Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

VIEWPOINT: How the OBBBA’s Tax Reform Could Fuel Your Company’s Growth

The One Big Beautiful Bill Act (OBBBA), a sweeping tax-reform package that includes significant provisions for businesses of all sizes, was signed into law on July 4. While many headlines have focused on individual tax cuts, the bill contains several game-changing business provisions that deserve the attention of every entrepreneur, CFO, and business owner. Three […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The One Big Beautiful Bill Act (OBBBA), a sweeping tax-reform package that includes significant provisions for businesses of all sizes, was signed into law on July 4. While many headlines have focused on individual tax cuts, the bill contains several game-changing business provisions that deserve the attention of every entrepreneur, CFO, and business owner.

Three key opportunities from the legislation are:

1. The return of 100 percent bonus depreciation — along with an expanded Section 179 and a brand-new Qualified Production Property category

2. Full expensing of domestic research and development costs

3. Expanded business interest deductions under a favorable EBITDA-based limitation

Return of 100 percent Bonus Depreciation, Expanded Section 179

What’s changed?

Under prior law, businesses were watching bonus depreciation phase down — dropping to 40 percent in 2025. The OBBBA restores 100 percent bonus depreciation for qualified property placed in service after Jan. 19, 2025. That means businesses can immediately expense the entire cost of eligible assets instead of depreciating them over several years.

What qualifies?

Bonus depreciation generally applies to:

• New and used tangible assets with a recovery period of 20 years or less (think equipment, machinery, furniture, and certain improvements to nonresidential real estate).

The OBBBA also introduces a new category to further incentivize domestic production: Qualified Production Property (QPP). While IRS guidance is (hypothetically / theoretically) expected, this new category is effectively referring to property built for manufacturing. For local manufacturers, contractors, and even breweries, this could be a major incentive to modernize facilities.

Section 179 expansion

Alongside bonus depreciation, the OBBBA significantly expands IRC §179 expensing, another powerful tool for small and mid-sized businesses. Section 179 allows companies to immediately deduct the cost of qualifying property — generally machinery, equipment, vehicles, and certain improvements to nonresidential real property (think roofs, HVAC, alarm, and security systems) — up to an annual limit. Under the new law, that limit increases to $2.5 million with the phase-out threshold beginning at $4 million of qualifying purchases. In practice, this means many more businesses, even those making substantial investments, will be able to expense the full cost of their purchases without relying solely on bonus depreciation.

Planning opportunities:

•Evaluate expansions. If you’re building out a production line, opening a new facility, or expanding capacity, review whether the investment qualifies as QPP.

•Compare strategies. Section 179 allows greater flexibility (you can pick individual assets to expense), while bonus depreciation applies automatically unless you elect out for an entire asset class. Smart planning can maximize deductions in years when taxable income is high. Note that your review process should factor in New York State’s exclusion of bonus depreciation.

Full Expensing of Domestic Research & Development

What’s changed?

One of the most controversial provisions of the 2017 Tax Cuts and Jobs Act (TCJA) required businesses to amortize domestic research and experimental (the IRS refers to this as “R&E”, but you’ll often hear this called R&D) expenditures over five years. This created cash flow headaches and reduced incentives for innovation.

The OBBBA repeals that rule and restores immediate expensing of domestic R&E costs for tax years beginning after Dec. 31, 2024. This means wages, supplies, and certain overhead costs directly tied to U.S.-based research can once again be deducted in full in the year incurred. In addition, businesses that capitalized research expenses from 2022 through 2024 can now accelerate recovery of such deductions, and small businesses (defined as average gross receipts under $31 million) may apply this change retroactively.

What Qualifies?

Qualifying expenditures include research or experimental costs intended to discover information that would eliminate uncertainty regarding the development or improvement of a product. Importantly, any amount incurred domestically for internally developed software is treated as a qualifying R&E expenditure.

