Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

New chief legal officer settles into new role at Broadview FCU

ALBANY — Broadview Federal Credit Union (Broadview FCU) announced that Lisa Harris is now serving as its new chief legal officer. She takes over a position previously held by Kendra Rubin, who was recently promoted to chief of staff at Broadview. Harris joins the credit union’s executive-leadership team as Broadview’s primary legal advisor, overseeing all […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ALBANY — Broadview Federal Credit Union (Broadview FCU) announced that Lisa Harris is now serving as its new chief legal officer.

She takes over a position previously held by Kendra Rubin, who was recently promoted to chief of staff at Broadview.

Harris joins the credit union’s executive-leadership team as Broadview’s primary legal advisor, overseeing all legal, corporate governance, compliance, and regulatory matters.

Broadview FCU resulted from the 2022 merger involving SEFCU and CAP COM.

A native of upstate New York, Harris brings to the role experience in legal strategy, regulatory compliance, and public service, Broadview said in its May 27 announcement.

Most recently, Harris served as chief compliance officer at Vivint and previously held senior-leadership positions at Meta, where she was director of economic development and director of business strategy and risk within Meta’s law-enforcement organization. Her background also includes service to the New York State government. She served in executive roles for four governors, was deputy counsel to the Senate Majority Republican Conference, and worked as floor counsel, ethics counsel, and counsel to the secretary of the Senate, handling all Senate litigation matters.

“We are pleased to welcome Lisa to Broadview’s executive leadership team. Throughout her career in both the public and private sectors, Lisa has demonstrated an ongoing commitment to integrity, service, and legal innovation,” Michael Castellana, CEO of Broadview FCU, said in the announcement. “Her leadership in navigating complex legal and regulatory environments makes her an ideal fit to lead our legal function during a period of growth and transformation. I am confident she will make a tremendous impact on Broadview and the members we serve.”

As chief legal officer, Harris is responsible for guiding Broadview’s legal strategy in alignment with its business goals. She will also provide counsel to Broadview’s executive and senior leaders and its board of directors on legal topics that include corporate governance, contracts, litigation, and regulatory compliance.

Harris will oversee the legal, compliance, and contract departments, “promoting a culture of ethics, accountability, and operational excellence across the organization,” the credit union said.

“I am thrilled to be a part of this organization, and its growth and success serving our members and the community,” Harris said in the Broadview FCU announcement.

Harris holds a bachelor’s degree in political science from SUNY Fredonia and earned her law degree from Ohio Northern University. She has worked as an adjunct professor at Albany Law School and previously served on the board of CanCode Communities, Broadview noted.

About Broadview FCU

Broadview says it’s among the largest credit unions in New York state with about $9 billion in assets, more than 500,000 members, and over 60 branches in the Capital Region, Binghamton, Syracuse, and Buffalo.

Outlook for CNY business banking clients remains strong, expert says

Inflation, interest rates, tariffs. These economic and business topics make for splashy headlines in the national news, but they aren’t making the same waves across Central New York’s business community according to a local banking expert. “Central New York is always a little more moderate,” when it comes to the effect of such economic changes,

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Inflation, interest rates, tariffs. These economic and business topics make for splashy headlines in the national news, but they aren’t making the same waves across Central New York’s business community according to a local banking expert.

“Central New York is always a little more moderate,” when it comes to the effect of such economic changes, says Lindsay Weichert, regional president at Community Bank, N.A., a unit of DeWitt–based Community Financial System, Inc. (NYSE: CBU), which has more than

$16 billion in total assets and is one of the 100 biggest banks in the U.S.

Inflation, while higher than some may like, has leveled out, she says. That allows businesses to factor those price changes in when planning. And at 2.7 percent in June, inflation is vastly improved from a high of 9 percent in 2022, she adds.

Stock markets are trading near all-time highs and unemployment rates remain historically low. All that paints a fairly strong economic picture, which we are also seeing in Central New York, Weichert contends.

Across Community Bank’s business portfolio, “sales are still holding really strong,” she says. Many of the bank’s business customers are posting solid earnings results.

“Businesses … are really resilient right now despite all the stuff you see in the headlines,” Weichert contends.

