Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Five Star Urgent Care changes name to WellNow Urgent Care

Five Star Urgent Care has rebranded and changed its name to WellNow Urgent Care. The organization describes itself as “one of New York’s fastest growing urgent-care providers.” “Effective immediately and over the next couple of months,” the transition will apply to all existing and future Five Star Urgent Care locations, the company said in a news […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Five Star Urgent Care has rebranded and changed its name to WellNow Urgent Care.

Five Star Urgent Care has rebranded and changed its name to WellNow Urgent Care.

The organization describes itself as “one of New York’s fastest growing urgent-care providers.”

“Effective immediately and over the next couple of months,” the transition will apply to all existing and future Five Star Urgent Care locations, the company said in a news release.

The firm’s website is currently displaying both the Five Star and the WellNow brands. The rebrand includes a new logo.

The first location it is opening as WellNow Urgent Care will be in Niskayuna in the Capital Region on Nov. 2.

Throughout the rebrand process, WellNow will be “focused on continued growth,” with additional location openings in Oneida and Irondequoit “planned for this fall,” per the release.

“This rebrand is about more than a name change — it represents a milestone evolution. Since we started in 2012, our company has been rooted in a strong history of putting our patients’ needs first. We’ve done this by delivering quick, quality, convenient urgent care, as well as putting the power in their hands by accessing up-to-date wait times at our facilities as well as being able to save their spot to be seen online before they come in. We feel that our new name and brand better reflect this philosophy and mission,” Dr. John Radford, founder & president of WellNow Urgent Care, said in the release.

Launched in 2012, Five Star Urgent Care opened its first location in Big Flats.

Besides Big Flats, Five Star / WellNow also operates locations in Cicero, DeWitt, Fairmount, Fayetteville, Clay, Ithaca, Oneonta, Oswego, and Vestal, along with locations in Plattsburgh, Big Flats, Geneva, Greece, Jamestown, and Niagara Falls. All facilities are open seven days a week.

The firm is headquartered in the Buffalo area.

New York manufacturing index posts small increase in October

The Empire State Manufacturing survey general business-conditions index rose 2 points to 21.1 in October, signaling some acceleration in the pace of growth in New York’s manufacturing sector. The October reading is “pointing to a slightly faster pace of growth than in September,” the Federal Reserve Bank of New York said in the survey report

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The Empire State Manufacturing survey general business-conditions index rose 2 points to 21.1 in October, signaling some acceleration in the pace of growth in New York’s manufacturing sector.

The October reading is “pointing to a slightly faster pace of growth than in September,” the Federal Reserve Bank of New York said in the survey report issued Oct. 15.

The latest month’s result is a rebound from the 7 point decline in September, which indicated a slowing of manufacturing growth.

A positive reading in the general business-conditions index indicates expansion or growth in state manufacturing activity, while a negative number shows a decline in the sector.

The survey found 36 percent of respondents reported that conditions had improved over the month, while 15 percent said that conditions had worsened.

Survey details

The new-orders index and the shipments index both showed “strong growth,” with the first index moving up 6 points to 22.5 and the second climbing 12 points to 26.3. Unfilled orders decreased, inventories “held steady,” and delivery times “continued to lengthen,” the New York Fed said.

The index for number of employees came in at 9.0 and the average-workweek index fell to 0.2, “indicating a modest increase in employment levels and no change in the length of the workweek.”

Price increases slowed somewhat but remained “elevated.” The prices-paid index fell 4 points to 42.0, and the prices-received index edged down to 14.3.

New York manufacturing firms remained “moderately optimistic” about the six-month outlook.

The index for future business conditions was “little changed” at 29.0, and the indexes for future new orders and shipments “pointed to continued solid growth.”

Respondents expected employment to increase in the months ahead, and the indexes for future prices “remained elevated.” The capital-expenditures index came in at 16.0, and the technology-spending index was at 9.2.

The New York Fed distributes the Empire State Manufacturing Survey on the first day of each month to the same pool of about 200 manufacturing executives in New York. On average, about 100 executives return responses.