Why this matters:

Whether you’re a tech startup developing software, a manufacturer improving processes, or even a food company testing new recipes, these costs may qualify. Combined with the R&D tax credit under IRC §41, this is a one-two punch of tax relief.

Planning opportunities:

• Rewrite history or accelerate now. Consider whether amending prior tax returns or “catching up” deductions on your 2025 return provides the greatest benefit. Businesses that incurred heavy R&D costs in recent years may unlock significant refunds.

Expanded Business Interest-Expense Deduction

The OBBBA permanently restores the EBITDA-based limitation for the business interest-expense deduction under IRC § 163(j). For tax years beginning after Jan. 1, 2025, businesses may deduct interest expense up to 30 percent of adjusted taxable income, calculated as EBITDA (earnings before interest, taxes, depreciation, and amortization). This change reverses the prior, more restrictive EBIT-based limitation that excluded depreciation and amortization from the calculation. In practical terms, this means depreciation and amortization (the DA of EBITDA) are added back to adjusted taxable income — raising the ceiling on deductible interest.

Planning Opportunities:

• Project the impact on your current debt. Forecast your taxable income and deductible interest under the new standard, factoring in the effects of bonus depreciation and R&D expensing, both of which increase EBITDA and thus the interest-deduction limitation

• Strategic Debt Planning. With cheaper after-tax borrowing, expansion projects that once looked marginal may now pencil out. This is especially relevant for small and mid-sized businesses seeking to expand capacity or acquire competitors.

Final Thoughts

The One Big Beautiful Bill Act is a turning point in business taxation. For many local companies, these provisions represent more than just tax savings — they’re tools to fuel growth, innovation, and expansion.

The key takeaway? Timing and proactive planning matters. Because these provisions hinge on assets and expenses incurred in 2025 and beyond, now is the time to coordinate with your CPA or tax advisor. Whether it’s accelerating equipment purchases, reevaluating R&D activities, or planning financing strategies, proactive businesses will capture the greatest benefits. This game will not be won from the sidelines.

Joe Greene is a senior manager at Evans and Bennett, LLP, a full-service accounting firm based in Syracuse. Contact him at jgreene@evansandbennett.com

Bryant & Stratton students train at new high-tech nursing lab at Liverpool campus

CLAY — Bryant & Stratton College has a new nursing lab at its Liverpool location at 7805 Oswego Road (Route 57) in the town of Clay. “This lab represents more than just new equipment. It reflects a commitment to educational excellence, innovation, and the future of compassionate, high quality nursing care,” Mary Hawkins, Syracuse market

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

CLAY — Bryant & Stratton College has a new nursing lab at its Liverpool location at 7805 Oswego Road (Route 57) in the town of Clay.

“This lab represents more than just new equipment. It reflects a commitment to educational excellence, innovation, and the future of compassionate, high quality nursing care,” Mary Hawkins, Syracuse market director at Bryant & Stratton College, said in addressing the gathering at the Liverpool campus during the July 18 formal-opening event.

Designed to replicate a small hospital wing, the lab features private patient rooms with simulation mannequins, a staff office, and a debriefing room equipped with a large wall monitor for real-time observation and discussion.

ERIC REINHARDT / CNYBJ

The school believes the simulation lab, along with an existing skills lab, will give Bryant & Stratton College “greater capacity” to equip future nurses with hands-on experience and help address Central New York’s ongoing nursing shortage.

In her remarks, Hawkins credited Sue Cumoletti, former director of the Syracuse campuses, and Kara Evans, a registered nurse, dean of instruction, and the nursing-program director, for the vision and leadership which resulted in the new simulation lab.

The event also included greetings from the CenterState CEO Ambassadors volunteer group and a ribbon cutting.

Those attending also had the chance to tour both the simulation lab and the skills lab, which included interactive demonstrations led by Bryant & Stratton nursing faculty.

The simulation lab provides real-time care scenarios with interactive simulation mannequins, and the skills lab, which the school describes as having “fully equipped hospital-like training environments.”

