Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Wendy’s to open new restaurant inside Destiny USA

SYRACUSE, N.Y. — Wendy’s is planning to open a new location inside Destiny USA, near the Dick’s Sporting Goods location in the complex’s Canyon area.

Centro awarded federal funding to purchase nine low-emission buses for BRT system

SYRACUSE, N.Y. — The Central New York Regional Transportation Authority (Centro) will use a federal grant of more than $9 million to buy about nine

TC3, Hobart and William Smith Colleges sign transfer agreement

DRYDEN, N.Y. — Tompkins Cortland Community College (TC3) and Hobart and William Smith Colleges (HWS) in Geneva on Thursday, Dec. 18 announced a new transfer

Otis Technology set for new leadership to begin 2026

LYONS FALLS, N.Y. — Otis Technology in Lewis County has promoted the company’s executive VP to serve as CEO, beginning Jan. 1, 2026. Brad McIntyre

Griffiss Institute generated $15.4M impact on Mohawk Valley in FY24, study found

ROME, N.Y. — In fiscal year 2024 (FY24), Rome’s Griffiss Institute generated a more than $15 million impact on the economy of the Mohawk Valley. That includes supporting 164 direct and indirect jobs and delivering $3.2 million to scholars and professionals to live, learn, and work alongside regional industry partners in the Mohawk Valley. For

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ROME, N.Y. — In fiscal year 2024 (FY24), Rome’s Griffiss Institute generated a more than $15 million impact on the economy of the Mohawk Valley.

That includes supporting 164 direct and indirect jobs and delivering $3.2 million to scholars and professionals to live, learn, and work alongside regional industry partners in the Mohawk Valley.

For every $1 the Griffiss Institute spent on labor in the Mohawk Valley, the community received $1.33 in wealth creation from Griffiss Institute activities, 96 percent of which were fueled by federal sources in FY24.

The findings are part of GI’s inaugural Economic Impact Report for NY2024 that was developed in collaboration with Hamilton College student researchers through the Levitt Public Affairs Center.

Working with the Griffiss Institute and Heather Hage, the institute’s president and CEO, the students conducted extensive economic modeling and data analysis to measure how GI’s technology transfer, workforce development, and startup initiatives contribute to the region’s prosperity, per the GI.

“The Griffiss Institute is a driving force in the Mohawk Valley, fueling innovation, empowering talent, and creating measurable economic impact,” Patricia Baskinger, chair of the Griffiss Institute board of directors, said in the announcement. “This year’s results demonstrate how intentional investment in people, partnerships, and purpose delivers tangible value for our community and the nation.”

In FY2024, the Griffiss Institute invested $800,000 in early-stage dual-use technology startups developing solutions for national security. It also supported 197 high-tech internships and 313 regional students to participate in STEM (science, technology, engineering, mathematics) camps.

It is also facilitating 228 partnerships for the Air Force Research Laboratory (AFRL) Information Directorate to collaborate with 130 industrial firms and 98 universities, in service to national-defense priorities, per its announcement.

In addition to its direct impact on the regional economy, the Griffiss Institute generated an estimated $4.9 million in federal, state, and local tax revenue.

“This report is about how government investments in science, research, education, and technology transfer can translate into significant social and economic outcomes for our communities. Beyond the policy and finance layers of economic analysis, it’s the people — the hundreds of interns and scholars, entrepreneurs, academic and government scientists, and our industry partners, who bring real-world challenges to the table and work together, through the Griffiss Institute, to drive innovation forward to the benefit of our country and community,” Heather Hage, president and CEO of Griffiss Institute, said. “Their collaboration is what drives our impact. We are proud to be part of a region that works together to create opportunities that strengthen both our local economy and our national security.”

The FY2024 Griffiss Institute Economic Impact Report was researched and authored by Hamilton College student researchers from the Levitt Public Affairs Center. They included Luke Hanson, Delaney Patterson, Samuel Low, and Ton Somnug, who worked under the mentorship of Hage. The student researchers analyzed real Griffiss Institute data, built economic models, and collected local insights to trace how each dollar invested circulates through the Mohawk Valley economy.

Five Star Bank parent company completes $80 million subordinated debt offering

WARSAW, N.Y. — Financial Institutions, Inc. (NASDAQ: FISI), parent company of Five Star Bank, announced that it has recently completed a private placement of $80 million in aggregate principal amount of fixed-to-floating rate subordinated notes (maturing in 10 years) to qualified institutional buyers and accredited institutional investors. The notes have a maturity date of Dec.