Looking at other signs of economic health, she says Community Bank is seeing consistent and solid capital expenditures and credit-line utilization rates by business clients. There aren’t any concerning upticks in credit use that could signal economic distress.

“We’re seeing really strong credit metrics,” Weichert says. The bank isn’t seeing an increase in charge-offs or delinquencies with its business customers either.

Interest rates have also remained relatively stable — the benchmark 10-year U.S. Treasury Note has spent much of the last five months in a range between 4.2 percent and 4.6 percent. This allows businesses, such as those planning capital projects, to have increased visibility and factor those rates into their costs. Current interest rates are nowhere near historic highs. However, coming on the heels of some historically low interest rates, particularly during the pandemic, makes the rates now seem much higher.

The rates could impact some businesses when it comes to projects, particularly because a lender will want to see a significant capital investment from the company to offset borrowing. Businesses that don’t have the capital to invest may need to delay projects for the time being, but Weichert isn’t seeing a lot of that happening.

The overall trend for the region is moderate expansion, she says. That is bolstered by several factors including projects like Micron.

The nature of the Central New York business community also contributes to that sense of stability.

“All the stakeholders in the community work very well together,” Weichert explains. On top of that, businesses and lenders in the region are disciplined. Businesses tend not to expand at outrageous rates, while lenders follow good lending practices, she explains.

Community Bank is feeling the positivity with its own corporate expansion plans.

“We decided we wanted to put up more branches,” Weichert says. Community Financial System is also investing $42 million in its Syracuse–area headquarters and will invest a total of $110 million in new branches and new regional headquarters in areas such as Rochester.

“We think it’s a strong [regional] economy, and we think it’s going to be profitable for the bank,” she says.

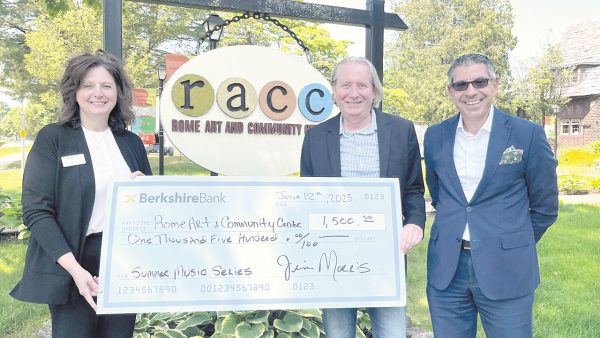

Berkshire Bank Foundation details $400K in Q2 grants to local nonprofits

The Rome Art and Community Center was among the more than 100 recipients of nearly $400,000 in total grants and other giving from the Berkshire Bank Foundation to local nonprofits during the second quarter of 2025. Several Central New York organizations were among the nonprofit organizations in New York, Massachusetts, Connecticut, Rhode Island and Vermont

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The Rome Art and Community Center was among the more than 100 recipients of nearly $400,000 in total grants and other giving from the Berkshire Bank Foundation to local nonprofits during the second quarter of 2025.

Several Central New York organizations were among the nonprofit organizations in New York, Massachusetts, Connecticut, Rhode Island and Vermont that the foundation invested in from April to June.

Berkshire Bank Foundation is the philanthropic arm of Berkshire Bank, a subsidiary of Berkshire Hills Bancorp, Inc. (NYSE: BHLB), which is headquartered in Boston.

Besides the Rome Art and Community Center, the recipient organizations include Crouse Health Foundation Inc. of Syracuse; Resource Center for Independent Living Inc. of Utica; Community Foundation of Herkimer and Oneida Counties Inc. in Utica; Contact Community Services Inc. of DeWitt; and Home Headquarters Inc. of Syracuse.

“We’re committed to building a future where every community has the tools it needs to thrive,” Lori Kiely, managing director of the Berkshire Bank Foundation, said in the announcement. “These investments reflect our belief in the power of local nonprofits to drive meaningful, lasting change.”