As the program moved from the lobby to the simulation lab, Evans told the gathered crowd, “As the only single institution, pre-licensure, bachelor of science degree in nursing program in the region, Bryant & Stratton College embraces a unique and impactful responsibility to educate and prepare the next generation of nurses who will serve our community with skill, compassion, and integrity.”

Bryant & Stratton College’s nursing program serves more than 2,000 students across New York state and beyond, the school said.

Upstate Medical University contributes more than $3 billion to state economy

SYRACUSE — Upstate Medical University contributes $3.2 billion to the state economy and supports, directly and indirectly, more than 24,000 jobs, a new report found. The economic-impact report “underscores the substantial contribution Upstate makes to the regional and state economy,” the health system said in its July 30 announcement. The report — conducted by Kansas

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE — Upstate Medical University contributes $3.2 billion to the state economy and supports, directly and indirectly, more than 24,000 jobs, a new report found.

The economic-impact report “underscores the substantial contribution Upstate makes to the regional and state economy,” the health system said in its July 30 announcement.

The report — conducted by Kansas City, Missouri–based Tripp Umbach — details Upstate’s “significant influence” in the form of employment, tax revenue, community involvement, and academic and research endeavors.

“Upstate today is a growing and dynamic force in the economy,” Paul Umbach, president of Tripp Umbach, who authored the report, said in the Upstate announcement.

In fiscal year 2024 (FY24), Upstate Medical University generated an estimated $3.2 billion in total economic impact for the state of New York, nearly doubling its impact from $1.7 billion in 2008, the report found. This growth, driven by Upstate’s health-care services, educational programs, and research initiatives, “demonstrates the vital role” the institution plays in advancing the economy and health-care infrastructure, the health system contended.

In a breakdown by geography, Upstate Medical University’s economic impact for Central New York is $2.8 billion, for Onondaga County the impact is $2.6 billion, and for the City of Syracuse the impact is $1 billion, per the report.

Upstate supports 11,531 direct jobs (this number as of July 2025 is 12,788) in New York and contributes to a total of 20,453 jobs when including indirect and induced employment. Since 2008, Upstate’s total employment impact has grown by 46 percent, “making it a key driver of job creation in the region,” per the announcement.

The academic health system also generated $241.6 million in state and local tax revenue through its regional spending in fiscal year 2024, nearly tripling its tax impact since 2008, the report found.

“This highlights Upstate’s crucial role in supporting the financial well-being of New York’s local and state governments,” per the Upstate announcement.

For every dollar the state invests, Upstate returns just under $50, the report found.

“We are proud of the Upstate tradition of excellence in education, research, and patient care, which not only enhances the well-being of our communities but also generates substantial economic and social value for Central New York and New York state,” Dr. Mantosh Dewan, president of Upstate Medical University, said. “The continued growth in our economic impact reflects the work of our students, faculty, staff, and healthcare providers, and our commitment to driving innovation in medicine and healthcare delivery.”

Definition of economic impact

Economic impact begins when an organization spends money, per the Upstate announcement.

Economic-impact studies measure the direct economic impact of an organization’s spending, plus additional indirect and induced spending in the economy as a result of direct spending. Direct economic impact measures the dollars that are generated within New York because of the presence of Upstate Medical University.

This includes not only spending on goods and services with vendors across the state and the spending of its employees, patients, and visitors, but also the business volume generated by businesses within New York that benefit from Upstate’s spending.

Upstate also stressed that it’s important to remember that not all dollars spent by Upstate stay in New York. Dollars that go out of the state in the form of purchases from out‐of‐state vendors aren’t included in the economic impact that Upstate makes on the state of New York.

The total economic impact includes the “multiplier” of spending from companies that do business with Upstate Medical University. Support businesses may include lodging establishments, restaurants, construction firms, vendors, and temporary agencies.

