Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

ESD seeks applications for second round of Grow-NY agribusiness competition

Empire State Development (ESD) is now accepting applications for the 2020 Grow-NY agribusiness competition. Grow-NY — in the second year of its three-year initiative — targets the food and agriculture cluster in Central New York, the Finger Lakes, and the Southern Tier regions of New York. The competition attracts “high-growth” food and agriculture startups “from […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Empire State Development (ESD) is now accepting applications for the 2020 Grow-NY agribusiness competition.

Empire State Development (ESD) is now accepting applications for the 2020 Grow-NY agribusiness competition.

Grow-NY — in the second year of its three-year initiative — targets the food and agriculture cluster in Central New York, the Finger Lakes, and the Southern Tier regions of New York.

The competition attracts “high-growth” food and agriculture startups “from around the world and across the state” to the Grow-NY region where they compete for a combined total of $3 million in prize money.

ESD says it will accept applications through July 15. From the applications submitted, ESD will select up to 20 finalists.

The selected finalists will receive mentorship from a business advisor; marketing promotion and publicity support for their startup; an expenses-paid, three-day business development trip to the Grow-NY region for up to two finalists per team; and introductions to potential investors.

The competition

Beginning in August, selected teams will enter into a mentoring and business-development phase that will run from September to November. Finalists will pitch their ideas and business plans at the Grow-NY Food and Ag Summit, a public symposium and industry forum, on Nov 17 and 18 at a soon-to-be-announced location in Syracuse. One team will be awarded the top prize of $1 million. Two $500,000 prizes and four $250,000 prizes will also be handed out.

Judges will base their decisions on five criteria, including viability of commercialization and business model, customer value, food and agriculture innovation, regional job creation, and the “quality and completeness of the team and its readiness to deliver.”

Winners will be required to “create a positive impact” in the Grow-NY region by “growing” job opportunities, connecting with local industry partners, and contributing to the region’s economy.

Cornell University administers the competition through its Center for Regional Economic Advancement.

“The Grow-NY program helps Cornell achieve its land grant mission by leveraging the abundant natural, commercial, and academic resources in our region to attract innovations in food and agriculture that help our community grow, make, move, and sell food more sustainably and with greater efficiency,” Kathryn Boor, dean of Cornell’s College of Agriculture and Life Sciences, said in a statement. “This becomes even more vital as we look for ways to recover from the economic effects of COVID-19. We’ve already seen results from the year one winners that fulfil on the promise of the program, and we’re looking forward to more, diverse, high-growth potential applicants in year two.”

Empire State Development is funding the competition through its Upstate Revitalization Initiative connected with the three regions — CNY Rising, Finger Lakes Forward, and Southern Tier Soaring.

Coronavirus fallout: Cornell sets hiring, salary freeze

ITHACA — Cornell University says it has a plan to help it deal with the financial fallout of the coronavirus pandemic, which has squeezed the revenue streams of the higher-education industry. The plan’s elements include a hiring freeze, a salary freeze, and an “immediate” suspension of discretionary spending. Cornell Provost Michael Kotlikoff and Joanne DeStefano,

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ITHACA — Cornell University says it has a plan to help it deal with the financial fallout of the coronavirus pandemic, which has squeezed the revenue streams of the higher-education industry.

The plan’s elements include a hiring freeze, a salary freeze, and an “immediate” suspension of discretionary spending.

Cornell Provost Michael Kotlikoff and Joanne DeStefano, executive VP and CFO, on March 30 sent a message to faculty and staff about the financial cutbacks, per the Cornell website.

“As you would expect, there are both near- and long-term financial impacts of de-densifying our campuses and of making such a rapid shift to virtual learning, and we write today to provide you with details on some immediate steps that we are taking to address these realities,” they wrote.

The school’s blueprint also includes a travel ban, converting all in-person summer programs that were set to start before July 12 to online offerings, a ban on new capital projects, and reevaluating projects already in progress to determine if they should proceed.

