Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

MMRI, MVHS, SUNY Poly form Mohawk Valley Biotech Collective

UTICA, N.Y. — Three Mohawk Valley Institutions on Wednesday formed the MV Biotech Collective, which is designed to “position the Mohawk Valley as a leader in biomedical innovation.” Representatives from the Masonic Medical Research Institute (MMRI), SUNY Polytechnic Institute (SUNY Poly), and Mohawk Valley Health System (MVHS) signed a memorandum of agreement to formally establish […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

UTICA, N.Y. — Three Mohawk Valley Institutions on Wednesday formed the MV Biotech Collective, which is designed to “position the Mohawk Valley as a leader in biomedical innovation.”

Representatives from the Masonic Medical Research Institute (MMRI), SUNY Polytechnic Institute (SUNY Poly), and Mohawk Valley Health System (MVHS) signed a memorandum of agreement to formally establish the alliance.

The MV Biotech Collective “unites the core strengths” of the three institutions: MMRI’s “foundational” scientific research, MVHS’s “critical clinical excellence” and SUNY Poly’s “advanced academic innovation,” the organizations contend.

“This signing is more than a formal agreement; it is the ignition point for a new era of scientific progress in New York State,” Maria Kontaridis, MMRI executive director, said. “By functioning as one unified team, we are able to accelerate scientific output, generate high-value IP, and drive economic development.”

Kontaridis is also the Gordon K. Moe professor and chair of biomedical research and translational medicine of MMRI.

Separately, the three organizations have been working on biotechnology projects within their own disciplines, MMRI said. The partnership will allow for easy cross-institutional collaboration, encouraging clinicians, scientists, faculty, and students to work together on shared projects.

The MV Biotech Collective’s primary goal is to foster a “one team” approach, enabling joint grant applications and strengthening established lines of research. It will allow the organizations to focus on artificial intelligence (AI) as a tool to “dramatically” accelerate the pace of discovery and create a biomedical hub in the region.

The Collective seeks to build entrepreneurship and innovation, supporting and growing new biomedical companies and “serving as a catalyst for regional economic growth,” MMRI said.

The Collective has plans to begin bringing the organizations together to form committees and create a three, five and 10-year strategic plan.

UTICA, N.Y. — The City of Utica is seeking state funding for downtown-improvement projects from two New York programs focusing on such projects. The city

Year-End Benefits Check: Is Your Team Getting the BOOST They Deserve for 2026?

As we close out 2025 and finalize employee benefits for the coming year, there’s one question every small to medium-sized business owner should ask: Are

Tompkins Financial Advisors’ chief investment officer to retire

ITHACA, N.Y. — Tompkins Financial Advisors announced that Geoff Blyth, senior VP and chief investment officer, has decided to retire in early 2026 from his role — after nearly seven years in the position. Tompkins Financial Advisors is the wealth-management arm of Tompkins Financial Corp. (NYSE: TMP), an Ithaca–based financial services holding company that is

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ITHACA, N.Y. — Tompkins Financial Advisors announced that Geoff Blyth, senior VP and chief investment officer, has decided to retire in early 2026 from his role — after nearly seven years in the position.

Tompkins Financial Advisors is the wealth-management arm of Tompkins Financial Corp. (NYSE: TMP), an Ithaca–based financial services holding company that is also parent of Tompkins Community Bank.

As Blyth prepares to step away from his full-time role, he will support the company in its search for a successor in the coming months and helping with the transition.

Blyth is responsible for leading the Tompkins Financial Advisors’ Investment Committee, overseeing the team-oriented and collaborative approach to the firm’s overall investment process and strategy, and working closely with clients on their portfolio needs. With 30 years of portfolio and investment management experience, he previously served as chief investment officer at Genesee Valley Trust Company and senior investment strategist at CNB Wealth Management. Blythe is a graduate of Colgate University.

“Geoff’s outstanding leadership and dedication have left an indelible mark on Tompkins,” Eric Taylor, president of Tompkins Financial Advisors, said in the announcement. “He set a remarkable example through his commitment to our clients, our team and the communities we serve, setting the standard for excellence, integrity and confidence in our strategies that we will continue to uphold as Tompkins grows and evolves. We’re deeply grateful for his years of service and wish him all the best as he embarks on this next chapter.”

