Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Canton branch of North Country Savings Bank formally opens newly remodeled lobby

CANTON, N.Y. — The project to remodel the lobby of the Canton branch of North Country Savings Bank is now complete. Brian Coakley, president and

SYRACUSE, N.Y. — The public-bidding process is now open for right-of-way enhancements at the former Syracuse Developmental Center (SDC) property on the city’s west side.

Five woman-owned businesses in Oneida, Herkimer counties each win $5K in grant funding

ROME, N.Y. — Five woman-owned businesses in Herkimer and Oneida Counties were each awarded $5,000 to support the growth and development of their businesses. The

TC3, Syracuse University sign transfer agreement

DRYDEN, N.Y. — Tompkins Cortland Community College (TC3) and Syracuse University (SU) on Tuesday announced a new transfer agreement that provides TC3 graduates a direct

Ithaca startup REEgen wins $150K in FuzeHub competition

ITHACA, N.Y. — REEgen, a biomining startup based in Ithaca, has won the grand prize of $150,000 in FuzeHub’s 2025 commercialization competition. The contest was held as part of the New York State Innovation Summit in Rochester in late October. FuzeHub is an Albany–based nonprofit that is focused on empowering small and medium-sized manufacturing and

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ITHACA, N.Y. — REEgen, a biomining startup based in Ithaca, has won the grand prize of $150,000 in FuzeHub’s 2025 commercialization competition.

The contest was held as part of the New York State Innovation Summit in Rochester in late October.

FuzeHub is an Albany–based nonprofit that is focused on empowering small and medium-sized manufacturing and technology companies in New York State

The company called REEgen — which was spun out of Cornell University — describes its work as “transforming the way the world gets its critical minerals — the lesser-known metals that drive modern life,” per the FuzeHub announcement.

In particular, REEgen is focused on recovering rare earth elements (REEs), which are essential for making strong, lightweight magnets that power everything from electronics, your car’s power steering system, to wind turbines. Its product is called BioREEcovery Scale Up.

The FuzeHub award will accelerate REEgen’s path to achieving revenue by enabling the company to start producing rare earths for the U.S. supply chain as early as mid-2026, the Ithaca firm said in an announcement on its website. REEgen has externally validated its mixed rare earth oxalate product and is currently working with feedstock partners to prepare for its first commercial BioREEcovery unit installation.

“Winning this competition is an exciting validation of REEgen’s mission to revitalize critical mineral recovery and enable a future of widespread energy security,” Alexa Schmitz, co-founder and CEO of REEgen, said in the firm’s announcement. “This award will jumpstart our remaining scaleup milestones, really accelerating our path to first rare earth sales from industrial waste in the United States. We’re so grateful for the continued support from FuzeHub and New York State towards our mission, and we look forward to building up REEgen as a NY clean tech startup in the coming years.”

“As New York continues to invest in technology innovation, FuzeHub is honored to help entrepreneurs move their creative ideas onto successful products,” Patty Rechberger, Innovation Fund manager at FuzeHub, said. “This year’s competition drew inspiring talent from across the state, and this funding helps accelerate their journey from concept to commercialization. We’re excited to support their growth and follow the positive impact they bring to the world.”

Twelve entrepreneurs from across New York state competed for a chance to win one of four awards. Besides the grand prize of $150,000, the runner-up secured $100,000, one team received $80,000, and two more teams received $60,000 each toward their startups.

GynStrong, Inc. from the Mid-Hudson region was the runner-up and was awarded $100,000, and FuzeHub also awarded $80,000 to CryoBio, Inc., which is based in Ithaca.

In addition, two additional teams will receive $60,000 each toward their startup ventures. They include IVSonance Biomedical Inc., which is based in Ithaca, as well as TunaBotics LLC, which is based in Syracuse.

“We’re proud to celebrate this year’s Commercialization Competition winners. Their projects reflect the incredible ability of New York State’s innovation ecosystem to solve problems through technology and ingenuity,” said Ben Verschueren, executive director of Empire State Development’s Division of Science, Technology and Innovation (NYSTAR). “By pairing visionary entrepreneurs with targeted support through the Jeff Lawrence Innovation Fund, we’re not just recognizing commercialization potential — we’re investing in the future of our state’s economy.”

