Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Wolfspeed reduces debt, emerges from Chapter 11 bankruptcy protection

Wolfspeed, Inc. (NYSE: WOLF), a company specializing in silicon-carbide technologies, has completed its financial-restructuring process, and on Sept. 29 announced its emergence from Chapter 11 bankruptcy protection. Based in Durham, North Carolina, Wolfspeed operates a plant in Marcy, in Oneida County. Through the restructuring process, the chipmaker has reduced its total debt by about 70 […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Wolfspeed, Inc. (NYSE: WOLF), a company specializing in silicon-carbide technologies, has completed its financial-restructuring process, and on Sept. 29 announced its emergence from Chapter 11 bankruptcy protection.

Based in Durham, North Carolina, Wolfspeed operates a plant in Marcy, in Oneida County.

Through the restructuring process, the chipmaker has reduced its total debt by about 70 percent, with maturities extended to 2030, and lowered its annual cash-interest expense by about 60 percent, per Wolfspeed’s announcement. In addition, the company believes that it “maintains ample liquidity” to continue supplying customers with leading silicon-carbide products.

With a self-funded business plan supported by free cash-flow generation, Wolfspeed says it is “well positioned to leverage its vertically-integrated 200mm manufacturing footprint — underpinned by a secure and scalable U.S.-based supply chain — to drive sustainable growth.”

“Wolfspeed has emerged from its expedited restructuring process, marking the beginning of a new era, which we are entering with new energy and a renewed commitment to the growth mindset and entrepreneurial spirit that have powered Wolfspeed since its inception,” Robert Feurle, CEO of Wolfspeed, said in the company’s announcement. “As we enter this new era, we do so with much improved financial stability, a scaled, greenfield and vertically integrated 200mm facility footprint, and our large capital deployment behind us.”

In the process of emerging from bankruptcy, Wolfspeed said it canceled and retired its old common stock (totaling about 156.5 million shares), and issued more than 25.8 million shares of new common stock. The company also converted from a North Carolina corporation to a Delaware corporation and adopted new bylaws, according to its Sept. 30 Form 8-K filing with the U.S. Securities & Exchange Commission.

Mohawk Valley EDGE reaction

In a separate statement, Mohawk Valley EDGE said that Wolfspeed had informed the Rome–based economic-development organization back on June 22 that it intended to enter into a restructuring-support agreement with key lenders. The agreement helped the company reduce its debt load.

Mohawk Valley EDGE went on to say that throughout this process, Wolfspeed has “remained fully committed” to its local obligations and partnerships, including those with the Oneida County Industrial Development Agency (OCIDA) and Mohawk Valley EDGE.

“The Mohawk Valley has faced its share of challenges over the years — from economic shifts to global disruptions — but our community has always responded with resilience, collaboration, and a shared commitment to progress,” Shawna Papale, president of Mohawk Valley EDGE, said in its statement. “Wolfspeed’s emergence from bankruptcy is a testament to that same spirit of perseverance and partnership.”

New state law requires quick reporting of cybersecurity, ransomware incidents

ALBANY, N.Y. — A new state law is now effect that requires all municipal corporations and public authorities to report cybersecurity incidents within 72 hours and ransomware payments within 24 hours to the New York State Division of Homeland Security and Emergency Services (DHSES). Within 30 days of making a ransomware payment, the victim organization

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ALBANY, N.Y. — A new state law is now effect that requires all municipal corporations and public authorities to report cybersecurity incidents within 72 hours and ransomware payments within 24 hours to the New York State Division of Homeland Security and Emergency Services (DHSES).

