Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

New York health-care laws that went into effect on Jan. 1

ALBANY, N.Y. — With 2026 underway, new health-care laws are now in effect in New York state. Health insurers will be required to cover medically

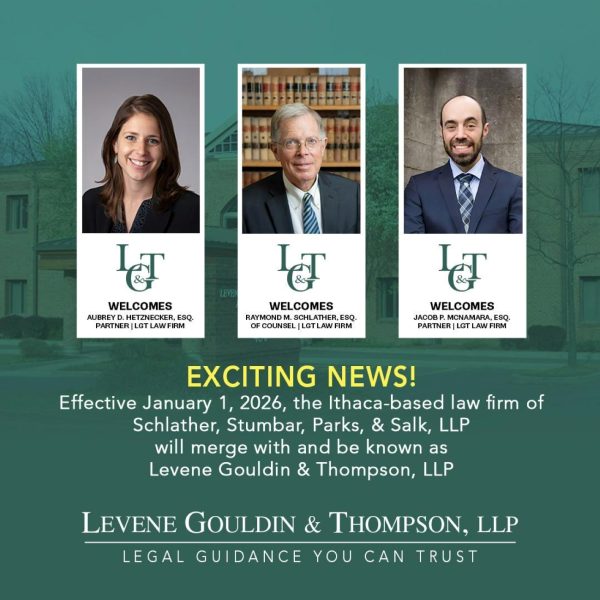

Ithaca law firm combines with Vestal firm

VESTAL, N.Y. — The Ithaca law firm of Schlather, Stumbar, Parks & Salk, LLP (SSPS) has combined with the Vestal–based law firm of Levene Gouldin

Guthrie Clinic names new president of Corning Hospital

CORNING, N.Y. — Guthrie Clinic has appointed Jennifer Yartym as the new president of Guthrie Corning Hospital, effective Jan. 1. Yartym, who is currently serving as president of Guthrie Cortland Medical Center, will also continue in that role, per the health system’s Friday announcement. Her appointment at Corning Hospital comes as Paul VerValin steps down

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

CORNING, N.Y. — Guthrie Clinic has appointed Jennifer Yartym as the new president of Guthrie Corning Hospital, effective Jan. 1.

Yartym, who is currently serving as president of Guthrie Cortland Medical Center, will also continue in that role, per the health system’s Friday announcement.

Her appointment at Corning Hospital comes as Paul VerValin steps down from his role as Corning Hospital president to focus on Guthrie Clinic responsibilities as executive VP and COO.

“As President of both hospitals, I will focus on creating consistency and standardizing processes to deliver the highest quality care,” Yartym said in the announcement. “I am fortunate to work with strong leaders and caregivers at both hospitals to support this work.”

Before joining Cortland Medical Center in 2019, Yartym was with Corning Hospital for 19 years, including time as VP of operations. She also served as interim hospital president during the COVID-19 pandemic, guiding response and recovery.

Mohawk Valley REDC awards funding to several projects

Mohawk Valley projects in Utica, Marcy, and at SUNY Oneonta are among those awarded funding through the state’s Regional Economic Development Council (REDC) initiative. The

Central New York projects awarded more than $26 million in state REDC funding

Projects in Cicero, Camillus, and Cortland are among those in Central New York awarded a total of $26.2 million through the state’s Regional Economic Development

After inaugural event, INSPYRE Innovation Hub to host another fireside chat this spring

SYRACUSE, N.Y. — CenterState CEO’s INSPYRE Innovation Hub (the former Tech Garden) has plans to host another in a series of fireside chats following the Dec. 11 inaugural event. The next fireside chat is set for this spring, with more details to come, per the M&T Bank (NYSE: MTB) announcement. The speaker series is the

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE, N.Y. — CenterState CEO’s INSPYRE Innovation Hub (the former Tech Garden) has plans to host another in a series of fireside chats following the Dec. 11 inaugural event.

The next fireside chat is set for this spring, with more details to come, per the M&T Bank (NYSE: MTB) announcement.