About Berkshire Bank

Berkshire Bank says it works with customers and clients in New England and New York. It operates 83 branches, including eight in Central New York. They include locations in Utica; two in Rome; two in New Hartford; along with Whitesboro, West Winfield, and Ilion. Berkshire Bank provides services through its commercial banking, retail banking, consumer lending, private banking, and wealth-management divisions.

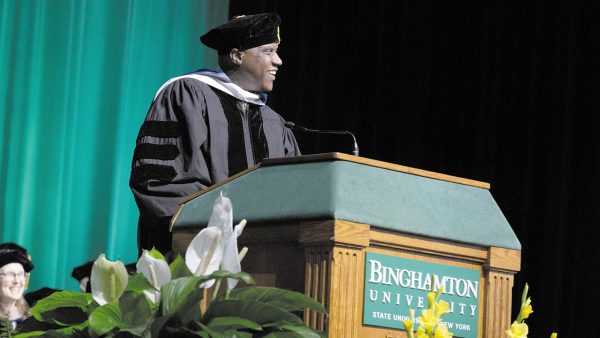

Visions CEO Muse awarded honorary doctorate degree from Binghamton University

VESTAL — Binghamton University has awarded Tyrone Muse, president and CEO of Visions Federal Credit Union (FCU), an honorary doctorate degree. Muse was honored as Doctor of Humane Letters (LHD) during the university’s School of Management commencement ceremony on May 16 in Vestal, the credit union said in a June 18 announcement. During the university’s

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

VESTAL — Binghamton University has awarded Tyrone Muse, president and CEO of Visions Federal Credit Union (FCU), an honorary doctorate degree.

Muse was honored as Doctor of Humane Letters (LHD) during the university’s School of Management commencement ceremony on May 16 in Vestal, the credit union said in a June 18 announcement.

During the university’s annual commencement week, the school recognizes recipients with a SUNY honorary degree: Doctor of Fine Arts, Doctor of Humane Letters, Doctor of Laws, or Doctor of Science.

Muse addressed the graduating Class of 2025 during the commencement ceremony, saying, “Think of yourself as a company and build your personal brand. Think of that one word you hope others use to define you. Live that word. Be that word. For me, that word is ‘Care.’”

In awarding honorary degrees, Binghamton University celebrates the recipients’ achievements and acknowledges their “unique relationship” with the university, Visions said.

“Binghamton is proud to present Tyrone Muse an honorary degree, an award that signifies his many professional achievements and deep and longstanding connection to the university,” Harvey Stenger, president of Binghamton University, said in the Visions announcement. “Mr. Muse has been a supporter of several important initiatives at the university, including the Institute for Child Development, the Fleishman Center for Career and Professional Development, and athletics capital projects. His leadership efforts on behalf of so many different civic organizations in the greater Binghamton community speak to his generous spirit and his commitment to improving the lives of others.”

Since becoming president and CEO of Visions in 2013, Muse has helped foster the credit union’s relationship with Binghamton University, Visions said. Serving as the official financial partner of Binghamton University since 2018, Visions supports the banking needs of students and faculty both on and off campus.

“Above and beyond that relationship,” Visions and Muse “continually support” the school community, and Muse has served as a volunteer on several boards and advisory committees for Binghamton University throughout the years.

The Summit FCU posted its highest asset growth last year

ROCHESTER — The chair of the board of directors for the Summit Federal Credit Union (FCU) says the organization’s 2024 asset growth was its highest since 2020, with an increase of $91 million, or 7 percent. It was part of board chair Chris Modesti’s message to a hybrid audience of board members, employees, and members

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ROCHESTER — The chair of the board of directors for the Summit Federal Credit Union (FCU) says the organization’s 2024 asset growth was its highest since 2020, with an increase of $91 million, or 7 percent.

It was part of board chair Chris Modesti’s message to a hybrid audience of board members, employees, and members during the credit union’s annual meeting held May 14. The event was held both virtually and in person, per the Summit FCU’s May 15 summary of the meeting.

In his message, Modesti told the gathering that financially, the Summit had a “remarkable year.”

“This is why we are able to continuously offer our members competitive interest rates on loans, and often higher-than-market rates on savings products,” he added. The credit union’s fiscal year ended on Dec. 31.