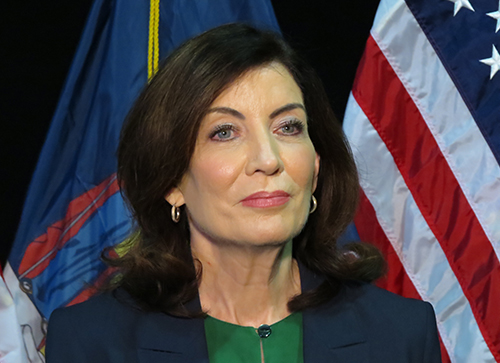

Within 30 days of making a ransomware payment, the victim organization must provide the payment amount, a justification for why it was necessary, and an explanation of the diligence performed to ensure the payment was lawful. The information will improve the state’s ability to address cybersecurity threats, safeguard critical infrastructure, and “tackle the scourge of ransomware,” the office of Gov. Kathy Hochul said.

Hochul first announced the proposed legislation during her 2025 State of the State address.

The governor signed the bill into law on June 27 after virtually convening local-government officials to discuss ongoing security efforts. The legislation also mandates annual cybersecurity-awareness training for government employees across New York state and sets data-protection standards for state-maintained information systems. On July 28, Hochul announced the law was in effect.

“This legislation strengthens our response and provides our state’s Department of Homeland Security and Emergency Services the necessary information to handle reports of attacks and keep New Yorkers safe,” the governor said in the announcement.

Municipal corporations and public authorities may report cybersecurity incidents, notice of ransomware payments, and justification for ransomware payments to DHSES through a web portal available at: https://www.dhses.ny.gov/.

Local governments, non-executive agencies, and state authorities should still call the DHSES Cyber Incident Response Team hotline at 1-844-OCT-CIRT (1-844-628-2478) if they need immediate cyber-incident response support.

“New York State is leading the way in cybersecurity threat and ransomware reporting,” Jackie Bray, commissioner of the New York State Division of Homeland Security and Emergency Services, said. “Now that the system is operational, our teams will be better armed to protect important infrastructure and address ransomware attacks.”

“With the operationalization of this landmark legislation, New York is making a clear statement that we are stronger together, enabling coordinated response and information sharing, and serving as a blueprint for the nation,” Colin Ahern, chief cyber officer of New York State, said.

Cybersecurity remains a concern for small businesses

Cybersecurity continues to be a key issue for small-business owners, with 41 percent citing payment fraud as their top concern, followed by phishing and email scams (27 percent) and identity theft (26 percent). It’s one of several topics addressed in a survey from Cleveland, Ohio–based KeyBank (NYSE: KEY) released on Sept. 16. Overall, KeyBank’s 2025

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Cybersecurity continues to be a key issue for small-business owners, with 41 percent citing payment fraud as their top concern, followed by phishing and email scams (27 percent) and identity theft (26 percent).

It’s one of several topics addressed in a survey from Cleveland, Ohio–based KeyBank (NYSE: KEY) released on Sept. 16.

Overall, KeyBank’s 2025 Small Business Survey found that about one in four (23 percent) small-business owners are stuck in survival mode and aren’t focused on long-term planning. Additionally, almost half (46 percent) of proprietors of small firms feel their performance fell short of expectations in 2025.

Still, 40 percent of small-business owners are cautiously planning ahead for their businesses’ futures. Another 46 percent say they are certain they could cover one month of operating expenses if an emergency arose, down just slightly from KeyBank’s Fall 2024 Small Business Survey (49 percent), “suggesting that they are preparing for stability and sustainability despite uncertainties.”

Even with an extra cushion of expenses saved, half (50 percent) of small-business owners say their top concern is inflation and rising costs — far outpacing factors like competition (33 percent), cash flow (25 percent), and labor shortages and hiring challenges (22 percent). In fact, a quarter (25 percent) of small-business owners are increasing prices for customers in light of recent tariffs and rising costs.

“Navigating the current economic environment has proven to be no small feat for small business owners,” Mike Walters, president of business banking at KeyBank, said in the announcement. “It’s reassuring to see small business owners’ passion and perseverance, despite the challenges that have come their way. Their ability to adapt — whether through tightening expenses, finding new ways to serve customers, or preparing for regulatory shifts — shows the grit and creativity at the heart of the small business community. It’s that determination that allows them to build the foundation needed for long-term growth.”