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

WARSAW, N.Y. — Financial Institutions, Inc. (NASDAQ: FISI), parent company of Five Star Bank, announced that it has recently completed a private placement of $80 million in aggregate principal amount of fixed-to-floating rate subordinated notes (maturing in 10 years) to qualified institutional buyers and accredited institutional investors.

The notes have a maturity date of Dec. 15, 2035 and bear interest, payable semi-annually, at the rate of 6.5 percent per year, until Dec. 15, 2030, the banking company said in its announcement. Starting on that date, the interest rate will reset quarterly to an interest rate per annum equal to the then-current, three-month Secured Overnight Financing Rate (SOFR) plus 312 basis points, payable quarterly until maturity.

Financial Institutions is entitled to prepay the notes in whole or in part at any time on or after Dec. 15, 2030, and to prepay the notes at any time upon certain other specified events. The notes received a BBB- rating from Kroll Bond Rating Agency, which recently revised the banking company’s long-term outlook to Stable, reflecting sustained improvement in its profitability and enhanced capital position.

Financial Institutions said it intends to use the net proceeds to redeem the $65 million in outstanding-debt issuances from 2015 and 2020, as well as for general corporate purposes. The $65 million in outstanding debt includes $35 million that began repricing quarterly on Oct. 15, 2025, and which currently bears interest of 8.17 percent, in addition to $30 million that began repricing quarterly on April 15, 2025, and which currently bears interest of 8.11 percent.

“We are pleased with the successful completion of this subordinated debt offering, which allows us to refinance existing issuances at more attractive rates, while providing additional capital for thoughtful deployment as we remain focused on creating long-term value for our shareholders,” Martin K. Birmingham, president and CEO of Financial Institutions, said in the company’s Dec. 11 announcement. “Given the additional $80.0 million of capital that will be on our balance sheet at year-end and our intent to call the outstanding $65.0 million in the first quarter, we do expect the Company’s Total Risk-Based Capital ratio to be temporarily elevated by approximately 150 basis points at year-end.”

Piper Sandler & Co. — headquartered in Minneapolis, Minnesota — served as sole placement agent for the subordinated debt offering. Washington, D.C.–based Luse Gorman, PC was legal counsel to Financial Institutions, and Hogan Lovells US LLP — whose U.S. headquarters is in Washington, D.C. — served as legal counsel to Piper Sandler & Co.

Financial Institutions is a financial holding company, based in Warsaw in New York’s Wyoming County, with about $6.3 billion in assets, offering banking and wealth-management products and services. Its Five Star Bank subsidiary provides consumer and commercial banking and lending services to individuals, municipalities, and businesses through banking locations spanning Western and Central New York and a commercial-loan production office serving the Mid-Atlantic region. Five Star Bank’s Central New York offices include a commercial-loan production office in Syracuse and retail branches in Auburn, Waterloo, and Geneva.

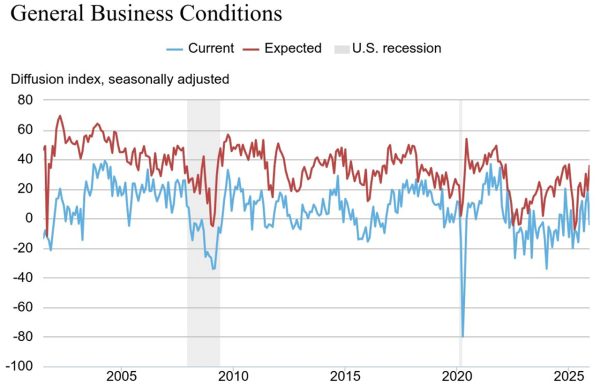

New York manufacturing index ends 2025 in negative territory

Respondents to the monthly Empire State Manufacturing Survey indicated unexpected contraction in the manufacturing sector with the general-business conditions index plunging 23 points to -3.9 in December. This breaks a run of several strong months, as the index had climbed 8 points to 18.7 in November, its fourth positive reading in the past five months

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Respondents to the monthly Empire State Manufacturing Survey indicated unexpected contraction in the manufacturing sector with the general-business conditions index plunging 23 points to -3.9 in December.

This breaks a run of several strong months, as the index had climbed 8 points to 18.7 in November, its fourth positive reading in the past five months and highest in a year.

Based on firms responding to the survey, the December reading indicates business activity “declined slightly” in New York state, the Federal Reserve Bank of New York said in its Dec. 15 report. The consensus expectations of analysts was a December index number of 10.0, according to Seeking Alpha.