Besides Modesti, the Summit FCU president and CEO Laurie Baker discussed the credit union’s community engagement initiatives for 2024.

“In 2024, our initiatives reached the highest levels of impact in our history,” Baker said, per the summary. “We supported 189 organizations with our time and talent as well as our monetary donations, reflecting over 1,100 hours spent in our communities — in classrooms, at festivals and events, and employment fairs. Each of these interactions and partnerships directly related to the overarching credit union philosophy of ‘people helping people.’”

Besides the remarks from Modesti and Baker, the Summit also presented college scholarships to five graduating seniors who are pursuing higher education. The recipients of this year’s scholarships included Hannah Bouwens, of Homer High School, in Homer, in Cortland County.

In addition, three of the Summit’s volunteers were recognized for their years of service to the credit union.

Founded in 1941, the Summit Federal Credit Union is a nonprofit, member-owned, financial cooperative. With more than $1.4 billion in assets, the Summit has over 250 employees and provides financial products and services for more than 95,000 members in Central New York, the Finger Lakes Region, and Western New York.

New Community Financial CFO outlines goals

DeWITT -— Community Financial System Inc.’s (NYSE: CBU) new chief financial officer brings a background in hedge funds and the Buffalo area to the banking and financial services company, which has targeted western New York as a growth-opportunity region. Marya Burgio Wlos, who was appointed to her position effective on March 31, is up for

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

DeWITT -— Community Financial System Inc.’s (NYSE: CBU) new chief financial officer brings a background in hedge funds and the Buffalo area to the banking and financial services company, which has targeted western New York as a growth-opportunity region.

Marya Burgio Wlos, who was appointed to her position effective on March 31, is up for the challenge of helping DeWitt–based Community Financial grow as it expands its Community Bank, N.A. branch presence across the state and plans to put her background to work helping the company reach its goals.

The Buffalo native started her career in Chicago after graduating from Canisius College and was able to connect with some hedge funds.

“I did that for a long time,” Wlos, 47, recalls. “I worked on the buy side.” Her time working for hedge funds helped hone skills she believes will serve her well at Community Financial.

“These were positions where I learned how to think,” she says. Wlos learned how to solve problems and look three steps ahead.

In 2018, Wlos took a job with M&T Bank (NYSE: MTB) in Buffalo, bringing her back to her roots.

“This was my first time at a bank,” she says. Wlos served as head of management accounting, finance until January 2021, when she became managing director and COO of investment bank at M&T.

While at M&T, Wlos not only learned the banking industry, but also learned how to build an internal network that helped her guide the right people into the right roles at the banking company. “You’re able to figure out where people shine,” she says.

Wlos made the move to Community Financial after a recruiter reached out to her on behalf of the company. “It was sort of an offer I couldn’t refuse,” she says of joining the company.

At Community Financial, she works closely with President/CEO Dimitar A. Karaivanov and she calls it a great partnership. “We’re both builders by nature,” Wlos says, and Community Financial is focused on building right now.

The company already announced plans for a new Syracuse headquarters, new branch locations, and regional offices in the Buffalo, Rochester, and Albany markets.

Based in Buffalo, Wlos will help spearhead those efforts. “We feel there’s a lot of organic growth opportunities,” she says of the Buffalo market. “My experience at M&T helps catapult that.”

Aside from supporting those growth goals, Wlos has outlined some goals of her own as she settles into the role.

“I want to make sure all the legs of the stool are efficient and connected,” she says, referencing Community Financial’s banking, insurance, benefits, and wealth-management divisions. While they all operate separately from the others, Wlos wants there to be enough connection between them to maximize the organization whether that means moving people to the roles they’re best suited for or just sharing problem-solving solutions.

Wlos succeeded Joe Sutaris as CFO. Sutaris retired March 31 and remained with Community Financial through July 1 to work with Wlos during the transition.

In connection with her appointment at CFO, Wlos will receive an annual base salary of $500,000, with the opportunity to receive annual incentive compensation, an equity incentive award, and an initial restricted stock award, based on performance criteria established by the Community Financial board of directors and the terms of the company’s incentive plans. That is according to a March 11 Community Financial System Form 8-K filing with the U.S. Securities & Exchange Commission.

