Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

SU’s Syverud to start Michigan job this summer

SYRACUSE, N.Y. — Syracuse University Chancellor Kent Syverud is in his final months leading the university, and this summer, will begin leading another of the nation’s well-known institutions of higher learning. The University of Michigan on Jan. 12 announced the selection of Syverud as its next president. His five-year term as Michigan’s 16th president will […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE, N.Y. — Syracuse University Chancellor Kent Syverud is in his final months leading the university, and this summer, will begin leading another of the nation’s well-known institutions of higher learning.

The University of Michigan on Jan. 12 announced the selection of Syverud as its next president. His five-year term as Michigan’s 16th president will begin July 1.

Syverud is in his final academic year at Syracuse University, having announced plans to step down in late August 2025. He started his duties leading Syracuse on Jan. 13, 2014.

Syverud earned graduate degrees from Michigan in the early 1980s.

He will replace Michigan’s interim President Domenico Grasso, who has been interim president since May 2025, when former President Santa Ono stepped down in an attempt to become president of the University of Florida.

A graduate of Irondequoit High School near Rochester, Syverud went on to earn a bachelor’s degree from Georgetown University in 1977, a law degree from the University of Michigan in 1981, and a master’s degree in economics from Michigan in 1983.

After graduating from Michigan, Syverud spent several years practicing law in the public and private sectors, including clerking for the late U.S. Supreme Court Justice Sandra Day O’Connor shortly after she became the first woman named to the U.S. Supreme Court bench.

During his tenure on the Hill, Syracuse University had record applications and enrollment. He also enabled Syracuse to play a central role in Central New York’s economic resurgence by helping attract global semiconductor chip manufacturer Micron Technology Inc. (NASDAQ: MU) to build its largest American fabrication facility in the region with plans to invest more than $100 billion over the next 20 years.

Syracuse University also became the “best private university for veterans,” with enrollment of veterans and military-connected families more than tripling since 2014, per the Michigan announcement.

Syracuse University’s endowment also more than doubled to over $2 billion in 2025 and the university raised more than $1.59 billion through the Forever Orange campaign, the largest fundraising effort in the school’s history. The campaign came to a successful close in December 2024.

Syverud currently serves on the boards of the Crouse Health System, the Dormitory Authority of the State of New York, Le Moyne College, the SUNY College of Environmental Science and Forestry, and the Presidents Advisory Council of the Voice of Intercollegiate Esports.

In 2016, he completed six years of service as one of two trustees of the Deepwater Horizon Oil Spill Trust, the $20 billion fund created by BP and the White House to manage claims related to the Gulf Oil Spill.

Hochul proposes measures to bring down auto-insurance rates

ALBANY, N.Y. — Gov. Kathy Hochul used her Jan. 13 State of the State address to announce a series of reforms to bring down auto-insurance rates and take action against “bad actors” whose fraudulent claims drive up costs. The new proposals include a “whole-of-government approach” to crack down on auto-insurance fraud. New Yorkers pay some

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ALBANY, N.Y. — Gov. Kathy Hochul used her Jan. 13 State of the State address to announce a series of reforms to bring down auto-insurance rates and take action against “bad actors” whose fraudulent claims drive up costs.

The new proposals include a “whole-of-government approach” to crack down on auto-insurance fraud.

New Yorkers pay some of the highest car insurance rates in the nation — totaling just over $4,000 annually on average, nearly $1,500 above the national average, Hochul’s office said. It went on to say that car-insurance rates are driven up by a combination of fraud, litigation, legal loopholes, and enforcement gaps, with staged crashes and associated insurance fraud inflating everyone’s premiums by as much as $300 per year on average, according to some estimates.

Cracking down on fraud

The governor wants to “reinvigorate” the state’s Motor Vehicle Theft and Insurance Fraud Prevention Board, empowering it to redouble its efforts toward investigating and prosecuting insurance fraud across the state.

This would include directly tasking the New York State Department of Financial Services (DFS), the New York State Department of Motor Vehicles, New York State Division of Criminal Justice, the New York State Police (NYSP) with a more “proactive and coordinated” approach to enforcement. That would include dedicated resources and staff at both DFS and NYSP focused on auto insurance, and ensuring coordination in law-enforcement response.