The commercialization competition occurs yearly as part of the FuzeHub Jeff Lawrence Innovation Fund, which has the support of Empire State Development. The office of Gov. Kathy Hochul provided additional funding for higher prize amounts in the competition, FuzeHub said.

Gains in new orders, shipments propel N.Y. manufacturing index to highest mark in a year

Respondents to the monthly Empire State Manufacturing Survey indicated gains in both new orders and shipments, and the survey’s general-business conditions index rose 8 points to 18.7 in November. The reading represented its highest since November 2024, and the fourth positive index number in the past five months. The index had climbed 19 points to

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

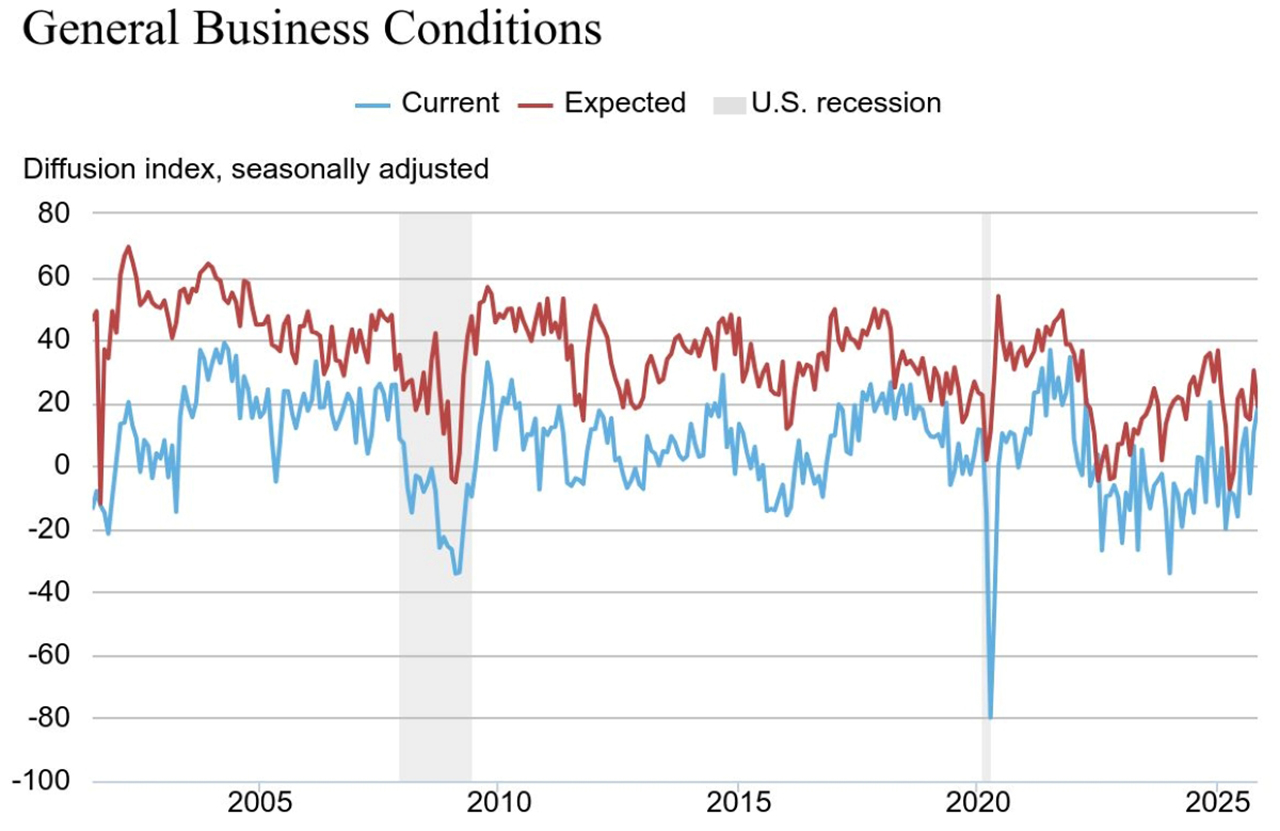

Respondents to the monthly Empire State Manufacturing Survey indicated gains in both new orders and shipments, and the survey’s general-business conditions index rose 8 points to 18.7 in November.