Pathfinder to pay Q2 dividend of 10 cents in early August

OSWEGO — Pathfinder Bancorp, Inc. (NASDAQ: PBHC), the bank holding company of Pathfinder Bank, has declared a cash dividend of 10 cents per share of its common stock for the second quarter of 2025. The dividend is payable on Aug. 8 to all shareholders of record as of July 18, according to a June 30

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

OSWEGO — Pathfinder Bancorp, Inc. (NASDAQ: PBHC), the bank holding company of Pathfinder Bank, has declared a cash dividend of 10 cents per share of its common stock for the second quarter of 2025.

The dividend is payable on Aug. 8 to all shareholders of record as of July 18, according to a June 30 announcement from James A. Dowd, president and CEO of Pathfinder Bancorp.

At Pathfinder’s current stock price, the payment yields about 2.6 percent on an annual basis.

Oswego–based Pathfinder Bancorp has total assets of $1.5 billion, as of March 31. Pathfinder Bank has 11 full-service branches located in its market areas of Oswego and Onondaga counties and one limited-purpose office in Oneida County.

Canandaigua National Bank names Syracuse–area branch locations

CANANDAIGUA — It’s been known since last fall that Canandaigua National Bank (CNB) was coming to the Syracuse area with several new branches. Now we know where. The bank announced on July 18 that over the next year, it will open four new branches at the following locations: the Washington Station Building at 333 W.

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

CANANDAIGUA — It’s been known since last fall that Canandaigua National Bank (CNB) was coming to the Syracuse area with several new branches. Now we know where.

The bank announced on July 18 that over the next year, it will open four new branches at the following locations: the Washington Station Building at 333 W. Washington St., Suite 130 in downtown Syracuse; 7507 Oswego Road (Route 57), in the town of Clay (CNB is calling this its Liverpool office); 6805 E. Genesee St. in the town of DeWitt; and 8065 Brewerton Road in Cicero.

The Washington Station branch will be the first open with renovations beginning soon. The new branch will open by the end of this year, CNB says. Construction of the remaining branches will take place over the next year, with grand-opening dates for each branch to be announced later.

Canandaigua National Bank is working with Syracuse–based King + King Architects to design the Washington Station office while Holmes, King, Kallquist & Associates, Architects of Syracuse will design the other three new branches.

“We are thrilled and honored to become part of these communities,” CNB President/CEO Frank Hamlin said in the announcement. “The site selections are the result of a thoughtful, multi-year process to understand how we can best position ourselves to begin to meet the needs of the Syracuse community as we become an integral part of its growth.”

Canandaigua National Bank is also in the process of identifying additional locations for further expansion into the Syracuse market.

“This is not just about physical locations; it is about continuing to build relationships and offer maximum convenience to the community,” CNB Chief Retail Officer Gwen Crawford said. “We believe these initial sites allow for that, and work is ongoing to identify more sites as part of our commitment and belief in the Syracuse community.”

Canandaigua National Bank first announced its plans to expand into the Syracuse region in the fall of 2024. Since then, the bank has hired employees to build out its retail, commercial lending, and business banking teams in the area. Those hires include:

• Rima Arnold — VP, community office manager, downtown Syracuse branch

• Mary Lemoniades — VP, community office manager, Liverpool branch

• Amr Sultan — community office assistant manager, DeWitt branch

• Renee Dellas — VP, commercial services officer, commercial lending team

• Mark Kay — VP, commercial services officer, commercial lending team

• Jeff Eades — VP, business banker, business banking team

Hiring for additional positions will continue as the branch locations progress, CNB adds.

Along with retail-banking services, Canandaigua National Bank offers business banking, commercial lending, mortgage lending and loan origination, wealth-management services, estate and trust services, and insurance. Headquartered in Canandaigua, the bank has 25 branches and three financial-services offices in Ontario and Monroe counties, as well as the CNB mobile banking service.

Founded in 1887, the bank describes itself as the only local, independent, community-owned bank in the Greater Rochester area. In June of this year, it rebranded to Canandaigua National Bank from its prior name of Canandaigua National Bank & Trust.

