Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Community Financial System boosts quarterly dividend in Q3

DeWITT, N.Y. — Community Financial System, Inc. (NYSE: CBU) — parent company of Community Bank, N.A. — recently announced that it has increased its quarterly cash dividend by 1 cent, or 2.2 percent, to 47 cents per share for the third quarter. The dividend will be payable on Oct. 10, to shareholders of record as […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

DeWITT, N.Y. — Community Financial System, Inc. (NYSE: CBU) — parent company of Community Bank, N.A. — recently announced that it has increased its quarterly cash dividend by 1 cent, or 2.2 percent, to 47 cents per share for the third quarter.

The dividend will be payable on Oct. 10, to shareholders of record as of Sept. 12. At Community Financial’s current stock price, the payment yields more than 3.2 percent on an annual basis.

“Today’s increase reflects the Board of Directors’ confidence in our sustainable long-term growth strategy as a diversified financial services company. Our annual dividend increases over the last 33 years are supported by our strong balance sheet and cash flow generation that provide us with flexibility to return cash to our Shareholders while investing in our long-term future,” Dimitar Karaivanov, president and CEO of Community Financial System, said in the mid-July announcement.

DeWitt–based Community Financial System is a diversified financial-services company that is focused on four main business lines — banking services, employee-benefit services, insurance services, and wealth-management services. Its banking subsidiary — Community Bank — is among the nation’s 100 largest banks with more than $16 billion in assets and operates about 200 branches across upstate New York, northeastern Pennsylvania, Vermont, and western Massachusetts.

Five graduate from Oswego Health’s paid CNA training program at The Manor at Seneca Hill

OSWEGO, N.Y. — Oswego Health announced that five employees recently graduated from its paid certified nursing assistant (CNA) training program at The Manor at Seneca Hill, marking a big step forward in their health-care careers. The quintet of graduates are Michaela Walsh, Candice DeMott, Nevaeh Emmons, Sean Herlihy, and Krystal Alvarado, and the health system

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

OSWEGO, N.Y. — Oswego Health announced that five employees recently graduated from its paid certified nursing assistant (CNA) training program at The Manor at Seneca Hill, marking a big step forward in their health-care careers.

The quintet of graduates are Michaela Walsh, Candice DeMott, Nevaeh Emmons, Sean Herlihy, and Krystal Alvarado, and the health system says they “represent the next generation of compassionate caregivers rising through the ranks with the support of Oswego Health.”

The five-week, 240-hour program includes classroom instruction, lab work, and clinical training — all offered at no cost to the participant, according to Oswego Health. While enrolled, trainees are employed full-time as resident-care aides and, upon graduation, transition into full-time CNA roles with a $3,500 sign-on bonus. Experienced CNAs are eligible for a $5,000 bonus.

The health system called it a strategic investment in workforce development that is part of Oswego Health’s broader mission to recruit, train, and retain local talent by offering hands-on experience, financial support, and clear career pathways.

“This program is so much more than a training opportunity — it’s an investment in people,” Andrea Doviak, executive director at The Manor at Seneca Hill, said in the announcement. “As someone who began my own healthcare journey as a CNA, I know the power of a program like this to change lives. Oswego Health is proud to offer our employees the tools and support they need to grow their careers right here in our community. We’re not just preparing individuals for jobs — we’re preparing them for lifelong careers in healthcare.”

The Manor at Seneca Hill is a skilled-nursing facility with 120 licensed beds, located at 20 Manor Drive in Oswego.

Oswego Health says it offers a full suite of career-advancement programs for roles such as phlebotomists, licensed practical nurses, registered nurses, and certified medical assistants. Tuition assistance is available for both full-time and part-time employees.

New York State Department of Environmental Conservation (DEC) environmental conservation police officer (ECO) Heather Scalisi on July 21 received the Stanley Hamlin Conservationist of the Year Award from the Onondaga County Federation of Sportsmen’s Clubs. Scalisi was honored for her dedication and commitment to the Onondaga County Federation’s Women in Nature Program (WIN), the DEC

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

New York State Department of Environmental Conservation (DEC) environmental conservation police officer (ECO) Heather Scalisi on July 21 received the Stanley Hamlin Conservationist of the Year Award from the Onondaga County Federation of Sportsmen’s Clubs.