“We fully appreciate that these steps are significant. But until we can better understand the full impact of COVID-19 on the economy, financial markets and the university, these steps are essential to our being able to sustain our commitment to our employees and our students and to ensuring that Cornell has the funds necessary to continue to be a world-class university,” the Cornell officials wrote.

Higher-education trend

Cornell is not alone as colleges across the nation have been hit hard by the financial implications of social-distancing measures taken to reduce the spread of the coronavirus. On-campus instruction has ended, residence halls and dining rooms have been emptied, graduation ceremonies have been postponed, and fundraising events have been curtailed. Also, the stock market selloff has hammered universities’ endowment portfolios. Furthermore, prospective students’ family finances have been damaged and on-campus visits have been scrubbed, making it challenging for colleges to fill out their incoming freshman and graduate-school classes for the fall. That’s not to mention uncertainty about future international travel restrictions and the impact that has on international students who are critical revenue sources for many universities.

Hiring freeze

Cornell is implementing a university-wide hiring freeze on staff and temporary workers. The Ivy League university is establishing a process for approval of any exceptions to this freeze. Deans will review all academic hires, the officials said.

Salary freeze

Cornell doesn’t plan to offer salary increases for the fiscal year 2021 that begins on July 1, other than those required by collective-bargaining agreements. The university says it won’t provide increases to existing salaries through bonuses, promotions, acting rates, changes to time status or additional pay without the approval of the respective school officials in charge.

Any salary-change requests already in process will be reevaluated. Salary increases related to faculty promotions are excluded from this freeze.

Discretionary spending

All discretionary spending, including the hiring of outside consultants, is suspended immediately, Cornell says. This includes food/meals, events, recognition banquets and other expenditures that are not critical to the operation of the university.

Capital projects

All existing capital projects will be reevaluated to determine whether they should proceed, and no new capital projects will be approved.

Summer programs

“Given the uncertainty of when normal campus operations will resume,” Cornell says all in-person summer programs or activities, such as summer classes, conferences, etc., that were slated to begin prior to July 12 are canceled or will be converted to online offerings. During this time, the university will continue Cornell summer classes taught remotely. The school hopes to make a decision about programs for the second half of the summer once the situation becomes clearer.

Travel ban

All Cornell-related travel is currently restricted to reduce the spread of COVID-19. When safe travel can resume, the university will only permit essential travel, including essential academic travel, travel on sponsored research funds, travel funded entirely by outside entities, and travel necessary to deliver instruction or outreach programs or to conduct essential university business.

How small businesses can benefit from the $2.2 trillion coronavirus relief package

The newly acted $2.2 trillion stimulus law has several features that will help small businesses stay afloat and keep their employees during the coronavirus crisis. Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act on March 27 and President Trump signed it into law. U.S. Small Business Administration (SBA) Administrator Jovita Carranza and U.S.

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The newly acted $2.2 trillion stimulus law has several features that will help small businesses stay afloat and keep their employees during the coronavirus crisis.

The newly acted $2.2 trillion stimulus law has several features that will help small businesses stay afloat and keep their employees during the coronavirus crisis.

Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act on March 27 and President Trump signed it into law.

U.S. Small Business Administration (SBA) Administrator Jovita Carranza and U.S. Treasury Secretary Steven T. Mnuchin on March 31 announced that the SBA and the Treasury Department have started a “robust mobilization effort of banks and other lending institutions to provide small businesses with the capital they need.”

For small businesses, the key feature of the CARES Act is the $349 billion Paycheck Protection Program, which is specifically designed to help small businesses keep their workforce employed. It will allow businesses to receive low-interest loans, fully guaranteed by the SBA, through participating banks, which will be forgiven if they meet certain requirements.

The new loan program will be available retroactively from Feb. 15, 2020, so employers can rehire their recently laid-off employees through June 30 of this year.

Here is how it works, according to the SBA:

• Who is eligible?: All small businesses, including nonprofits, veterans’ organizations, tribal concerns, sole proprietorships, self-employed individuals, and independent contractors, with 500 or fewer employees, or no greater than the number of employees set by the SBA as the size standard for certain industries

• Maximum loan amount: $10 million

• Loan forgiveness: if proceeds are used for payroll costs and other designated business operating expenses in the eight weeks following the date of loan origination. Note: Because the agency expects an avalanche of companies and people applying, it’s anticipating that no more than 25 percent of the forgiven loan amount may be spent on non-payroll costs.

