Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

A Message to the Central New York Business Community

Dedicated to our founder and to the team who made it all possible Since 1986, The Central New York Business Journal has been a family

Slocum-Dickson physician to serve as educator for Diabetes Fellowship Program at MVHS

NEW HARTFORD — Slocum-Dickson Medical Group recently announced that its physician Dayal Raja will serve as an educator for the new Diabetes Fellowship Program at

Harris Beach Murtha AI industry team starts

PITTSFORD — The law firm Harris Beach Murtha has launched an artificial-intelligence (AI) industry team to help clients with navigating the legal, ethical, regulatory, and

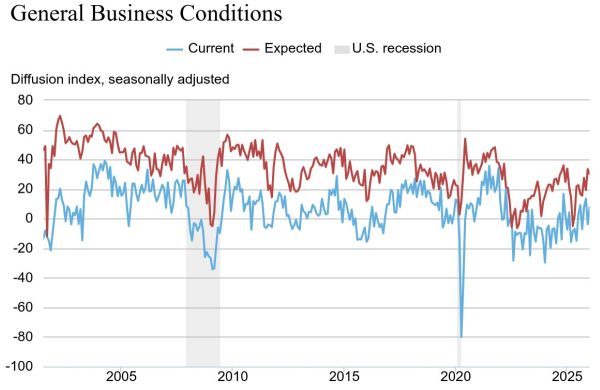

New York manufacturing index begins 2026 in positive territory

Respondents to the monthly Empire State Manufacturing Survey reported increases in new orders and shipments, helping to boost the survey’s general-business conditions index by 11

SRC to develop embedded computer capabilities in $24M Air Force pact

CICERO — SRC, Inc. will use a $24 million contract to develop next-generation, embedded artificial intelligence and machine-learning capabilities across ground, air, and space domains. The Air Force Research Laboratory (AFRL) awarded the funding. Based in Cicero, SRC is a nonprofit defense research and development company. Through the contract, SRC will develop new machine-learning algorithms,

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

CICERO — SRC, Inc. will use a $24 million contract to develop next-generation, embedded artificial intelligence and machine-learning capabilities across ground, air, and space domains.

The Air Force Research Laboratory (AFRL) awarded the funding. Based in Cicero, SRC is a nonprofit defense research and development company.

Through the contract, SRC will develop new machine-learning algorithms, high-performance embedded computing capabilities and ultra-low size, weight, and power (SWaP) hardware.

This research and development work will “empower the military without depending on external networks,” SRC said. These capabilities are designed for missions that include on-board data processing, situational awareness, and information analysis.

The effort focuses on advancing “edge processing,” the ability to parse large amounts of data and run complex algorithms directly on-board a platform instead of relying on distant data centers. SRC’s work aims to “significantly accelerate” data processing.

“We’re proud to continue our collaboration with AFRL as we advance the next generation of embedded at-the-edge computing,” Kevin Hair, president and CEO of SRC, Inc., said in the announcement. “These advancements will strengthen operational effectiveness and provide greater agility and precision in rapidly evolving environments.”

SRC employs more than 1,400 people. In addition to its Cicero headquarters, SRC has locations across the U.S., as well as sites in Canada, the United Kingdom, and Australia.

Lockheed’s Salina plant wins $22.6M Navy contract modification

It’s for foreign military sales to Canada SALINA — The Lockheed Martin Rotary and Mission Systems’ plant in suburban Syracuse has recently been awarded a nearly $22.6 million modification to a previously awarded contract to exercise an option for AN/SLQ-32(V)6 design agent engineering, incidental material, and travel. This contract involves foreign military sales (FMS) to

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

It’s for foreign military sales to Canada

SALINA — The Lockheed Martin Rotary and Mission Systems’ plant in suburban Syracuse has recently been awarded a nearly $22.6 million modification to a previously awarded contract to exercise an option for AN/SLQ-32(V)6 design agent engineering, incidental material, and travel.

This contract involves foreign military sales (FMS) to Canada. Work will be performed in Lockheed Martin’s Salina facility, and is expected to be completed by January 2027, according to a Jan. 8 contract announcement from the U.S. Department of War.

