Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Recruitment underway for Leadership Cayuga Class of 2026

AUBURN — Cayuga County residents interested in participating in Leadership Cayuga can sign up now. Leadership Cayuga is a civic-leadership program of the Cayuga County Chamber of Commerce. Leadership Cayuga is a community program designed to give participants the tools and contacts needed to be an effective leader in Cayuga County. Its graduates are “prepared […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

AUBURN — Cayuga County residents interested in participating in Leadership Cayuga can sign up now.

Leadership Cayuga is a civic-leadership program of the Cayuga County Chamber of Commerce.

Leadership Cayuga is a community program designed to give participants the tools and contacts needed to be an effective leader in Cayuga County. Its graduates are “prepared to make a positive difference in their work and communities,” the chamber contended in its announcement.

The program is open to emerging leaders who live or work in Cayuga County, as well as established leaders new to the area, and promising high school students, the Cayuga County Chamber said in the announcement. All ages are welcome and encouraged to apply.

Leadership Cayuga will begin in September with monthly class days focused on local topics such as economic development, health & wellness, local history, education, and more. The class culminates in May with a project presentation and graduation.

“As a recent transplant to the area, Leadership Cayuga not only helped me to get acquainted with my new home, but helped me to explore all of the ways that I can get involved!” Emma Dailey of the Seward House who graduated from Leadership Cayuga in the Class of 2023, said in the chamber’s announcement.

Recruitment is underway for the 2026 class. More information on the program, including the online application, is available at: http://www.cayugacountychamber.com/get-involved/leadership-cayuga/.

NSTC in Albany focuses on future of chipmaking

ALBANY — It’s said to have the “most advanced” chip-making machinery that will bring together the nation’s top industry leaders, universities, innovators, and entrepreneurs under one roof. The country’s first National Semiconductor Technology Center (NSTC) is now open at Albany NanoTech in the Capital Region. The NSTC’s overall mission is to “ensure the future of

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ALBANY — It’s said to have the “most advanced” chip-making machinery that will bring together the nation’s top industry leaders, universities, innovators, and entrepreneurs under one roof.

The country’s first National Semiconductor Technology Center (NSTC) is now open at Albany NanoTech in the Capital Region.

The NSTC’s overall mission is to “ensure the future of innovation in chipmaking happens here” in the U.S., the office of U.S. Senate Minority Leader Charles Schumer (D–N.Y.) contended in its announcement. Schumer was in Albany for the July 14 formal-opening ceremony.

The center “firmly establishes Upstate NY as the heart for America’s semiconductor research and manufacturing,” the lawmaker boasted. The 2022 CHIPS & Science Act, which Schumer helped spearhead through Congress as then-U.S. Senate Majority Leader, created the center, his office noted.

The NSTC EUV (extreme ultraviolet) Accelerator at Albany NanoTech is a place for leaders in the semiconductor industry to conduct research and collaborate. That includes bringing industry leaders like Micron Technology Inc. (NASDAQ: MU), which is coming to the town of Clay; IBM, which is headquartered in Westchester County; GlobalFoundries in Malta in the Capital Region; ASML of Wilton, Connecticut; Applied Materials (NASDAQ: AMAT); Tokyo Electron Ltd., and more to the table to partner on next-generation research and development.

Schumer’s office said EUV technology is essential to the semiconductor industry and is some of the most advanced machinery in the world, in which light is used to print patterns and make chips on wafers. EUV lithography is what has allowed the breakthroughs to make this technology nanoscopic and allows for the chips that power everything from smartphones, computers, and vehicles to artificial intelligence.

The NSTC EUV Accelerator at Albany NanoTech is one of three major NSTC facilities. The U.S. Department of Commerce announced that California’s Silicon Valley will host NSTC’s Administrative and Design Facility and Phoenix, Arizona will host the Prototyping and Advanced Packaging Piloting Facility.

In his announcement, Schumer proclaimed the country’s first-ever National Semiconductor Technology Center is “open for business!”

“Today, the eyes of the world turn to Albany and Upstate NY as the next frontier where the scientific and engineering breakthroughs in chipmaking that we cannot even fathom today will happen. The ribbon cutting for this facility will be heard like a sonic boom and make it clear that America will lead the future of semiconductor technology,” the senator said.