Spending multipliers attempt to estimate the ripple effect in the state economy where the spending occurs. For example, spending by Upstate with local vendors provides these vendors with additional dollars that they re‐spend in the local economy, causing a multiplier effect.

Methodology

Upstate’s economic impact was estimated using IMPLAN (IMpact Analysis for PLANning), an econometric modeling system developed by applied economists at the University of Minnesota and the U.S. Forest Service, Upstate Medical University said.

The IMPLAN modeling system has been in use since 1979 and is used by more than 500 private consulting firms, university research centers, and government agencies. The IMPLAN modeling system combines the U.S. Bureau of Economic Analysis’ (BEA) input-output benchmarks with other data to construct quantitative models of trade flow relationships between businesses and between businesses and final consumers.

From this data, one can examine the effects of a change in one or several economic activities to predict its effect on a specific state, regional, or local economy (impact analysis).

The IMPLAN input-output accounts capture all monetary market transactions for consumption in a given period. The IMPLAN input-output accounts are based on industry survey data collected periodically by the U.S. BEA and follow a balanced-account format recommended by the United Nations.

MMRI uses $500K DOD grant to research catastrophic injuries

UTICA — The Masonic Medical Research Institute (MMRI) in Utica will use a $500,000 grant from the U.S. Department of Defense (DOD) for an ongoing research project. It directly addresses a critical need for military personnel who have survived catastrophic injuries, particularly those from blasts, MMRI said. The money will aid the work in developing

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

UTICA — The Masonic Medical Research Institute (MMRI) in Utica will use a $500,000 grant from the U.S. Department of Defense (DOD) for an ongoing research project.

It directly addresses a critical need for military personnel who have survived catastrophic injuries, particularly those from blasts, MMRI said.

The money will aid the work in developing methods to examine the health of vascularized composite allografts (VCA).

This will result in doctors having the ability to quickly determine whether graft rejection is occurring and alter the immunosuppression needed to keep the transplant viable, MMRI said.

VCAs are transplants made of skin, muscle, bones, and nerves, such as an arm or a face, to restore function and appearance.

Those surviving blasts would be candidates for VCAs, yet the risks associated with this “life-changing” therapeutic option “often outweigh the benefits,” as rejection of the graft could put the patient’s life at risk.

Jason McCarthy, associate professor of biomedical research and translational medicine at MMRI, is the principal investigator.

“Our goal is to develop technologies to facilitate routine examination of markers of rejection to catch episodes early, allowing for the modification of immunosuppressive therapies,” McCarthy said in the MMRI announcement. “Current gold standard diagnostics detect rejection too late. Using our technology, we envision in-home monitoring of graft health, enabling more widespread adoption of VCA transplantation.”

McCarthy — working alongside Carl Atkinson, Ph.D., from Northwestern University — combines expertise in the immune system with bioengineering to design these advanced imaging tools. The ultimate vision is to make these tools available in simple, user-friendly devices, MMRI said.

“We’re conducting groundbreaking research right here in the Mohawk Valley,” Maria Kontaridis, Ph.D., executive director, Gordon K. Moe professor and chair of biomedical research and translational medicine at MMRI, contended. “This funding will empower our talented scientists to help a part of the population who have sacrificed so much to keep our country safe — our dedicated soldiers and veterans. I am incredibly proud of Dr. McCarthy and his team for leading this vital project.”

The nonprofit MMRI says it is dedicated to scientific research that improves the health and quality of life for all humankind.

“We conduct high quality research aimed at developing a deeper understanding of the causes of cardiovascular, neurocognitive and autoimmune diseases, in the hopes of identifying innovative treatments and cures for these devastating ailments,” per the announcement.

