Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

NBT Bancorp profit surges 43 percent in Q3

NORWICH — NBT Bancorp Inc. (NASDAQ: NBTB), parent company of NBT Bank, recently reported that its net income rose 43 percent to $54.5 million in the third quarter from $38.1 million in the year-prior period, as it improved margins and benefitted from a recent merger. NBT’s earnings per share rose to $1.03, compared to 80 […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

NORWICH — NBT Bancorp Inc. (NASDAQ: NBTB), parent company of NBT Bank, recently reported that its net income rose 43 percent to $54.5 million in the third quarter from $38.1 million in the year-prior period, as it improved margins and benefitted from a recent merger.

NBT’s earnings per share rose to $1.03, compared to 80 cents over the same period.

Norwich–based NBT Bancorp completed the acquisition of Evans Bancorp, Inc. on May 2, adding 200 employees and 18 branches in Western New York, $1.67 billion in loans, and $1.86 billion in deposits. In connection with the transaction, NBT issued 5.1 million shares of common stock, with a value of $221.8 million as of the closing date.

“For the third quarter of 2025, we achieved record net income and earnings per share, and we reported a return on average assets of 1.35% and a return on average tangible common equity of 17.35%,” NBT Bancorp President and CEO Scott Kingsley said in the Oct. 27 earnings report. “These results reflect productive growth in earning assets, deposits, and our sixth consecutive quarter of net interest margin improvement, including a full quarter of our merger with Evans Bancorp, Inc. completed in May.”

The NBT board of directors approved a fourth-quarter cash dividend of 37 cents per share at a meeting held on Oct. 27. The dividend is up by 3 cents, or 8.8 percent, over the amount the banking company paid in the fourth quarter of 2024. This is NBT’s 13th straight year of annual dividend increases. The company will pay the new, higher dividend on Dec. 15, to stockholders of record as of Dec. 1.

Kingsley said the dividend increase is “illustrative of our ongoing commitment to providing favorable long-term returns.”

NBT Bancorp did not purchase any shares of its common stock during the third quarter, ended Sept. 30. On the same day as its earnings report and dividend increase, the NBT board authorized and approved an amendment to the company’s previously announced stock repurchase program. Pursuant to the amended stock buyback program, NBT may repurchase up to

2 million shares of its common stock with all repurchases under the program to be made by Dec. 31, 2027.

Ithaca Rotary Club awards nearly $15,000 in community grants to 11 local nonprofits

ITHACA — The Ithaca Rotary Club recently handed out $14,798 to its 2025 Community Grants awardees. From a pool of 41 applications, 11 grant proposals from area nonprofits received funding, the club announced. Awards are made from the Rotary Club’s donor-advised fund held at the Community Foundation of Tompkins County. The Ithaca Rotary Club, in

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ITHACA — The Ithaca Rotary Club recently handed out $14,798 to its 2025 Community Grants awardees. From a pool of 41 applications, 11 grant proposals from area nonprofits received funding, the club announced.

Awards are made from the Rotary Club’s donor-advised fund held at the Community Foundation of Tompkins County.

The Ithaca Rotary Club, in a Sept. 24 announcement, listed the following local not-for-profit organizations as 2025 grant recipients, with dollar amount and grant purpose included:

• Community Science Institute, $1,500 — Provide discounted water testing through the newly launched Water Testing Assistance Fund program

• Downtown Ithaca Children’s Center, $1,000 — Rechargeable two-way radios for organizational safety and emergency support

• Enfield Food Distribution, $1,500 — Offset the sudden 50-percent reduction in funding received from The Emergency Food Assistance Program (TEFAP)

• Family & Children’s Service, $1,500 — Purchase 30 $50 food gift cards for homeless youth supported by the Open Doors program

• Foodnet Meals on Wheels, $875 — Buy a picnic table and a bike rack for staff use

• Friends of Stewart Park, $1,500 — Match Wegmans’ donation to complete construction of one new accessible picnic table near the Stewart Park playground

• Ithaca Children’s Garden, $1,500 — Install a pond liner, replace deteriorating dock decking, and mount interpretive watercolor panels at its Tadpole Pond Habitat

• Ithaca Community Childcare Center, $1,500 — Purchase weather-resistant play materials that support physical development and integrate into the natural playscape

• Lansing Center Trail, $1,423 — Create a Volunteer Tool Library stocked with gardening and outdoor tools

• Loaves & Fishes, $1,500 — Purchase an ice machine to support daily meal service and enhance food safety

• New Roots Charter School, $1,000 — Expand the free personal-care product pantry and add basic school supplies

The Ithaca Rotary Club said it issues a call for proposals in June of each year. Grants are intended to promote the quality of life in Tompkins County. Small nonprofit organizations are especially encouraged to apply. All grant applications must be for projects completed within Tompkins County.