As the state investigates and builds cases against scammers and fraudsters, her office says the governor will ensure her agencies are partnering with prosecutors statewide to ensure crimes are not going unpunished. To equip prosecutors with the tools they need to shut down organized crime rings, Hochul will offer legislation to ensure prosecutors can seek criminal penalties against any individual responsible for organizing a staged accident, not just the particular individual behind the wheel.

Working with district attorneys across New York, the state says it will seek to help build cases that put an end to the organized fraud that’s “robbing” New Yorkers via elevated insurance rates.

The governor also plans to advance additional efforts to take on medical providers who participate in fraud by signing off on phony medical diagnoses that result in “enormous” payouts, “increasing the probability” that these white-collar crimes will lead to “temporary or permanent loss of licensure” for the providers who commit them.

State agencies will also seek to take action when New York drivers illegally register their vehicles in other states, which artificially decreases their coverage and raises costs for law-abiding New York drivers.

Strengthening insurer anti-fraud programs

Insurance companies must play a central role in tackling fraudulent behavior that targets their policyholders, Hochul’s office said. However, current law handcuffs insurers’ ability to protect their law-abiding customers against fraud and abuse by capping the time they have to identify, investigate, and report instances of fraud to just 30 days.

To ensure fraud is identified and punished, Hochul plans to increase the timeframe insurers have to report fraud and reduce barriers to alleging fraud in court, giving insurers more time to investigate claims and avoid paying fraudulent ones.

Her office went on to say that legislation will balance increased flexibility to crack down on fraud with the need to preserve crucial consumer protections, such as allowing policy-holders to collect 2 percent interest on any payment insurers hold back as an incentive to ensure insurers continue to move quickly on evaluating genuine claims.

Limiting damages for bad behavior in an accident

When drivers are involved unlawful behavior at the time of an incident, they shouldn’t be able to win sizable insurance payouts, Hochul’s office said. However, current law permits people committing crimes, including impaired driving, to receive generous payouts — including for pain and suffering and emotional distress — which are paid from the premiums contributed by law-abiding drivers.

Hochul wants to cap the payout on these types of non-economic damages for drivers engaging in criminal behavior at the time of the incident. Specific crimes that would warrant the capping of damages include uninsured motorists, who have violated state financial responsibility laws, contributing to additional cost in the insurance market.

They would also include people convicted of driving while impaired at the time of the incident; and individuals committing a felony (or fleeing one) at the time of an incident.

Limiting damages for those “mostly” at fault in causing accident

New York is in a minority of states that allow drivers that are deemed “mostly” at fault in an accident to still collect extensive damages, including non-economic damages. This means that in New York, even the driver deemed mostly at fault for an accident can walk away with a sizable payout for that accident.

Most states — including Colorado, Connecticut, Delaware, Massachusetts and New Jersey — however, have rules which only permit recovery of damages if a plaintiff is not primarily at fault for the accident. Hochul plans to seek changes to New York’s laws that will limit the non-economic damages a driver can obtain if they are mostly at fault for an accident, introducing a measure of accountability for who is compensated by insurance after an incident.

Tightening the serious injury threshold

New York’s no-fault insurance law allows for people injured in an auto accident to make claims for compensation that stretches beyond reimbursement for the medical expenses or lost wages associated with an injury.

The additional compensation is intended to offer support for the pain and suffering of victims with serious injuries. The “serious injury” threshold is intended to screen out minor injuries from personal-injury litigation in keeping with the original intent of the no-fault law to reserve litigation only for auto accidents causing serious harm.

However, New York’s legal definition of serious injury is “vague, applied inconsistently, and can include temporary injuries that only sideline an individual for a short time following an accident rather than the more significant injuries that would merit further payouts,” per Hochul’s office.

Without a “fair and firm” definition of serious injuries, individuals without significant harms may try to “game the system” to win astronomically high “jackpot” awards from courts associated with these harms — raising rates for everyone else.