The reading represented its highest since November 2024, and the fourth positive index number in the past five months.

The index had climbed 19 points to 10.7 in October, after dropping 21 points to -8.7 in September.

Based on manufacturing firms responding to the survey, the November reading indicates business activity “increased at a solid pace” in New York state, the Federal Reserve Bank of New York said in its Nov. 17 report.

A positive index number indicates expansion or growth in manufacturing activity, while a negative reading on the index indicates a decline in the sector.

The November survey found new orders and shipments increased “significantly,” the New York Fed said. Supply availability “worsened somewhat,” and inventories expanded.

Firms expect conditions to improve in the months ahead, though firms were not as optimistic as last month.

Survey details

Survey details

The new-orders index rose 12 points to 15.9 and the shipments index increased 2 points to 16.8, pointing to “significant” gains in both orders and shipments.

After three months of negative readings, the inventories index rose 8 points to 6.7. The delivery-times index edged up to 7.7, and the supply-availability index ticked down to -11.5, continuing the trend of somewhat longer delivery times and worsening supply availability, the New York Fed said.

The index for number of employees ticked up to 6.6, while the average-workweek index rose to a multi-year high of 7.7, suggesting a modest increase in employment levels and hours worked.

Both price indexes declined slightly but remained elevated: the prices-paid index dropped 3 points to 49.0, and the prices-received index also dipped 3 points to 24.0.

Firms still expect conditions to improve in the months ahead, but the index for future general business conditions declined to 19.1, down 11 points from its recent high in October.

New orders and shipments are expected to increase, and supply availability is expected to be little changed. Firms continue to anticipate significant price increases ahead. Capital spending plans grew, with the capital-expenditures index rising 14 points to 11.5, the New York Fed said.

The New York Fed distributes the Empire State Manufacturing Survey on the first day of each month to the same pool of about 200 manufacturing executives in New York. On average, about 100 executives return responses.

New Drakos Urgent Care in Camillus starts seeing patients

CAMILLUS, N.Y. — The latest Drakos Urgent Care location in Camillus, which has been open for less than a month, is now seeing patients. It’s the company’s third area location providing urgent-care services. Drakos Urgent Care & Health Services in Camillus opened on Oct. 29, the company tells CNYBJ. It’s located at 5301 W Genesee

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

CAMILLUS, N.Y. — The latest Drakos Urgent Care location in Camillus, which has been open for less than a month, is now seeing patients.

It’s the company’s third area location providing urgent-care services.

Drakos Urgent Care & Health Services in Camillus opened on Oct. 29, the company tells CNYBJ. It’s located at 5301 W Genesee St., Suite 50 in the Camillus Commons shopping center.

The new location is a 5,000-square-foot facility, which is twice as large as Drakos’ other two urgent cares with 15 exam rooms. The other two Drakos locations in Clay and Cicero have handled nearly 60,000 visits since opening in 2023 and 2024, respectively, Drakos noted.

The new Camillus urgent care includes a partitioned waiting room with a separate entrance to the pediatric exam rooms, and a separate door for patients who need ambulance transport to an area hospital.

It also includes on-site lab facilities, along with an X-ray machine and radiology technicians on staff. The Camillus facility also has a fireplace room where patients under observation can relax in overstuffed chairs.

Drakos Urgent Care’s workforce has more than doubled in the past two years to nearly 100 to “keep up with demand,” and the company is continuing to hire, it said.

Drakos has contracted with multiple school districts and other local organizations to provide health screenings, vaccines, drug testing, and more health services.

Drakos Urgent Care locations are open until 10 p.m. or later each day.