Giovanni’s Big Cheese Pizzeria in Oneida formally opens under new ownership

ONEIDA — Giovanni’s Big Cheese Pizzeria in Oneida recently formally opened under new ownership. The business, led by new owners Giovanni and Rosalinda Purpura, held a grand opening and ribbon-cutting event at its 118 Phelps St. location on Oct. 9 with the Greater Oneida Chamber of Commerce. The new owners took over in the spring,

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ONEIDA — Giovanni’s Big Cheese Pizzeria in Oneida recently formally opened under new ownership.

The business, led by new owners Giovanni and Rosalinda Purpura, held a grand opening and ribbon-cutting event at its 118 Phelps St. location on Oct. 9 with the Greater Oneida Chamber of Commerce.

The new owners took over in the spring, according to the Giovanni’s Big Cheese Facebook page.

The eatery’s menu includes pizza, chicken wings, calzones, subs, Stromboli rolls, lasagna, manicotti, baked ziti, salads, and more.

Loretto preps for future dementia care with $11 million project

DeWITT — Citing data from the Chicago, Illinois–based Alzheimer’s Association, Loretto is preparing for the time when more people will require memory care and memory-care facilities. The organization has plans for an $11 million project involving renovations and new construction to “expand and enhance” dementia care at three of its locations. They include the Nottingham in

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

DeWITT — Citing data from the Chicago, Illinois–based Alzheimer’s Association, Loretto is preparing for the time when more people will require memory care and memory-care facilities.

The organization has plans for an $11 million project involving renovations and new construction to “expand and enhance” dementia care at three of its locations.

They include the Nottingham in DeWitt, along with the Heritage and the Cunningham buildings on Loretto’s main campus in Syracuse, Loretto said in a news release.

“Loretto is the only organization in Central New York that can support all dementia levels and all income levels. Through this initiative, we are investing even more in the care that we provide as the need grows and this disease evolves,” Dr. Kimberly Townsend, president and CEO of Loretto, contended.

The organization announced the project during an Oct. 19 news conference and groundbreaking ceremony at the Nottingham.

Loretto in its release cited data from the Alzheimer’s Association indicating that the number of Americans age 65 and older living with memory loss is projected to jump from 5.1 million in 2016 to 16 million in 2050. Nearly 18 percent of that growth will happen in New York.

The memory loss would be the result of Alzheimer’s and other dementia conditions, Loretto noted.

Donation

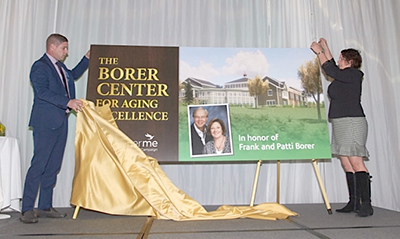

The work at the Nottingham will include a new building, which will be called the Borer Center for Aging Excellence.

Frank and Patti Borer and their family have pledged $1 million to Loretto’s RememberMe Capital Campaign in support of the memory-care initiative.

The campaign’s goal is $5 million, Julie Sheedy, VP of marketing and the Foundation, tells CNYBJ in an email.

Loretto is already over the $3.6 million mark in the RememberMe Capital Campaign, “thanks to the Borers and others who have already contributed to this campaign,” per the release.

For their donation, Loretto honored the Borers with its Legacy Award during its annual luncheon held Oct. 18.

Project details

Providence, Rhode Island–based Gilbane Building Co., which has a Syracuse office, is the contractor for the project, according to information that Sheedy provided CNYBJ.

QPK Design of Syracuse is providing architectural and civil-engineering services. John P. Stopen Engineering, also of Syracuse, is handling the structural-engineering work.

The Center for Aging Excellence at the Nottingham will include a new living community for residents living with dementia. The facility will “enable residents to maintain their independence for as long as possible without jeopardizing their safety,” Loretto said.

The Nottingham Center for Aging Excellence will also provide classrooms, offices, and common spaces to support continuing education for staff and family on the care and treatment of those with dementia.

The Heritage will undergo renovations to incorporate the latest designs and technology to support residents with dementia. Loretto describes the Heritage as the “first residential program of its kind in Central New York created to care for those with Alzheimer’s disease or other dementias.”

