Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Lyndon E. Hall has joined Bond, Schoeneck & King PLLC as an associate attorney. She joins both the tax and business and transactions practice groups

Finalists in 9th round of Genius NY have more time to prep for pitch night

SYRACUSE — The five finalists in this year’s 9th round of the Genius NY business accelerator will have more time to do their work before making a final pitch for funding. Companies from Utica, Syracuse, Ohio, New Jersey, and Sweden will also be the first Genius NY finalists to work on their products and projects

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE — The five finalists in this year’s 9th round of the Genius NY business accelerator will have more time to do their work before making a final pitch for funding.

Companies from Utica, Syracuse, Ohio, New Jersey, and Sweden will also be the first Genius NY finalists to work on their products and projects inside the new INSPYRE Innovation Hub (the former Tech Garden) in downtown Syracuse.

One of the companies entered the market following years of research at universities that included Syracuse University (SU), per its website.

The chosen finalists will work to build relationships in the region, develop their go-to-market plans, and spend time refining their pitches before presenting to a panel of judges at Innovation Night on May 7, 2026. The move of finals night from the fall to next spring will afford the teams “greater opportunity to become a part of the community,” ESD contended.

The finalist teams will compete for a total of $3 million in direct investment, with one grand prize of up to $1 million and four $500,000 awards. The program is the largest business accelerator for the uncrewed systems and robotics industry in the world.

Genius NY stands for Growing ENtrepreneurs & Innovators in UpState New York.

The finalists were chosen from a “highly competitive” application process that received submissions from startups from around the world, including “record interest” from U.S. companies, Empire State Development (ESD) said in an Aug. 11 announcement.

Supported by the CNY Rising Upstate Revitalization Initiative (URI) and administered by CenterState CEO, Genius NY brings companies to Central New York to participate in the yearlong in-residence accelerator where they receive assistance with product development, business development, as well as networking opportunities with investors and business leaders.

Genius NY participants are required to commit to operating their business in Central New York for at least one year.

“This year’s finalists bring the latest in uncrewed aerial and robotics technology right here to Central New York,” Kara Jones, director of Genius NY, said in the ESD announcement. “Our community’s robust UAS ecosystem, resources and expertise make this region the perfect launching pad for these innovative startups. We’re excited that this year’s teams are further along in their businesses, many with proven traction, active pilots or commercial deployments. These companies are building technologies that solve real-world problems across defense, infrastructure, and public safety. We’re eager to introduce these businesses to the Central New York community and begin offering them the top-of-the-line assets and resources that GENIUS NY is known for as they become the first cohort to operate out of the INSPYRE Innovation Hub.”

Since 2017, Genius NY has invested nearly $24 million in 42 businesses from around the world. In addition, Genius NY companies have raised more than $350 million in follow-on funding and have created hundreds of new jobs in New York state, ESD said.

Finalists

The five selected finalists (listed in alphabetical order with firm descriptions) are the following:

• Flox (Stockholm, Sweden): AI (artificial intelligence) that understands and speaks to wild animals — running on Edge pods, drones, and trains — to steer wildlife away from critical areas, per the ESD announcement.

• Lamarr.AI (Syracuse / Atlanta): Uses drones and AI to inspect building exteriors, delivering faster, more affordable, and more accurate data than traditional methods. Its website says the firm “entered the market in 2023 as the product of more than 6 years of [U.S. Department of Energy]-funded research across MIT, Georgia Tech, and Syracuse University [SU].” The company’s website lists Atlanta as the headquarters but CenterState CEO tells CNYBJ that the company’s founders are living in Syracuse and have worked out of SU.

• Lighthouse Avionics (Ohio): Offers low-cost optical solutions to monitor low-altitude airspace for drone threats, bird strikes, and FAA compliance.

• Modovolo (Utica): A drone company building low-cost, modular aircraft with extended flight times, designed for a wide range of commercial and defense uses.

• Skyfire AI (New Jersey): Deploys autonomous drone swarms and AI to improve response times and situational awareness for first responders and defense teams.

