Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

FustCharles adds Albany-area firm in expansion to Capital Region

SYRACUSE — An accounting firm based in the Capital Region has joined FustCharles, a Syracuse–based accounting, tax, and advisory firm. Stephen J Flood, CPA, PLLC a Latham–based accounting and tax practice, joined the firm as of Jan. 1, per the FustCharles announcement. The expansion “strengthens” FustCharles’ presence across upstate New York and extends the firm’s […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE — An accounting firm based in the Capital Region has joined FustCharles, a Syracuse–based accounting, tax, and advisory firm.

Stephen J Flood, CPA, PLLC a Latham–based accounting and tax practice, joined the firm as of Jan. 1, per the FustCharles announcement. The expansion “strengthens” FustCharles’ presence across upstate New York and extends the firm’s footprint into the Capital Region, per the Jan. 6 announcement.

The Stephen J Flood firm, which has four employees, will take the FustCharles name, the local firm tells CNYBJ in an email.

As part of this integration, Stephen Flood and his team will continue serving clients from its Latham location, ensuring uninterrupted service and familiar points of contact. Clients will also gain access to FustCharles’ “expanded resources, specialized service teams, and broader regional capabilities,” the Syracuse firm noted.

“We are excited to welcome Stephen Flood and his entire team to FustCharles,” Tom Giufre, tax partner at FustCharles, said in the announcement. “Their long-standing reputation, strong client relationships, and commitment to high-quality service align seamlessly with our Firm’s values and strategic direction. Expanding into the Capital Region represents a significant milestone for us — one that strengthens our ability to attract top talent, deepen our expertise, and continue building a team that delivers exceptional value to our clients.”

Founded more than 40 years ago, FustCharles provides audit, tax, and advisory services for commercial, health care, and nonprofit organizations. FustCharles now operates from offices in Syracuse, Rochester, and the Albany area.

Framework finalized for Oneida County AI task force

UTICA — Oneida County says it has a framework for its upcoming artificial intelligence (AI) task force. It marks a “significant step toward the responsible evaluation and use of artificial intelligence across county government and the broader community,” per the Jan. 7 announcement. With the framework in place, the county will now move forward with

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

UTICA — Oneida County says it has a framework for its upcoming artificial intelligence (AI) task force.

It marks a “significant step toward the responsible evaluation and use of artificial intelligence across county government and the broader community,” per the Jan. 7 announcement.

With the framework in place, the county will now move forward with assembling the task force committee.

“This framework ensures that Oneida County approaches artificial intelligence thoughtfully, responsibly and with the public interest at the forefront,” Oneida County Executive Anthony Picente said. “AI has the potential to improve efficiency and service delivery, but it must be implemented with clear safeguards, transparency and accountability. This task force will help us strike that balance as we move forward.”

First announced in Picente’s State of the County Address earlier this year, the artificial intelligence task force (AITF) will serve in an advisory capacity, charged with evaluating opportunities, risks, operational impacts, and ethical considerations associated with AI technologies. Its work will focus on improving government operations, supporting economic development, strengthening governance and data protections, preparing the workforce, and increasing public understanding of AI.

The county expects that membership will include about 10 representatives from key sectors, including information technology, planning, human resources, public safety, ethics, economic and workforce development, education, business and community advocacy, along with private-sector technology expertise. The AITF will meet at least monthly and may establish sub-working groups as needed.

Initial deliverables are anticipated within three to four months and will include an AI readiness assessment and preliminary opportunity and risk analysis. Final policy and governance recommendations are expected within eight to 12 months, at which time the county executive may determine whether to continue the task force as an ongoing advisory body, Oneida County said.

Cornell to use $55M donation to endow Cornell CALS Ashley School

ITHACA — The largest donation in the history of Cornell University’s College of Agriculture and Life Sciences (CALS) will help establish the Cornell CALS Ashley School of Global Development and the Environment. The school is named in honor of Cornell graduate Stephen Ashley, who donated $55 million to endow the school, Cornell said. It combines

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ITHACA — The largest donation in the history of Cornell University’s College of Agriculture and Life Sciences (CALS) will help establish the Cornell CALS Ashley School of Global Development and the Environment.