All loans under this program will have the following features:

• Interest rate of 0.5 percent

• Maturity of 2 years

• First payment deferred for six months

• 100-percent guarantee by SBA

• No collateral

• No personal guarantees

• No borrower or lender fees payable to SBA

The Treasury Department and SBA said they expect to have this program up and running on Friday, April 3, so that businesses can go to a participating SBA 7(a) loan program lender, bank, or credit union to apply for a loan, and “be approved on the same day.”

“Our goal is to position lenders as the single point-of-contact for small businesses — the application, loan processing, and disbursement of funds will all be administered at the community level,” Carranza said.

Rob Simpson, president of CenterState CEO, is urging area companies to call their financial institution and apply as soon as possible.

“Don’t wait to call your bank. Call them now. Let them know your need and interest,” Simpson said on a webinar his organization set up for area businesses on the day the CARES Act was passed. “This is one of the most innovative public policy programs we’ve seen come out of Washington in a while,” he added.

Congressman John Katko (R–Camillus), who also appeared on the webinar, told companies, “You’d be crazy not to apply for it.”

Katko added that all the area banks he talked to would be participating in the program.

As of press time, the SBA didn’t have a link on its website to an application for the Paycheck Protection Program loans, but small businesses can visit SBA.gov/Coronavirus for more information and updates about the program.

The List feature is on temporary hold

The Central New York Business Journal is temporarily putting our weekly The List feature on hold beginning with this issue for the duration of the statewide coronavirus shutdown. Pausing a popular and longstanding part of our publication was not an easy decision, but it necessary to uphold the quality, completeness, and integrity of information we

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The Central New York Business Journal is temporarily putting our weekly The List feature on hold beginning with this issue for the duration of the statewide coronavirus shutdown.

Pausing a popular and longstanding part of our publication was not an easy decision, but it necessary to uphold the quality, completeness, and integrity of information we pass along to our readers.

The lockdown has disrupted our ability to compile complete lists. Data for most of our lists is collected through surveys sent via email, supplemented with telephone follow-up. With so many organizations temporarily closed, at reduced staff levels, or working from remote locations, we are simply unable to reach many of the contacts who normally provide information.

The current situation also affects the representativeness of data we might be able to collect. We want the information in our lists to show an accurate picture of the organizations listed in terms of size, scope, products/services offered, etc. The results of any survey research are a snapshot in time. Taking a snapshot during this time of COVID-19-related layoffs, facility closures, projects placed on hold, and shifts in operations would provide an extremely atypical and skewed picture of most companies.

We still intend to publish every list on our 2020 editorial calendar. A firm schedule for that can’t be worked out at this uncertain moment. But as soon as the government’s workforce restrictions are lifted, we will resume surveying and produce a timetable for publishing the delayed lists in future issues.

In the meantime, CNYBJ remains committed to providing the business community of our region news and information to help navigate this challenging period.

CNY unemployment rates mostly fell in February

It’s the last report before the coronavirus crisis slammed the state’s job market Unemployment rates in the Syracuse, Utica–Rome, Binghamton, and Ithaca regions declined in February compared to the year-ago month. At the same time, the jobless rate in the Watertown–Fort Drum area rose compared to February 2019, while the rate in the Elmira region

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

It’s the last report before the coronavirus crisis slammed the state’s job market

Unemployment rates in the Syracuse, Utica–Rome, Binghamton, and Ithaca regions declined in February compared to the year-ago month.

Unemployment rates in the Syracuse, Utica–Rome, Binghamton, and Ithaca regions declined in February compared to the year-ago month.

At the same time, the jobless rate in the Watertown–Fort Drum area rose compared to February 2019, while the rate in the Elmira region remained unchanged.

The figures are part of the latest monthly New York State Department of Labor data released on March 31.