Hochul wants to reform the serious-injury threshold by proposing “objective and fair” medical standards for what actually qualifies as a serious injury. This will create “clear and objective” criteria for what constitutes a serious injury; avoid unnecessary and expensive litigation; and will help stop instances where individuals are attempting to exploit a system to attempt to win payouts that are not aligned with the severity of their injuries and push everyone else’s rates up, the governor’s office said.

Insurance agents’ group response

Kelly Gonyo, chair of the board of Big I New York, on Jan. 13 issued the following statement in response to New York Gov. Kathy Hochul’s State of the State address:

“Big I New York welcomes the attention Governor Kathy Hochul is giving to the impact of high auto, home, and liability insurance costs on New York families and businesses. Affordable and accessible property and casualty insurance is foundational to enabling New Yorkers to own cars, purchase homes, secure affordable housing, and protect their livelihoods.

Safe and affordable transportation is essential for working families — to get their children to school, buy groceries, and get to work — and for commerce to flow along New York’s roadways.

It is deeply frustrating to see fraudsters exploit a system intended to help people recover after an accident through legitimate medical care and vehicle repair. Even more alarming is the reckless staging of accidents on our highways, putting innocent New Yorkers in harm’s way purely for profit.”

Big I New York says it has represented the common business interests of independent insurance agents since 1882. More than 1,450 agencies and their 13,000-plus employees currently rely on the DeWitt, New York–based not-for-profit trade association for legislative advocacy, continuing education and other means of industry support.

NYS Insurance Fund offers SUNY students paid internships

ALBANY, N.Y. — The New York State Insurance Fund (NYSIF) is offering SUNY students paid internships. Through the partnership, NYSIF will provide 100 SUNY students with a paid internship at NYSIF offices throughout New York state beginning this year, SUNY Chancellor John King, Jr. announced Dec. 23. NYSIF is the largest workers’-compensation insurer in New

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ALBANY, N.Y. — The New York State Insurance Fund (NYSIF) is offering SUNY students paid internships.

Through the partnership, NYSIF will provide 100 SUNY students with a paid internship at NYSIF offices throughout New York state beginning this year, SUNY Chancellor John King, Jr. announced Dec. 23.

NYSIF is the largest workers’-compensation insurer in New York state and among the 10 largest nationwide, per the description in the SUNY announcement. NYSIF covers 2 million workers and insures nearly 200,000 employers in statewide.

NYSIF’s mission is to guarantee the availability of workers’ compensation, disability insurance, and paid family leave at the lowest possible cost to New York employers while maintaining a solvent fund.

“Internship experiences are important drivers of upward mobility and success for all students,” King contended. “Through this partnership with NYSIF, SUNY students will have the opportunity to build vital real-world skills while also exploring a career path that interests them. We are proud to work with NYSIF to provide our students with high-quality internship opportunities that will lead them to a successful future.”

The partnership between SUNY and NYSIF builds on SUNY’s goal for every student to participate in an internship or experiential learning opportunity by the time they graduate. Since its inception in 2023, NYSIF’s internship program has hosted 46 SUNY interns, and 11 SUNY graduates have joined NYSIF in permanent, full-time jobs.

The partnership between SUNY and NYSIF will double the number of students hosted at the fund and provide students with opportunities to learn in a business setting. Students who participate in the internship program will work across NYSIF divisions including administration, claims, division of confidential investigations, finance, investments, office of general counsel, premium audit, marketing and communications, and underwriting.

“At NYSIF, we are seeking the best and brightest within New York State to help us achieve our mission,” Gaurav Vasisht, executive director and CEO of the New York State Insurance Fund, said. “Becoming a NYSIF team member provides students with an excellent opportunity to work on interdisciplinary teams throughout our organization where they will be immersed in strategic business operations and have an opportunity to solve real-world business challenges as well as develop innovative products and business solutions.”

SUNY says it has worked to expand internship opportunities through the launch of programs that include the SUNY Educational Opportunity Career Development Internship program; the Chancellor’s Summer Research Excellence Fund; the SUNY Institute for Local News; the Veterans Enrollment and Support internship program; and the SUNY Climate Corps.

With state-government investment, the SUNY board of trustees now provides $14.5 million in annual state funding to support paid internships for students at state-operated campuses, per the announcement.