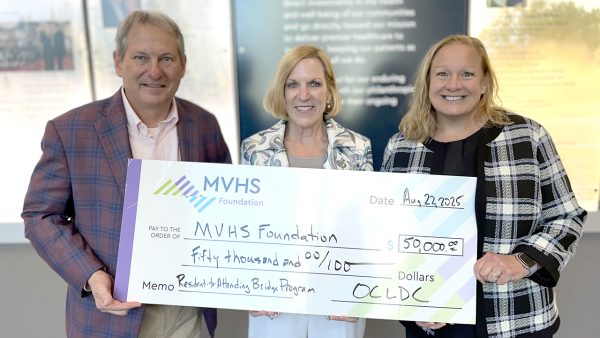

OCLDC provides $50K to support MVHS physician-retention program

UTICA — A new initiative aimed at strengthening physician retention in the Mohawk Valley region will use $50,000 in funding from the Oneida County Local Development Corporation (OCLDC). The funding, which OCLDC approved, will support the Mohawk Valley Health System’s (MVHS) Resident-to-Attending Bridge program, a workforce-development effort designed to help final-year medical residents transition into

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

UTICA — A new initiative aimed at strengthening physician retention in the Mohawk Valley region will use $50,000 in funding from the Oneida County Local Development Corporation (OCLDC).

The funding, which OCLDC approved, will support the Mohawk Valley Health System’s (MVHS) Resident-to-Attending Bridge program, a workforce-development effort designed to help final-year medical residents transition into long-term attending roles within the community, MVHS said.

The program includes structured mentorship, faculty development, board-preparation stipends, and relocation assistance for graduates who commit to staying in the region.

“This investment is a powerful endorsement of our shared commitment to building a sustainable healthcare workforce,” Darlene Stromstad, president and CEO of MVHS, said in the announcement. “We are deeply grateful to OCLDC for recognizing the importance of physician retention as a cornerstone of regional economic vitality.”

The initiative aligns with OCLDC’s mission to support workforce sectors “critical to Oneida County’s long-term stability and quality of life.” Health care remains one of the most important sectors in the region, and retaining trained physicians is key to ensuring continued access to high-quality care, MVHS contends.

The health system welcomed 35 new resident physicians this summer across seven residency programs, including family medicine, general surgery, psychiatry and pharmacy. Of the 10 family-medicine graduates, six have committed to staying in the Mohawk Valley, with roles ranging from hospitalists to faculty members.

“This program is not just about retaining talent — it’s about investing in the future of our community,” Shawna Papale, executive director of OCLDC and Mohawk Valley EDGE, said. “We’re proud to partner with MVHS on this initiative and look forward to seeing its impact on both healthcare and economic development in our region.”

The $50,000 contribution from OCLDC builds on recent philanthropic momentum at MVHS, including a $100,000 gift from a former physician and a $50,000 grant from a corporate fund to enhance simulation training, the health system noted.

VIEWPOINT: End of an Era: New York’s COVID-19 Paid Sick Leave Has Ended

After more than five years, New York State’s pioneering COVID-19 paid sick leave law officially came to an end on July 31, 2025. What the COVID-19 Leave Covered When the state law was first introduced in March 2020, it was designed to provide employees leave if they needed to quarantine or isolate due to COVID-19.

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

After more than five years, New York State’s pioneering COVID-19 paid sick leave law officially came to an end on July 31, 2025.

What the COVID-19 Leave Covered

When the state law was first introduced in March 2020, it was designed to provide employees leave if they needed to quarantine or isolate due to COVID-19. For many businesses, this meant adjusting policies overnight to comply with new rules during an unprecedented time. The COVID-19 leave provided up to three separate periods of leave while an employee was subject to a quarantine or isolation order. According to the statute, the leave was either paid or unpaid, depending on the employer’s size and income. Medical documentation was required for multiple leaves, and leave was not available if employees were able to work remotely. Employers were not allowed to deduct this leave from other available paid leave such as regular sick or vacation time.