OPINION: One Big Beautiful Bill Sets New Direction for How Government Spends Taxpayer Money

The recent signing of the federal tax and spending bill (H.R. 1) — called the “One Big Beautiful Bill Act” — into law has predictably been met with resistance from Albany’s One-Party Rule. State Democrats have retreated from earlier suggestions of a special legislative session to address funding concerns. However, they are nonetheless united in

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The recent signing of the federal tax and spending bill (H.R. 1) — called the “One Big Beautiful Bill Act” — into law has predictably been met with resistance from Albany’s One-Party Rule. State Democrats have retreated from earlier suggestions of a special legislative session to address funding concerns. However, they are nonetheless united in their opposition to reforms, restructuring, and streamlining the state’s most costly benefit programs.

While ignoring all of the new law’s significant benefits, opponents are fixated on changes coming to Medicaid, which include increased work, eligibility, and verification requirements, and the potential loss of enrollees.

It’s important to know the whole story. New York’s Medicaid program is the second-most expensive in the nation, behind only California. At a total cost of $125.8 billion, including a $44.7 billion state share, Medicaid has clearly drifted too far away from the original intent of the program. What was designed to be a mechanism to provide low-income and disabled individuals with critical health care has since snowballed into an avalanche of government bloat and excess.

The unchecked growth of Medicaid has been driven by spending decisions from Albany. The policymakers most unnerved at the thought of more efficient health care and public-assistance programs are the ones largely responsible for the current mess. Despite warnings this spring of federal fiscal action, Democrats passed an unprecedented $254 billion budget that increased the state share of Medicaid by 16.3 percent. They saw a “Stop” sign but accelerated through it when they should have been slowing down.

To help control unsustainable growth, it’s entirely appropriate to verify eligibility and meet criteria for participation in a program funded by taxpayers. There is nothing unfair about setting basic expectations to ensure that capable, qualified individuals are part of the workforce rather than enabling an over-reliance on public assistance. We can make sure people are receiving the help they need while also ensuring New York’s benefit programs are actually working the way they’re supposed to work.

The changes driven by H.R. 1 represent an overdue shift away from Democrats’ unsustainable approach to spending: Demand a blank check and no questions asked from the taxpaying public.

On July 17, Gov. Kathy Hochul convened a camera-friendly meeting of state agency heads to once again criticize the federal spending bill. She announced her intention to travel across New York and campaign against the One Big Beautiful Bill Act. It’s hard to imagine that during her scare-tactic road show the governor will mention all components of the federal plan, including wildly popular provisions to:

• Provide $50 billion to rural hospitals through a Rural Health Transformation Program;

• Eliminate taxes on tips and overtime pay;

• Increase the Child Tax Credit from $1,200 to $2,200;

• Raise the State and Local Tax (SALT) deduction from $10,000 to $40,000;

• Make permanent the Tax Cuts and Jobs Act of 2017, allowing Americans to

avoid a 22-percent tax increase; and,

• Establish a new temporary senior tax deduction of $6,000, which is added to the currently available standard deductions for seniors.

Rather than acknowledge provisions of H.R. 1 that will put more money in the pockets of Americans, expect more of the same political posturing from the governor and her allies. Since January, they have incorrectly predicted doomsday scenarios of a crashing economy, unbearable inflation and a spiraling stock market — none of which have materialized. Instead, inflation sits at 2.7 percent, nearly half the average inflation rate (5 percent) we experienced during President Joe Biden’s four years; gas prices hit a four-year low during Fourth of July weekend; and the most recent jobs report shows 147,000 jobs were added in June, exceeding all expectations.

If nothing else, the One Big Beautiful Bill Act has forced New York’s left-wing tax-and-spend policymakers to look in the mirror. The tough decisions and steps toward fiscal responsibility that have been put off for years are finally going to have to be made. For millions of over-taxed New Yorkers who send too much of their paychecks to Albany, that’s a good thing.

William (Will) A. Barclay, 56, Republican, is the New York Assembly minority leader and represents the 120th New York Assembly District, which encompasses all of Oswego County, as well as parts of Jefferson and Cayuga counties.