Graduate students recognized in SUNY Poly white-coat ceremony

MARCY, N.Y. — A total of 88 graduate students at SUNY Polytechnic Institute (SUNY Poly) participated in a Jan. 9 white-coat ceremony following their work in the school’s family nurse practitioner and psychiatric mental health nurse practitioner programs. The ceremony marked the completion of the instructional portion of the students’ programs and the beginning of

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

MARCY, N.Y. — A total of 88 graduate students at SUNY Polytechnic Institute (SUNY Poly) participated in a Jan. 9 white-coat ceremony following their work in the school’s family nurse practitioner and psychiatric mental health nurse practitioner programs.

The ceremony marked the completion of the instructional portion of the students’ programs and the beginning of their clinical practice.

The white-coat ceremony “serves as a rite of passage” in health-care education, “emphasizing the importance of compassion, professionalism, and ethical responsibility alongside clinical excellence,” per the SUNY Poly announcement.

SUNY Poly President Winston Soboyejo addressed the students, their families, and ceremony attendees. Following his remarks, students donned their white coats and collectively recited the nurses’ oath, “publicly affirming their commitment to patient-centered care,” the school said.

“The White Coat Ceremony marks an important beginning for our students and a powerful commitment to the values that define healthcare,” Soboyejo said in the announcement. “From the very start of their training, they affirm that compassion and humanism are essential to nursing excellence. As they take their oath and don the white coat, they accept a profound responsibility to care for patients with skill, empathy, and integrity. This ceremony reminds us that the white coat is not a symbol of status, but of service, trust, and accountability to the communities we serve.”

The white-coat ceremony tradition “highlights the importance of humanism” in health-care education and to reinforce the ethical obligations of those entering the profession, SUNY Poly noted. At SUNY Poly, the ceremony reflects the institution’s commitment to preparing healthcare professionals who lead with both expertise and empathy.

New United Way of CNY leader to start duties in February

SYRACUSE, N.Y. — The woman who has been leading the Friends of the Rosamond Gifford Zoo is set to be the next leader of the United Way of Central New York. The local United Way’s board of directors has appointed Carrie Large as the organization’s new president and CEO, effective on Monday, Feb. 2. Described

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE, N.Y. — The woman who has been leading the Friends of the Rosamond Gifford Zoo is set to be the next leader of the United Way of Central New York.

The local United Way’s board of directors has appointed Carrie Large as the organization’s new president and CEO, effective on Monday, Feb. 2.

Described as a “seasoned nonprofit leader with a deep commitment” to the Central New York community, Large will succeed Nancy Kern Eaton, who retired on Dec. 31 after a distinguished career of service, the United Way said.

“After an extensive and rigorous search, it became clear that Carrie Large is the visionary leader we need to shepherd United Way of Central New York,” Kerry Tarolli, who chairs the United Way of Central New York board of directors, said in the announcement. “Carrie’s proven track record of operational excellence and her authentic passion for our community make her uniquely qualified to address the evolving needs of our neighbors.”

During her time with the zoo, Large was “instrumental in driving strategic growth, enhancing community engagement, and stewarding the organization through vital capital improvements.” Prior to her work at the zoo, Large spent nearly two decades in leadership roles at ACR Health, where she focused on operational management, fundraising, and community advocacy.

Large holds a degree from SUNY Brockport and has been a resident of the Syracuse area for over 20 years.

“I am incredibly honored to join United Way of Central New York, an organization that stands at the very heart of our community’s support system,” Large said. “Having spent my career working within the local nonprofit landscape, I have seen firsthand the transformative power of collaboration. I look forward to working alongside our dedicated staff, volunteers, and partners to build a Central New York where every individual has the opportunity to thrive.”

About the United Way of CNY

The United Way of Central New York, which has operated for more than a century, works across sectors by bringing together individuals, nonprofits, businesses, and government partners to solve complex challenges and create lasting solutions.

To meet evolving needs, it funds high-impact programs, coordinates partnerships, convenes stakeholders, delivers direct services, engages volunteers, and uses data to “drive collective impact,” per its announcement.

