This is the 13th edition of Siena College Research Institute’s (SRI) Upstate Business Leader Study CEO confidence across upstate New York in 2019 was measured at 75.3, down 21.3 points as business leaders grew more “pessimistic” compared to 2018. However, 53 percent of Upstate CEOs say it is either not at all likely (13 percent) […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year's worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

This is the 13th edition of Siena College Research Institute’s (SRI) Upstate Business Leader Study

CEO confidence across upstate New York in 2019 was measured at 75.3, down 21.3 points as business leaders grew more “pessimistic” compared to 2018.

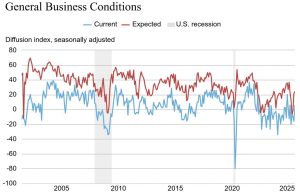

However, 53 percent of Upstate CEOs say it is either not at all likely (13 percent) or not very likely (40 percent) that the U.S. economy will be in recession between now and the end of 2020. Meanwhile, 32 percent say a recession is somewhat likely while 13 percent say a recession is either very likely (10 percent) or almost certain (3 percent).

That’s according to the annual Siena College Research Institute (SRI) Upstate Business Leader Study, which the school released Feb.7. The survey, conducted mostly in late 2019, is now in its 13th year.

Current confidence was down 20.2 points while future confidence declined 22.4 points.

Overall confidence in Central New York was 71.9, 3.4 points below the Upstate CEO confidence figure. The Central New York confidence level was 96.7 a year ago.

Current confidence in Syracuse was 72.7, down 28 points from last year (100.7) and 4.4 points below the Upstate number (77.1).

Future confidence in Syracuse, 71.1, was down 21.7 points from a year before (92.8) and 2.4 points below the Upstate future confidence number (73.5).

The Business Council of New York State, Inc. sponsored the survey, which SRI researchers conducted between October 2019 and January 2020.

“The results of this survey should once again send a strong signal to lawmakers in Albany. The women and men that provide private sector jobs in New York State believe that more needs to be done to protect their investments and the people they employ. Based on this annual survey, upstate business leaders remain fairly optimistic about the overall economy in 2020, and about prospects for their specific sector and business, although somewhat less so than a year ago, and their plans for hiring and investing reflect that change,” Heather Briccetti, president & CEO of the Business Council of New York State, said. “As in prior years, top issues of concern include those significantly or wholly the result of governmental policies — the cost of health care, regulations and tax levels. Two-thirds say New York is doing a poor job of managing the state’s business climate; and while business leaders are expressing a far higher level of confidence in Washington’s impact on business, that confidence as fallen somewhat as well. CEOs are also expressing concerns about the impact that recent major policy initiatives in New York — increased minimum wage, aggressive carbon-reduction mandates, paid family leave — are having or will have on their operations. These results compare closely to what we hear from New York business leaders every day, and reinforces our efforts promote pro-jobs, pro-investment reforms in Albany.”

SRI interviewed 667 Upstate CEOs of private, for-profit companies via mail or web, including 64 in Central New York, 35 in the Mohawk Valley, 31 in the North Country, and 47 in the Southern Tier.

Across Upstate, CEOs interviewed work in the service industry, along with the engineering and construction, manufacturing, retail, wholesale, financial, and food and beverage industry sectors.

CEO sentiment

Besides the recession question, the survey also found that more than half (56 percent) of CEOs think that their company will be in business in New York 10 years from today, while 17 percent say that they will not be in business.

SRI notes “significant variation” by region with 72 percent in the Capital Region and 61 percent in Westchester predicting business operations in 10 years while only 39 percent from the Southern Tier think that their company will endure.

The survey also found that only 32 percent (down from 41 percent as recently as in 2017) say that if they had it to do all over again — considering all factors — they would locate their business in New York.

In addition, the survey found only 17 percent (down from 27 percent a year ago) say that current business conditions in New York as compared to six months ago are better.

The findings also indicate 17 percent of respondents say conditions are better, 47 percent say conditions are the same, while 36 percent indicate they are worse. In the year-earlier survey, 27 percent said better, 46 percent indicated the same, and 26 percent said worse.

For Central New York, SRI director Donald Levy also reviewed the data on the business conditions question. “Right now, Central New York, 18 percent [see them as] better; 45 percent [see them as] worse. A year ago, it was 26 [percent] better. Only 18 [percent] worse, so that’s a swing. The year did not live up to their expectations.”

Levy spoke with CNYBJ on Feb. 5.

Similarly, only 17 percent of respondents say that conditions in New York state for their industry are better over the last six months, down from 25 percent that saw improving conditions within their industry last year. A year prior, 32 percent said that conditions had worsened in their industry while this year that pessimistic percentage has risen to 44 percent.

And when asked about their immediate geographic area, 53 percent say that the general business climate is staying the same, 32 percent indicate it is worsening, and only 12 percent say that it is improving. In 2016, CEOs had a stronger assessment of their local area with 57 percent saying that conditions were staying the same, only 20 percent seeing conditions worsening, while 22 percent said that they were improving.

Why so pessimistic?

The survey found Upstate CEOs “lack confidence” in government’s ability to enhance business conditions across all levels — state, federal and local.