Preparing for what’s ahead

Looking ahead to 2026, business owners are prioritizing the strategies, resources, and self-care that will help shape their resilience, KeyBank said.

When it comes to seeking professional advice, 21 percent of small-business owners agree they’d feel more secure by having regular conversations with their business bankers, with many looking for guidance on cash flow (33 percent), financial planning (33 percent), and tax strategy (31 percent).

As for maintaining personal resilience, 30 percent of small-business owners say they feel more resilient with a good night’s sleep — ensuring they balance daily self-care needs with long-term business planning.

“Small business owners are proving that resilience is more than just surviving challenges; it’s about planning ahead, leaning on trusted advisors, and making sure they have the clarity and confidence to move forward,” Walters said.

Methodology

This survey was conducted online with Survey Monkey, including 2,144 respondents — ages 18-99, from across the U.S., who own or operate a small-to-medium size business with an annual gross revenue of less than $10 million — completed the survey in July.

Endicott–based IT firm TechMD is now under new ownership

ENDICOTT, N.Y. — TechMD, an Endicott–based information-technology (IT) services firm that operates New York offices in DeWitt and Ithaca, is now under new ownership. Integris, which is based in Cranbury Township, New Jersey, acquired TechMD, along with its security division, 1nteger Security, per a mid-June announcement on the Integris website. It didn’t include any financial

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ENDICOTT, N.Y. — TechMD, an Endicott–based information-technology (IT) services firm that operates New York offices in DeWitt and Ithaca, is now under new ownership.

Integris, which is based in Cranbury Township, New Jersey, acquired TechMD, along with its security division, 1nteger Security, per a mid-June announcement on the Integris website. It didn’t include any financial terms of the acquisition agreement.

Integris describes itself as a “national leader in future-ready managed services,” backed by Toronto, Ontario–based OMERS Private Equity.

The acquired company was founded in 1986 as ICS and rebranded to TechMD in 2023. Besides its Northeast locations, TechMD also has a “strong presence in California,” Integris said.

Following the acquisition, TechMD appears to be operating under the Integris name. A web search of the name TechMD redirects users to the Integris website.

Guggenheim Securities, LLC acted as exclusive financial advisor to TechMD, Integris noted.

The acquisition is Integris’ largest to date and “signifies the next pivotal milestone” in the firm’s “continued evolution” by expanding the company’s products and services that “drive digital maturity” for small to midsize businesses.

“Our mission has been to develop a technology company that is future-ready and forward-thinking with a strong sense of duty toward the customer experience, and we believe Integris is the perfect representation of this direction,” Kevin Blake, president and CEO of TechMD, said in the Integris announcement. “Integris and its leadership are in the right position to elevate our combined experience and technology solutions to the next level, and we’re thrilled to be joining their team.”

Blake now serves as an advisory board member of the Integris board of directors, per the Integris website.

TechMD says it’s been helping small to midsize businesses and organizations power their success through technology for more than 20 years. This extensive knowledge and expertise in providing IT managed services, cybersecurity services, technical services, cloud solutions and product procurement will assist in advancing Integris’ vision for the future of the industry.

“Every acquisition we make is a strategic step toward our vision of transforming Integris into a smarter, faster, and more transformative digital powerhouse,” Glenn Mathis, newly appointed CEO, and previous president and COO, of Integris, said. “By bringing like-minded teams and capabilities into the Integris family, we’re not just expanding our footprint — we’re deepening our ability to elevate the customer experience. Together, we will deliver a high-impact platform that’s more responsive, more secure, and more aligned with the real needs of our clients.”

This pivotal moment in Integris’ history also marks the progression of leadership for the company. After founding and leading the company since its inception, Rashaad Bajwa is transitioning from CEO to executive chairman of the Integris board.