United Way efforts focus on four key areas: youth opportunity, healthy community, financial security, and community resiliency. Working together with our donors, partners, and the people it serves, the organization says it is “building a Central New York where everyone has the opportunity to thrive.”

GROW Wealth Partners adds two financial advisors from the Rochester area

PHOENIX, N.Y. — GROW Wealth Partners — an advisory and wealth-management firm with offices in Phoenix, Watertown, and Potsdam — has brought aboard two Rochester–area financial advisors in a merger. Richard Anderson, of Anderson & Associates, and James Farley, of Farley Financial, are merging their operations with GROW Wealth Partners. Both Anderson and Farley are

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

PHOENIX, N.Y. — GROW Wealth Partners — an advisory and wealth-management firm with offices in Phoenix, Watertown, and Potsdam — has brought aboard two Rochester–area financial advisors in a merger.

Richard Anderson, of Anderson & Associates, and James Farley, of Farley Financial, are merging their operations with GROW Wealth Partners. Both Anderson and Farley are based in Pittsford, a Rochester suburb.

GROW Wealth Partners sees the merger as “strengthening its advisory capabilities and expanding its footprint across key U.S. markets,” per the Jan. 7 announcement.

Under the new agreement, Anderson and Farley will join the GROW team, bringing their experience and resources to enhance the firm’s offerings in personalized wealth management, retirement and income-distribution planning, business planning, and long-term financial strategies.

Besides its offices in Phoenix, Watertown, and Potsdam, GROW Wealth Partners also serves clients in Longmont, Colorado. With this merger, GROW will now have an additional office in Pittsford in Monroe County.

“Joining forces with GROW Wealth Partners is a natural extension of the way we’ve always served our clients,” Anderson said. “This merger allows us to bring even more resources, planning depth, and collaboration to the table while preserving the personal relationships and trust we’ve built with our clients over the years. Our clients will gain a larger, highly coordinated team working on their behalf, with the same values, the same commitment and an even stronger foundation for their financial future.”

“This merger marks a pivotal moment for GROW Wealth Partners,” Trevor Garlock, co-founder of GROW Wealth Partners, added in the announcement. “By joining forces with Richard Anderson and James Farley, we combine decades of collective experience and a shared commitment to helping clients achieve long-term financial security and peace of mind. Our expanded team and geographic reach will allow us to better serve families, business owners and individuals across multiple states with the same deeply personalized service that has defined GROW from day one.”

GROW Wealth Partners is a full-service wealth-management firm partnered with Northwestern Mutual’s (NM) Private Client Group, delivering financial planning, retirement-distribution planning, and wealth-management solutions.

The firm notes that members of GROW Wealth Partners use GROW Wealth Partners as a marketing name for doing-business-as representatives of Northwestern Mutual. Northwestern Mutual Private Client Group is a select group of NM advisors and representatives.

New York State’s minimum wage rises 50 cents per hour

ALBANY, N.Y. — New York’s minimum wage rose 50 cents per hour in all regions of the state to begin 2026, marking the third straight year of increases of the same amount. The minimum wage rose to $17 per hour in New York City, Westchester, and Long Island from $16.50 last year, while the rest

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ALBANY, N.Y. — New York’s minimum wage rose 50 cents per hour in all regions of the state to begin 2026, marking the third straight year of increases of the same amount.

The minimum wage rose to $17 per hour in New York City, Westchester, and Long Island from $16.50 last year, while the rest of the state had an increase to $16 per hour from $15.50 the prior year.

This rise of 50 cents per hour is the last of a series of three annual increases of that amount as the minimum wage also went up by half a dollar an hour in both 2024 and 2025, Gov. Kathy Hochul announced.

Starting in 2027, the minimum wage will increase annually at a rate determined by the consumer price index for urban wage earners and clerical workers (CPI-W) for the Northeast region — described by the governor’s office as the “most accurate regional measure of inflation.”

A 3 percent rise in CPI-W would result in a 2027 increase of 51 cents per hour in the minimum wage in New York City, Westchester, and Long Island and a rise of 48 cents an hour in the rest of the state. If CPI-W rose 2 percent, the minimum-wage increases in 2027 would be 34 cents and 32 cents, respectively.

