angels” commit not just to potential investments but to mentoring both students and entrepreneurs throughout the process, the Whitman School noted.

Entrepreneurs with university affiliations — having an alumnus, student, parent, faculty, or staff member on their founding team — can apply to pitch for seed-stage funding. The program focuses on companies with valuations under $10 million that have raised less than $2 million to date, but with the potential to grow and be an attractive investment.

“What excites me most about OBAN is how it transforms the traditional boundaries between classroom and deal room,” Erin Draper, director of experiential programs at Whitman, who is leading the launch of the program alongside McKelvie, said. “Students aren’t just observing the investment process within OBAN. They’re essential to it. And our angels are actively mentoring the next generation of investors and entrepreneurs. This creates a virtuous cycle that benefits everyone involved.”

OBAN participation

The Whitman School is now accepting applications for all three OBAN participating groups: students, angel investors, and entrepreneurs.

Students: Upper-level undergraduate and graduate students can apply for the selective spring 2026 cohort. Prerequisites include foundational entrepreneurship coursework. The Whitman School of Management has reached out to students directly.

As for angel investors, accredited investors with SU connections can become founding members of the network.

“This will be a very select group and grow over time,” the school noted. Membership application information can be found at: https://syracuseuniversity.qualtrics.com/jfe/form/SV_5u2O7cvBgV65Bmm

Binghamton to close State Street parking garage Jan. 5

Move comes before planned demolition Binghamton plans to request bids for demolition of the garage in the coming weeks, per the city’s website. The mayor announced plans for the ramp’s demolition in September during his 2026 budget address. The ramp, located on the corner of State and Henry streets, was built in 1970. “As

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Move comes before planned demolition

Binghamton plans to request bids for demolition of the garage in the coming weeks, per the city’s website.

The mayor announced plans for the ramp’s demolition in September during his 2026 budget address. The ramp, located on the corner of State and Henry streets, was built in 1970.

“As the City moves forward with plans to tear down the aging State Street parking ramp, LAZ Parking is working to relocate monthly parkers and bring operations to a close,” Binghamton Mayor Jared Kraham said in the announcement. “Downtown’s two new parking garages on Water Street and Hawley Street are providing residents and visitors with safe and easy parking options. With the State Street ramp at the end of its useful life, demolition will clear the way for economic development opportunities in a critical corner of downtown Binghamton.”

Permitted parkers at the ramp can contact LAZ Parking at (607) 759-1026 or email binghamton@lazparking.com with questions, or to seek more information on relocation.

Businesses whose customers and employees use the State Street ramp can also reach out to the city’s Office of Economic Development at (607) 772-7161 for assistance in identifying alternate parking options.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.