The Cunningham, which houses a dedicated dementia floor for the most advanced-stage residents, will also undergo renovations to implement the latest designs and technology to meet the needs of those in the late stages of the disease. The renovations will include upgraded window treatments to optimize use of natural light.

It’ll also include new technology, such as headphones and computers, to provide various options for residents to benefit from calming music and interactive games to stimulate memory and reduce agitation.

Northern Credit Union converts to state charter

WATERTOWN — The New York State Department of Financial Services (DFS) has approved Northern Credit Union’s application to convert its charter to conduct business to a New York State charter, effective Oct. 18. Prior to the conversion, Northern Credit Union operated as Northern Federal Credit Union, the DFS said in an Oct. 1 news release.

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

WATERTOWN — The New York State Department of Financial Services (DFS) has approved Northern Credit Union’s application to convert its charter to conduct business to a New York State charter, effective Oct. 18.

Prior to the conversion, Northern Credit Union operated as Northern Federal Credit Union, the DFS said in an Oct. 1 news release.

In addition to the charter conversion, Northern Credit Union announced it has broken ground on a new branch office in Adams.

Northern Credit Union currently serves about 30,000 members through seven locations across the North Country and through an online and mobile-banking program.

Charter conversion

With the charter conversion, the credit union will now be able to expand its community-based field of membership to serve people, businesses, and other legal entities in Jefferson, Lewis, St. Lawrence, Oswego, Clinton, Franklin, Onondaga, and Madison counties.

Northern’s current field of membership includes Jefferson, Lewis and parts of St. Lawrence counties and the credit union has assets of $244 million.

“As the need for increased accessibility to financial options grows within our communities, so does our commitment to Northern and Central New York,” Dan St. Hilaire, president and CEO of Northern Credit Union, said in the DFS release. “Becoming a state-charted credit union and expanding our field of membership will enable the progression of our core mission of providing personalized service and banking solutions to enhance the financial well-being to a greater number of families and individuals. We look forward to a long-lasting, mutual value partnership with DFS, our communities, and members.”

New York currently has a total of 139 state-chartered commercial banks, savings banks and bank-holding companies; 15 state-chartered credit unions; 84 foreign branches; 10 foreign agencies; and 27 representative offices, with assets totaling more than $1.8 trillion.

Adams location

Northern Credit Union’s new building is located on County Route 178, just off Interstate 81. The credit union says it will provide “easier access” to southern Jefferson County members and those who frequently travel on I-81.

The upcoming branch is replacing the existing office along Route 11 in Adams, Northern said in an email response to a CNYBJ inquiry. The credit union didn’t provide a cost figure for the project.

Northern Credit Union expects contractors to complete construction by late spring 2019.

GYMO Architecture, Engineering, & Land Surveying of Watertown is the site architect and engineer, and Hueber-Breuer Construction Co. Inc. of Syracuse is the general contractor on the project.

The new branch will have a self-service area with two “personal tellers” with “ATM functionality.” The exterior will offer three drive-thru lanes including three “personal tellers” that members can also use as ATMs.

The branch interior will offer an automatic coin machine; two offices to connect members directly with lenders and advisors through secure video chat; a conference room that features the same technology; a children’s play area and refreshment zone; and a tablet-equipped waiting area.

“We’re elated to make this significant investment for members in southern Jefferson and northern Oswego counties and hope they will enjoy their modern relationship center and convenient new location,” St. Hilaire said in a credit union news release.

SBA announces FY 2018 small-business loan data, top regional lenders

SYRACUSE — The U.S. Small Business Administration (SBA) on Oct. 11 released its fiscal year (FY) 2018 lending report, with 670 7(a) and 504 loan approvals valued at $177 million across the 34-county Syracuse district. “Small businesses in upstate New York are accessing the affordable capital they need to start and expand with SBA-backed loans,”

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE — The U.S. Small Business Administration (SBA) on Oct. 11 released its fiscal year (FY) 2018 lending report, with 670 7(a) and 504 loan approvals valued at $177 million across the 34-county Syracuse district.

“Small businesses in upstate New York are accessing the affordable capital they need to start and expand with SBA-backed loans,” Bernard J. Paprocki, director of the SBA Syracuse district office, said in a release.