St. Joseph’s Health expands orthopedic, spine care with launch of new practice

SYRACUSE, N.Y. — St. Joseph’s Health has announced the upcoming opening of St. Joseph’s Health Orthopedic and Spine Care, which expands access to orthopedic and

Onondaga County reaches new contract agreement with deputy sheriff’s police association

SYRACUSE, N.Y. — Onondaga County on Wednesday announced a tentative contract agreement with the Onondaga County Deputy Sheriff’s Police Association (OCSPA). The four-year pact includes

Point Place Casino formally opens new hotel, restaurant, event space

SULLIVAN, N.Y. — The Oneida Indian Nation on Monday formally opened the newly expanded Point Place Casino Hotel in the Bridgeport area of the town

Ithaca company wins $500K in Grow-NY competition; NYC firm wins grand prize

CANANDAIGUA, N.Y. — An Ithaca business secured $500,000 in the seventh annual Grow-NY agribusiness competition held last week in Canandaigua. The company called Seen Nutrition is a food tech startup in the menopause market, initially focused on bone health, with a patented dietary calcium chew made with dairy produced in Central New York. Brekland of

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

CANANDAIGUA, N.Y. — An Ithaca business secured $500,000 in the seventh annual Grow-NY agribusiness competition held last week in Canandaigua.

The company called Seen Nutrition is a food tech startup in the menopause market, initially focused on bone health, with a patented dietary calcium chew made with dairy produced in Central New York.

Brekland of Brooklyn was the $1 million grand-prize winner, Gov. Kathy Hochul said in announcing the winners. Brekland is building a novel, biodegradable foam coating that brings new, in-field functionality to crop protection products.

The competition awarded a total of $3 million in prize money to seven of the 20 finalists selected for the Grow-NY business accelerator.

Winners were announced at the Grow-NY Summit, a two-day event in Canandaigua where finalists pitched their business plans to a panel of expert judges.

Besides Seen Nutrition, Mothership Materials of New York City also won $500,000. The $250,000 winners included Living Ink Technologies of Berthoud, Colorado; Trebe Biotech of Pergamino, Buenos Aires, Argentina; Whipnotic of New York City; and ZILA BioWorks of Renton, Washington.

Each winning company will establish operations in the region for at least one year and provide a modest equity stake to Cornell University, helping to fund future food and agriculture-entrepreneurship programs.

Cornell University’s Center for Regional Economic Advancement administers the competition, which is focused on “enhancing the emerging food, beverage and agriculture innovation cluster” in Central New York, Finger Lakes and Southern Tier regions, per the Hochul announcement.

“Grow-NY exists to create lasting economic development by attracting startups and investors into our world class agrifood ecosystem, leveraging innovation to create opportunity, supporting and creating growth for new and existing ventures alike,” Jenn Smith, Grow-NY program director, said in the state’s announcement. “We are thrilled to have this year’s winners help us accomplish our goals while moving toward their own.”

Allegiant Air to increase flights from Syracuse directly to Fort Lauderdale in February

SYRACUSE, N.Y. — Allegiant Air will expand its nonstop flights from Syracuse Hancock International Airport (SYR) directly to Fort Lauderdale-Hollywood International Airport (FLL) next year.

New York manufacturing index in November hits highest level in a year

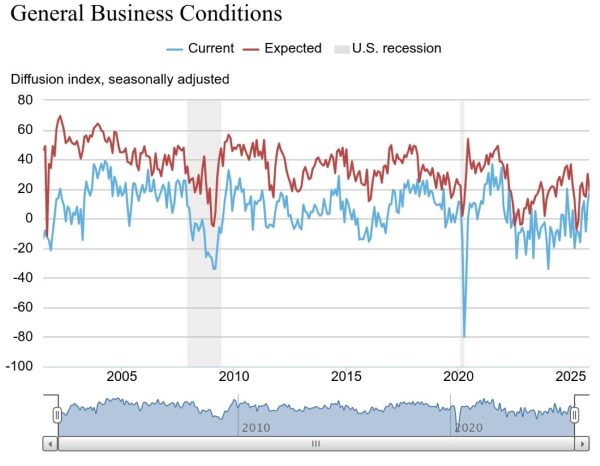

The general-business conditions index of the Empire State Manufacturing Survey rose 8 points to 18.7 in November, its fourth positive reading in the past five

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.