NNY Community Foundation names 2025-2026 Youth Philanthropy Council

WATERTOWN, N.Y. — The Northern New York (NNY) Community Foundation recently announced its 2025-2026 Youth Philanthropy Council class, welcoming 12 new and five returning students to the leadership program. The Youth Philanthropy Council is a NNY Community Foundation advisory committee that was chartered in 2010 to promote positive youth development and engage young people in

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

WATERTOWN, N.Y. — The Northern New York (NNY) Community Foundation recently announced its 2025-2026 Youth Philanthropy Council class, welcoming 12 new and five returning students to the leadership program.

The Youth Philanthropy Council is a NNY Community Foundation advisory committee that was chartered in 2010 to promote positive youth development and engage young people in meaningful activities that build their skills. Throughout the yearlong program, students deepen their understanding of community needs while learning about community philanthropy and its impact across Northern New York, the foundation said. Council members grow to become informed critical thinkers and philanthropic leaders as they engage in lessons that may never be taught in a traditional classroom.

“When Council members graduate, they frequently say the Council is one of the most transformational experiences of their high school career. Above all, it is a powerful, multi-dimensional leadership program that instills lifelong lessons in civic responsibility and engagement,” Rande S. Richardson, NNY Community Foundation executive director, said in the Oct. 13 announcement. “Our donors are making valuable investments in our youth and helping ensure that our community’s future is in good hands.”

This year’s Youth Philanthropy Council includes 17 representatives from Carthage, General Brown, Immaculate Heart Central, Lyme, South Jefferson, and Watertown High School. Council members are in their junior, or senior class.

The class is comprised of the following people:

• Valerie Akins, Carthage Central, junior, first-year member

• Caitlin Daugherty, Watertown High, junior, first-year member

• Gaige Doroha, Watertown High, junior, first-year member

• Hudson Guldenpfennig, Watertown High, junior, first-year member

• Maxwell Hunt, Lyme Central, junior, first-year member

• Nola Johnson, Watertown High, junior, first-year member

• Oliver King, South Jefferson Central, junior, first-year member

• Isabel Mendez, General Brown Central, junior, first-year member

• Annabelle Renzi, South Jefferson Central, junior, first-year member

• William Steward, South Jefferson Central, senior, second-year member

• Lucy Swartz, Watertown High, junior, first-year member

• Julia Tontarski, Immaculate Heart Central, junior, second-year member

• Lydia Tremont, South Jefferson Central, junior, first-year member

• Trey Urf, Watertown High, junior, second-year member

• April Wang, Watertown High, senior, second-year member

• Frances Weir, Watertown High, junior, first-year member

• Alexandria Zajac, Immaculate Heart Central, junior, second-year member

Students elected members to this year’s Council Executive Committee during the last meeting of the school year in June. Watertown High School senior April Wang will serve as the council chair; Watertown High School junior Trey Urf will serve as vice chair; and Immaculate Heart Central junior Julia Tontarski was elected to serve as council secretary.

Seen Nutrition of Ithaca awarded $500,000 in Grow-NY competition

CANANDAIGUA, N.Y. — Seen Nutrition of Ithaca won $500,000 in the seventh annual Grow-NY agribusiness competition held Nov. 12-13 in Canandaigua. Seen Nutrition is a food-tech startup in the menopause market, initially focused on bone health, with a patented dietary calcium chew made with dairy produced in Central New York, as described in the Nov.

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

CANANDAIGUA, N.Y. — Seen Nutrition of Ithaca won $500,000 in the seventh annual Grow-NY agribusiness competition held Nov. 12-13 in Canandaigua.

Seen Nutrition is a food-tech startup in the menopause market, initially focused on bone health, with a patented dietary calcium chew made with dairy produced in Central New York, as described in the Nov. 13 announcement about the Grow-NY winners from the office of Gov. Kathy Hochul.

Brekland of Brooklyn was the $1 million grand-prize winner. Brekland is building a novel, biodegradable foam coating that brings new, in-field functionality to crop protection products.

The competition awarded a total of $3 million in prize money to seven of the 20 finalists selected for the Grow-NY business accelerator.