If all options are exercised, work will continue through January 2029. Fiscal 2026 other procurement (Navy) funds of $2.3 million (67 percent), FMS (Canada) funds totaling $545,000 (16 percent), Fiscal 2026 operations and maintenance (Navy) funds of $500,000 (14 percent), and Fiscal 2025 other procurement (Navy) funds totaling $105,000 (3 percent) will be obligated at the time of award. Of that, $500,000 will expire at the end of the current fiscal year, per the contract announcement. The Naval Sea Systems Command in Washington, D.C. is the contracting authority.

Lockheed Martin Rotary and Mission Systems is part of Lockheed Martin Corp. (NYSE: LMT) a Bethesda, Maryland–based global defense-technology company. Lockheed Martin has two Central New York plants — the one in Salina plus another facility in Owego.

Finger Lakes Land Trust has conserved 35,000 acres in 12-county region

ITHACA — The Finger Lakes Land Trust (FLLT) of Ithaca called it a “major milestone,” saying it has conserved 35,000 acres across the 12-county Finger Lakes region. The accomplishment represents more than three decades of long-term, consensus-based strategies to protect the “cherished landscapes” of the Finger Lakes, the FLLT contended in its recent announcement. Since

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ITHACA — The Finger Lakes Land Trust (FLLT) of Ithaca called it a “major milestone,” saying it has conserved 35,000 acres across the 12-county Finger Lakes region.

The accomplishment represents more than three decades of long-term, consensus-based strategies to protect the “cherished landscapes” of the Finger Lakes, the FLLT contended in its recent announcement.

Since its beginning as an all-volunteer organization in 1989, the FLLT says it has grown into an accredited conservation organization with a growing network of protected lands. By focusing on water quality, outdoor recreation, scenic beauty, and wildlife habitat, the organization says it has protected more than six miles of lakeshore, 1,752 acres of wetlands, 221 miles of creek frontage, and has created 55 miles of publicly accessible hiking trails to date.

Recent projects include the permanent protection of 850 feet of pristine shoreline at the south end of Skaneateles Lake, a partnership with the Village of Aurora to create a new shoreline park on Cayuga Lake, the opening of a new nature preserve on Keuka Lake’s Bluff Point, and the purchase of a 117-acre addition to the state’s Harriet Hollister Spencer Recreation Area near Honeoye Lake, the FLLT said.

The FLLT extends sincere gratitude to its members, partners, and volunteers whose dedication and commitment have ensured the organization’s success.

“I personally would like to express my appreciation to those mentioned above,” Karen Meriwether, chair of the FLLT board of directors and Keuka Lake resident. “Additionally, I would like to recognize the staff of FLLT not only for their many contributions to this milestone but for the enthusiastic and respectful manner in which they approach every aspect of their work.”

The FLLT owns and manages a network of more than 45 nature preserves that are open to the public and holds perpetual conservation easements on 200 properties that remain in private ownership.

The FLLT focuses on protecting critical habitat for fish and wildlife, conserving lands that are important for water quality, connecting existing conservation lands, and keeping prime farmland in agriculture. The organization also provides programs to educate local governments, landowners, and residents about conservation and the region’s unique natural resources.

North Country biotech research institute receives $4.2 million in federal funding

SARANAC LAKE — The Trudeau Institute recently received $4.2 million in federal funding to support its cutting-edge biotechnology research. The money will enable the Saranac Lake–based biotech-research institute to identify, develop, and disseminate best practices for the application of process control, automated data collection, and measurement techniques in the biosciences and biotechnology, according to a

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SARANAC LAKE — The Trudeau Institute recently received $4.2 million in federal funding to support its cutting-edge biotechnology research.

The money will enable the Saranac Lake–based biotech-research institute to identify, develop, and disseminate best practices for the application of process control, automated data collection, and measurement techniques in the biosciences and biotechnology, according to a Jan. 7 announcement from U.S. Rep. Elise Stefanik (R–N.Y. 21). The institute will also use the funds to advance the mission of the National Institute of Standards and Technology by facilitating more rapid commercialization of biotechnology in both the public and private sectors.