What Happens Now

With the law no longer in place, employees will need to rely on other existing leave options if they become ill with COVID-19 (or another serious health condition). Depending on the situation, those options may include:

• Family and Medical Leave Act (FMLA): an employee may be eligible for FLMA leave if the employee is unable to perform the essential functions of their job due to the employee’s serious health condition or to care for the employee’s spouse, child, or parent with a serious health condition.

• Americans with Disabilities Act (ADA): an employee may be eligible for protections under the ADA if the employee has a serious COVID-related illness that qualifies the employee for leave or for other reasonable accommodation(s) thereunder.

• New York State Paid Family Leave: an eligible employee may use New York State Paid Family Leave to care for a family member with a serious health condition.

• New York State Paid Sick Leave: an employee may use New York State Paid Sick Leave for mental or physical illness, injury, health condition or for the diagnosis, care or treatment thereof, or for medical diagnosis or preventive care for the employee or a member of their family for whom they are providing care or assistance with care. The amount of leave and whether the employer is required to provide paid or unpaid leave may depend upon the employer’s size and income.

• New York City Earned Safe and Sick Time Act: an employee may use Safe and Sick Leave for the employee’s health, including to receive medical care or to recover from illness or injury, to care for a family member who is sick or has a medical appointment or when the employee’s job or child’s school closes due to a public-health emergency. The amount of leave and whether the employer is required to provide paid or unpaid leave may depend upon the employer’s size and income.

What Employers Should Do

Even though COVID-19 is no longer a declared emergency, illnesses that keep employees out of work are not going away. With cold and flu season around the corner, now is a good time for employers to:

• Review and update sick-leave policies.

• Ensure compliance with New York State and New York City requirements.

• Communicate clearly with employees about what leave options are available.

Samuel G. Dobre and Jason F. Kaufman are members in the New York City office of the Syracuse–based law firm Bond, Schoeneck & King PLLC. Rachel E. Kreutzer is an associate attorney in Bond’s New York City office.

VIEWPOINT: More than clicks & follows: How health-care influencers are changing the game

What do a YouTube doctor with 13 million subscribers and a hospital with a Facebook Live series have in common? They’re winning hearts — and health decisions — online. As traditional media outlets have seen their power and influence decline in the digital age, a new category of content creators rose to fill the information

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

What do a YouTube doctor with 13 million subscribers and a hospital with a Facebook Live series have in common? They’re winning hearts — and health decisions — online.

As traditional media outlets have seen their power and influence decline in the digital age, a new category of content creators rose to fill the information gap. But the influencer economy is nothing if not uneven.

The ease of finding an influencer with expertise who consistently delivers high-caliber content depends greatly on the topic and industry. They face the same challenges faced by legacy media — building trust, demonstrating expertise, effecting positive change — only wrapped in a different package.

No industry is more primed for influencer disruption than health care. The role of influencers in growing health-care awareness and education among the general public is not new (think Dr. Joyce Brothers or Dr. Dean Edell). For brands navigating this crowded digital landscape, the challenge lies in identifying the right voices who bring more than charisma.

To cut through public distrust, influencers have to be credible, trustworthy, relatable, and not overly polished. They have to be highly relevant to the conversation and brand values and mission. Finding them is easier said than done.

The role of creators, influencers, and KOLs

Health-care influencers have a unique opportunity to reach niche audiences with relatable, often personal content. The most successful ones create not just content, but also community. On the upper end of this spectrum is Dr. Mike Varshavski, a certified family medicine physician, who has a YouTube subscriber base of nearly 13 million. Others work in tighter circles, offering guidance in specialized areas like reproductive health, nutrition, or chronic-illness management.

It’s worth distinguishing between influencers and key opinion leaders (KOLs) in the health-care space. Influencers build their own followings through platforms like TikTok, YouTube, or Instagram (e.g., Dr. Julie Smith). KOLs, on the other hand, are respected experts backed by institutions — people like Dr. Anthony Fauci, whose influence comes from their position and credentials more than their personal social-media presence.