The top three current challenges that CEOs say they face are all directly tied to government actions. The challenges are health-care costs (66 percent), governmental regulation (65 percent), and taxation (58 percent).

Only 6 percent say New York is doing an excellent or good job of creating a business climate in which companies like theirs will succeed, while 66 percent say that the state is doing a poor job. This assessment of the state-government contribution to enhance business conditions for these CEOs is unchanged from 2018.

“Their appraisal of state government continues to be abysmal,” says Levy.

Upstate CEOs want the governor and state legislature to focus on spending cuts (53 percent); business income-tax reform (52 percent); personal income-tax reform (50 percent); and infrastructure development (42 percent).

But only 13 percent are somewhat or very confident in the ability of state government to improve the business climate.

The survey also found 39 percent (down “significantly” from 51 percent a year ago) say the federal government is doing a good or excellent job of creating a business climate in which companies like theirs will succeed. It also found 25 percent (up from 22 percent) give the federal government a grade of poor.

After two consecutive years of growing appreciation of the federal government’s contribution to the business climate, this decline signals a “sense of disappointment” among CEOs.

In addition, 37 percent (down from 46 percent last year) are somewhat or very confident in the ability of the federal government to improve the business climate for businesses like theirs.

At the same time, Upstate CEOs said (by a margin of 47 to 16 percent) that the federal tax reform has had a positive rather than negative impact on their business, while 30 percent say that the federal tax reform has had no impact on their business.

And, only 28 percent rate local governmental support for business as either good or excellent, albeit up from 19 percent in 2016.

The survey also found CEOs expressing “continuing concerns” about their local area’s support for business.

When asked about their immediate geographic area, 53 percent say the general business climate is staying the same, 32 percent believe it is worsening, and only 12 percent say it is improving.

Twenty-eight percent rate their local area as good/excellent as an area where business can succeed while 70 percent give their local area a grade of only fair or poor. The numbers are down from 2017 at 32 percent excellent/good and 64 percent fair/poor.

The findings also indicate that 39 percent rate their local area as excellent/good on workforce suitability while 59 percent provide a negative assessment, that is, fair/poor. These numbers are down from 46 percent excellent/good, 52 percent fair/poor.

Expectations for 2020

The Siena survey found 55 percent of Upstate CEOs indicating that they will concentrate on expansion of existing markets; 50 percent will focus on growth in existing products; 29 percent will concentrate on technology innovation; 27 percent on internal restructuring; and 26 percent on entry into new markets.

The order of areas of concentration is “consistent” with previous years, SRI said.

Across Upstate, when asked which industry sectors will have a positive impact on the economic vitality of their geographic area over the next three to five years, CEOs indicated education (23 percent); tourism (20 percent); technology (17 percent); and medical (14 percent) as the top industry sectors.

Siena’s data says technology is the top economic sector in the Capital Region and Mohawk Valley. Education is the top sector in Central New York, the Finger Lakes, the Southern Tier, and in Western New York. Tourism is the top sector in the North Country.

Researchers also found 41 percent expect their revenues to grow while 24 percent anticipate decreasing revenues. These expectations are down from 50 percent anticipating increases and only 16 percent expecting declines a year ago. The North Country and the Southern Tier have the weakest revenue expectations among their CEOs.

Westchester, the Capital Region, and Mid-Hudson are the strongest areas for CEO revenue expectations, the study found.

The data also indicates fewer CEOs, 34 percent, expect increasing profitability while 32 percent predict decreasing profitability. Again, these expectations are lower than those of profitability a year ago when 37 percent expected increasing profits while 25 percent expected decreasing profits. Westchester (52 percent) has the most robust expectations for increasing profitability, while the North Country (19 percent) and the Southern Tier (23 percent) had the lowest percentages of business leaders expecting higher profits.

The survey found 51 percent plan to invest in fixed assets over the coming year. This important indicator of investment in their businesses is down from 57 percent last year.

The data also indicates that 30 percent plan to increase their workforce while 12 percent plan to reduce the size of their workforce. These figures are also down from 38 percent increasing/8 percent decreasing from last year.

Another way to look at the hiring indicator is the ratio between those hiring and those downsizing. This year’s ratio is 2.5 while last year’s ratio was 4.75. Westchester (44 percent), Mid-Hudson (34 percent), the Capital Region (34 percent), and Western New York (34 percent) have the highest anticipated rates of hiring. The areas anticipating the highest rates of decreasing workforces are the North Country (19 percent) and the Southern Tier (21 percent).

The data also indicate 28 percent of Central New York CEOs and 29 percent in the Mohawk Valley have plans to moderately increase their workforce.

“61 percent [in Central New York, 57 percent in the Mohawk Valley] remain the same, so it’s leaning downward,” says Levy.

The Siena survey also found 19 percent (down from 27 percent) of business leaders expect the state economy to be better over the next year. Thirty-eight percent (down from 43 percent) expect the state economy to remain the same, and 43 percent (up from 30 percent) expect it to worsen. No region has a better economic projection than 25 percent better, 37 percent the same, and 38 percent worse, Siena said.