Scalisi was honored for her dedication and commitment to the Onondaga County Federation’s Women in Nature Program (WIN), the DEC said in a recent announcement. The primary mission of WIN is to inspire women to embrace the outdoors through participation at the club’s annual Outdoor Skills Workshop, along with other seminars and recreational outings focused on shooting, hunting, and fishing.

ECO Scalisi participated in her first WIN outdoor workshop in 2023 as a designated representative for New York State ECOs. In 2024, she joined the WIN planning committee and, this year, volunteered as chair, coordinating meetings, recording minutes, and ensuring the committee remained focused on the group’s mission of getting more women involved in outdoor recreation.

On April 26, Scalisi’s hard work paid off as the annual Women in Nature event attracted 130 women from across Central New York to experience all types of outdoor sports including crossbow shooting, fishing, wildlife cooking, nature photography, and axe throwing, the DEC said.

2025 Family-Owned Business Directory

Welcome to the Central New York Business Journal’s 2025 Family-Owned Business Directory. This is our 2nd annual Family-Owned Businesses list, with firms listed alphabetically. The expanded entries allow the firms to list their notable clients, projects, or contracts, and the option to provide photos. The information for these entries was supplied by the companies and

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Welcome to the Central New York Business Journal’s 2025 Family-Owned Business Directory.

This is our 2nd annual Family-Owned Businesses list, with firms listed alphabetically. The expanded entries allow the firms to list their notable clients, projects, or contracts, and the option to provide photos.

The information for these entries was supplied by the companies and their websites.

Click here to read the Directory!

WISE offers business-plan writing course in September

SYRACUSE, N.Y. — The WISE Women’s Business Center is accepting applications for the next course on writing a business plan, which is called “Accelerate: Business Plan Intensive.” The 10-week, hands-on course is geared toward women entrepreneurs who have recently launched a new business or have a well-vetted business idea for which they need a business

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE, N.Y. — The WISE Women’s Business Center is accepting applications for the next course on writing a business plan, which is called “Accelerate: Business Plan Intensive.”

The 10-week, hands-on course is geared toward women entrepreneurs who have recently launched a new business or have a well-vetted business idea for which they need a business plan, according to an Aug. 6 WISE email about the course.

A business plan is necessary if you plan to apply for a bank loan. It’s also a useful tool when bringing on business partners or looking for investors. The writing process itself will also help you determine if your business has a chance at success, give you an idea of startup costs and how much you’ll need to invest or finance, and uncover potential challenges. A business plan is a “living, changing” document that gives you as the business owner a “strategic roadmap for the future,” WISE said.

Course cost

The fee for this program is $150 and covers all 10 sessions, optional expert sessions, and a 3-month subscription to LivePlan, a business-plan writing tool.

The WISE Women’s Business Center says its goal is to make the program accessible to the community. The center is able to keep costs low for this cohort through partial sponsorship by Empire State Development. The course fee of $150 partially covers the cost of program facilitators, materials, and software. A limited number of need-based partial scholarships are available. For information about scholarship availability, those interested can contact Jennifer McGee, program manager, at jemcgee@syr.edu.

Course specifics

This course covers every major section of the business plan — from executive summary to financial forecasts, using real-life examples and best practices. Throughout the program, those involved will attend class sessions, spend time working on their plans, and get feedback and 1:1 support from a business mentor.

Between sessions, optional expert-led sessions will be available covering relevant small-business topics such as accounting, human resources, legal considerations, loan readiness, and MWBE (Minority and/or Women-Owned Business Enterprise) certification.

Course instructors include Kelly Wypych, a WISE business counselor and co-founder of Vetric Creatography, and Barb Stone, a WISE business counselor and owner of Build Your Path, LCC.

Eligibility

To be eligible for the program, an applicant must be the owner of a recently launched business or have a well-vetted business idea. If you haven’t yet launched, you must supply evidence of significant market research and describe the steps you’ve taken to validate your business idea.

In addition, you must commit to attending all 10 classes, which are held on Tuesday evenings from 5:30 p.m. to 7:30 p.m., starting Sept. 30.

An applicant must also commit to spending more than two hours outside of class every week to work on the business plan and keep up with the writing assignments. An applicant must also complete all required steps in the application and registration process, the WISE Women’s Business Center said.

