Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Shane M. McCrohan has joined Bond, Schoeneck & King PLLC as a senior counsel in the trust and estate practice group. He focuses on the

N.Y.’s local sales-tax collections rise nearly 4% in 1st half of 2025

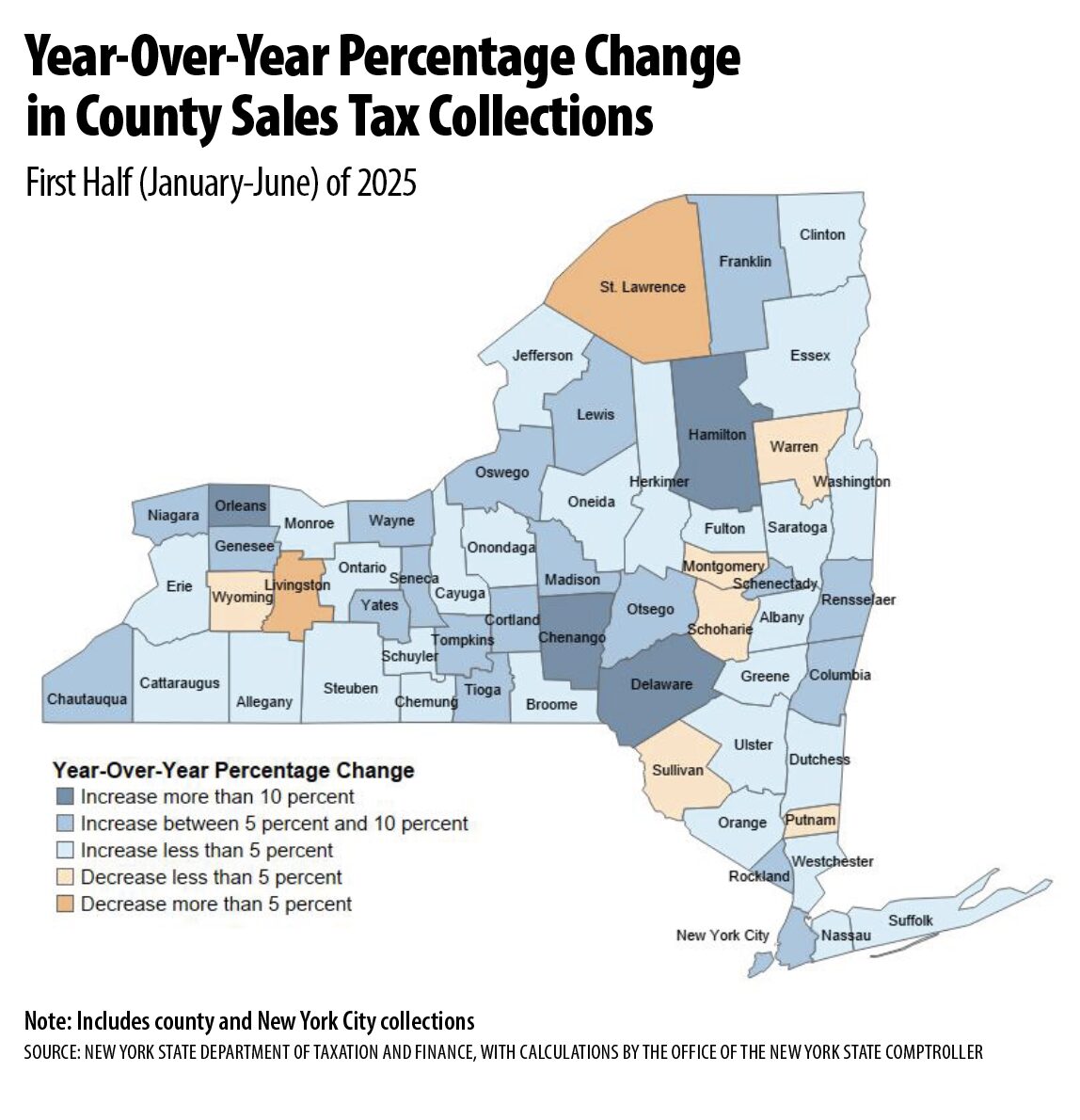

ALBANY — Local government sales-tax collections totaled $11.9 billion in the first six months of 2025, up 3.7 percent (or $423 million) compared to the first half of last year. That’s according to a report that New York State Comptroller Thomas DiNapoli issued on July 30. Year-over-year growth in collections during the first half of

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ALBANY — Local government sales-tax collections totaled $11.9 billion in the first six months of 2025, up 3.7 percent (or $423 million) compared to the first half of last year.