Winners were announced at the Grow-NY Summit, a two-day event in Canandaigua where finalists pitched their business plans to a panel of expert judges.

About Seen Nutrition

Seen Nutrition was co-founded by Cornell University lecturer Adrienne Bitar, and pharmacist Jennifer Han. Their flagship product, the Calcium Chew Complete, is made with dairy from the Upstate region. It is the first dietary calcium supplement made entirely from real foods.

“The company is committed to sourcing local ingredients and addressing the urgent need for bone health solutions for women over 40,” the company said in an Aug. 26 announcement about its selection as a Grow-NY finalist.

The startup has “deep ties” to Cornell and the region. Seen Nutrition is an alum of Cornell’s Dairy Runway program; a Rev Ithaca Startup Works member; and has used the Food Innovation Lab at Cornell AgriTech and the Seneca Foods Foundation Pilot Plant in Geneva to develop and scale its product.

Production was supported at Sweet Pea Kitchen in Rochester and fulfillment is completed by Watkins Glen ARC, Seen Nutrition said.

“Being selected as a Grow-NY finalist is an honor and a responsibility,” Bitar said. “We are proud to build a business that strengthens the local dairy industry while innovating in the field of women’s bone health nutrition.”

“As a pharmacist, I’ve seen the challenges women face with bone health. We created a solution rooted in the foods we trust here in Upstate New York,” Han added.

Additional winners

Besides Seen Nutrition, Mothership Materials of New York City also won $500,000. The $250,000 winners included Living Ink Technologies of Berthoud, Colorado; Trebe Biotech of Pergamino, Buenos Aires, Argentina; Whipnotic of New York City; and ZILA BioWorks of Renton, Washington.

Each winning company will establish operations in the region for at least one year and provide a modest equity stake to Cornell University, helping to fund future food and agriculture-entrepreneurship programs.

Cornell University’s Center for Regional Economic Advancement administers the competition, which is focused on “enhancing the emerging food, beverage and agriculture innovation cluster” in Central New York, Finger Lakes and Southern Tier regions, per the Hochul announcement.

“Grow-NY exists to create lasting economic development by attracting startups and investors into our world class agrifood ecosystem, leveraging innovation to create opportunity, supporting and creating growth for new and existing ventures alike,” Jenn Smith, Grow-NY program director, said in the state’s announcement. “We are thrilled to have this year’s winners help us accomplish our goals while moving toward their own.”

In its seventh year, the Grow-NY competition attracted 270 applicants from 41 countries. Applicants came from 31 states, and 53 startups applied from across New York state.

Solvay Bank names branch manager for upcoming East Syracuse–area branch

DeWITT, N.Y. — Briana Fox will serve as AVP, branch manager for Solvay Bank’s upcoming East Syracuse–area location at the Wegmans plaza on James Street in the town of DeWitt. It will be the 10th branch for Solvay Bank, the oldest community bank established in Onondaga County, per the Nov. 6 announcement. Fox joined Solvay

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

DeWITT, N.Y. — Briana Fox will serve as AVP, branch manager for Solvay Bank’s upcoming East Syracuse–area location at the Wegmans plaza on James Street in the town of DeWitt.

It will be the 10th branch for Solvay Bank, the oldest community bank established in Onondaga County, per the Nov. 6 announcement.

Fox joined Solvay Bank in 2016 as a banking solutions representative at its Fairmount office. Along the way, Solvay Bank promoted Fox to assistant branch manager at Solvay Bank’s DeWitt location, and most recently, branch manager for the North Syracuse office.

The future 2,200-square-foot Smart Office, located in the Wegmans plaza on James Street, is making “significant” progress, with framing now complete and further phases “actively underway” Solvay Bank noted. This branch will offer personal, business, and municipal-banking products and services.

Founded in 1917, Solvay Bank currently has nine branch locations in Solvay, Baldwinsville, Camillus, Cicero, DeWitt, Liverpool, North Syracuse, Westvale, and downtown Syracuse in the State Tower Building, as well as a commercial lending presence in the Mohawk Valley.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

Survey details

Survey details