A negative reading on the index indicates a decline in the sector, while a positive index number points to expansion or growth in manufacturing activity.

The December survey found new orders held steady while shipments decreased modestly, the New York Fed said. Delivery times quickened, unfilled orders declined, and supply availability worsened.

However, going forward, New York manufacturing firms grew “increasingly optimistic” and expect conditions to improve in the months ahead.

Survey details

New orders held steady, with about one-third of firms reporting an increase and about one-third reporting a decrease, and shipments were modestly lower, with the index dropping 23 points to -5.7, the New York Fed said.

The inventories index came in at 4.0, pointing to a small increase in inventories. The delivery-times index fell below zero to -5.9, and the unfilled-orders index decreased to -14.9, its lowest level since January 2024, indicating quicker delivery times and fewer unfilled orders.

The supply-availability index edged up but remained negative at -6.9, suggesting worsening supply availability.

The index for number of employees ticked up to 7.3, its sixth positive reading in seven months, while the average-workweek index edged down to 3.5, suggesting a modest increase in employment levels and a small increase in hours worked.

Both price indexes remained elevated but declined for a second straight month: the prices-paid index dropped 11 points to 37.6 — its lowest level since January — and the prices-received index dipped 4 points to 19.8.

Optimism about the future

The index for future business conditions soared 17 points to 35.7, its highest level since January, suggesting firms have become more optimistic that conditions will improve over the next six months. The indexes for future new orders and shipments both reached their highest levels of 2025. Supply availability is expected to be little changed.

Firms continue to anticipate elevated price increases. Inventories are expected to continue to expand. The capital-expenditures index came in at 6.9, pointing to a small increase in capital-spending plans, the New York Fed said.

The New York Fed distributes the Empire State Manufacturing Survey on the first day of each month to the same pool of about 200 manufacturing executives in New York. On average, about 100 executives return responses.

Naturally Lewis Awards Night honors businesses, owners

LOWVILLE, N.Y. — A meat processor located northeast of Lowville is this year’s recipient of the Naturally Lewis Outstanding Business Award. Red Barn Meats, Inc. was among the businesses that Naturally Lewis recognized during its Membership Awards Night held on Nov. 19 at the Town Hall Theater in Lowville. The event brought together more than

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

LOWVILLE, N.Y. — A meat processor located northeast of Lowville is this year’s recipient of the Naturally Lewis Outstanding Business Award.

Red Barn Meats, Inc. was among the businesses that Naturally Lewis recognized during its Membership Awards Night held on Nov. 19 at the Town Hall Theater in Lowville.

The event brought together more than 100 business and community leaders to acknowledge the achievements of the Naturally Lewis membership, which contributes to the success of Lewis County’s economy.

Besides Red Barn Meats, this year’s award recipients include North Country Family Health Center, which was recognized with the Community Excellency Award following a recent acquisition and expansion.

In addition, Naturally Lewis honored Good Ol’ Wishy’s of Croghan with the Discover Tug Hill Award, acknowledging its 30 years of service. The organization also recognized Scott and Ingrid Moshier with the Entrepreneur of the Year Award for their involvement in businesses that include Wolff’s Body Shop, Monnat & Nortz Service Station, The Old Croghan Engine House, and Moving Mountains Café.

The Moshiers have invested nearly $250,000 in Croghan’s downtown businesses, renovating the historic Old Engine House and expanding Moving Mountains Café, per the Naturally Lewis Facebook page.

To be eligible for an award, a business must be an active Naturally Lewis member and meet the criteria of each respective award category. Businesses and organizations were nominated for awards by Naturally Lewis staff, and public voting decided the award recipients.

“This year has been defined by growth, reinvestment, and resilience with more than $8 million invested directly into our local economy by the nominees in this room alone,” Jenna Lauraine, programs & partnerships director at Naturally Lewis, said in the announcement. “Tonight’s awards honor not only individual achievements, but the collective momentum of a county that continues to grow, adapt, and thrive because of the people who call it home.”

Naturally Lewis says membership in the organization can provide businesses and organizations with the tools and resources needed to start and grow. Businesses and nonprofits interested in joining the Naturally Lewis membership can find more information at naturallylewis.com/min/membership.

Naturally Lewis is an economic-development organization that administers the services of the Lewis County Chamber of Commerce, County of Lewis Industrial Development Association, and Lewis County Development Corporation.