Klepper, Hahn & Hyatt has recently hired Glenn Mannerberg, P.E., as a senior structural engineer. He has 40 years of experience in the industry. Mannerberg

Launch NY 2025 investments include firms in Southern Tier

BUFFALO, N.Y. — Companies in Ithaca and Binghamton are among nine firms benefiting from Launch NY investments totaling $1.35 million so far in 2025. Launch NY investments in 2024 totaled $2.765 million, per a July 29 announcement. Bridge Green of Binghamton secured a $250,000 from LP Fund II and nonprofit seed fund. Bridge Green is

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

BUFFALO, N.Y. — Companies in Ithaca and Binghamton are among nine firms benefiting from Launch NY investments totaling $1.35 million so far in 2025.

Launch NY investments in 2024 totaled $2.765 million, per a July 29 announcement.

Bridge Green of Binghamton secured a $250,000 from LP Fund II and nonprofit seed fund. Bridge Green is a new portfolio company for Launch NY and focuses on innovative technologies that upcycle and extract critical minerals from used lithium-ion batteries to support a “circular economy and strengthen the domestic supply chain,” Launch NY said.

At the same time, Dimensional Energy of Ithaca will use a $75,000 investment from LP Fund I and nonprofit seed fund. Dimensional Energy has received previous investments from Launch NY to commercialize its carbon-capture technology.

Launch NY invests from its for-profit LP Funds I and II, nonprofit seed fund and the growing Investor Network, which is a syndicate of accredited investors who receive access to pre-vetted startup investment opportunities in upstate New York.

“Launch NY has not wavered in its crucial role establishing Upstate NY as a viable place to build high-growth startup companies,” Marnie LaVigne, Ph.D., president and CEO of Launch NY, said in the announcement. “We continue to see tremendous innovation emerging from these communities, and we’re proud to help them build early traction as they launch their products into the market and attract additional capital from other sources.”

Launch NY describes itself as the only venture-development organization serving upstate New York and the most active seed fund in New York state. The organization’s announcements this year included the close of its $15.775 million Launch NY Limited Partner (LP) Fund II in the second quarter and geographic expansion into Albany.

WNY startups

Besides the Ithaca and Binghamton firms, Launch NY also invested in five firms that are based in Buffalo, one in Rochester, and one in Webster.

Launch NY made a $200,000 investment into PhysicianX, a Buffalo-based technology startup that empowers medical residents, fellows, and established doctors seeking new career options.

It also invested $285,000 in 3AM Innovations of Buffalo from the Launch NY LP I, nonprofit seed fund and Investor Network. 3AM Innovations has received previous investments from Launch NY and provides software to keep first responders safe in emergency situations.

Another Buffalo firm, Arbol, picked up a $100,000 investment from the nonprofit seed fund. Arbol has received previous investments from Launch NY and is a financial operating system that helps colleges keep students enrolled by identifying financial risks early and guiding students with personalized support.

In addition, BetterMynd of Buffalo will a nearly $125,000 investment from LP Fund I and nonprofit seed fund. BetterMynd is an existing Launch NY portfolio company and creates a venue for web-based mental health therapy at colleges and universities.

Launch NY also invested $60,000 in Edenesque of Buffalo with the money coming from LP Fund II and nonprofit seed fund. The plant-based dairy startup has received previous investments from Launch NY.

In Monroe County, a $185,000 investment in Nordetect in Rochester coming from LP Fund II and nonprofit seed fund. Nordetect is a new portfolio company for Launch NY which enables precision agriculture and environmental monitoring.

Panacheeza of Webster will use $75,000 from the nonprofit seed fund. Panacheeza is a shelf-stable, plant-based grated parmesan made with just five simple ingredients.

New study on Ithaca retail strategy urges focus on arts, artisan culture

ITHACA, N.Y. — Downtown Ithaca needs a retail mix that focuses on the merchandising of arts and crafts products, along with marketing campaigns to position Ithaca as a must-visit destination for the arts and artisan culture. Those are among the recommendations in a new study that focuses on a retail strategy for the City of

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ITHACA, N.Y. — Downtown Ithaca needs a retail mix that focuses on the merchandising of arts and crafts products, along with marketing campaigns to position Ithaca as a must-visit destination for the arts and artisan culture.

Those are among the recommendations in a new study that focuses on a retail strategy for the City of Ithaca.

The Downtown Ithaca Alliance (DIA) and the City of Ithaca see the study as a “critical step” toward revitalizing Ithaca’s retail landscape, per the Aug. 7 DIA announcement.

MJB Consulting handled the work on the preliminary retail analysis and strategy. MJB, which is based in New York City and Berkeley, California is a national retail planning and real-estate consultancy focused on urban and downtown business districts.