That’s according to a report that New York State Comptroller Thomas DiNapoli issued on July 30.

Year-over-year growth in collections during the first half of 2025 almost doubled the 1.9 percent growth in collections in the same period last year and was nearly the same as the average growth rate for the January to June period from 2010-2019 during the recovery and expansion following the Great Recession.

“While New York’s local sales tax collections experienced stronger growth in the first half of 2025, future revenues may become less predictable as local communities weather federal policy changes, inflation and other economic factors,” the comptroller said. “Local officials should continue to take advantage of all the financial tools and guidance my office has to offer to help them strengthen their finances and resiliency amid these uncertain times.”

Report findings

DiNapoli’s report on sales-tax collections in the first half of 2025 found each of the state’s 10 economic-development regions, including New York City, produced a year-over-year increase in first-half collections.

New York City’s sales-tax collections totaled nearly $5.4 billion in the first half of 2025, an increase of 4.7 percent ($242 million), year over year, while aggregate collections for the counties and cities in the rest of the state grew by 2.8 percent ($156 million).

Outside of New York City, regional growth ranged from a low of 1.3 percent (Mohawk Valley) to a high of 4.6 percent (Southern Tier).

The report also found nearly 86 percent of counties experienced a year-over-year increase in first-half collections.

Hamilton County generated the highest growth in the first half at 14.6 percent, followed by the counties of Delaware (12.9 percent), Orleans (12.1 percent) and Chenango (11.7 percent). Several other counties had strong growth, including Oswego (9.1 percent), Schenectady (8.4 percent), and both Franklin and Madison (8 percent).

Among the eight counties that had decreases in first-half collections, St. Lawrence had the steepest decline at -5.7 percent, followed by Livingston (-5.1 percent) and both Sullivan and Schoharie (-2.9 percent).

Nearly 75 percent of cities outside of New York City that impose their own sales tax had growth in the first half. Norwich had the largest increase at 19.3 percent, followed by Salamanca (15.4 percent). Conversely, the cities of Ogdensburg, Johnstown, Glens Falls, Mount Vernon, and Utica each had decreases in collections, ranging from -0.6 percent to -4 percent.

New York home sales slip in July, inventory levels rise

ALBANY — Realtors in New York state sold 10,046 previously owned homes this July, down 2.3 percent from the 10,286 homes they sold in July 2024. At the same time, pending sales dipped slightly in July, foreshadowing a possible decline in closed home sales in the next couple of months. That’s according to the New

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

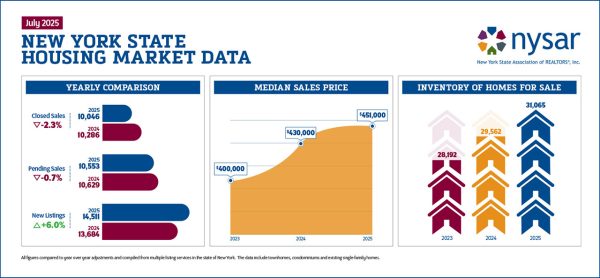

ALBANY — Realtors in New York state sold 10,046 previously owned homes this July, down 2.3 percent from the 10,286 homes they sold in July 2024.

At the same time, pending sales dipped slightly in July, foreshadowing a possible decline in closed home sales in the next couple of months. That’s according to the New York State Association of Realtors (NYSAR) July housing report issued on Aug. 21.

The housing-sales results in the latest month came amid a backdrop of interest rates that have started to drop. NYSAR cites Freddie Mac as indicating rates on a 30-year fixed-rate mortgage dipped from 6.82 percent in June to a monthly average of 6.72 percent in July. That’s also down a bit compared to July 2024, when interest rates averaged 6.84 percent. Freddie Mac is the more common way of referring to the Virginia–based Federal Home Loan Mortgage Corporation.

New York sales data

Statewide housing inventory reached 31,065 units in July, a 5.1 percent increase from July 2024’s total of 29,562 available homes. This marks five straight months of increasing inventory statewide, NYSAR noted. But it comes after several years of compressed inventory.

New listings of existing homes for sale in New York jumped 6 percent to 14,511 this July from 13,684 in the year-ago month.

Pending sales totaled 10,553 in July, off 0.7 percent from the 10,629 pending sales in the same month in 2024, according to the NYSAR data.