New chief legal officer settles into new role at Broadview FCU

ALBANY — Broadview Federal Credit Union (Broadview FCU) announced that Lisa Harris is now serving as its new chief legal officer. She takes over a position previously held by Kendra Rubin, who was recently promoted to chief of staff at Broadview. Harris joins the credit union’s executive-leadership team as Broadview’s primary legal advisor, overseeing all

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ALBANY — Broadview Federal Credit Union (Broadview FCU) announced that Lisa Harris is now serving as its new chief legal officer.

She takes over a position previously held by Kendra Rubin, who was recently promoted to chief of staff at Broadview.

Harris joins the credit union’s executive-leadership team as Broadview’s primary legal advisor, overseeing all legal, corporate governance, compliance, and regulatory matters.

Broadview FCU resulted from the 2022 merger involving SEFCU and CAP COM.

A native of upstate New York, Harris brings to the role experience in legal strategy, regulatory compliance, and public service, Broadview said in its May 27 announcement.

Most recently, Harris served as chief compliance officer at Vivint and previously held senior-leadership positions at Meta, where she was director of economic development and director of business strategy and risk within Meta’s law-enforcement organization. Her background also includes service to the New York State government. She served in executive roles for four governors, was deputy counsel to the Senate Majority Republican Conference, and worked as floor counsel, ethics counsel, and counsel to the secretary of the Senate, handling all Senate litigation matters.

“We are pleased to welcome Lisa to Broadview’s executive leadership team. Throughout her career in both the public and private sectors, Lisa has demonstrated an ongoing commitment to integrity, service, and legal innovation,” Michael Castellana, CEO of Broadview FCU, said in the announcement. “Her leadership in navigating complex legal and regulatory environments makes her an ideal fit to lead our legal function during a period of growth and transformation. I am confident she will make a tremendous impact on Broadview and the members we serve.”

As chief legal officer, Harris is responsible for guiding Broadview’s legal strategy in alignment with its business goals. She will also provide counsel to Broadview’s executive and senior leaders and its board of directors on legal topics that include corporate governance, contracts, litigation, and regulatory compliance.

Harris will oversee the legal, compliance, and contract departments, “promoting a culture of ethics, accountability, and operational excellence across the organization,” the credit union said.

“I am thrilled to be a part of this organization, and its growth and success serving our members and the community,” Harris said in the Broadview FCU announcement.

Harris holds a bachelor’s degree in political science from SUNY Fredonia and earned her law degree from Ohio Northern University. She has worked as an adjunct professor at Albany Law School and previously served on the board of CanCode Communities, Broadview noted.

About Broadview FCU

Broadview says it’s among the largest credit unions in New York state with about $9 billion in assets, more than 500,000 members, and over 60 branches in the Capital Region, Binghamton, Syracuse, and Buffalo.

Outlook for CNY business banking clients remains strong, expert says

Inflation, interest rates, tariffs. These economic and business topics make for splashy headlines in the national news, but they aren’t making the same waves across Central New York’s business community according to a local banking expert. “Central New York is always a little more moderate,” when it comes to the effect of such economic changes,

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Inflation, interest rates, tariffs. These economic and business topics make for splashy headlines in the national news, but they aren’t making the same waves across Central New York’s business community according to a local banking expert.

“Central New York is always a little more moderate,” when it comes to the effect of such economic changes, says Lindsay Weichert, regional president at Community Bank, N.A., a unit of DeWitt–based Community Financial System, Inc. (NYSE: CBU), which has more than

$16 billion in total assets and is one of the 100 biggest banks in the U.S.

Inflation, while higher than some may like, has leveled out, she says. That allows businesses to factor those price changes in when planning. And at 2.7 percent in June, inflation is vastly improved from a high of 9 percent in 2022, she adds.

Stock markets are trading near all-time highs and unemployment rates remain historically low. All that paints a fairly strong economic picture, which we are also seeing in Central New York, Weichert contends.

Across Community Bank’s business portfolio, “sales are still holding really strong,” she says. Many of the bank’s business customers are posting solid earnings results.