East Oneida Lake wastewater- treatment plant project to continue into fall of 2026

SYLVAN BEACH — The New York State Environmental Facilities Corporation (EFC) expects “substantial” completion of the $51 million construction project to modernize the East Oneida Lake wastewater-treatment plant in the fall of 2026. EFC officials toured the project on June 17, noting at the time that the Village of Sylvan Beach had indicated crews were

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYLVAN BEACH — The New York State Environmental Facilities Corporation (EFC) expects “substantial” completion of the $51 million construction project to modernize the East Oneida Lake wastewater-treatment plant in the fall of 2026.

EFC officials toured the project on June 17, noting at the time that the Village of Sylvan Beach had indicated crews were making “significant progress” on the project. Construction started in May 2024.

Those involved in the tour included Maureen Coleman, president and CEO of EFC, per the June 18 announcement.

The project involves comprehensive upgrades to its 1970s-era facilities, “protecting residents and the environment,” EFC said. More than half of the project is funded by grants from EFC to help reduce the financial impact on local ratepayers, with investments also “delivering good-paying jobs” to the region through the construction phase.

“This is a vital investment in clean water and in the affordability of local water infrastructure,” Coleman said in the EFC announcement. “This project symbolizes Governor Hochul’s unwavering commitment to delivering funding that ensures important projects move forward without placing an unsustainable financial burden on the communities they serve.”

The project involves upgrading an outdated wastewater-treatment system to a more effective process that meets current standards, EFC said. The effort includes building new treatment tanks and equipment; improving how wastewater is handled; and making site-wide repairs and upgrades — like fixing buildings, roads, electrical systems, and backup power — to keep the facility running reliably and efficiently.

The Village of Sylvan Beach is primarily handling work on the project, but its impact spreads far beyond village borders, EFC said. The plant also serves the towns of Sullivan, Lenox, Verona, and Vienna, as well as Verona Beach State Park. Modernizing the plant and its treatment facilities will ensure reliable wastewater services for 8,000 area residents and businesses and improve water quality in Fish Creek and Oneida Lake, per the EFC announcement.

“This project reflects the Village’s deep commitment to protecting our residents, our environment, and our future,” Sylvan Beach Mayor Richard Sullivan said in the EFC announcement. “We set out to build a stronger, modern wastewater system — and thanks to strong partnerships and careful planning, we’re delivering it on time and within budget.”

Timothy H. Doolittle has joined Bond Schoeneck & King PLLC as senior counsel in the property department, focusing on the representation of lenders in commercial

Shane M. McCrohan has joined Bond, Schoeneck & King PLLC as a senior counsel in the trust and estate practice group. He focuses on the

N.Y.’s local sales-tax collections rise nearly 4% in 1st half of 2025

ALBANY — Local government sales-tax collections totaled $11.9 billion in the first six months of 2025, up 3.7 percent (or $423 million) compared to the first half of last year. That’s according to a report that New York State Comptroller Thomas DiNapoli issued on July 30. Year-over-year growth in collections during the first half of