“Increasing the minimum wage is yet another way Governor Kathy Hochul is making New York a more affordable place to live, work, and raise a family,” Roberta Reardon, commissioner of the New York State Department of Labor, said in the Dec. 22 announcement. “With costs rising, this increase is crucial for workers looking to make ends meet.”

Employees can visit the New York State Department of Labor’s minimum wage webpage for more information, including an interactive Minimum Wage Lookup Tool to verify their correct pay rate.

EBRI presents Lifetime Achievement Award to two benefits-industry leaders

The Employee Benefit Research Institute (EBRI) has recognized two benefits-industry leaders for devoting their careers to “preserving, protecting and enhancing” retirement security and health benefits. The Washington, D.C.–based EBRI has honored Mathew Greenwald, founder & managing director of Greenwald Research, and James Klein, senior advisor with the American Benefits Council, with its 2025 Lifetime Achievement

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The Employee Benefit Research Institute (EBRI) has recognized two benefits-industry leaders for devoting their careers to “preserving, protecting and enhancing” retirement security and health benefits.

The Washington, D.C.–based EBRI has honored Mathew Greenwald, founder & managing director of Greenwald Research, and James Klein, senior advisor with the American Benefits Council, with its 2025 Lifetime Achievement Award.

“For close to four decades, Matt and Jim’s work shaped how American workers prepare for and navigate their healthcare and retirement and both have left an enduring mark on our industry,” Barb Marder, president & CEO of EBRI, said in the Dec. 22 announcement. “I feel fortunate to have worked with Matt and Jim during my tenure at EBRI. They have established themselves as true industry leaders and well deserving of the EBRI Lifetime Achievement Award.”

Both organizations are based in Washington, D.C.

About the recipients

Mathew Greenwald is founder & managing director, strategic initiatives, at Greenwald Research. Greenwald founded the company in 1985 and is a recognized retirement research expert with more than 40 years of experience, EBRI said.

He is an inductee in the Insured Retirement Institute’s Hall of Fame and has a Ph.D. in sociology from Rutgers University.

“It is especially meaningful to get this award from EBRI, an organization that I believe shares Greenwald Research’s strong motivation to help companies in the employee benefits area and also contribute to enhancing the retirement security of Americans,” Greenwald said. “I’ve dedicated my career to research on financial security before and in retirement. Being recognized by our long-time partner EBRI for my work is a great honor.”

James Klein is senior advisor to the American Benefits Council. Klein has been with the council for more than 37 years, including 33 years as president.

Prior to joining the council, Klein was a practicing ERISA attorney and later manager of pension & health-care policy at the U.S. Chamber of Commerce.

“Because the Employee Benefit Research Institute is held in the highest esteem by the entire employee benefits community, recognition by EBRI is an exceptional honor,” Klein said. “I gratefully accept this award not only on my own behalf, but also in recognition of the extraordinary accomplishments of my colleagues on the American Benefits Council staff, and the support and guidance from our member companies. Throughout my career I have relied on the unsurpassed credibility of EBRI research and data to inform my work.”

The annual EBRI Lifetime Achievement Award is the successor to the EBRI Ray Lillywhite Award, which previously honored leaders in the employee-benefits community, including U.S. Senators Rob Portman and Ben Cardin and Nobel laureate William Sharpe, professor emeritus at the Stanford University Graduate School of Business.

The EBRI is a nonprofit, independent, and unbiased resource organization that provides the “most authoritative and objective” information about critical issues relating to employee-benefit programs in the U.S.

Upstate Medical University establishes Saktipada Mookherjee, MD, Endowed Professorship in Cardiology

SYRACUSE, N.Y. — Upstate Medical University and the Upstate Foundation recently announced the establishment of the Saktipada Mookherjee, MD, Endowed Professorship in Cardiology, which will support excellence in clinical care, education, mentorship, research, and innovation within its Division of Cardiology. The announcement was made by Eileen Pezzi, VP for development at Upstate; Lawrence Chin, MD,

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE, N.Y. — Upstate Medical University and the Upstate Foundation recently announced the establishment of the Saktipada Mookherjee, MD, Endowed Professorship in Cardiology, which will support excellence in clinical care, education, mentorship, research, and innovation within its Division of Cardiology.