“Businesses … are really resilient right now despite all the stuff you see in the headlines,” Weichert contends.

Looking at other signs of economic health, she says Community Bank is seeing consistent and solid capital expenditures and credit-line utilization rates by business clients. There aren’t any concerning upticks in credit use that could signal economic distress.

“We’re seeing really strong credit metrics,” Weichert says. The bank isn’t seeing an increase in charge-offs or delinquencies with its business customers either.

Interest rates have also remained relatively stable — the benchmark 10-year U.S. Treasury Note has spent much of the last five months in a range between 4.2 percent and 4.6 percent. This allows businesses, such as those planning capital projects, to have increased visibility and factor those rates into their costs. Current interest rates are nowhere near historic highs. However, coming on the heels of some historically low interest rates, particularly during the pandemic, makes the rates now seem much higher.

The rates could impact some businesses when it comes to projects, particularly because a lender will want to see a significant capital investment from the company to offset borrowing. Businesses that don’t have the capital to invest may need to delay projects for the time being, but Weichert isn’t seeing a lot of that happening.

The overall trend for the region is moderate expansion, she says. That is bolstered by several factors including projects like Micron.

The nature of the Central New York business community also contributes to that sense of stability.

“All the stakeholders in the community work very well together,” Weichert explains. On top of that, businesses and lenders in the region are disciplined. Businesses tend not to expand at outrageous rates, while lenders follow good lending practices, she explains.

Community Bank is feeling the positivity with its own corporate expansion plans.

“We decided we wanted to put up more branches,” Weichert says. Community Financial System is also investing $42 million in its Syracuse–area headquarters and will invest a total of $110 million in new branches and new regional headquarters in areas such as Rochester.

“We think it’s a strong [regional] economy, and we think it’s going to be profitable for the bank,” she says.

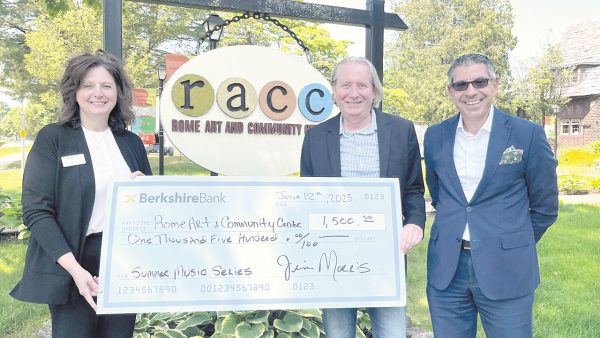

Berkshire Bank Foundation details $400K in Q2 grants to local nonprofits

The Rome Art and Community Center was among the more than 100 recipients of nearly $400,000 in total grants and other giving from the Berkshire Bank Foundation to local nonprofits during the second quarter of 2025. Several Central New York organizations were among the nonprofit organizations in New York, Massachusetts, Connecticut, Rhode Island and Vermont

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The Rome Art and Community Center was among the more than 100 recipients of nearly $400,000 in total grants and other giving from the Berkshire Bank Foundation to local nonprofits during the second quarter of 2025.

Several Central New York organizations were among the nonprofit organizations in New York, Massachusetts, Connecticut, Rhode Island and Vermont that the foundation invested in from April to June.

Berkshire Bank Foundation is the philanthropic arm of Berkshire Bank, a subsidiary of Berkshire Hills Bancorp, Inc. (NYSE: BHLB), which is headquartered in Boston.

Besides the Rome Art and Community Center, the recipient organizations include Crouse Health Foundation Inc. of Syracuse; Resource Center for Independent Living Inc. of Utica; Community Foundation of Herkimer and Oneida Counties Inc. in Utica; Contact Community Services Inc. of DeWitt; and Home Headquarters Inc. of Syracuse.

“We’re committed to building a future where every community has the tools it needs to thrive,” Lori Kiely, managing director of the Berkshire Bank Foundation, said in the announcement. “These investments reflect our belief in the power of local nonprofits to drive meaningful, lasting change.”