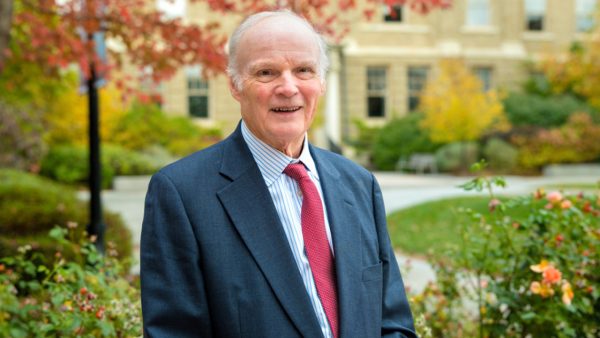

The school is named in honor of Cornell graduate Stephen Ashley, who donated $55 million to endow the school, Cornell said. It combines the departments of global development and natural resources and the environment, per the university’s Dec. 16 announcement.

Ashley is chairman and CEO of The Ashley Companies, a Rochester–based firm that specializes in property management, brokerage, financing, and real-estate investment.

“Steve Ashley’s decades of leadership, advocacy and support for Cornell have had a profound impact on the university,” Cornell University President Michael Kotlikoff said in the announcement. “This investment to create the Ashley School is both timely and visionary, allowing us to bring together the expertise in agricultural, life, environmental and social sciences that underpin environmental and human well-being locally and globally. We are so grateful to Steve for his generosity, partnership and friendship.”

Ashley has been involved with Cornell University for more than a half century, including 55 years on the University Council, 16 years on the Cornell board of trustees, and 10 years as co-chair of the Far Above capital campaign, the school said.

In 2016, he received the Frank H.T. Rhodes Exemplary Alumni Service Award, the university’s highest award for alumni service.

“My family has had a strong, multigenerational relationship with Cornell,” Ashley said. “I met my wife, Janice, at Cornell and over the years, Cornell has influenced much of my personal and professional life. I am delighted to be able to support this initiative, which has been so thoughtfully framed and structured. I appreciate how it creates even stronger collaborations between agriculture, environmental science, economics and research to positively impact communities.”

CALS plans to recruit at least 10 additional faculty members to the new school, including three who will focus on agricultural, development and environmental economics, Benjamin Houlton, dean of CALS, said in the Cornell announcement.

Houlton said the concept for the school began with growing recognition of shared teaching, research and extension interests, especially among new faculty in the departments of natural resources and the environment and global development.

“The Ashley School will create a dynamic ecosystem for discovery, experiential learning and innovation, transcending disciplines to spark scientific breakthroughs and real-world economic benefits for New York state and the world,” Houlton said. “Steve’s vision will allow us to leverage research, teaching and extension to address many of the world’s greatest challenges — personifying our land-grant mission.”

The school will continue to support the two departments’ two undergraduate degrees (including one, environment and sustainability, that is shared with the College of Arts and Sciences), five undergraduate minors, four master’s degree programs and two Ph.D. degrees. Enrolled students won’t be affected, and students seeking to enroll in those programs can continue to do so. No new programs, majors or minors are forming at this time, but future formations will be considered in collaboration with faculty, CALS leadership said.

Ask Rusty: My Wife Believes She Can Get a Spousal Benefit While I’m Still Alive; Can She?

Dear Rusty: A friend of my wife told her, and she believes, that she could receive a Social Security (SS) benefit based on my SS benefit that I’m currently receiving while I’m still alive. I told her she could only get spousal survivor benefits. Is there any truth to what she now believes? Would you

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

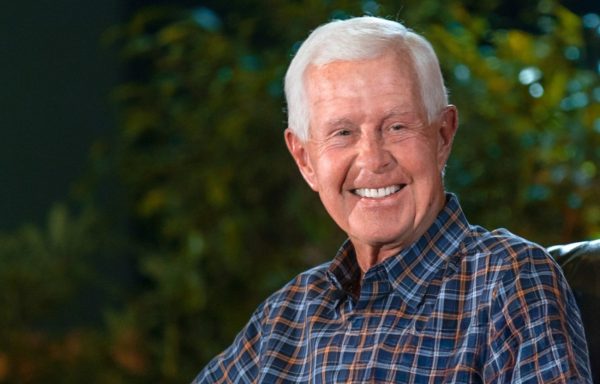

Dear Rusty: A friend of my wife told her, and she believes, that she could receive a Social Security (SS) benefit based on my SS benefit that I’m currently receiving while I’m still alive. I told her she could only get spousal survivor benefits. Is there any truth to what she now believes? Would you settle this issue for us please? Thank you.