The announcement was made by Eileen Pezzi, VP for development at Upstate; Lawrence Chin, MD, dean of the Alan and Marlene Norton College of Medicine; and Cynthia Taub, MD, chair of the Department of Medicine and the Edward C. Reifenstein Endowed Professor of Medicine.

The endowed professorship honors the career and legacy of Mookherjee, professor of medicine in the Division of Cardiology, who has served the Upstate community since 1969. He continues to mentor fellows and treat patients weekly, reflecting his long-standing commitment to medicine, teaching and compassionate care, according to a Jan. 7 release on the Upstate Medical University website. The medical school noted that it will soon name a faculty member to hold the professorship.

“Dr. Mookherjee represents the very best of Upstate, an educator, clinician and mentor whose impact spans generations,” Pezzi said. “Through this endowed professorship, we are ensuring that his passion for excellence in patient care and medical education continues to shape the future of cardiology at Upstate.”

Chin emphasized the significance of the professorship and the legacy it recognizes. “Dr. Mookherjee has dedicated his life to advancing cardiovascular care and training physicians who serve across the region and beyond,” Chin said in the release. “This endowed professorship will help sustain his legacy of excellence and support the growth of our cardiology program for years to come.”

Upstate President Mantosh Dewan, MD, SUNY Distinguished Service Professor and the Alan and Marlene Norton Presidential Chair, reflected on the honor with deep appreciation for Mookherjee’s influence.

“Dr. Mookherjee’s devotion to his patients and trainees has been nothing short of extraordinary,” Dewan said. “His wisdom, humility and unwavering presence have enriched our institution for decades. To see his name attached to an endowed professorship is deeply fitting and a tribute to the countless lives he has touched through his example.”

The Division of Cardiology at Upstate is the region’s only academic cardiology program and continues to expand its clinical, educational and research missions, the release stated. The establishment of the endowed professorship will enhance its ability to deliver innovative, high-quality cardiovascular care and training.

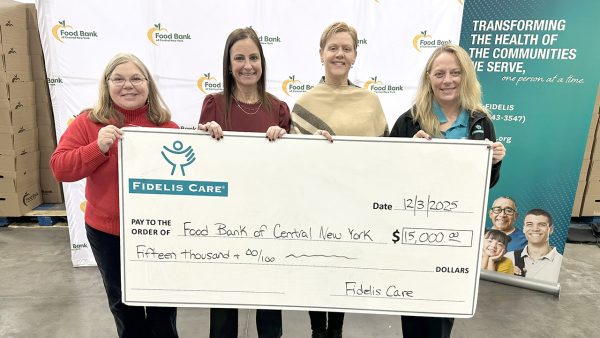

Fidelis Care presents $15,000 food security grant to Food Bank of Central New York

VAN BUREN, N.Y. — Fidelis Care, a statewide health plan with more than 2.4 million members in New York state and a Centene Corporation company, on Dec. 3 presented a $15,000 Here for Your Health food security grant to Food Bank of Central New York in the town of Van Buren. This grant is one

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

VAN BUREN, N.Y. — Fidelis Care, a statewide health plan with more than 2.4 million members in New York state and a Centene Corporation company, on Dec. 3 presented a $15,000 Here for Your Health food security grant to Food Bank of Central New York in the town of Van Buren.

This grant is one of 10 totaling $130,000 awarded to providers and community-based organizations that support innovative food security and Food Is Medicine practices in communities across New York state, according to a Fidelis Care announcement.

Food Bank of Central New York is leading the effort to eliminate hunger in the region, in partnership with others in the community, through education, advocacy, and distribution of nutritious food. Food Bank CNY supplies food to more than 500 community programs in 11 counties of New York state, distributing more than 22,500,000 pounds in 2024.

The Fidelis Care grant supports a partnership with Upstate University Hospital to address chronic disease management through access to nutritious food for patients experiencing food insecurity. Funding will be used toward monthly distributions of fresh fruits and vegetables, the announcement stated.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.