About Berkshire Bank

Berkshire Bank says it works with customers and clients in New England and New York. It operates 83 branches, including eight in Central New York. They include locations in Utica; two in Rome; two in New Hartford; along with Whitesboro, West Winfield, and Ilion. Berkshire Bank provides services through its commercial banking, retail banking, consumer lending, private banking, and wealth-management divisions.

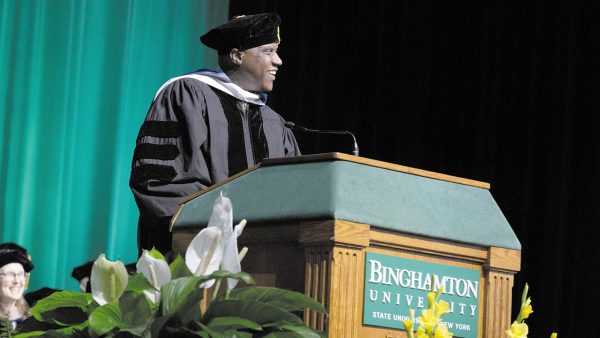

Visions CEO Muse awarded honorary doctorate degree from Binghamton University

VESTAL — Binghamton University has awarded Tyrone Muse, president and CEO of Visions Federal Credit Union (FCU), an honorary doctorate degree. Muse was honored as Doctor of Humane Letters (LHD) during the university’s School of Management commencement ceremony on May 16 in Vestal, the credit union said in a June 18 announcement. During the university’s

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

VESTAL — Binghamton University has awarded Tyrone Muse, president and CEO of Visions Federal Credit Union (FCU), an honorary doctorate degree.

Muse was honored as Doctor of Humane Letters (LHD) during the university’s School of Management commencement ceremony on May 16 in Vestal, the credit union said in a June 18 announcement.

During the university’s annual commencement week, the school recognizes recipients with a SUNY honorary degree: Doctor of Fine Arts, Doctor of Humane Letters, Doctor of Laws, or Doctor of Science.

Muse addressed the graduating Class of 2025 during the commencement ceremony, saying, “Think of yourself as a company and build your personal brand. Think of that one word you hope others use to define you. Live that word. Be that word. For me, that word is ‘Care.’”

In awarding honorary degrees, Binghamton University celebrates the recipients’ achievements and acknowledges their “unique relationship” with the university, Visions said.

“Binghamton is proud to present Tyrone Muse an honorary degree, an award that signifies his many professional achievements and deep and longstanding connection to the university,” Harvey Stenger, president of Binghamton University, said in the Visions announcement. “Mr. Muse has been a supporter of several important initiatives at the university, including the Institute for Child Development, the Fleishman Center for Career and Professional Development, and athletics capital projects. His leadership efforts on behalf of so many different civic organizations in the greater Binghamton community speak to his generous spirit and his commitment to improving the lives of others.”

Since becoming president and CEO of Visions in 2013, Muse has helped foster the credit union’s relationship with Binghamton University, Visions said. Serving as the official financial partner of Binghamton University since 2018, Visions supports the banking needs of students and faculty both on and off campus.

“Above and beyond that relationship,” Visions and Muse “continually support” the school community, and Muse has served as a volunteer on several boards and advisory committees for Binghamton University throughout the years.

The Summit FCU posted its highest asset growth last year

ROCHESTER — The chair of the board of directors for the Summit Federal Credit Union (FCU) says the organization’s 2024 asset growth was its highest since 2020, with an increase of $91 million, or 7 percent. It was part of board chair Chris Modesti’s message to a hybrid audience of board members, employees, and members

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ROCHESTER — The chair of the board of directors for the Summit Federal Credit Union (FCU) says the organization’s 2024 asset growth was its highest since 2020, with an increase of $91 million, or 7 percent.

It was part of board chair Chris Modesti’s message to a hybrid audience of board members, employees, and members during the credit union’s annual meeting held May 14. The event was held both virtually and in person, per the Summit FCU’s May 15 summary of the meeting.

In his message, Modesti told the gathering that financially, the Summit had a “remarkable year.”

“This is why we are able to continuously offer our members competitive interest rates on loans, and often higher-than-market rates on savings products,” he added. The credit union’s fiscal year ended on Dec. 31.