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

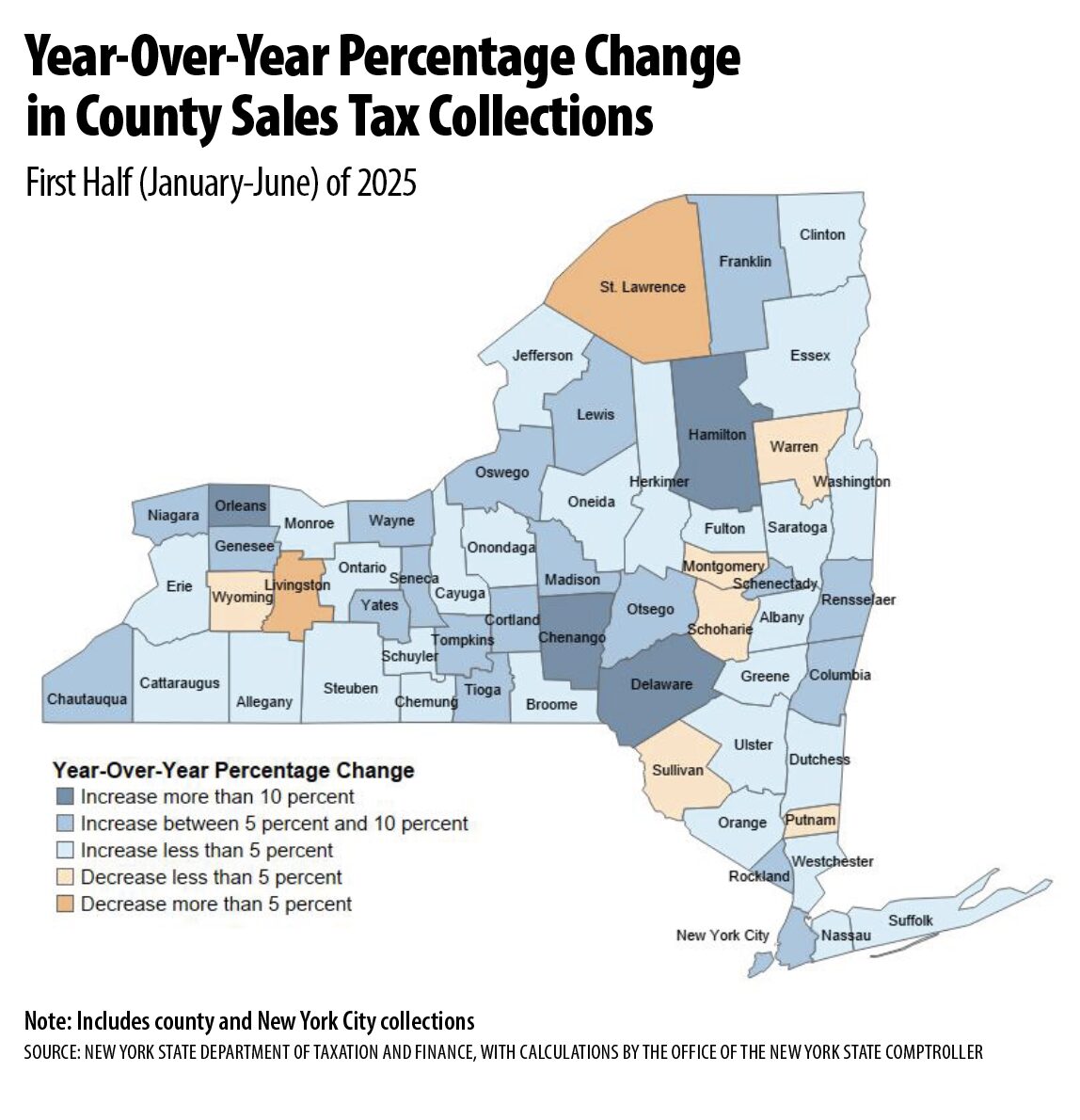

ALBANY — Local government sales-tax collections totaled $11.9 billion in the first six months of 2025, up 3.7 percent (or $423 million) compared to the first half of last year.

That’s according to a report that New York State Comptroller Thomas DiNapoli issued on July 30.

Year-over-year growth in collections during the first half of 2025 almost doubled the 1.9 percent growth in collections in the same period last year and was nearly the same as the average growth rate for the January to June period from 2010-2019 during the recovery and expansion following the Great Recession.

“While New York’s local sales tax collections experienced stronger growth in the first half of 2025, future revenues may become less predictable as local communities weather federal policy changes, inflation and other economic factors,” the comptroller said. “Local officials should continue to take advantage of all the financial tools and guidance my office has to offer to help them strengthen their finances and resiliency amid these uncertain times.”

Report findings

DiNapoli’s report on sales-tax collections in the first half of 2025 found each of the state’s 10 economic-development regions, including New York City, produced a year-over-year increase in first-half collections.

New York City’s sales-tax collections totaled nearly $5.4 billion in the first half of 2025, an increase of 4.7 percent ($242 million), year over year, while aggregate collections for the counties and cities in the rest of the state grew by 2.8 percent ($156 million).

Outside of New York City, regional growth ranged from a low of 1.3 percent (Mohawk Valley) to a high of 4.6 percent (Southern Tier).

The report also found nearly 86 percent of counties experienced a year-over-year increase in first-half collections.

Hamilton County generated the highest growth in the first half at 14.6 percent, followed by the counties of Delaware (12.9 percent), Orleans (12.1 percent) and Chenango (11.7 percent). Several other counties had strong growth, including Oswego (9.1 percent), Schenectady (8.4 percent), and both Franklin and Madison (8 percent).