“It has been the privilege of my life to help build Integris into what it is today, however, I cannot think of a more perfect fit for the future of Integris than Glenn,” said Bajwa. “Our industry is undergoing exciting changes, with Integris at the forefront of this innovative charge, and with Glenn’s powerful thought leadership on how AI, automation and data will transform the MSP of the future, now is the perfect time for him to take over the reigns as CEO and for me to help support Integris from my position on the Board.”

Tech Valley Cybersecurity Symposium set for Schenectady on Oct. 14

SCHENECTADY — The 4th annual Tech Valley Cybersecurity Symposium is set for Oct. 14 at Rivers Casino & Resort in Schenectady. LogicalNet — a digital security provider serving the Capital Region for more than 30 years — announced the event Sept. 17. The Cybersecurity Symposium is focused on giving business leaders the tools and insights

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SCHENECTADY — The 4th annual Tech Valley Cybersecurity Symposium is set for Oct. 14 at Rivers Casino & Resort in Schenectady.

LogicalNet — a digital security provider serving the Capital Region for more than 30 years — announced the event Sept. 17.

The Cybersecurity Symposium is focused on giving business leaders the tools and insights to improve their security “without being distracted by sales pitches.”

“Cybersecurity is essential for every business, no matter the size or specialty of the company. With both scams and regulations on the rise, it’s never been more important to protect your company organization,” Tush Nikollaj, CEO of LogicalNet, said in the announcement. “Our Symposium offers the opportunity to connect with fellow leaders and develop a digital security plan away from any distractions that a typical event with a sales and marketing component may have.”

The symposium will include leaders and executives from across multiple sectors who will provide attendees with education, practical advice, actionable insights, and best-practice strategies to protect their businesses. The sectors include health care, nonprofits, banking, higher education, manufacturing, and finance.

Though this event is free, those who wish to attend must be approved. LogicalNet encourages anyone in an executive level or decision-making position to register for attendance at this web page: https://logical.net/cybersecurity-symposium/2025-tech-valley-cybersecurity-symposium/.

Keynote speaker

Jason Manar, the chief information security officer of Kaseya, is this year’s keynote speaker. Miami, Florida–based Kaseya is a global provider of AI (artificial intelligence)-powered cybersecurity and information-technology (IT) management software for IT firms and small to mid-size businesses.

Prior to his role at Kaseya, Manar worked for the FBI as the assistant special agent in charge of cyber, counterintelligence, intelligence, and the languages service program at the San Diego office.

Other prominent speakers at the Cybersecurity Symposium will include Anna Mercado Clark, partner and chief information security officer at Buffalo–based Phillips Lytle LLP; Chant Vartanian, founder and CEO of Los Angeles, California–based M-Theory Group; and Paul Mazzucco, chief information security officer at St. Louis, Missouri–based TierPoint.

Coach AI is first product in PAR Technology’s new PAR AI intelligence suite

NEW HARTFORD, N.Y. — PAR Technology Corp. (NYSE: PAR) describes its PAR AI as a new intelligence layer embedded directly into the PAR product suite. PAR AI introduced Coach AI, a purpose-built intelligent assistant designed for critical roles in restaurant operations, as described in the company’s Sept. 9 announcement. PAR Technology, based in New Hartford,

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

NEW HARTFORD, N.Y. — PAR Technology Corp. (NYSE: PAR) describes its PAR AI as a new intelligence layer embedded directly into the PAR product suite.

PAR AI introduced Coach AI, a purpose-built intelligent assistant designed for critical roles in restaurant operations, as described in the company’s Sept. 9 announcement.

PAR Technology, based in New Hartford, is a foodservice-technology provider.

PAR AI-powered features are built into the core of PAR’s products — spanning POS (point of service), back office, loyalty, drive-thru, and payments — with no technical training or new apps required. This embeds AI directly in an existing workflow to “deliver actionable insights seamlessly and create unique outcomes.”