Paprocki also announced the most active lenders in the Central New York and Southern Tier regions for federal fiscal year 2018 that ended Sept. 30. In Central New York, Buffalo–based M&T Bank (NYSE: MTB); Pittsfield, Massachusetts–based Berkshire Bank; and Utica–based Adirondack Bank had the highest number of 7(a) approvals in their respective categories, based on asset size.

In the Southern Tier, M&T Bank; Five Star Bank, which is based in Warsaw in Wyoming County; and Tioga State Bank, which is based in Spencer in Tioga County, had the highest number of 7(a) approvals in their respective categories, based on asset size.

The 7(a) loan program is the most widely used access-to-capital SBA program, with flexible use of proceeds and a loan maximum of $5 million.

The SBA’s 504 program offers long-term, fixed-rate financing for major assets such as land, building, and equipment with a loan maximum of $5 million.

Overall lending

For the 12th straight year, M&T Bank topped all large commercial banks in the Central New York region and the entire 34-county Syracuse district in small-business lending, the SBA said. M&T Bank in fiscal year 2018 assisted small businesses in Central New York with 58 loans at a value of $3.3 million and district-wide with 102 loans totaling $7.8 million.

For the fourth year in a row, Berkshire Bank was the most active large community lender in the Central New York region and the entire Syracuse district. Berkshire Bank approved 45 loans to Central New York businesses, valued at $4.2 million and 92 loans district-wide worth $10.2 million.

Adirondack Bank was the top small community lender in Central New York with 12 loan approvals valued at $6.3 million.

For the 12th year in a row, M&T Bank topped all large commercial banks in the Southern Tier, per the agency’s news release. M&T Bank in fiscal year 2018 assisted small businesses in the Southern Tier with 33 loans at a value of $3.5 million.

Five Star Bank was the most active large community lender in the Southern Tier for the fourth year in a row, with 20 loans valued at $723,800.

For the second year in a row, Tioga State Bank ranked the top small community lender in the Southern Tier with five approvals worth $409,400.

“Strong relationships with our lending partners and streamlined application processes will continue to help more … entrepreneurs use SBA financing to create jobs and invest in their businesses and communities,” Paprocki said in describing the activity in both the Central New York and Southern Tier regions.

The SBA doesn’t make direct loans to small businesses, but the agency says its use of its guaranty authority enables commercial lenders to make loans to small businesses they would otherwise not have made.

The SBA Central New York region encompasses the 13 counties of Cayuga, Franklin, Fulton, Hamilton, Herkimer, Jefferson, Lewis, Madison, Montgomery, Oneida, Onondaga, Oswego, and St. Lawrence.

The SBA Southern Tier region covers the 10 counties of Broome, Chemung, Chenango, Cortland, Delaware, Otsego, Schuyler, Steuben, Tioga, and Tompkins.

The other 11 counties in the 34-county Syracuse District are in the Capital region.

AmeriCU Credit Union remodels Yorkville branch

YORKVILLE — Construction workers have finished a remodeling project at the Yorkville branch office of Rome–based AmeriCU Credit Union. Plans for the project started in late 2017, and crews started working on the initiative at 4957 Commercial Drive earlier this year, says Nicholas Cray, VP of member relations and marketing, who spoke with CNYBJ on

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

YORKVILLE — Construction workers have finished a remodeling project at the Yorkville branch office of Rome–based AmeriCU Credit Union.

Plans for the project started in late 2017, and crews started working on the initiative at 4957 Commercial Drive earlier this year, says Nicholas Cray, VP of member relations and marketing, who spoke with CNYBJ on Oct. 22.

“We began in earnest in June and [continued] through the early part of September … We were able to remain open during that time,” he notes. AmeriCU didn’t provide a project cost total.

Rin-Buhr Construction Corporation of Utica was the general contractor for the project, says Cray.

AmeriCU opened its Yorkville location in 1999, and “it was due” for some improvement work. It was “still completely functional, but not as modern as we’d prefer. That precipitated the project,” says Cray.