OPINION: As It Turns Out, the Federal Government Does Valuable Things

While all eyes have been on the Capitol Hill maneuvering around the 900-page bill [H.R.1 — One Big Beautiful Bill Act (OBBBA)] carrying out President Donald Trump’s agenda, something interesting has been happening in federal agencies. They’ve been bringing laid-off workers back. In fact, CNN reported late in June, they’ve been “scrambl[ing] to fill critical

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

While all eyes have been on the Capitol Hill maneuvering around the 900-page bill [H.R.1 — One Big Beautiful Bill Act (OBBBA)] carrying out President Donald Trump’s agenda, something interesting has been happening in federal agencies. They’ve been bringing laid-off workers back. In fact, CNN reported late in June, they’ve been “scrambl[ing] to fill critical gaps in services left by the Department of Government Efficiency (DOGE)-led effort to shrink the federal workforce.”

Not long after that story appeared, The Washington Post published another, reporting that DOGE “has lost the power to control the government’s process for awarding billions of dollars in federal funds.” Instead, individual federal departments and agencies will again be able to post funding opportunities directly to the government website used by organizations and businesses around the country. But that’s only after grants for funding things like health workers who care for patients with Alzheimer’s disease and efforts to prevent falls by older adults were delayed and, possibly, derailed altogether.

Meanwhile, much of the drama in Congress around the mega-legislation — which will add significantly to the national debt, strip millions of Americans off Medicaid, and cut taxes on the wealthy—has flowed from a simple fact: [The OBBBA] is extremely unpopular [according to some recent polling]. As Republican Senator Thom Tillis of North Carolina — who decided not to run for re-election after announcing his opposition to the bill — put it to reporters, “I don’t bow to anybody when the people of North Carolina are at risk, and this puts them at risk.” The same is true in states all around the country.

Taken by itself, any of these storylines would be interesting. But taken together, they point to one conclusion: As Americans, we may not be fond of the federal government, but on the whole we like the services it provides or [funds]. We like government that’s efficient and on top of its game. We like having an effective military, warnings of approaching hurricanes, and an air-traffic control system that keeps us safe. We even like the social safety net — because among other things, Medicaid helps keep your neighbors healthy and our hospitals operating, and Social Security and Medicare mean that you don’t have to go bankrupt to help your aging parents or grandparents live decent lives.

That CNN story is instructive. As Eric Bradner reported, even though the administration is backtracking, “the rapid rehirings are a warning sign that it has lost more capacities and expertise that could prove critical — and difficult to replace — in the months and years ahead. ‘There are time bombs all over the place in the federal government because of this,’ said Elaine Kamarck, the director of the Center for Effective Public Management at the Brookings Institution. ‘They’ve wreaked havoc across nearly every agency.’” And so the federal government is trying to regain the capacity it lost on everything from mine safety to preventing childhood lead poisoning to pursuing food safety to responding to bird flu.

There is no question it could work more efficiently, or that you can find instances of waste and abuse. But I’m struck by a quote from a former DOGE staffer who gave an interview to NPR in which he said, “I personally was pretty surprised, actually, at how efficient the government was. This isn’t to say that it can’t be made more efficient … but these aren’t necessarily fraud, waste and abuse.”

This country is engaged in an experiment. [The OBBBA] that the GOP leadership in Congress has muscled through will reduce federal spending on health care by over $1 trillion — most of that coming from Medicaid — and cut up to 12 million people off health insurance over the next decade [according to estimates]. These are unprecedented numbers, and those cuts will reverberate throughout our country: in rural hospitals, in community health centers, in neighborhoods where health-care workers have been laid off, and in spending Medicaid enrollees will now have to devote to their physicians rather than their local stores.

Lee Hamilton, 94, is a senior advisor for the Indiana University (IU) Center on Representative Government, distinguished scholar at the IU Hamilton Lugar School of Global and International Studies, and professor of practice at the IU O’Neill School of Public and Environmental Affairs. Hamilton, a Democrat, was a member of the U.S. House of Representatives for 34 years (1965-1999), representing a district in south-central Indiana.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.