With phase I nearing completion, MJB is now finalizing its findings and recommendations into a written report to be released later this fall. The DIA and the City of Ithaca have already contracted MJB for phase II implementation, The second phase will focus on the creation of leasing materials that “reframe the opportunity” in the minds of prospective tenants. It’ll also focus on the training of an in-house prospector to support local landlords and brokers in attracting businesses that correspond to the recommendations of the strategy.

The recommendations complement DIA’s ongoing work in placemaking, marketing, and economic development to “create and sustain an environment conducive to a thriving retail sector and further investment.”

“This retail study provides a comprehensive roadmap for strengthening Ithaca’s business districts citywide,” Ithaca Mayor Robert Cantelmo said in the Downtown Ithaca Alliance announcement. “From Collegetown to the West End, the insights and recommendations recognize that our community’s economic vitality depends on thoughtful, place-based strategies that reflect the character of each district while uniting us through shared values and aspirations. I’m grateful to the Downtown Ithaca Alliance, City staff, and MJB Consulting for their collaborative work, which will help ensure Ithaca remains a dynamic and inclusive place to live, work, and visit.”

Retail strategy

Commissioned in 2023, the study focuses on creating a “cohesive,” citywide retail strategy for Ithaca’s key business districts. They include downtown Ithaca, centered on the Commons pedestrian mall; the West State Street corridor; the West End, including the waterfront; and Collegetown, adjacent to Cornell University.

MJB’s work “responds to the city’s unique position as a university town with a broader regional trade area of over 100,000 people and a robust tourism draw,” per the DIA announcement.

Rather than viewing Ithaca’s market through the traditional lenses of “town and gown” or local versus out-of-towner, MJB proposed a “more unifying approach” focused on shared psychographics — common lifestyles, values, and aspirations. The shift in perspective allowed MJB to identify retail opportunities that resonate with both residents and visitors alike, DIA said.

Specifically, MJB identified an opportunity to market Ithaca, and downtown Ithaca in particular, to the “yupster” psychographic — well-educated, well-off households that celebrate the artistic and creative lifestyle — which predominates among both Ithacans as well as tourists.

Preliminary recommendations

The MJB study recommends curating a retail mix in downtown Ithaca that focuses on the merchandising of arts and crafts products as well as handmade goods more generally, complemented by other synergistic tenants like bookstores, vintage/consignment shops, cafes, eateries and wine bars.

It also recommends providing support for landlords and brokers to recruit tenants that align with this positioning, including the creation of leasing materials that tell Ithaca’s and downtown Ithaca’s “unique” story.

In addition, the report recommends developing targeted marketing campaigns to position Ithaca as a must-visit regional “(if not national)” destination for the arts and artisan culture, aligning with the “Ithaca is Gorges” brand.

MJB also recommends enhancing downtown’s role as a regional hub for the creative ecosystem by fostering collaborations between local makers, galleries, theaters, and other entrepreneurial platforms.

Beyond downtown Ithaca, MJB also emphasized the need for Cornell University, with its roughly 27,000 students, to assume a proactive role in revitalizing the Collegetown district as a selling point for prospective faculty, researchers, and students, pointing to successful models at peer institutions like Yale and the University of Pennsylvania.

MJB also reframed the West State Street corridor as more than just a connector between districts, “with its own psychographic appeal and retail niche that is nonetheless quite fragile and urgently in need of a more robust City response.”

“This much-anticipated strategy taps into what makes Ithaca special and offers us the possibility to turn our unique assets into economic drivers,” Nan Rohrer, CEO of the Downtown Ithaca Alliance, said. “Downtown is more than a shopping district — it’s a creative ecosystem. By centering our retail recruitment around this core identity, we’re creating a destination that is authentic to both locals and visitors, while defining a compelling case for future investors, business owners, and residents.”