Riverside Farm Market formally opens at new location in St. Lawrence County

POTSDAM, N.Y. — Riverside Farm Market, a farm-direct store offering locally sourced products and prepared meals, recently formally opened at its new location at 6759 Route 11 in the town of Potsdam, in St. Lawrence County. The business, owned by Joe Eisele and Dean Laubscher, held a grand opening and ribbon-cutting ceremony with the St.

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

POTSDAM, N.Y. — Riverside Farm Market, a farm-direct store offering locally sourced products and prepared meals, recently formally opened at its new location at 6759 Route 11 in the town of Potsdam, in St. Lawrence County.

The business, owned by Joe Eisele and Dean Laubscher, held a grand opening and ribbon-cutting ceremony with the St. Lawrence County Chamber of Commerce (STLC) on the morning of Saturday, Nov. 22, the chamber announced.

The event celebrated the successful launch of the farm-direct store, which emphasizes high-quality, locally produced items. It also included the kickoff of Christmas tree sales.

Eisele and Laubscher expressed their enthusiasm for bringing the concept to the community.

“We’re grateful,” Eisele said in a Nov. 25 chamber announcement. “A lot of people helped us, and we are grateful to all who did.”

Laubscher expressed special gratitude for builder Jerry Montelione.

Riverside Farm Market focuses on locally sourced meats, including beef and pasture-raised chicken from Northern Limits Farm, as well as locally sourced pork and lamb. It also offers produce and a wide array of goods from local farmers, artists, and makers, per the announcement.

The owners also previewed an important expansion: a commercial kitchen that was set to open soon. This kitchen will prepare clean, fresh, and fast breakfast and lunch sandwiches, as well as hearty dinner meals ready for families. The prepared food line will adhere to a commitment to minimal ingredients, no nitrates or preservatives, and non-GMO or organic choices, the announcement stated.

The ribbon-cutting ceremony featured live music from local performers Nick Rycoft and Larry Holly, along with a live presence from the radio station B99.3. Attendees had the chance to sample items from several local vendors, including Nibbles Snackery, One Steep at a Time, Raquette River Roasters, and Canton Apples.

Casullo appointed to M&T Bank Directors Advisory Council for CNY

SYRACUSE, N.Y. — M&T Bank recently announced it has appointed David Casullo, founder and CEO of Daneli Partners, to its Directors Advisory Council for Central New York. The 11-member council meets regularly to discuss business, customer, and community impact opportunities within Central New York and provides insights to support M&T’s ongoing efforts to develop locally

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE, N.Y. — M&T Bank recently announced it has appointed David Casullo, founder and CEO of Daneli Partners, to its Directors Advisory Council for Central New York.

The 11-member council meets regularly to discuss business, customer, and community impact opportunities within Central New York and provides insights to support M&T’s ongoing efforts to develop locally customized product and service models.

David Casullo, who is also co-founder of Overlook Ridge Development, “brings a dynamic blend of entrepreneurial vision, executive leadership and deep civic engagement to the Central New York council,” M&T Bank said in its Nov. 25 announcement. He is an experienced entrepreneur, executive coach, and real-estate developer with more than three decades of leadership experience across manufacturing, retail, and service industries.

Daneli Partners is a leadership-development firm focused on cultivating high-integrity, high-energy leaders to drive the revitalization of upstate New York. Overlook Ridge Development is a mission-driven real-estate company advancing sustainable economic growth in small localities like Little Falls.

Casullo is the author of “Leading the High-Energy Culture” and has advised Fortune 500 executives, government leaders, and emerging changemakers worldwide. His corporate leadership includes serving as senior VP of human resources at Raymour & Flanigan, where he launched the Leadership Development Institute and helped scale the company to a billion-dollar enterprise, the announcement stated. At age 36, Casullo became the first non-family president of Burrows Paper Corp., a milestone in the company’s 75-plus-year history.

Casullo’s civic leadership includes board roles as chair with Human Technologies and Bassett Healthcare Network and serving in a director seat with Mohawk Valley Community College’s Center for Leadership Excellence. He has also served with the City of Little Falls Planning Board and Harbor Committee and has led multiple community development initiatives.

M&T Bank has 41 branches and employs nearly 400 people in its Central New York region, which covers Onondaga, Cayuga, Oswego, Madison, Herkimer, Jefferson, Lewis, Oneida, and Seneca Counties. It operates a regional headquarters on South Clinton Street in downtown Syracuse. The bank ranks No. 1 in deposit market share and is the top U.S. Small Business Administration (SBA) lender in Central New York.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.