Ask Rusty: How Do I Navigate the Social Security Maze?

Dear Rusty: I am a woman, turning 65 [soon]. It seems that deciding when to claim Social Security is complicated. I would like more information to navigate through this maze. Thank you. Signed: Ready to Claim Dear Ready to Claim: Deciding when to claim Social Security can be challenging, but we hope to make it

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Dear Rusty: I am a woman, turning 65 [soon]. It seems that deciding when to claim Social Security is complicated. I would like more information to navigate through this maze. Thank you.

Signed: Ready to Claim

Dear Ready to Claim: Deciding when to claim Social Security can be challenging, but we hope to make it a bit easier for you. You can, of course, call us at any time to speak to one of our certified Social Security advisors, but I’ll share some pertinent information here as well.

Be aware that at age 65, you have not yet reached your Social Security (SS) full retirement age (FRA). Born in 1960, your FRA is age 67, and that is when you can receive 100 percent of the SS benefit you’ve earned from a lifetime of working. If you claim SS at age 65, your monthly amount will be reduced by about 13.3 percent from your age 67 entitlement (a permanent reduction). If you wait a bit more and claim at age 66 the reduction would be about 6.7 percent. To receive 100 percent of your “primary insurance amount” you should wait until age 67 to claim. Note you can also wait longer than your FRA and earn delayed retirement credits up to age 70, when your monthly amount would be about 24 percent more than your FRA entitlement.

If you are still working, at age 65 you will also be subject to Social Security’s annual earnings test (AET), which limits how much you can earn when collecting SS benefits before your full retirement age. The earnings limit for 2025 is $23,400 (it changes annually) and if you earn more than that, the Social Security Administration will take away $1 in benefits for every $2 you are over the limit. There is also a special rule for the first calendar year you are collecting early benefits, which will result in you not getting benefits for any month your work earnings are more than $1,950 after your early benefits start. So, if you claim SS at age 65 and continue to work, you won’t get any SS benefits in any 2025 month thereafter that you earn more than the monthly limit (unless your total annual; 2025 earnings are less than the annual limit). FYI, the earnings limit no longer applies once you attain your full retirement age.

In the end, when deciding when you should claim Social Security, you should consider your need for Social Security money, your life expectancy, your plans for working, and your marital status. If you are (or were) married, you might be eligible for a spousal (or ex-spouse) benefit. You may also want to peruse the Social Security Q&A section at our website: www.SocialSecurityReport.org. So, as you have already discerned, deciding when to claim Social Security can be confusing, but we are always here to assist you as needed.

You can either call us directly at (888) 750-2622 or email your specific Social Security questions to us at: SSAdvisor@amacfoundation.org. In either case, we will be most happy to help you decide when to claim, based on your unique personal circumstances.

Russell Gloor is a national Social Security advisor at the AMAC Foundation, the nonprofit arm of the Association of Mature American Citizens (AMAC). The 2.4-million-member AMAC says it is a senior advocacy organization. Send your questions to: ssadvisor@amacfoundation.org.

Author’s note: This article is intended for information purposes only and does not represent legal or financial guidance. It presents the opinions and interpretations of the AMAC Foundation’s staff, trained, and accredited by the National Social Security Association (NSSA). The NSSA and the AMAC Foundation and its staff are not affiliated with or endorsed by the Social Security Administration (SSA) or any other governmental entity.

Urban farms, community gardens in CNY, Mohawk Valley, Southern Tier awarded state funding

ALBANY, N.Y. — Organizations in Central New York, the Mohawk Valley, and the Southern Tier were among 51 groups awarded a total of $2.5 million

Solvay Bank hires branch manager for upcoming James Street Wegmans plaza location

DeWITT, N.Y. — Solvay Bank on Thursday said it has appointed Briana Fox as AVP, branch manager for its upcoming East Syracuse–area location at the Wegmans plaza on James Street in the town DeWitt. It will be the 10th branch for Solvay Bank, the oldest community bank established in Onondaga County, per the announcement. Fox

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

DeWITT, N.Y. — Solvay Bank on Thursday said it has appointed Briana Fox as AVP, branch manager for its upcoming East Syracuse–area location at the Wegmans plaza on James Street in the town DeWitt.