The February data reflects a time before the coronavirus pandemic hit the state, necessitating a shutdown of non-essential businesses and much of daily life in the second half of March. Weekly jobless claims filings soared in the state, so unemployment rates are likely to jump across the state when the March jobs report comes out.

Regional unemployment rates

The jobless rate in the Syracuse area fell to 4.7 percent in February from 5 percent in the year-earlier period.

The Utica–Rome region’s unemployment rate slipped to 4.8 percent from 5.2 percent; the Watertown–Fort Drum area’s number inched up to 7.1 percent from 7 percent; the Binghamton region’s rate dipped to 5.3 percent from 5.4 percent; the Ithaca area posted a 3.6 percent rate, down from 3.8 percent; and the Elmira region’s rate was unchanged at 4.7 percent.

The local unemployment data isn’t seasonally adjusted, meaning the figures don’t reflect seasonal influences such as holiday hires.

The unemployment rates are calculated following procedures prescribed by the U.S. Bureau of Labor Statistics, the state Labor Department said.

Statewide unemployment rate

New York state’s unemployment rate was 3.7 percent in February, down from 3.8 percent in January and 4 percent in February 2019.

The federal government calculates New York’s unemployment rate partly based upon the results of a monthly telephone survey of 3,100 state households that the U.S. Bureau of Labor Statistics conducts.

Upstate Medical University seeks recovered COVID-19 patients for “emergency” clinical trial

SYRACUSE, N.Y. — Upstate Medical University is seeking people who have recovered from the illness caused by coronavirus to donate plasma in an “emergency” clinical

Unemployment Insurance Benefits Under the CARES Act

On March 27, 2020, President Trump signed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) — a $2.2 trillion stimulus bill to respond to the coronavirus pandemic. The unemployment-insurance portion of this act, known as the Relief for Workers Affected by Coronavirus Act, provides enhanced unemployment benefits including larger benefit amounts, availability for

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

On March 27, 2020, President Trump signed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) — a $2.2 trillion stimulus bill to respond to the coronavirus pandemic. The unemployment-insurance portion of this act, known as the Relief for Workers Affected by Coronavirus Act, provides enhanced unemployment benefits including larger benefit amounts, availability for a longer period of time, and extended coverage for individuals who are not typically eligible for unemployment benefits, as outlined below.

A. Increased benefits

Under the CARES Act, individuals who are already eligible to receive unemployment benefits under state law will receive an additional $600 per week on top of their state benefits. This amount is a flat rate for everyone, no matter the amount of underlying benefits they would normally receive from their state. For example, a laid-off worker who is eligible and receives the maximum unemployment benefit in New York of $504 per week will receive a total of $1,104 ($504 in state benefits + $600 in federal pandemic unemployment compensation). However, a laid-off employee who receives a lower amount of state unemployment benefits will receive the same weekly $600 payment. It is currently unclear, however, if this additional weekly payment will be available to individuals who are receiving partial unemployment benefits from their state, or who are participants in a shared-work program.

States can provide the additional $600 in one payment or send the extra amount separately, as long as it is all done on the same weekly basis. Because the additional federal unemployment payment is a flat $600 for all eligible individuals, it is possible that some individuals could receive more in unemployment benefits than they would if they continued working.

Importantly, the additional income received through enhanced unemployment benefits will not affect individuals’ eligibility for other federal benefits like Medicaid and the Children’s Health Insurance Program (CHIP). While eligible individuals will apply through their state for benefits, the additional $600 weekly payment will be fully reimbursed by the federal government. This increased unemployment benefit will be available to individuals who independently qualify for and receive state unemployment benefits through July 31, 2020.

B. Extended time for benefits

Many states, including New York, provide for 26 weeks of unemployment benefits. The CARES Act will provide certain eligible workers with an additional 13 weeks of benefits, up to 39 total weeks. While each state will pay out the extended benefits to eligible workers, the federal government will reimburse each state in full for the additional benefits paid out. The 13 weeks of extended unemployment benefits would apply to two categories of applicants:

Those who meet the expanded eligibility criteria discussed in Section D below, who are unemployed, partially unemployed, or unable to work due to a qualifying reason related to COVID-19 at any time from Jan. 27, 2020 through Dec. 31, 2020; or

Those who have exhausted their typical 26 weeks of unemployment eligibility, and are actively seeking work, between enactment of the CARES Act and Dec. 31, 2020, as discussed in Section E below.