Among the eight counties that had decreases in first-half collections, St. Lawrence had the steepest decline at -5.7 percent, followed by Livingston (-5.1 percent) and both Sullivan and Schoharie (-2.9 percent).

Nearly 75 percent of cities outside of New York City that impose their own sales tax had growth in the first half. Norwich had the largest increase at 19.3 percent, followed by Salamanca (15.4 percent). Conversely, the cities of Ogdensburg, Johnstown, Glens Falls, Mount Vernon, and Utica each had decreases in collections, ranging from -0.6 percent to -4 percent.

New York home sales slip in July, inventory levels rise

ALBANY — Realtors in New York state sold 10,046 previously owned homes this July, down 2.3 percent from the 10,286 homes they sold in July 2024. At the same time, pending sales dipped slightly in July, foreshadowing a possible decline in closed home sales in the next couple of months. That’s according to the New

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

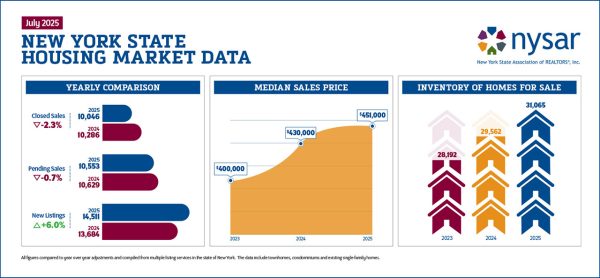

ALBANY — Realtors in New York state sold 10,046 previously owned homes this July, down 2.3 percent from the 10,286 homes they sold in July 2024.

At the same time, pending sales dipped slightly in July, foreshadowing a possible decline in closed home sales in the next couple of months. That’s according to the New York State Association of Realtors (NYSAR) July housing report issued on Aug. 21.

The housing-sales results in the latest month came amid a backdrop of interest rates that have started to drop. NYSAR cites Freddie Mac as indicating rates on a 30-year fixed-rate mortgage dipped from 6.82 percent in June to a monthly average of 6.72 percent in July. That’s also down a bit compared to July 2024, when interest rates averaged 6.84 percent. Freddie Mac is the more common way of referring to the Virginia–based Federal Home Loan Mortgage Corporation.

New York sales data

Statewide housing inventory reached 31,065 units in July, a 5.1 percent increase from July 2024’s total of 29,562 available homes. This marks five straight months of increasing inventory statewide, NYSAR noted. But it comes after several years of compressed inventory.

New listings of existing homes for sale in New York jumped 6 percent to 14,511 this July from 13,684 in the year-ago month.

Pending sales totaled 10,553 in July, off 0.7 percent from the 10,629 pending sales in the same month in 2024, according to the NYSAR data.

Despite the increased housing inventory, prices continued to rise in the state. Median home-sales prices hit a record high of $451,000 in July, up 4.9 percent from the $430,000 price tag in July 2024. This marks the highest monthly median-sales price since statistics have been kept in New York state. The last time NYSAR reported a decrease in median home-sales prices in year-over-year comparisons was July 2023.

All home-sales data is compiled from multiple-listing services in New York, and it includes townhomes and condominiums in addition to existing single-family homes, according to NYSAR.

Business Energy Advisors program in Tompkins County expands to help nonprofits

ITHACA — Tompkins County’s Business Energy Advisors (BEA) program is expanding to provide specialized energy-consulting services for nonprofit organizations. The new initiative adds to the BEA program’s existing services, offering additional support to help nonprofits in existing buildings plan cost-effective energy upgrades, reduce operating costs, and access financial incentives, per the Tompkins County announcement. Tompkins

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ITHACA — Tompkins County’s Business Energy Advisors (BEA) program is expanding to provide specialized energy-consulting services for nonprofit organizations.

ITHACA — Tompkins County’s Business Energy Advisors (BEA) program is expanding to provide specialized energy-consulting services for nonprofit organizations.

The new initiative adds to the BEA program’s existing services, offering additional support to help nonprofits in existing buildings plan cost-effective energy upgrades, reduce operating costs, and access financial incentives, per the Tompkins County announcement.

Tompkins County believes the BEA program has “long been a trusted resource” for commercial businesses, municipalities, manufacturing facilities, and multifamily properties, guiding energy planning for new construction and major renovations.