“Trudeau is a uniquely important asset for the North Country and for the nation,” Garry Douglas, president of the North Country Chamber of Commerce, said in the Stefanik announcement. “Securing fresh federal support for its research endeavors has been one of our priorities in Congress, working actively with Congresswoman Stefanik and with Senators Schumer and Gillibrand, including meetings in Washington in the fall. The Congresswoman’s appropriation of $4.2 million for bio research together with $2.5 million from the Senators for modernization of specialized equipment will help to sustain and grow Trudeau’s vital work for years to come. This is a very welcome advance at the very start of the new year. Onward and upward!”

The Trudeau Institute says it is a not-for-profit research institute with a “world-renowned reputation for R&D in immunity to infectious disease.” Its mission is to safeguard human health and combat 21st century global health crises, from drug-resistant TB to emerging viruses and pandemics, by empowering specialized R&D in regional and global translational science partnerships, per its website.

Oswego Fire Department receives $300,000 in state funding

Grant will help buy self-contained breathing apparatuses OSWEGO — State Senator Christopher J. Ryan (SD-50) announced in December that a $300,000 state grant has been awarded to the City of Oswego Fire Department for the purchase of 30 new self-contained breathing apparatuses (SCBAs), cylinders, and masks. The new SCBAs will replace aging safety equipment and

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Grant will help buy self-contained breathing apparatuses

OSWEGO — State Senator Christopher J. Ryan (SD-50) announced in December that a $300,000 state grant has been awarded to the City of Oswego Fire Department for the purchase of 30 new self-contained breathing apparatuses (SCBAs), cylinders, and masks.

The new SCBAs will replace aging safety equipment and will be used to provide a portable, independent supply of breathable air to users in hazardous environments involving high heat, smoke, toxic gases, and oxygen-deficient atmospheres.

“Our firefighters put their lives on the line every day,” Senator Ryan said of the funding. “It is our responsibility to ensure they have the tools necessary to do their jobs safely and effectively while serving our community.”

The Oswego Fire Department serves 250,000 people annually.

Paul Conzone, Oswego’s Fire Chief and Director of Emergency Management said of the new equipment, “These new SCBA are updated to the latest NFPA standards and include cutting-edge technologies that will result in increased public safety.”

City of Oswego Mayor Robert Corridino added, “The new SCBA equipment will greatly enhance public safety by allowing us to acquire critical gear that protects our firefighters while ensuring responsible stewardship of taxpayer resources. We are deeply appreciative of Senator Ryan and his team’s dedicated efforts in securing this funding, which will strengthen Oswego’s public safety capabilities now and into the future.”

Abraham House names new chief development officer

UTICA — Abraham House recently announced the appointment of Julian Testa as its new chief development officer, strengthening the organization’s leadership team. In this role, Testa will lead Abraham House’s donor engagement, fundraising, and community outreach efforts. This will develop support for the sustainability of the organization and ensure continued access to high-quality, no-cost care

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

UTICA — Abraham House recently announced the appointment of Julian Testa as its new chief development officer, strengthening the organization’s leadership team.

In this role, Testa will lead Abraham House’s donor engagement, fundraising, and community outreach efforts. This will develop support for the sustainability of the organization and ensure continued access to high-quality, no-cost care for residents and their families, Abraham House contends.

Testa brings extensive experience in nonprofit development, relationship-building, and mission-driven fundraising. With a strong commitment to community-centered care, Testa’s leadership will play a critical role in expanding philanthropic partnerships and growing support for Abraham House’s programs and services.

“I am honored to join Abraham House and support its meaningful mission. Compassion and dignity are at the heart of this organization, along with the extraordinary community support behind it,” Testa said in the Jan. 14 announcement. “I look forward to working with donors, volunteers, and partners to strengthen and grow our organization,” she concluded.

Abraham House says it is a nonprofit organization dedicated to providing compassionate, end-of-life care at no cost to individuals with terminal illnesses. Operating homes in Utica and Rome, the organization offers 24-hour care, comfort, and dignity to terminally ill patients while supporting their families during difficult times.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.