Signed: Uncertain Husband

Dear Uncertain Husband:

Well, I surely don’t want to get in the middle of your martial discussion, but I’ll be happy to explain Social Security’s rules about your wife’s eligibility for spousal benefits while you are both still living. And just for awareness for both of you, the rules about spousal benefits are one of the most confusing areas of Social Security.

Per the Social Security rules, a spouse (e.g., your wife) can receive a “spousal boost” from you — while you are still living — if the SS retirement benefit she is personally entitled to at her full retirement age (FRA) is less than 50 percent of the SS retirement benefit you are (were) entitled to at your FRA (note: full retirement age amounts are used to calculate living spouse benefits, regardless of when each of you actually claimed your Social Security).

So, if your FRA entitlement benefit amount is more than twice your wife’s FRA entitlement benefit amount, she can, indeed, get a “spousal boost” from your record while you are both still living. The spousal boost is added to her own SS retirement amount and will be based on the difference between her FRA entitlement and half of your FRA entitlement. Thus, in this discussion, your wife may be correct — she may be able to get a spousal boost from you while both of you are living, depending on how your personal FRA retirement amounts compare. The best way for your wife to find out is to contact the Social Security Administration at (800) 772-1213 to inquire, and if she’s eligible, also make an appointment to apply for her spousal benefit.

And to clarify your wife’s options as your possible widow, a surviving spouse can also receive a survivor benefit if their marital partner passes away, but only if the deceased spouse’s current benefit (at death) was more than the surviving spouse is already receiving. The surviving spouse receives the higher amount, instead of their own smaller Social Security retirement benefit.

But here is an important thing to know: Whenever any Social Security benefit (including a spousal or surviving spouse benefit) is claimed before the recipient’s full retirement age, the payment amount is permanently reduced (both spousal and survivor benefits do not reach maximum until the recipient’s FRA). And just to complete the picture for survivor benefits, a surviving spouse is also entitled to a one-time, lump-sum death benefit of $255 if their marital partner dies, in addition to any other benefit to which they are entitled.

Russell Gloor is a national Social Security advisor at the AMAC Foundation, the nonprofit arm of the Association of Mature American Citizens (AMAC). The 2.4-million-member AMAC says it is a senior advocacy organization. Send your questions to: ssadvisor@amacfoundation.org.

Author’s note: This article is intended for information purposes only and does not represent legal or financial guidance. It presents the opinions and interpretations of the AMAC Foundation’s staff, trained, and accredited by the National Social Security Association (NSSA). The NSSA and the AMAC Foundation and its staff are not affiliated with or endorsed by the Social Security Administration (SSA) or any other governmental entity.

INSPYRE Innovation Hub to host another fireside chat this spring

SYRACUSE — CenterState CEO’s INSPYRE Innovation Hub (the former Tech Garden) has plans to host another in a series of fireside chats coming up this spring with more details to come. That’s according to a Dec. 12 announcement M&T Bank (NYSE: MTB). The inaugural event was held Dec. 11. The speaker series is the first

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE — CenterState CEO’s INSPYRE Innovation Hub (the former Tech Garden) has plans to host another in a series of fireside chats coming up this spring with more details to come.

That’s according to a Dec. 12 announcement M&T Bank (NYSE: MTB). The inaugural event was held Dec. 11.

The speaker series is the first initiative to be created through M&T Bank’s founding sponsor partnership with the INSPYRE Innovation Hub.

The first fireside chat featured Jeff Knauss, CEO and co-founder of Arcovo AI, an artificial intelligence (AI) automation agency that empowers small and mid-size firms to integrate advanced AI solutions into everyday workflows.

Arcovo AI is also a tenant at INSPYRE Innovation Hub.

The new quarterly series is the first program developed as part of M&T’s long-term, multi-year partnership with INSPYRE Innovation Hub.

INSPYRE fireside chats are “intimate and candid conversations highlighting the pivotal moments, challenges and breakthroughs that have defined the entrepreneurial journeys of Central New York innovators,” M&T Bank said.

Those attending will hear about “building resilient businesses, navigating uncertainty, cultivating visionary leadership and remaining grounded while pursuing bold ideas,” per the announcement.