C. Waiver of seven-day waiting period

Many states, including New York, typically provide for a seven-day waiting period from layoff or termination before individuals can apply for and receive unemployment benefits. New York has already waived that seven-day waiting period for people who are out of work due to COVID-19-related closures or quarantines. For all states who waive the typical seven-day waiting period, New York included, the federal government will provide full funding for unemployment benefits paid out during that waived waiting period through the end of 2020.

D. Expanded eligibility for COVID-19 related reasons

The CARES Act would also make far more workers eligible for unemployment benefits than usual. Newly covered individuals would receive the amount they would have received using the calculation method of their respective state, plus an additional $600 each week. Since these workers would not typically be eligible to receive unemployment benefits, the entire amount of benefits they receive will be funded by the federal government.

Newly covered individuals include those who have exhausted their unemployment benefits, independent contractors and self-employed individuals who are unemployed, partially employed, or unable or unavailable to work because:

• The individual has been diagnosed with COVID-19 or is experiencing symptoms of COVID-19 and seeking a medical diagnosis;

• A member of the individual’s household has been diagnosed with COVID-19;

• The individual is providing care for a family member or a member of the individual’s household who has been diagnosed with COVID-19;

• A child or other person in the household for which the individual has primary caregiving responsibility is unable to attend school or another facility that is closed as a direct result of COVID-19 public health emergency and such school or facility care is required for the individual to work;

• The individual is unable to reach their place of employment because of a quarantine imposed as a direct result of the COVID-19 public health emergency;

• The individual is unable to reach their place of employment because the individual has been advised by a health care provider to self-quarantine due to concerns related to COVID-19;

• The individual was scheduled to commence employment and does not have a job or is unable to reach the job as a direct result of the COVID-19 public health emergency;

• The individual has become the breadwinner or major support for a household because the head of the household has died as a direct result of COVID-19;

• The individual had to quit his or her job as a direct result of COVID-19;

• The individual’s place of employment is closed as a direct result of the COVID-19 public health emergency; or

• The individual meets any additional criteria established for unemployment assistance.

Newly covered individuals include those who are seeking part-time employment, do not have sufficient work history, or who otherwise would not qualify for regular unemployment benefits under state or federal law, provided they are unable to work due to one of the above-listed COVID-19 related reasons. In order to receive these benefits, newly covered individuals will be required to self-certify that they meet the above eligibility criteria and are otherwise able to work.

Workers who are able to work from home and those receiving paid sick leave or paid family leave (including under the recently enacted Families First Coronavirus Response Act) are ineligible to receive unemployment benefits under the CARES Act.

This expanded unemployment coverage will be available retroactively, for unemployment dating back to Jan. 27, 2020 and continuing through Dec. 31, 2020, subject to a cap of 39 total weeks. The U.S. Secretary of Labor will establish a process for making assistance available for the weeks of unemployment that eligible individuals experienced prior to enactment of the CARES Act.

E. Expanded eligibility for those actively seeking work

Similar to the expansion of benefits for individuals who are not typically eligible for benefits, the CARES Act provides an additional 13 weeks of eligibility to individuals who have exhausted their normal 26-week allotment of unemployment benefits and are actively seeking work. However, unlike the benefits available to independent contractors, self-employed individuals or certain others, benefits under this portion of the CARES Act are only available to applicants who are totally unemployed, which excludes those able to find part-time work.

To qualify for this additional benefit, an individual must:

• Have exhausted their rights to regular unemployment compensation from their state;

• Have no rights to unemployment compensation under state, federal, or Canadian law, or to compensation under any other federal program; and

• Be able to work, available to work, and actively seeking work.

• Importantly, being “actively seeking work” requires applicants to engage in a search for employment available in the labor market (while still considering their skills and capabilities) and maintain a list of employers they have contacted, including the method and date of contact. Additionally, when requested, applicants must provide these records of their job search to their state as verification that they are seeking employment.