He described the remodeling effort as “fairly extensive,” noting that involved removing cubicles, putting in new offices, and adding new paint and wallpaper. “Really just a complete facelift,” he says.

Cray also notes that AmeriCU members visiting the branch will see that the credit union has replaced all print posters with digital screens following the project.

The Greater Utica Chamber of Commerce on Oct. 17 held a formal opening to acknowledge the remodeling project.

“This remodel has brought a new look and feel to our Financial Center after being here for almost 20 years,” Ellen Traub, manager of the Commercial Drive financial center, said in the chamber’s news release. “The new offices allow us to offer our members a more professional, private experience and our waiting area is much more open and inviting.”

The Yorkville branch has 26 employees, says Cray.

AmeriCU refers to its branches as “financial centers.” When asked about why they’re described as such, Cray says the branches offer a “wide variety of other services.”

“Through some subsidiaries, we offer insurance, investment, retirement planning, capital management … those types of things that are not traditionally associated with a bank branch,” he explains.

The nonprofit AmeriCU has more than 130,000 members and nearly $1.5 billion in assets. It operates 19 full-service financial centers in Central and Northern New York.

Visions updates website and plans upgrade for online banking portal

ENDWELL — Visons Federal Credit Union announced it has revamped its website to make it more “user-friendly and informative.” The new design seeks to make it easier for members to identify helpful resources. One of the site changes involves adding the “Articles and Magazines” section under the Resources tab. The articles cover topics ranging from

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ENDWELL — Visons Federal Credit Union announced it has revamped its website to make it more “user-friendly and informative.” The new design seeks to make it easier for members to identify helpful resources.

One of the site changes involves adding the “Articles and Magazines” section under the Resources tab. The articles cover topics ranging from refinancing student loans and auto loans to identity theft and homeownership, Visions said in a news release posted on the website.

Visions said phase two of the updates made to its website will focus on enhancing the online banking portal for all members. That upgrade is scheduled for Nov. 6.

Visions Federal Credit Union, based in Broome County, serves nearly 200,000 members in communities throughout New Jersey, New York, and Pennsylvania.

Community banks in today’s digital world

Banking technology has changed exponentially over the past decade. From online banking and mobile deposits to enhancements in fraud monitoring, the way we use and monitor money is changing faster than consumers can keep up. These advancements have left many wondering where that leaves banks. Will the community bank disappear in today’s digital world? As a

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Banking technology has changed exponentially over the past decade. From online banking and mobile deposits to enhancements in fraud monitoring, the way we use and monitor money is changing faster than consumers can keep up. These advancements have left many wondering where that leaves banks. Will the community bank disappear in today’s digital world?

As a 30-year veteran of the financial industry, I’ve seen the incredible and positive impact technology advancements have had on the way we do business. In my current position, evaluating how technology can advance our offerings is part of our everyday discussions.

Technology is all about service

As a banking industry, our technology is all about efficiency, stability, and service. We want to make banking easier and more secure for our customers. To provide the best service possible, banks need an enhanced online-banking platform, robust enterprise-level call-center management tools, and technologies to increase internal efficiencies.

In addition to customer-facing technology, banks have a whole team of experts behind-the-scenes ensuring our internal technology is providing the best possible security and service to our customers.

However, while banks will continue to rely more on technology, the need for a human connection will remain.

A need for relationships

When customers walk through the doors of a bank for a mortgage, business loan, or other service, they normally have a lot of questions. What’s the best option for me? How long will this take? What’s the next step?

As any financial professional will tell you, each situation is unique and the answers to these questions are different for every customer. The need for a face-to-face conversation to determine these answers is where the value in personal banking relationships lies, and that’s something online and mobile banking will never be able to completely replace.

We hear from customers time and time again that they choose a bank because they feel heard, appreciated, and understood.

The future of banking

When I look at the future of banking, I’m extremely excited about what’s to come. Technology will be ingrained in what we do like never before, helping us further our goal of helping customers with their financial needs whenever and wherever it’s needed.

Advancements in technology will increase our abilities to understand and address customers’ needs at all times.

From simple banking functions like making a loan payment and account transfers to more advanced services like opening accounts and applying for loans, the customer should and will have the option to conduct these in branch or in the comfort of their home based on their preferences. No customer is alike, and strong technology will be the driving factor to ensure all of our customer needs are met — in branch and beyond.