“PAR AI marks a turning point in how we serve our customers,” Savneet Singh, CEO of PAR Technology, said in the announcement. “We’re going AI native, embedding it into everything we do. It’s not about building tools anymore — it’s about owning the workflows to drive new outcomes within existing processes. The result? Automation that’s not just efficient, but intelligent — driving unique outcomes that were unthinkable before Gen AI. Systems that don’t just respond — they anticipate, adapt, and evolve. PAR AI isn’t just powering tasks; it’s the foundation for running a smarter, faster, more agile business. Coach AI is just the beginning of a future where AI drives clarity, speed, and performance across the entire restaurant experience.”

PAR describes Coach AI as the operational intelligence assistant for corporate leaders, area coaches, and managers, embedded into the PAR OPS platform. Coach AI provides instant answers, eliminating manual data analysis and interpretation, and redirects valuable time to train staff or engage with guests.

Through simple, natural language questions, Coach AI pulls live data from POS, inventory, labor scheduling, and external disparate files to deliver clear visualizations, KPI grids, and actionable recommendations — all without platform-hopping, PAR said.

The company went on to say that coming this fall is a marketing-intelligence assistant for marketers, integrated into the PAR Engagement platform. It will “transform” campaigns and customer data into “instant, actionable” insights.

This conversational AI assistant will provide real-time analytics on loyalty program performance, digital ordering, and customer-engagement metrics, eliminating wait times for custom reports and manual feedback analysis, per the PAR Technology announcement.

MVCC hosts faculty from Dominican Republic, share STEM education practices

UTICA, N.Y. — Three faculty members from the Autonomous University of Santo Domingo (UASD) in the Dominican Republic visited Mohawk Valley Community College (MVCC) in early September to do some learning. The instructors traveled to Utica to explore MVCC’s approach to strengthening education in the areas of science, technology, engineering, and mathematics (STEM). Gladys Nunez,

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

UTICA, N.Y. — Three faculty members from the Autonomous University of Santo Domingo (UASD) in the Dominican Republic visited Mohawk Valley Community College (MVCC) in early September to do some learning.

The instructors traveled to Utica to explore MVCC’s approach to strengthening education in the areas of science, technology, engineering, and mathematics (STEM).

Gladys Nunez, Rosa Almonte, and Reina Raveras — all mathematicians and part of UASD’s STEAM education project — visited MVCC in Utica on Sept. 4 and Sept. 5. It was part of a UASD training program aimed at strengthening professors’ skills in implementing active, innovative, and contextualized methodologies from a STEM perspective.

While on campus, they were involved in a series of activities to highlight MVCC’s approach to STEM education and initiatives to enhance faculty skills.

The visit included tours of MVCC’s science laboratories and discussions about future facility developments.

It also included a tour of the Learning Commons with discussion and sharing of teaching methodologies and integrated learning supports in mathematics; a tour of the College-Community-Connection office, which helps students deal with non-academic challenges (like food insecurity and homelessness) so they can focus on completing their educational goals; and tours of technology and fabrication labs, paired with conversations on pedagogy and applied learning.

The visit additionally involved discussion of non-credit to credit pathways, including MVCC’s free FastTrack career program, and a discussion of STEM teaching methods, engagement strategies, and the strengths of MVCC’s Engineering and Engineering Technology programs.

The visit also included training approaches in advanced-manufacturing education.

MVCC faculty and staff also shared best practices, teaching resources, and innovative instruction models that have been developed to support student success and faculty excellence.

“This exchange underscores the importance of collaboration across borders to advance STEM education,” Randall VanWagoner, president of MVCC, said. “We are proud to showcase the work being done at MVCC to strengthen teaching and learning, and to learn from our colleagues at the Autonomous University of Santo Domingo.”