With the new expansion, nonprofits in Tompkins County can access customized consulting services designed specifically to meet their needs and resource constraints — while the BEA program continues to serve all other sectors as before.

To learn more about the program, visit: https://tcgov.co/bea.

About the nonprofit service

The nonprofit-focused services include two “flexible” consulting options. The first option is an Enhanced BEA – Energy System Design, a full-service offering that includes technical specifications, contractor-bid guidance, and an informed list of energy incentives. This program is “ideal” for nonprofits planning a major renovation and/or heating system upgrade, Tompkins County contended.

The second option is a Heating System Bid Review, a streamlined review of contractor proposals with expert feedback on energy efficiency, cost-effectiveness, and best-fit systems.

“These new services ensure that nonprofits, often operating with limited resources, can make informed decisions that lower energy costs while supporting their mission,” Hailley Delisle, sustainability coordinator for Tompkins County, said in the announcement. “We’re proud to help these vital community organizations become more sustainable.”

Participating nonprofits will benefit from free support from energy consultants; help in identifying grants, rebates, and incentives; and customized energy-system design recommendations. Nonprofit organizations located in Tompkins County with existing buildings are eligible to participate in these new offerings.

Meanwhile, the broader BEA program remains fully available to commercial businesses, multifamily properties, manufacturing facilities, and municipalities considering energy-related construction or renovation. Program participants will benefit from personalized energy goal setting, technical feasibility studies, and comprehensive energy options reports.

Thruway service area employee charged with identity theft, grand larceny

The New York State Police recently arrested a woman employee of a New York State Thruway service area for allegedly running up a tab of more than $1,600 on a credit card left behind by a customer. On the evening of Aug. 11, State Police responded to the Sloatsburg service area in the village of

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The New York State Police recently arrested a woman employee of a New York State Thruway service area for allegedly running up a tab of more than $1,600 on a credit card left behind by a customer.

On the evening of Aug. 11, State Police responded to the Sloatsburg service area in the village of Sloatsburg (Rockland County) for a report of a larceny complaint. On Aug. 12, State Police arrested Raufoliana O. Louis Jean, 28, of Spring Valley, for 4th degree grand larceny (2 counts) and 2nd degree identity theft.

A preliminary investigation revealed that Louis Jean, an employee at the service area, used a credit card left behind by a patron to make purchases without their permission. Further investigation revealed that Louis Jean used the card at several businesses in Spring Valley, and purchased a total of $1,636.18 worth of merchandise.

Louis Jean was transported to the State Police station in Tarrytown for processing and released on an appearance ticket returnable to the Sloatsburg Village Court on Aug. 27.

Bousquet Holstein names two to board of managers

SYRACUSE — Bousquet Holstein PLLC announced on July 1 that attorneys Natalie P. Hempson-Elliott and Julia J. Martin have been elected by its members to serve on the firm’s board of managers. Hempson-Elliott and Martin will replace Philip Bousquet and Joshua Werbeck, who have transitioned off the board, effective July 1. They join the firm’s

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE — Bousquet Holstein PLLC announced on July 1 that attorneys Natalie P. Hempson-Elliott and Julia J. Martin have been elected by its members to serve on the firm’s board of managers.

Hempson-Elliott and Martin will replace Philip Bousquet and Joshua Werbeck, who have transitioned off the board, effective July 1. They join the firm’s other managing members: Laurence G. Bousquet, Cecelia R.S. Cannon, David A. Holstein, Jana M. McDonald, and L. Micha Ordway, Jr.

Hempson-Elliott has more than 15 years of experience advising clients in a broad range of business, commercial real estate, and public-finance transactions. She represents both nonprofit and for-profit organizations in complex development projects, often involving various economic incentives (tax credits), federal and state funding programs, and multifaceted construction and permanent financing.

Martin re-joins the firm’s board of managers after completing a term from 2022-2024. Known for her clear, strategic counsel, Martin advises clients on a wide range of tax and business matters, including corporate income, sales and use, franchise, and personal income taxes. She has extensive experience representing clients before New York State tax authorities in audits and litigation and is a trusted advisor to individuals and businesses seeking effective, purposeful guidance.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.