The vast majority of health-care experts do not enjoy a public-facing platform. Not every M.D. or Ph.D. enjoys going on camera and answering popular questions for an online audience. But for those who do, creating content and building an audience has never been easier.

Key trends driving influencer use in health care

Several recent trends have amplified the impact of health-care influencers:

• Telehealth became normalized. COVID-19 pushed more people, especially older adults, to embrace digital tools like Zoom for routine appointments. This shift opened the door for people to explore health topics online without the stigma.

• Mental health went mainstream. Influencers began speaking candidly about their own mental-health journeys, creating space for open, judgment-free conversations. As a result, audiences became more comfortable talking about therapy, treatment, and self-care.

• Representation improved. Communities like Black Health Matters and LGBTQ+ wellness accounts emerged to fill a void. These voices provide relevant, culturally competent guidance to people who might not find it locally.

Strategies for regulated brands to leverage influencers

Some legacy health-care brands have been able to leverage influencer networks for their own marketing needs to great effect. Components of a successful health-care influencer marketing strategy include:

1. Choosing the right partners. Align your brand with influencers who share your values.

2. Emphasize HIPAA-friendly content. Put patient privacy first by anonymizing patient stories whenever necessary to maintain trust among current and future patients.

3. Aim for authentic engagement. Be transparent about your organization, its people, and how you’re working toward your mission.

Several organizations are already doing this well. The FDA’s public education campaign to prevent youth from using tobacco products (“The Real Cost”) and GRADIANT’S TikTok and Instagram campaigns effectively use influencer-style content to reach teens. The Mayo Clinic has turned its staff into influencers by hosting Q-and-A sessions with their own clinicians on their popular social-media channels. The Cleveland Clinic has also used Facebook Live to host several live Q&A sessions with experts on topics ranging from foodborne illness to osteoporosis to regular updates on how the clinic is doing.

Navigating challenges and opportunities

Of course, influencer marketing isn’t without risk. The spread of misinformation is one of the internet’s worst side effects, and health-care brands have a responsibility to combat it. Being part of the solution, not the problem, should be central to any health-care organization’s content initiatives. So too should regulatory compliance, as any content produced by a health-care organization must comply with federal and state laws. Being associated with misinformation and possible legal repercussions can damage a brand’s reputation overnight.

The payoff for any influencer-content initiative requires patience, but brand loyalty is a just reward for a long-term partnership. As an influencer’s audience grows, so can your brand’s, and vice versa.

Monitoring the online-influencer marketplace for emerging voices and mediums is important. TikTok did not exist a decade ago; now it claims more than 2 billion users. Influencer-marketing agencies number in the tens of thousands, and can help brands identify creators who match their tone, mission, and budget. The frontier will continue to shift, but the opportunity is real and growing.

For health-care brands, influencer partnerships aren’t about chasing trends. They’re about reaching people with empathy, clarity, and purpose. Done right, they can be a powerful force for education, engagement, and positive change.

JoAnne Gritter is the chief operations officer at ddm marketing + communications, a B2B digital-marketing agency for highly complex and highly regulated industries. She is responsible for overseeing and facilitating collaboration between all major functional areas at ddm, including finance, human resources, IT, operations, sales, and marketing.

ConnextCare using hybrid dental room in Oswego

Helped by $100,000 Delta Dental grant OSWEGO — ConnextCare says it is now using a hybrid dental room at its Oswego office, thanks to a $100,000 grant from the Delta Dental Foundation that it used to complete the project. The space is designed to expand

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Helped by $100,000 Delta Dental grant

OSWEGO — ConnextCare says it is now using a hybrid dental room at its Oswego office, thanks to a $100,000 grant from the Delta Dental Foundation that it used to complete the project.

The space is designed to expand access to dental care for patients of all ages, ConnextCare said in its July 22 announcement.