Hal Wentworth is senior VP of retail banking at Community Bank N.A., which is headquartered in DeWitt and has more than 230 branches across upstate New York, northeastern Pennsylvania, western Massachusetts, and Vermont.

Hal Wentworth is senior VP of retail banking at Community Bank N.A., which is headquartered in DeWitt and has more than 230 branches across upstate New York, northeastern Pennsylvania, western Massachusetts, and Vermont.

How a Bank Can Help Your Business Succession Planning

Whether you’re getting ready for retirement, just starting out in the leadership of your business, or are considering an ownership role in your future career, the best thing you can do to prepare yourself and your current or future business for success is to build a relationship with a commercial banker. Two of the most

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Whether you’re getting ready for retirement, just starting out in the leadership of your business, or are considering an ownership role in your future career, the best thing you can do to prepare yourself and your current or future business for success is to build a relationship with a commercial banker.

Two of the most common types of business succession are the sale of a business or an internal leadership change. Internal leadership changes are most common in family businesses. I’d like to take a minute to recognize the impressive work that goes into starting, running, and continuing the legacy of a family business. This is no small feat, and that’s why NBT Bank is the presenting sponsor for the 4th annual Family Business Awards of CNY on Dec. 4, 2018, produced by BizEventz.

Even if business succession seems far in the future, if you don’t have a succession plan and a successor (family member, current employee, or outside party) identified, it’s important to start thinking about it now.

Your commercial banker is an excellent place to start if you are a current business owner. Your banker has access to a team of financial professionals at his or her bank that can take the necessary time now to understand your current financial position as well as your goals for retirement and business continuity. This team will then help you build a plan that considers timing, financial needs, ideal sale/purchase terms, and the continued legacy of your business.

If you are on the other side of the succession equation and are planning to take over a business-ownership role, then it is even more critical to build a relationship with a commercial banker as soon as possible. To best position yourself for an optimal purchase structure and to ensure you are able to secure the necessary funding for the purchase or buyout of a business, your bank will need to get to know you, see your personal financial history, review your business plan, and understand your goals for the future of the business.

While many people only think about the initial loan from a bank that may be required to purchase a business, the most successful business leaders are already thinking much farther down the road. If you are planning to buy into an existing company, then you should also be talking with your commercial-banking team about how you plan to finance operations, banking products to support cash management and employee services, as well as plans for future growth.

There is a lot of information that will be required to prepare for that first meeting. Among other things, a bank will evaluate and help new owners to consider the following questions:

• What connections, management, and other attributes did the prior owner bring to the business?

• How reliant is the business sustainability upon the previous owner?

• What is the expertise of the people who are staying in the business to help ensure continued success?

• Is there a non-compete agreement and/or management contract with the prior owner?

• What was the last owner taking from the company via salary and benefits?

• Is the projected annual loan servicing that is being taken out to purchase the business offset by what the prior owner was taking? (The goal for the new owner is to not exceed the amount of his/her annual loan payments to what the previous owner was taking out of the business.)

• How many new owners will there be? If there will be more than one owner, what is their strategy for managing and decision-making?

We have worked with plenty of current and potential business owners who work hard to make sure they consider all these components for their business (and personal) success. We have also seen many who are not nearly as prepared as they thought they needed to be. It’s important to discuss with your bankers the myriad scenarios involved in local business transitions so you can set up the company for long-term sustainability.

Richard Shirtz is NBT Bank’s regional president serving Onondaga, Oswego, and Cortland counties. He is responsible for NBT’s commercial banking business and geographic oversight of all other area business units. Shirtz joined NBT as part of the bank’s acquisition of Alliance Bank in 2013 and has more than 30 years of commercial-banking experience.

Richard Shirtz is NBT Bank’s regional president serving Onondaga, Oswego, and Cortland counties. He is responsible for NBT’s commercial banking business and geographic oversight of all other area business units. Shirtz joined NBT as part of the bank’s acquisition of Alliance Bank in 2013 and has more than 30 years of commercial-banking experience.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.