SRC wins $24M U.S. Air Force contract for AI, computing architecture development work

CICERO, N.Y. — SRC Inc. was recently awarded a nearly $24.3 million contract for innovative research and development of advanced efficient computing architectures and systems. The pact provides for development of robust algorithms and applications, in order to achieve orders of magnitude improvement in size, weight, and power, for deploying robust artificial intelligence and machine-learning

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

CICERO, N.Y. — SRC Inc. was recently awarded a nearly $24.3 million contract for innovative research and development of advanced efficient computing architectures and systems.

The pact provides for development of robust algorithms and applications, in order to achieve orders of magnitude improvement in size, weight, and power, for deploying robust artificial intelligence and machine-learning capabilities in an embedded computing environment for ground, air, and space domains. That’s according to a Sept. 26 contract announcement from the U.S. Department of War (formerly called the Department of Defense).

Work will be performed at SRC’s facility in Cicero and is expected to be completed by Nov. 26, 2028. This award is the result of a competitive acquisition, and two bids were received. Fiscal 2024 and fiscal 2025 research, development, test, and evaluation funds of $203,460 are being obligated at the time of award, per the contract announcement. The Air Force Research Laboratory in Rome is the contracting authority.

SRC is a not-for-profit research and development company that says it combines information, science, technology, and ingenuity to solve problems in the areas of defense, environment, and intelligence. It employs more than 1,400 people.

OPINION: Medicaid Waste is Another Example of N.Y. Being its Own Worst Enemy

New York State’s unrelenting taxes and a dwindling population — in addition to chronic fraud, abuse, and waste — continue to hinder economic growth. The last thing New Yorkers need is to see their own state government wasting money, but that is, unfortunately, what appears to have happened thanks to a newly uncovered Department of

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

New York State’s unrelenting taxes and a dwindling population — in addition to chronic fraud, abuse, and waste — continue to hinder economic growth. The last thing New Yorkers need is to see their own state government wasting money, but that is, unfortunately, what appears to have happened thanks to a newly uncovered Department of Health (DOH) oversight costing more than a billion dollars.

Reports from the Office of the New York State Comptroller indicate the state accidentally distributed $1.2 billion in Medicaid payments to managed-care companies for covering individuals who were residing out of state. The enormity of this error is both alarming and disturbing, and so is the fact that it could have been avoided if the DOH had basic vetting and verification practices in place to prevent it.

The improper payments were made despite the existence of a federal database known as the Public Assistance Reporting Information System, which is designed specifically to identify residents who may be receiving benefits payments from more than one state. Unfortunately for New Yorkers, the comptroller’s audit found DOH did not begin sending relevant data or conducting reviews on potential duplicate payments until after $1.5 billion had already been sent to unreviewed individuals.

Additionally, Comptroller Thomas DiNapoli’s office found the DOH failed to properly transfer individuals eligible for Medicare off Medicaid, which led to another errant $294.4 million in inappropriate spending, as well as other overpayments and improper expenditures. These are not rounding errors; these mistakes cost New Yorkers billions of dollars at a time when every dollar matters.

It is no secret New York has faced myriad waste and fraud issues in recent years, but the sheer magnitude of these errors threatens to further damage our already fragile health-care system. New York State already spends too much on Medicaid, among the most bloated programs in the nation, and we simply cannot afford to send a single dollar to anyone who is not rightfully eligible.

These mistakes must be cleaned up immediately. New Yorkers literally cannot afford any more incompetence.

William (Will) A. Barclay, 56, Republican, is the New York Assembly minority leader and represents the 120th New York Assembly District, which encompasses all of Oswego County, as well as parts of Jefferson and Cayuga counties.