It will be the 10th branch for Solvay Bank, the oldest community bank established in Onondaga County, per the announcement.

Fox joined Solvay Bank in 2016 as a banking solutions representative at its Fairmount office. Along the way, Solvay Bank promoted Fox to assistant branch manager at Solvay Bank’s DeWitt location, and most recently, branch manager for the North Syracuse office.

The future 2,200-square-foot Smart Office, located in the Wegmans plaza on James Street, is making “significant” progress, with framing now complete and further phases “actively underway” Solvay Bank noted. This branch will offer personal, business, and municipal-banking products and services.

Founded in 1917, Solvay Bank currently has nine branch locations in Solvay, Baldwinsville, Camillus, Cicero, DeWitt, Liverpool, North Syracuse, Westvale, and downtown Syracuse in the State Tower Building, as well as a commercial lending presence in the Mohawk Valley.

SUNY to represent New York in Center for State Service Innovation

ALBANY, N.Y. — Service Year Alliance has selected New York to join the inaugural group of the Center for State Service Innovation, an effort seeking

Issuing 1099s: What Every Business Owner Needs To Know

If you are a business owner, you have likely heard of Form 1099. It is a crucial part of tax compliance and should not be

Tech Farm II expansion at Cornell Agriculture and Food Technology Park in Geneva is complete

GENEVA, N.Y. — The expansion of the Cornell Agriculture and Food Technology Park Corporation’s (CAFTPC) Tech Farm II in Geneva is now complete. The project

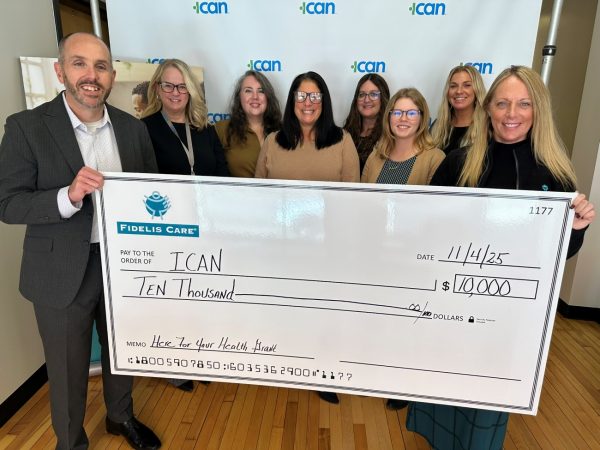

Fidelis Care awards $10K grant to Utica’s Integrated Community Alternatives Network

UTICA, N.Y. — Fidelis Care on Tuesday presented a $10,000 Here for Your Health maternal health grant to Integrated Community Alternatives Network (ICAN) in Utica. This grant is one of seven totaling $130,000 awarded to providers and community-based organizations that support innovative strategies in postpartum care and maternal mental health in underserved communities across New

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

UTICA, N.Y. — Fidelis Care on Tuesday presented a $10,000 Here for Your Health maternal health grant to Integrated Community Alternatives Network (ICAN) in Utica.

This grant is one of seven totaling $130,000 awarded to providers and community-based organizations that support innovative strategies in postpartum care and maternal mental health in underserved communities across New York State.

Fidelis Care, a Centene Corporation company, is a statewide health plan with more than 2.4 million members in New York State. Fidelis Care has regional offices are located in Syracuse, Rochester, Buffalo, Albany, and New York City.

ICAN provides individualized and non-traditional services to many populations, including pregnant and postpartum women through preventive programs and established residences.

The Fidelis Care grant supports the purchase of AI-powered live translation earbuds available in 40 languages for staff, local clinics, and partners who work with pregnant and postpartum clients. AI is short for artificial intelligence.

This real-time, two-way communication “enhances the client’s experience and maternal health outcomes” by making services linguistically inclusive, cost-effective, and culturally competent, Fidelis Care said.

Clarkson CUHEAT program graduates first group of clean-energy trainees

POTSDAM, N.Y. — Clarkson University in Potsdam says the first participants in its Home Energy Awareness Training (CUHEAT) program have completed their training. The program

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.