Despite the increased housing inventory, prices continued to rise in the state. Median home-sales prices hit a record high of $451,000 in July, up 4.9 percent from the $430,000 price tag in July 2024. This marks the highest monthly median-sales price since statistics have been kept in New York state. The last time NYSAR reported a decrease in median home-sales prices in year-over-year comparisons was July 2023.

All home-sales data is compiled from multiple-listing services in New York, and it includes townhomes and condominiums in addition to existing single-family homes, according to NYSAR.

Business Energy Advisors program in Tompkins County expands to help nonprofits

ITHACA — Tompkins County’s Business Energy Advisors (BEA) program is expanding to provide specialized energy-consulting services for nonprofit organizations. The new initiative adds to the BEA program’s existing services, offering additional support to help nonprofits in existing buildings plan cost-effective energy upgrades, reduce operating costs, and access financial incentives, per the Tompkins County announcement. Tompkins

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ITHACA — Tompkins County’s Business Energy Advisors (BEA) program is expanding to provide specialized energy-consulting services for nonprofit organizations.

ITHACA — Tompkins County’s Business Energy Advisors (BEA) program is expanding to provide specialized energy-consulting services for nonprofit organizations.

The new initiative adds to the BEA program’s existing services, offering additional support to help nonprofits in existing buildings plan cost-effective energy upgrades, reduce operating costs, and access financial incentives, per the Tompkins County announcement.

Tompkins County believes the BEA program has “long been a trusted resource” for commercial businesses, municipalities, manufacturing facilities, and multifamily properties, guiding energy planning for new construction and major renovations.

With the new expansion, nonprofits in Tompkins County can access customized consulting services designed specifically to meet their needs and resource constraints — while the BEA program continues to serve all other sectors as before.

To learn more about the program, visit: https://tcgov.co/bea.

About the nonprofit service

The nonprofit-focused services include two “flexible” consulting options. The first option is an Enhanced BEA – Energy System Design, a full-service offering that includes technical specifications, contractor-bid guidance, and an informed list of energy incentives. This program is “ideal” for nonprofits planning a major renovation and/or heating system upgrade, Tompkins County contended.

The second option is a Heating System Bid Review, a streamlined review of contractor proposals with expert feedback on energy efficiency, cost-effectiveness, and best-fit systems.

“These new services ensure that nonprofits, often operating with limited resources, can make informed decisions that lower energy costs while supporting their mission,” Hailley Delisle, sustainability coordinator for Tompkins County, said in the announcement. “We’re proud to help these vital community organizations become more sustainable.”

Participating nonprofits will benefit from free support from energy consultants; help in identifying grants, rebates, and incentives; and customized energy-system design recommendations. Nonprofit organizations located in Tompkins County with existing buildings are eligible to participate in these new offerings.

Meanwhile, the broader BEA program remains fully available to commercial businesses, multifamily properties, manufacturing facilities, and municipalities considering energy-related construction or renovation. Program participants will benefit from personalized energy goal setting, technical feasibility studies, and comprehensive energy options reports.

Thruway service area employee charged with identity theft, grand larceny

The New York State Police recently arrested a woman employee of a New York State Thruway service area for allegedly running up a tab of more than $1,600 on a credit card left behind by a customer. On the evening of Aug. 11, State Police responded to the Sloatsburg service area in the village of

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The New York State Police recently arrested a woman employee of a New York State Thruway service area for allegedly running up a tab of more than $1,600 on a credit card left behind by a customer.

On the evening of Aug. 11, State Police responded to the Sloatsburg service area in the village of Sloatsburg (Rockland County) for a report of a larceny complaint. On Aug. 12, State Police arrested Raufoliana O. Louis Jean, 28, of Spring Valley, for 4th degree grand larceny (2 counts) and 2nd degree identity theft.

A preliminary investigation revealed that Louis Jean, an employee at the service area, used a credit card left behind by a patron to make purchases without their permission. Further investigation revealed that Louis Jean used the card at several businesses in Spring Valley, and purchased a total of $1,636.18 worth of merchandise.

Louis Jean was transported to the State Police station in Tarrytown for processing and released on an appearance ticket returnable to the Sloatsburg Village Court on Aug. 27.

Bousquet Holstein names two to board of managers

SYRACUSE — Bousquet Holstein PLLC announced on July 1 that attorneys Natalie P. Hempson-Elliott and Julia J. Martin have been elected by its members to serve on the firm’s board of managers. Hempson-Elliott and Martin will replace Philip Bousquet and Joshua Werbeck, who have transitioned off the board, effective July 1. They join the firm’s

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE — Bousquet Holstein PLLC announced on July 1 that attorneys Natalie P. Hempson-Elliott and Julia J. Martin have been elected by its members to serve on the firm’s board of managers.