New York rural counties face severe health-care provider shortage

ALBANY, N.Y. — A recent report by New York State Comptroller Thomas P. DiNapoli found a severe shortage of health professionals, including primary care, OBGYN doctors, pediatricians, dentists, and mental-health practitioners in 16 rural counties in the Empire State. The report, titled “The Doctor is…Out: Shortages of Health Professionals in Rural Areas,” described the shortfalls

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

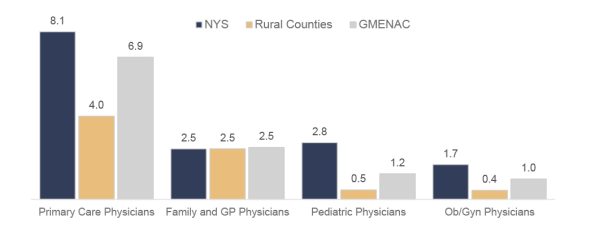

ALBANY, N.Y. — A recent report by New York State Comptroller Thomas P. DiNapoli found a severe shortage of health professionals, including primary care, OBGYN doctors, pediatricians, dentists, and mental-health practitioners in 16 rural counties in the Empire State.

The report, titled “The Doctor is…Out: Shortages of Health Professionals in Rural Areas,” described the shortfalls as “alarming” and found that several of the counties have no pediatricians or OBGYN physicians at all.

The 16 counties examined, with a combined population of 748,093 people, were: Allegany, Cattaraugus, Chenango, Delaware, Essex, Franklin, Greene, Hamilton, Herkimer, Lewis, Schuyler, Steuben, Sullivan, Washington, Wyoming, and Yates. All of the counties have been designated by the federal government as having professional shortages in at least two fields of medicine.

Key findings of the comptroller’s report include the following:

- On average, the 16 counties have four primary care physicians per 10,000 people, less than half the ratio for New York state (8.1) and the U.S. (8.4) as a whole.

- The rural counties examined have 0.5 pediatricians for every 10,000 people, compared to the statewide ratio of 2.8 and the national ratio of 1.8.

- In the 16 counties combined, there is an average of one OBGYN physician for every 23,000 people.

- There are no pediatric physicians in three of the 16 counties. Four of the counties have no OBGYN physicians.

- The rural counties’ dentist to 10,000 population ratio (3.6) is less than half of the state ratio (8.3).

- All 16 of the rural counties studied are designated as mental health HP Shortage Areas either for the entire population, or for segments such as the low-income or Medicaid-eligible populations.

A key factor driving the shortage, according to the DiNapoli report, is the limited number of physical facilities in New York’s rural counties. The report stated, “Not all counties have hospitals or rural health clinics, and those that do operate on tight margins, or at a loss.”

The report offers some potential options for overcoming the barriers to access in rural areas including medical-transport services, expanded telemedicine, mobile clinics, and incentivizing health professionals to serve in rural areas through loan forgiveness, stipends, or subsidies.

“Having access to health care is an essential quality of life issue and helps people live healthier lives,” DiNapoli said. “Addressing gaps in the rural healthcare workforce to alleviate current shortages and plan for future demand will not only positively impact the health of people living in less populated areas of New York, but could also create new jobs and bolster our rural economies.”

You can check out the full report at: https://www.osc.ny.gov/files/reports/pdf/rural-health-shortages.pdf?utm_medium=email&utm_source=govdelivery

Strategic tops $2.5 billion in assets under management

UTICA, N.Y. — Strategic Financial Services, Inc. — an independent wealth-management firm with offices in the Mohawk Valley, Syracuse, and beyond — recently announced that its assets under management have grown to surpass $2.5 billion. “This milestone reflects the continued trust our clients place in us — and our commitment to having ‘good people’ that

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

UTICA, N.Y. — Strategic Financial Services, Inc. — an independent wealth-management firm with offices in the Mohawk Valley, Syracuse, and beyond — recently announced that its assets under management have grown to surpass $2.5 billion.

“This milestone reflects the continued trust our clients place in us — and our commitment to having ‘good people’ that consistently deliver for those clients; reaching the $2.5 billion milestone is proof that the model works,” Alan Leist III, Strategic’s CEO, said in the announcement.

In business since 1979, Strategic has more than 40 employees, servicing over 1,250 clients. Areas of focus include investment management, financial planning, institutional investment management, and corporate retirement plans.

“It is exciting to see this kind of growth, but even more meaningful to know it’s happening because we’re helping people live great lives. We will keep investing in what matters — our people, our process, and our client experience — so we’re always delivering the best of Strategic,” Doug Walters, chief investment officer at Strategic Financial Services, said in the announcement.

Strategic is headquartered in Utica, with satellite offices in Rome, Little Falls, Syracuse, Rochester, and West Palm Beach, Florida. The wealth-management firm says it is growing from established roots, and continuing to expand its geographic footprint and influence across the northeast and throughout the U.S.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.