Centro to use federal funding to buy new low-emission buses

SYRACUSE — The Central New York Regional Transportation Authority (Centro) plans to purchase about nine low-emission buses for its upcoming Bus Rapid Transit (BRT) system. Centro will use a federal grant of more than $9 million to help buy the new buses. The funding will allow Centro to purchase custom-designed, compressed natural gas (CNG) buses

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE — The Central New York Regional Transportation Authority (Centro) plans to purchase about nine low-emission buses for its upcoming Bus Rapid Transit (BRT) system.

Centro will use a federal grant of more than $9 million to help buy the new buses.

The funding will allow Centro to purchase custom-designed, compressed natural gas (CNG) buses built specifically for BRT service.

The money is awarded through the U.S. Department of Transportation’s Low- or No-Emission Program, the office of U.S. Representative John Mannion (D–Geddes) said in an announcement.

These buses will have a unique design and dedicated branding so riders can clearly identify them as part of the BRT system, the congressman’s office noted.

Mannion joined Christopher Tuff, CEO of Centro; Nicholas Laino, chairman of the CNYRTA board of directors; Syracuse Mayor Ben Walsh; and Syracuse Deputy Mayor and Mayor-elect Sharon Owens for the Dec. 22 announcement at Centro’s location at 200 Cortland Ave. in Syracuse.

“Public transit is about people getting to work, getting to school, their medical appointments, shopping, family, and to get back home,” Mannion said in his remarks at the event. “Riders expect buses that are clean, consistent, on time, and reliable, and Centro delivers.”

The congressman went on to say the investment also aligns directly with the ongoing Interstate 81 viaduct-replacement project. As the community rebuilds and maintains its transportation network, transit has to be modern, accessible, flexible, and connected to the neighborhoods and institutions that make the city and region work.

“And BRT is a key part of that,” Mannion said.

In his remarks, Centro’s Tuff called the grant funding “exciting progress” for public transportation here in Syracuse as officials continue working to improve the region for investment.

“We’re in the process of a system redesign, which will segue into the BRT project in 2028,” Tuff said. “This funding is just another piece to keep BRT moving forward.”

The buses that Centro will purchase with the grant money will be different than the ones that are currently in service, Tuff noted.

“If you’re a customer that’s waiting at one of our unique BRT stops along James Street, you will see that that’s a BRT bus coming my way,” Tuff contended. “You’ll know the difference. You’ll see the difference and identify that that’s the bus I need to be on.”

Syracuse’s BRT system is designed to provide faster, more reliable, and more frequent transit service, connecting neighborhoods with downtown, University Hill, major employers, health-care institutions, and the transit hub, per the Mannion announcement. The bus service runs every 12-15 minutes.

Tully Central School District names new superintendent

TULLY, N.Y. — The Tully Central School District Board of Education has announced the appointment of Andy Buchsbaum as the district’s new superintendent of schools.

Cornell University’s largest-ever donation places alum’s name on College of Engineering

ITHACA, N.Y. — Cornell University will use donations from 1962 graduate David Duffield — a co-founder of both PeopleSoft and Workday — to establish the

Valley Health Services awarded $15,000 grant to buy new equipment

HERKIMER, N.Y. — Bassett Healthcare Network’s Valley Health Services will use a $15,000 grant from the Community Foundation of Herkimer & Oneida Counties to support

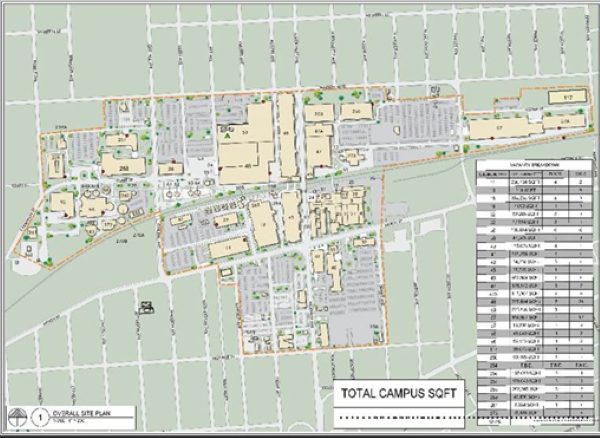

The Agency selects a design firm for the Huron campus in Endicott

ENDICOTT, N.Y. — The Agency says it has selected Colliers Engineering & Design to complete a master facility plan for the Huron campus. It is

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.