The hybrid dental room includes equipment and technology that allow providers to perform both preventive and restorative services in a single, flexible space, ConnextCare said. The addition has enhanced ConnextCare’s ability to meet the growing demand for dental services in the community while “improving efficiency and reducing wait times.”

“We are incredibly grateful to Delta Dental for their support in helping us bring this project to life,” said Tricia Peter Clark, president and CEO of ConnextCare. “The new hybrid room allows us to better serve our patients by increasing our capacity and improving the overall patient experience.”

The grant from the Delta Dental Foundation (DDF) aligns with its mission to advance oral health and reduce disparities in care across New York state, per the ConnextCare announcement. DDF is a nonprofit, charitable organization that serves as the philanthropic arm of Delta Dental and its affiliate companies.

About ConnextCare

Established in 1969, ConnextCare is a network of health-care practices providing Oswego County and surrounding county residents with health care and related services.

ConnextCare operates health centers in Central Square, Fulton, Mexico, Oswego, Parish, Phoenix, and Pulaski. It also operates nine school-based health centers located in the APW, Mexico, Pulaski, Fulton, Oswego, and Sandy Creek school districts.

ConnextCare was previously known as NOCHSI, or Northern Oswego County Health Services Inc.

UHS Chenango Memorial expands cardiology services with two new specialists

NORWICH — UHS Chenango Memorial Hospital says it is expanding its cardio-pulmonary program with the addition of two new cardiologists, seeking to improve access to

OPINION: There is No Place for Political Violence in America

The appalling assassination of conservative activist Charlie Kirk [on Sept. 10] shook the nation to its core and must be a wake-up call to all Americans. Political violence is a dire threat to us all, and endangers Americans everywhere, regardless of where they live or what they believe. For the sake of our families, our

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The appalling assassination of conservative activist Charlie Kirk [on Sept. 10] shook the nation to its core and must be a wake-up call to all Americans. Political violence is a dire threat to us all, and endangers Americans everywhere, regardless of where they live or what they believe. For the sake of our families, our children, and future generations of Americans, we cannot tolerate it under any circumstances.

Charlie Kirk was a father, a husband, a devout Christian, and someone who loved his country. He held strong opinions on controversial topics, and actively engaged in conversations with those who disagreed with his perspectives. That was his right, and his appearances on college campuses embodied a core component of American democracy — civil discourse.

But one’s stance on controversial policies should never amount to a death sentence. Charlie Kirk once said, “What we have to get back to is being able to have a reasonable disagreement where violence is not an option.” I encourage all Americans to stand united in the face of the violence and choose unity, not vengeance, compassion, not cruelty.

We are at a crossroads today. Political temperatures and tensions are running extremely high, fueled in large part by rhetoric that is not just blatantly false, but highly dangerous. The images of the events in Utah were shocking beyond words. And the vile reactions seen online, coming from radical leftists publicly celebrating the death of Charlie Kirk, show how deranged some have become and the significant challenges we have in front of us.

It is our duty as Americans to find a way to overcome them together. We must not let this heinous act spark further division of an increasingly fractured electorate. We must not allow violence to continue to escalate in the name of ideology.

Charlie Kirk’s wife and children must find a way forward without him. That’s what political violence does; it brings nothing but endless pain, suffering, and despair to all in its wake. It is a disgraceful means to an end, and we have all seen firsthand the devastation it brings to families, communities, and countries.

Today, as you go about your business at home, in school, or at work, remember what makes America so special: We are a nation full of diverse ideas and opinions, and they make us stronger. We have a tremendous capacity to set aside our differences and confront hatred while united as Americans. We did it after 9/11, and, unfortunately, today we must do it again. I am calling on all New Yorkers to put peace and understanding ahead of hatred and anger. I believe that is the only way forward after the recent tragic events.

William (Will) A. Barclay, 56, Republican, is the New York Assembly minority leader and represents the 120th New York Assembly District, which encompasses all of Oswego County, as well as parts of Jefferson and Cayuga counties.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.