Besides Modesti, the Summit FCU president and CEO Laurie Baker discussed the credit union’s community engagement initiatives for 2024.

“In 2024, our initiatives reached the highest levels of impact in our history,” Baker said, per the summary. “We supported 189 organizations with our time and talent as well as our monetary donations, reflecting over 1,100 hours spent in our communities — in classrooms, at festivals and events, and employment fairs. Each of these interactions and partnerships directly related to the overarching credit union philosophy of ‘people helping people.’”

Besides the remarks from Modesti and Baker, the Summit also presented college scholarships to five graduating seniors who are pursuing higher education. The recipients of this year’s scholarships included Hannah Bouwens, of Homer High School, in Homer, in Cortland County.

In addition, three of the Summit’s volunteers were recognized for their years of service to the credit union.

Founded in 1941, the Summit Federal Credit Union is a nonprofit, member-owned, financial cooperative. With more than $1.4 billion in assets, the Summit has over 250 employees and provides financial products and services for more than 95,000 members in Central New York, the Finger Lakes Region, and Western New York.

New Community Financial CFO outlines goals

DeWITT -— Community Financial System Inc.’s (NYSE: CBU) new chief financial officer brings a background in hedge funds and the Buffalo area to the banking and financial services company, which has targeted western New York as a growth-opportunity region. Marya Burgio Wlos, who was appointed to her position effective on March 31, is up for

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

DeWITT -— Community Financial System Inc.’s (NYSE: CBU) new chief financial officer brings a background in hedge funds and the Buffalo area to the banking and financial services company, which has targeted western New York as a growth-opportunity region.

Marya Burgio Wlos, who was appointed to her position effective on March 31, is up for the challenge of helping DeWitt–based Community Financial grow as it expands its Community Bank, N.A. branch presence across the state and plans to put her background to work helping the company reach its goals.

The Buffalo native started her career in Chicago after graduating from Canisius College and was able to connect with some hedge funds.

“I did that for a long time,” Wlos, 47, recalls. “I worked on the buy side.” Her time working for hedge funds helped hone skills she believes will serve her well at Community Financial.

“These were positions where I learned how to think,” she says. Wlos learned how to solve problems and look three steps ahead.

In 2018, Wlos took a job with M&T Bank (NYSE: MTB) in Buffalo, bringing her back to her roots.

“This was my first time at a bank,” she says. Wlos served as head of management accounting, finance until January 2021, when she became managing director and COO of investment bank at M&T.

While at M&T, Wlos not only learned the banking industry, but also learned how to build an internal network that helped her guide the right people into the right roles at the banking company. “You’re able to figure out where people shine,” she says.

Wlos made the move to Community Financial after a recruiter reached out to her on behalf of the company. “It was sort of an offer I couldn’t refuse,” she says of joining the company.

At Community Financial, she works closely with President/CEO Dimitar A. Karaivanov and she calls it a great partnership. “We’re both builders by nature,” Wlos says, and Community Financial is focused on building right now.

The company already announced plans for a new Syracuse headquarters, new branch locations, and regional offices in the Buffalo, Rochester, and Albany markets.

Based in Buffalo, Wlos will help spearhead those efforts. “We feel there’s a lot of organic growth opportunities,” she says of the Buffalo market. “My experience at M&T helps catapult that.”

Aside from supporting those growth goals, Wlos has outlined some goals of her own as she settles into the role.

“I want to make sure all the legs of the stool are efficient and connected,” she says, referencing Community Financial’s banking, insurance, benefits, and wealth-management divisions. While they all operate separately from the others, Wlos wants there to be enough connection between them to maximize the organization whether that means moving people to the roles they’re best suited for or just sharing problem-solving solutions.

Wlos succeeded Joe Sutaris as CFO. Sutaris retired March 31 and remained with Community Financial through July 1 to work with Wlos during the transition.

In connection with her appointment at CFO, Wlos will receive an annual base salary of $500,000, with the opportunity to receive annual incentive compensation, an equity incentive award, and an initial restricted stock award, based on performance criteria established by the Community Financial board of directors and the terms of the company’s incentive plans. That is according to a March 11 Community Financial System Form 8-K filing with the U.S. Securities & Exchange Commission.

