Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

YMCA of the Greater Tri-Valley credits membership growth to ongoing facility improvements

ROME, N.Y. — The YMCA of the Greater Tri-Valley says more than 500 new members have joined the organization since Dec. 1. The growth follows

Coughlin & Gerhart re-elects Abbott as managing partner

BINGHAMTON, N.Y. — Coughlin & Gerhart, LLP announced it has re-elected Rachel Abbott as its managing partner. Originally elected in 2022, Abbott has been instrumental

Micron breaks ground on work to construct semiconductor-manufacturing campus in Clay

CLAY, N.Y. — Micron Technology, Inc. (Nasdaq: MU) on Friday broke ground on work to construct its upcoming $100 billion semiconductor-manufacturing campus in the town

Bassett Healthcare Network concludes 2025 with ‘significant projected financial improvements’

COOPERSTOWN, N.Y. — Bassett Healthcare Network recently announced that its operational performance has “significantly improved” with a projected positive margin for the fiscal year ending on Dec. 31, 2025. The health-care organization, based in Cooperstown, sees it as a “remarkable turnaround” when “put in context of recent fiscal years,” per its announcement. In 2023, the

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

COOPERSTOWN, N.Y. — Bassett Healthcare Network recently announced that its operational performance has “significantly improved” with a projected positive margin for the fiscal year ending on Dec. 31, 2025.

The health-care organization, based in Cooperstown, sees it as a “remarkable turnaround” when “put in context of recent fiscal years,” per its announcement. In 2023, the organization had a negative margin of about $60 million and in 2024, a negative margin of about $55 million.

Staci Thompson, president & CEO of Bassett Healthcare Network, says the financial turnaround is due to initiatives launched in 2024 to stabilize the organization’s financial performance and operations.

“I am so proud of the hard work of so many here at Bassett who have made these improvements possible. That includes literally thousands of people – practitioners, clinical chiefs, staff of every description, and the executive leadership team. It’s been quite a feat, and it wasn’t easy,” Thompson said in the announcement. “While we know Bassett, like all rural healthcare systems around the country, will continue to face challenges, we are developing the fiscal discipline and operational strategies to navigate these changes as needed.”

Dr. Henry Weil, chief clinical and academic officer of Bassett Healthcare Network and president of Bassett Medical Center, has worked for Bassett for 40 years and credits Thompson’s work.

Weil went on to say that the public may have an “outdated perception” of Bassett.

“It is understandable that, looking at 2023 and 2024 financial numbers, the communities we serve may feel anxious about Bassett’s financial health,” Weil said. “But our patients and communities should be relieved to know that current year-end financial information paints a very different story – that of a plainly stable organization successfully navigating what elsewhere is a deepening crisis in rural care. Thankfully, Staci’s and my concerns are now less about finances and more about ease of access to care for our communities of patients.”

Bassett is “building on the positive momentum” of the turnaround work of 2024 and 2025 by launching a 2026-2028 strategic plan that focuses on growth and access, quality and care innovations, and recruitment and retention.

“These three pillars of our three-year strategic plan will continue to propel us forward with the positive momentum we’ve been building,” Thompson said. “We are excited for the future and want to assure our patients and communities that Bassett Healthcare Network is here to provide the excellent care and services they have come to depend on.”

Herkimer County HealthNet survey seeks input on local health assets and needs

HERKIMER, N.Y. — Herkimer County HealthNet, in partnership with Bassett Medical Center Research Institute, is calling on residents of Herkimer and Dolgeville to participate in

Delta changes course, will continue Binghamton flights

MAINE, N.Y. — Delta Air Lines now says flights will continue at the Greater Binghamton Airport (BGM) in the town of Maine, after previously planning to end them. That’s according to Jan. 9 statements from both Gov. Kathy Hochul and Broome County Executive Jason Garnar. The Atlanta, Georgia–based airline on Dec. 30 had announced plans

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

MAINE, N.Y. — Delta Air Lines now says flights will continue at the Greater Binghamton Airport (BGM) in the town of Maine, after previously planning to end them.

That’s according to Jan. 9 statements from both Gov. Kathy Hochul and Broome County Executive Jason Garnar. The Atlanta, Georgia–based airline on Dec. 30 had announced plans to eliminate air service at the Broome County facility.

“I am pleased that Delta has identified available aircraft in order to resume daily service at BGM in the Spring. Preserving this flight is a win for the entire Southern Tier, ensuring that this newly modernized airport serves travelers for years to come and that is why I fought so hard to protect this lifeline for workers and businesses in the Binghamton area,” Hochul said.

In a separate statement, Garnar said Broome County is “grateful” to the governor for “stepping up” getting the Delta Air Lines service restored at the airport in the town of Maine.

“This is a big win for our neighbors, our businesses, and everyone who depends on reliable air travel. Governor Hochul has been a true friend to Broome County and the entire Southern Tier, always listening and always delivering when it matters,” Garnar contended. “We also thank Senator Schumer for his leadership and all the folks in our community who rallied together to make this happen. And we’re especially thankful to Delta for believing in our region and bringing this important service back to Broome County. We’re going to keep working hard every single day to bring even more air service home.”