Hempson-Elliott and Martin will replace Philip Bousquet and Joshua Werbeck, who have transitioned off the board, effective July 1. They join the firm’s other managing members: Laurence G. Bousquet, Cecelia R.S. Cannon, David A. Holstein, Jana M. McDonald, and L. Micha Ordway, Jr.

Hempson-Elliott has more than 15 years of experience advising clients in a broad range of business, commercial real estate, and public-finance transactions. She represents both nonprofit and for-profit organizations in complex development projects, often involving various economic incentives (tax credits), federal and state funding programs, and multifaceted construction and permanent financing.

Martin re-joins the firm’s board of managers after completing a term from 2022-2024. Known for her clear, strategic counsel, Martin advises clients on a wide range of tax and business matters, including corporate income, sales and use, franchise, and personal income taxes. She has extensive experience representing clients before New York State tax authorities in audits and litigation and is a trusted advisor to individuals and businesses seeking effective, purposeful guidance.

Oneida County hotels post strong month of business in July

UTICA, N.Y. — Oneida County hotels registered a rise in overnight guests in July, as two other key indicators of business performance also improved. The

DEC now controls Onondaga Lake Visitors Center

Honeywell transferred it to the agency GEDDES — The Onondaga Lake Visitors Center on the lake’s southern shore is now under

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Honeywell transferred it to the agency

GEDDES — The Onondaga Lake Visitors Center on the lake’s southern shore is now under the control of the New York State Department of Environmental Conservation (DEC).

The DEC on June 10 announced the transfer of the Visitors Center, which is located at 280 Restoration Way in the town of Geddes, from Honeywell.

The center features informative displays about the historic cleanup and restoration of Onondaga Lake, its tributaries, and watershed, the DEC said in its announcement.

The Visitors Center is retaining its name and following renovations, it will become a public outreach facility operated by DEC’s Bureau of Environmental Education.

The renovations are ongoing, and the DEC’s Environmental Education team “is already planning monthly programming into the 2026 season, which will run from April to September,” a DEC spokesperson tells CNYBJ in an email.

Honeywell originally built and opened the Visitors Center in 2012 to share information with the public about the cleanup and the history of Onondaga Lake. Displays in the center showcase the cleanup plan and progress, return of native plants and animals, and habitat restoration and enhancements.

“Onondaga Lake is an incredible natural resource and the cleanup of one of New York’s most polluted waterbodies is an undeniable success story,” DEC Commissioner Amanda Lefton said in the announcement. “DEC embraces the opportunity to help New Yorkers and visitors alike learn about the history of the lake and its cleanup and the ecosystems its rebirth is helping to support and thrive.”

The DEC will operate the Onondaga Lake Visitors Center seasonally, April through October, and serve as a point of contact for environmental and educational organizations interested in hosting events or programming at the lakeside location. By fostering partnerships with local colleges and universities, including the SUNY College of Environmental Science and Forestry, the center will provide learning and career-development opportunities for students of all ages, the department noted.

The DEC works with the U.S. Fish and Wildlife Service to oversee implementation of Natural Resource Damage Assessment and Restoration Plan Projects for Onondaga Lake. The transfer of the center to the DEC was among the plan’s requirements, the department noted.

Onondaga Lake cleanup, restoration

Crews completed cleanup activities for Onondaga Lake in 2016 in accordance with the 2005 Record of Decision, the DEC said.

The department continues to oversee the completed cleanup and Honeywell’s ongoing monitoring of the lake-bottom cap to “ensure it remains effective and fully protective of public health and the environment.”

In its announcement, the DEC also said, “Significant progress continues to be made in cleaning up Onondaga Lake and its tributaries and watershed, enabling Central New Yorkers to once again connect to this important resource. Dramatic improvements in wastewater and stormwater management, coupled with tremendous progress in cleaning up historical industrial contamination, have improved water quality and aided in the return of native plants and animals. With these improvements, the lake is once again becoming a destination for outdoor enthusiasts, while serving as a source of community pride.”

New workforce-development specialists join MACNY

Will support expansion of apprenticeship and youth career exploration opportunities DeWITT — MACNY, The Manufacturers Association, recently hired a pair of workforce-development specialists to further advance its mission to expand early career exploration and strengthen workforce pipelines across the state through the development of apprenticeship and pre-apprenticeship programming. Mohamed Thiam has joined Partners for Education

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Will support expansion of apprenticeship and youth career exploration opportunities

DeWITT — MACNY, The Manufacturers Association, recently hired a pair of workforce-development specialists to further advance its mission to expand early career exploration and strengthen workforce pipelines across the state through the development of apprenticeship and pre-apprenticeship programming.