Pathfinder to pay Q2 dividend of 10 cents in early August

OSWEGO — Pathfinder Bancorp, Inc. (NASDAQ: PBHC), the bank holding company of Pathfinder Bank, has declared a cash dividend of 10 cents per share of its common stock for the second quarter of 2025. The dividend is payable on Aug. 8 to all shareholders of record as of July 18, according to a June 30

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

OSWEGO — Pathfinder Bancorp, Inc. (NASDAQ: PBHC), the bank holding company of Pathfinder Bank, has declared a cash dividend of 10 cents per share of its common stock for the second quarter of 2025.

The dividend is payable on Aug. 8 to all shareholders of record as of July 18, according to a June 30 announcement from James A. Dowd, president and CEO of Pathfinder Bancorp.

At Pathfinder’s current stock price, the payment yields about 2.6 percent on an annual basis.

Oswego–based Pathfinder Bancorp has total assets of $1.5 billion, as of March 31. Pathfinder Bank has 11 full-service branches located in its market areas of Oswego and Onondaga counties and one limited-purpose office in Oneida County.

Canandaigua National Bank names Syracuse–area branch locations

CANANDAIGUA — It’s been known since last fall that Canandaigua National Bank (CNB) was coming to the Syracuse area with several new branches. Now we know where. The bank announced on July 18 that over the next year, it will open four new branches at the following locations: the Washington Station Building at 333 W.

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

CANANDAIGUA — It’s been known since last fall that Canandaigua National Bank (CNB) was coming to the Syracuse area with several new branches. Now we know where.

The bank announced on July 18 that over the next year, it will open four new branches at the following locations: the Washington Station Building at 333 W. Washington St., Suite 130 in downtown Syracuse; 7507 Oswego Road (Route 57), in the town of Clay (CNB is calling this its Liverpool office); 6805 E. Genesee St. in the town of DeWitt; and 8065 Brewerton Road in Cicero.

The Washington Station branch will be the first open with renovations beginning soon. The new branch will open by the end of this year, CNB says. Construction of the remaining branches will take place over the next year, with grand-opening dates for each branch to be announced later.

Canandaigua National Bank is working with Syracuse–based King + King Architects to design the Washington Station office while Holmes, King, Kallquist & Associates, Architects of Syracuse will design the other three new branches.

“We are thrilled and honored to become part of these communities,” CNB President/CEO Frank Hamlin said in the announcement. “The site selections are the result of a thoughtful, multi-year process to understand how we can best position ourselves to begin to meet the needs of the Syracuse community as we become an integral part of its growth.”

Canandaigua National Bank is also in the process of identifying additional locations for further expansion into the Syracuse market.

“This is not just about physical locations; it is about continuing to build relationships and offer maximum convenience to the community,” CNB Chief Retail Officer Gwen Crawford said. “We believe these initial sites allow for that, and work is ongoing to identify more sites as part of our commitment and belief in the Syracuse community.”

Canandaigua National Bank first announced its plans to expand into the Syracuse region in the fall of 2024. Since then, the bank has hired employees to build out its retail, commercial lending, and business banking teams in the area. Those hires include:

• Rima Arnold — VP, community office manager, downtown Syracuse branch

• Mary Lemoniades — VP, community office manager, Liverpool branch

• Amr Sultan — community office assistant manager, DeWitt branch

• Renee Dellas — VP, commercial services officer, commercial lending team

• Mark Kay — VP, commercial services officer, commercial lending team

• Jeff Eades — VP, business banker, business banking team

Hiring for additional positions will continue as the branch locations progress, CNB adds.

Along with retail-banking services, Canandaigua National Bank offers business banking, commercial lending, mortgage lending and loan origination, wealth-management services, estate and trust services, and insurance. Headquartered in Canandaigua, the bank has 25 branches and three financial-services offices in Ontario and Monroe counties, as well as the CNB mobile banking service.

Founded in 1887, the bank describes itself as the only local, independent, community-owned bank in the Greater Rochester area. In June of this year, it rebranded to Canandaigua National Bank from its prior name of Canandaigua National Bank & Trust.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.