Delta is the only commercial airline operating at the Binghamton airport, per a separate statement from U.S. Senate Minority Leader Charles Schumer (D–N.Y.).

“When I first heard Delta was planning to end service at the Greater Binghamton Airport, I made it clear that this decision to permanently end service at Greater Binghamton Airport would leave thousands of New Yorkers across the region without access to air service and urged them to reconsider,” Schumer said. “I’m thrilled that Delta has heeded the call to reverse course and resume daily service at Binghamton in the spring. I have been proud to deliver millions in federal funding to improve passenger experience and safety at the Greater Binghamton Airport and will always fight to protect vital services that help the Southern Tier reach new heights.”

It was back on Dec. 30 when Mark Heefner, the Greater Binghamton Airport’s commissioner of aviation, issued a statement reacting to Delta Air Lines announcement that it planned to cease operations at the Binghamton airport on Feb. 14.

NYS awards millions to Syracuse housing projects

SYRACUSE, N.Y. — Two Syracuse housing projects — in the East Adams neighborhood and at the site of the former Syracuse Developmental Center on the city’s west side — will get built with millions of dollars from New York State. Phases 1 and 2 of the East Adams neighborhood project was awarded $172 million, and

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE, N.Y. — Two Syracuse housing projects — in the East Adams neighborhood and at the site of the former Syracuse Developmental Center on the city’s west side — will get built with millions of dollars from New York State.

Phases 1 and 2 of the East Adams neighborhood project was awarded $172 million, and the Jensen Avenue Apartments will get $99 million, the office of Gov. Kathy Hochul announced on Dec. 29.

The awards are part of nearly $2 billion in housing bonds and subsidies for 24 housing developments located in communities across New York state that will create or preserve more than 6,600 “affordable, supportive, sustainable, and modern homes,” per the governor’s announcement.

Financing is allocated through New York State Homes and Community Renewal’s recent bond issuances, which provided $865 million in housing bonds and $990 million in subsidy.

Project details

The first and second phases of a multi-phase redevelopment of the East Adams neighborhood will create 257 apartments. The units in these two phases will be affordable to households earning up to 60 percent of the area median income.

St. Louis, Missouri–based McCormack Baron Salazar will handle the multi-phase redevelopment of the East Adams neighborhood that will create about 1,500 homes, Hochul’s office said.

Crews will build the Jensen Avenue Apartments development on the site of the former Syracuse Developmental Center, a formerly state-owned psychiatric hospital that is now vacant. The first phase of a three-phase development includes affordable and market-rate rental units, as well as homeowner-occupied townhomes. The 261 apartments in this phase will be affordable to households earning up to 80 percent of the area median income.

Albanese Development Corp. of Garden City in Nassau County is the project developer.

All awarded projects will “achieve high levels of sustainability and carbon reduction, complementing New York’s mission to address climate change by decreasing emissions by 85 percent by 2050 across all sectors,” the governor’s office contended.

When coupled with additional private funding and resources, the projects receiving state funding are expected to generate $3.5 billion in overall investment, it added.

MVHS sets deadline for interest in redeveloping former St. Elizabeth campus

UTICA, N.Y. — Qualified developers interested in redeveloping the former St. Elizabeth Medical Center (SEMC) in Utica have some upcoming dates they need to keep in mind. Mohawk Valley Health System (MVHS) has issued a request for expressions of interest (RFEI) for the project. The health system says the question deadline is Jan. 19, and

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

UTICA, N.Y. — Qualified developers interested in redeveloping the former St. Elizabeth Medical Center (SEMC) in Utica have some upcoming dates they need to keep in mind.

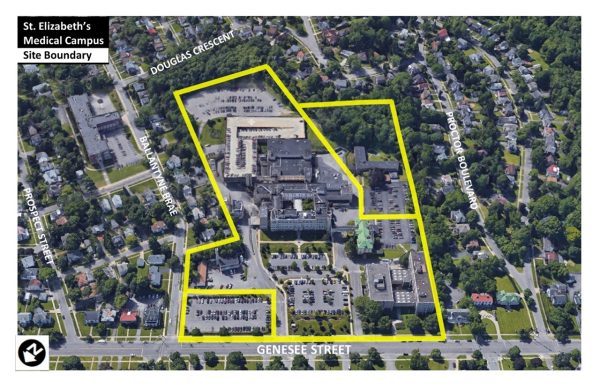

Mohawk Valley Health System (MVHS) has issued a request for expressions of interest (RFEI) for the project. The health system says the question deadline is Jan. 19, and the proposal-submission deadline is Feb. 2. The SEMC campus is a 21.3-acre site located on Genesee Street in Utica.

Following submission, selected respondents will be invited to participate in interviews and site tours, with developer selection anticipated later in 2026.

“The RFEI marks a major milestone in the long-planned transformation of the former hospital campus and builds upon extensive community engagement, planning and environmental review,” MVHS said in a Dec. 22 announcement.