The speaker series is the first initiative to be created through M&T Bank’s founding sponsor partnership with the INSPYRE Innovation Hub.

The first fireside chat featured Jeff Knauss, CEO and co-founder of Arcovo AI, an artificial intelligence (AI) automation agency that empowers small and mid-size firms to integrate advanced AI solutions into everyday workflows.

Arcovo AI is also a tenant at INSPYRE Innovation Hub.

The new quarterly series is the first program developed as part of M&T’s long-term, multi-year partnership with INSPYRE Innovation Hub.

INSPYRE fireside chats are “intimate and candid conversations highlighting the pivotal moments, challenges and breakthroughs that have defined the entrepreneurial journeys of Central New York innovators,” M&T Bank said.

Those attending will hear about “building resilient businesses, navigating uncertainty, cultivating visionary leadership and remaining grounded while pursuing bold ideas,” per the announcement.

Arc Herkimer receives NYSARC guardianship grant

HERKIMER, N.Y. — NYSARC Trust Services has awarded Arc Herkimer a $14,250 grant to “support and enhance” operating expenses of its guardianship program during 2025.

Delta Air Lines to eliminate service to Binghamton airport in February

MAINE, N.Y. — Delta Air Lines has told the Greater Binghamton Airport that it will eliminate its service to the facility in February. Mark Heefner,

East Adams, former Syracuse Developmental Center property housing projects awarded state funding

SYRACUSE, N.Y. — The state has awarded millions to Syracuse housing projects in the East Adams neighborhood and at the site of the former Syracuse

SYRACUSE, N.Y. — Paige’s Childhood Cancer Fund has donated $200,000 to benefit cancer care and research at Upstate Golisano Children’s Hospital. Paige officials and family members presented the check to the Upstate Foundation and hospital officials in a brief ceremony on Monday in the Kinney Performance Center of Upstate Golisano Children’s Hospital in Syracuse, per

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE, N.Y. — Paige’s Childhood Cancer Fund has donated $200,000 to benefit cancer care and research at Upstate Golisano Children’s Hospital.

Paige officials and family members presented the check to the Upstate Foundation and hospital officials in a brief ceremony on Monday in the Kinney Performance Center of Upstate Golisano Children’s Hospital in Syracuse, per the Upstate Medical University website.

Paige’s Butterfly Run — which is now operating as Paige’s Childhood Cancer Fund —has raised nearly $5 million to support pediatric-cancer care and research at Upstate Golisano Children’s Hospital since 1997. The money provides direct assistance to families facing childhood cancer and blood disorders, helping cover expenses such as food, gas, medical costs, and supportive services, while also advancing clinical care and research initiatives.

“We are deeply grateful to Paige’s Childhood Cancer Fund and its supporters for their continued commitment to our patients and families,” Dave Bartell, assistant vice president for development at the Upstate Foundation for Upstate Golisano Children’s Hospital, said in the announcement. “Their partnership makes a lasting difference by strengthening services that support families during some of the most challenging moments of their lives.”

The Upstate Foundation is the philanthropic arm of Upstate Medical University and works to connect donor generosity with meaningful impact across patient care, education and research.

“Paige’s Childhood Cancer Fund experienced an extraordinary year of growth thanks to our generous supporters,” Chris Arnold, Paige’s father and co-chair of Paige’s Childhood Cancer Fund board, said. “Our contribution affirms our commitment to walk with families from diagnosis through survivorship — and, in heartbreaking cases, bereavement. It is an honor to support both the families we serve and the extraordinary frontline team at the pediatric cancer center at Upstate Golisano Children’s Hospital, in loving memory of Paige Yeomans Arnold, a precious life cut short.”

Also participating in the presentation was Paige’s mother, Ellen Yeomans, and Paige’s grandparents.

Paige’s Childhood Cancer Fund honors the life of Paige Yeomans Arnold, who was diagnosed with leukemia in 1993 at age 6 and died a year later from complications related to a bone marrow transplant. The organization raises funds through multiple events throughout the year, including its signature annual event held each June.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.