OPINION: Congress Is No Longer an Equal Branch

Though Congress-watchers have been focused since the beginning of the year on the ever-shrinking power of Capitol Hill, the common wisdom finally seems to be catching up. The New York Times recently headlined the online version of a front-page story, “Trump Tramples Congress’s Power, With Little Challenge From G.O.P.” Two days later, the Wall Street

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Though Congress-watchers have been focused since the beginning of the year on the ever-shrinking power of Capitol Hill, the common wisdom finally seems to be catching up. The New York Times recently headlined the online version of a front-page story, “Trump Tramples Congress’s Power, With Little Challenge From G.O.P.” Two days later, the Wall Street Journal took a different angle: “Cases on Trump’s Powers Raise Stakes for Congress: If president persuades courts on his expansive claims of authority, it would shrink the domain of the legislative branch.”

“Expansive claims of authority” is putting it mildly. We’re not even a quarter of the way through the second Trump administration, and the list of assaults on Congress’s prerogatives seems to grow every day. The White House is trying to claw back money Congress appropriated; it launched a military assault outside U.S. territorial waters without even notifying members; it is trying to cancel $5 billion in foreign aid approved by Congress; it’s pursued an economy-altering regime of tariffs — which the Constitution explicitly places in Congress’s domain; it’s repeatedly ousted administration officials just voted in by Congress; it has sought aggressively to block or at least control congressional oversight (another constitutional mandate)… By the time you read this, there will undoubtedly be more examples.

To some extent, this is simply a continuation of long-term trends. As New York Times reporters Julian E. Barnes and Catie Edmonson write, “For nearly a century, Democratic and Republican presidents alike have sought to amass more power, particularly to conduct foreign policy and military operations, and with a few exceptions, succeeded in chipping away at congressional influence.” Or to put it more succinctly, as former federal judge and current Stanford law professor Michael McConnell does in the Wall Street Journal, “When the president pushes the envelope, the other side of the envelope is Congress.”

And in certain arenas, most notably crafting the federal budget and war powers, Congress seemed content even before the first Trump administration to give the president more power. What seems different this time is the extent to which the leadership in both chambers has bowed to the administration’s wishes and avoided standing up for Congress’s authority.

I’ll be honest: I think this is misguided. I don’t think it’s an accident that the U.S. reached the apogee of its power at a time when Congress was a fully functioning, equal branch of government. There were plenty of reasons, ranging from the deep subject-matter expertise of prominent committee chairs and even rank-and-file members to policies that were more deliberative, representative, and sustainable because they often reflected compromise across regions, constituencies, and ideologies. Everything from the Social Security Act of 1935 to the Civil Rights Act of 1964 to the War Powers Resolution of 1973 came out of a Congress not just willing, but eminently capable of working collaboratively in a determination to flex its muscles.

Yet even I, an unabashed and enthusiastic proponent of congressional power, have to recognize that those days are likely done. Since the 1990s, deep partisan divides — stoked by leaders seeking to cement their power — have made it difficult (though not impossible) to reach compromises across the aisle. The centralization of power in leadership hands has robbed committees of their ability to deliberate on policy, hear from expert witnesses, and apply technical expertise to legislation. And perhaps more than anything else, several generations of members have lost the instinct of congressional power — and along with it, the knowledge and legislative skills necessary to sustain Congress as a co-equal branch. There are the occasional glimmers of a congressional pulse — the Epstein files are a good example — but they stand out because they’re so rare.

Still, while Congress may never return to its powerful heyday, let alone to the roles our founders envisioned for it, there is no question that it can re-assert some of its authority whenever its members choose to do so. They can hold meaningful oversight hearings; they can withhold funding for administration initiatives they dislike; they can challenge, in court, presidential attempts to steal their constitutional authority. They can even craft and then pass legislation they believe the country needs. Congress has the right; it’s just a matter of will.

Lee Hamilton, 94, is a senior advisor for the Indiana University (IU) Center on Representative Government, distinguished scholar at the IU Hamilton Lugar School of Global and International Studies, and professor of practice at the IU O’Neill School of Public and Environmental Affairs. Hamilton, a Democrat, was a member of the U.S. House of Representatives for 34 years (1965-1999), representing a district in south-central Indiana.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.