The redevelopment vision calls for a predominantly residential project that will deliver needed market-rate housing while preserving the historic character of the site and enhancing the surrounding South Utica neighborhood.

“This RFEI represents an exciting next step for the St. Elizabeth campus and for the City of Utica,” Dr. William LeCates, president and CEO of MVHS, said. “Through a collaborative planning process with the City of Utica, community partners and local stakeholders, we have established a thoughtful vision for redevelopment. We now look forward to engaging with experienced developers who share that vision and can help bring it to life.”

The RFEI seeks proposals that emphasize new-housing development, including market-rate apartments, townhomes or single-family homes, with the potential for limited neighborhood-scale retail and well-integrated greenspace.

Proposals should align with the approved reuse plan, respect the architectural context of the surrounding Olmsted-designed neighborhood, and incorporate sustainable-design practices, per the MVHS announcement.

Utica Mayor Michael Galime emphasized the broader community impact of the project. “The redevelopment of the former SEMC campus is a critical opportunity for Utica,” Galime said in the MVHS announcement. “This site has the potential to deliver high-quality housing, strengthen our neighborhoods and support continued economic growth. I appreciate MVHS and our community partners for the inclusive planning process that has brought us to this point and for their commitment to ensuring this redevelopment benefits residents and the city as a whole.”

The St. Elizabeth Campus Reuse Master Plan was developed through a public outreach process led by the City of Utica in coordination with MVHS and community stakeholders. A generic environmental impact statement (GEIS) was completed in 2025 under the State Environmental Quality Review Act (SEQRA), creating a framework that positions the site as redevelopment-ready, MVHS said.

“The City has been intentional about planning for growth while respecting neighborhood character,” Galime added. “Issuing this RFEI sends a strong message that Utica is ready to partner with developers who are aligned with our vision for smart, sustainable and community-centered redevelopment.”

The full RFEI is available online at: https://www.nyscr.ny.gov/Ads/Details/2129517.

Also, supporting planning documents are available at: https://www.cityofutica.com/departments/urban-and-economic-development/planning/St-Elizabeths-Re-Use-Master-Plan/index

Selected SUNY campuses win grant awards for student mental-health programs

ALBANY, N.Y. — Several regional SUNY campuses are set to receive funding through the system’s Mental Health First Aid grant program. Binghamton University, Onondaga Community College, Tompkins Cortland Community College, SUNY Oneonta, SUNY Oswego, SUNY Morrisville, and Alfred State College are among the recipients. SUNY Chancellor John King, Jr. announced the awards on Jan. 8.

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ALBANY, N.Y. — Several regional SUNY campuses are set to receive funding through the system’s Mental Health First Aid grant program.

Binghamton University, Onondaga Community College, Tompkins Cortland Community College, SUNY Oneonta, SUNY Oswego, SUNY Morrisville, and Alfred State College are among the recipients.

SUNY Chancellor John King, Jr. announced the awards on Jan. 8. The grants provide targeted funding to strengthen campus-wide approaches to student mental health and well-being across the SUNY system.

The program will award up to $8,000 grants to 27 SUNY campuses, including 16 state-operated campuses and 11 community colleges. On an annual basis, when fully implemented, the funding is estimated to support the delivery of mental health first-aid training for almost 3,000 faculty, staff, and other non-clinical campus personnel, expanding campus capacity to recognize and respond to students in distress, SUNY said.

The grant funding will support the creation and expansion of campus Mental Health First Aid programming, including instructor certification, campus-wide training delivery, required materials, and outreach efforts to strengthen mental-health literacy. Campuses with existing Mental Health First Aid programs are encouraged to use the funding to expand training for additional students, faculty, and staff and, where appropriate, provide training opportunities to neighboring SUNY campuses.

“Mental health is health, and our priority at SUNY is to advance every aspect of our students’ growth and to ensure they have the support needed to succeed in their academic, professional, and personal development,” King said. “The grants provided through this innovative program will help ensure more SUNY staff and personnel are trained to recognize and address mental health concerns and to support students in need.”

King first announced the Mental Health First Aid Grant program as part of his 2025 State of the University policy agenda. It reflects the SUNY board of trustees’ “ongoing commitment to proactive, systemwide strategies” that support student mental health.

By extending training beyond campus counseling centers, the initiative equips faculty and staff with practical tools to provide timely, informed support and connect students with appropriate professional resources, SUNY contends.

“Faculty and staff are often the first to notice when a student is struggling, and they deserve practical, evidence-based tools to respond with confidence and care,” Tramaine El-Amin, VP of Mental Health First Aid, said. “These grants will help 27 SUNY campuses expand Mental Health First Aid training, so more educators and frontline staff can recognize the signs of mental health and substance use challenges, start supportive conversations, and connect people to appropriate resources. SUNY is making an important investment in campus wellbeing and in the everyday moments when being prepared can make a difference.”

Munson to use $25K grant from the NYS Council on the Arts

UTICA, N.Y. — Munson, a fine-arts organization located at 310 Genesee St. in Utica, will use a $25,000 grant from the New York State Council

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.