Mohamed Thiam has joined Partners for Education & Business, Inc. (PEB), a MACNY affiliate, where he will lead youth-focused workforce initiatives in the Syracuse City School District, including the Pathways in Technology Early College High School (P-TECH) programs, Public Service Leadership Academy at Fowler and ITC, the K-8 Smart Start Program, and the Career, Technology & Education Fair. His work will focus on building school-to-career pathways by connecting students with employers, coordinating hands-on experiences, and aligning programming with industry needs, MACNY said in a late July announcement. Thiam brings nearly a decade of experience in workforce and economic development, community organizing, and advocacy for underrepresented communities. Before joining PEB, he served as a job coach at InterFaith Works of CNY, where he helped immigrants and refugees navigate employment barriers, built partnerships with employers, and supported career advancement. He’s also a former graduate teaching assistant with a master’s degree in Pan-African Studies from Syracuse University.

Christa Matolka has come aboard MACNY’s talent development team to support the Real Life Rosies and Advance 2 Apprenticeship pre-apprenticeship programs, which prepare participants for careers in advanced manufacturing and other high-demand fields. She will collaborate with employers, educators, and community partners to recruit participants, support program delivery, and help participants successfully transition into registered apprenticeship programs and careers, MACNY notes. Matolka brings more than a decade of experience in the pharmaceutical and biotech industries, with a proven track record in highly process-driven environments. She has held key roles at companies such as LOTTE Biologics, Regeneron Pharmaceuticals, and Ecovative Design, where she specialized in quality compliance, equipment validation, training development, and project execution. Her ability to manage complex systems, adhere to strict regulatory standards, and deliver effective team training positions her well to support pre-apprenticeship participants as they prepare for success in technical careers, the association contends. She holds a bachelor’s degree in biological sciences from the University at Albany.

MACNY contends that Thiam and Matolka bring a combination of experience and industry insight that will elevate the association’s statewide efforts to develop a skilled, inclusive, and future-ready workforce through career exploration and apprenticeship opportunities.

MACNY, based at 5788 Widewaters Parkway in the town of DeWitt, is a 112-year-old nonprofit organization representing manufacturers throughout Central and Upstate New York.

NYS Parks announces upgrades to Black Diamond Trail, near Ithaca

ULYSSES — The New York State Office of Parks, Recreation and Historic Preservation in late July announced more than $1 million in upgrades to a popular Southern Tier multi-use trail connecting the city of Ithaca with Taughannock Falls State Park in the town of Ulysses. The improvements — an enhanced bridge crossing, new restrooms and

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ULYSSES — The New York State Office of Parks, Recreation and Historic Preservation in late July announced more than $1 million in upgrades to a popular Southern Tier multi-use trail connecting the city of Ithaca with Taughannock Falls State Park in the town of Ulysses.

The improvements — an enhanced bridge crossing, new restrooms and a new parking lot — provide a more welcoming experience for people who enjoy walking, running, and biking on the Black Diamond Trail, New York State Parks contends.

“Trailways like the Black Diamond Trail provide New Yorkers with an affordable and healthy option to explore their communities and enjoy the great outdoors,” New York State Parks Commissioner Pro Tempore Randy Simons said in the announcement. “These improvements make this already-popular trail even better, will benefit hikers, cyclists and skiers, and further strengthen the connection between Taughannock Falls and Ithaca and our communities.”

The $1.4 million State Parks project includes a new 70-vehicle parking lot and year-round public restrooms at the trail’s northern end near the park’s famous 215-foot waterfall, as well as rehabilitation of a historical railroad trestle that serves as the connecting bridge between the park’s North and South rim trails. The restroom building’s design aesthetic echoes a train depot, in keeping with the trail’s railroad history.

The 8.4-mile northern segment of the Black Diamond Trail follows the route of the former Lehigh Valley Railroad and connects Ithaca’s Cass Park and the Allan H. Treman State Marine Park to Taughannock Falls State Park, New York State Parks says. The stone-dust route ranges from mature forests of maple, hemlock, oak, and hickory to views of rustic agricultural lands, and dozens of ravines where cascading waters flow toward Cayuga Lake.

This rail trail is part of the former flagship passenger line of the Lehigh Valley Railroad. Known as the Black Diamond Express, this luxury train passenger service ran from New York City to Buffalo from 1896 until 1959.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.