The benefits available to individuals who are actively seeking work are the same as available under the other portions of the CARES Act, meaning they will receive a payment equal to unemployment compensation calculated using the methodology of their state, plus an additional $600 per week in additional benefits. Because these additional benefits —including those provided under the calculation of their state—would not typically be available for these additional 13 weeks, the full amount of benefits paid out to each eligible individual will be funded by the federal government. These benefits will be available from enactment of the CARES Act through Dec. 31, 2020.

Notably, due to the enactment of the CARES Act in late March, it is unlikely that recently unemployed workers will exhaust their 26 weeks of unemployment before the July 31 expiration of the generally available $600 Federal Pandemic Unemployment Compensation payments. Consequently, there may be a period of time after July 31, 2020 and before an unemployed individual exhausts his or her typical allotment of 26 weeks of unemployment, where the additional Federal Pandemic Unemployment Compensation is not available, until an individual reaches their 27th week of unemployment and this benefit becomes available again, provided they are actively seeking work.

F. Additional assistance for nonprofits

Finally, the CARES Act includes a provision to reimburse nonprofit organizations for one-half of their costs incurred to pay unemployment benefits between March 13, 2020 and Dec. 31, 2020.

Things to consider

When making decisions on response and impact of the COVID-19 pandemic on employees and operations, including decisions on workforce adjustments, furloughs and continuation of pay and other benefits, employers should consider these enhanced unemployment-benefit provisions, together with the business incentives provided under the CARES Act and other recently enacted state and federal legislation.

Paul J. Buehler, III is an associate attorney in the Albany office of Syracuse–based Bond, Schoeneck & King PLLC and Mallory A. Campbell is an associate attorney in the firm’s New York City office. This viewpoint article is drawn from an April 1 post on the firm’s New York Labor and Employment Law Report blog. Contact Buehler at pbuehler@bsk.com and contact Campbell at mcampbell@bsk.com

A Sign of the Times-April 6, 2020

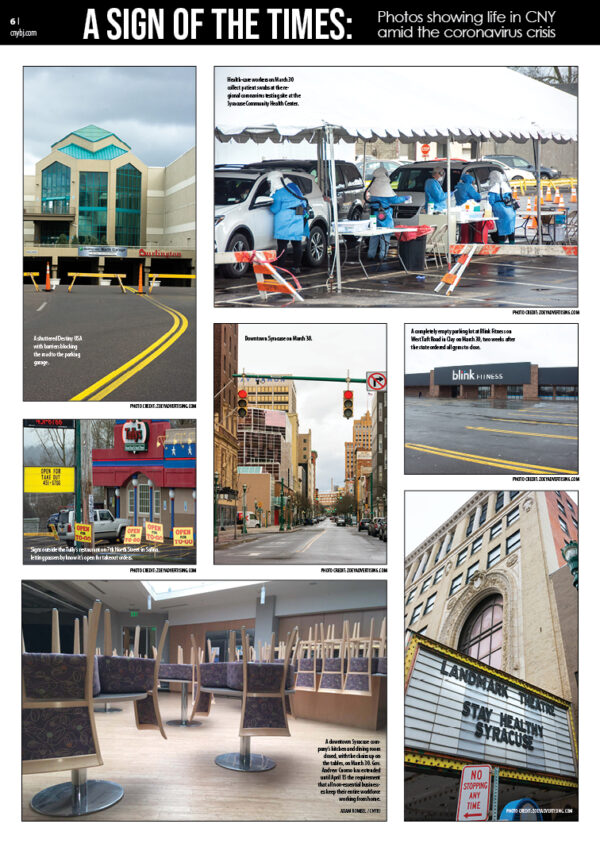

A SIGN OF THE TIMES:Photos showing life in CNY amid the coronavirus crisis

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

MACNY: State budget includes funding for apprentice program

DeWITT, N.Y. — The newly approved state budget includes $750,000 to sustain the manufacturers’ intermediary apprenticeship program (MIAP). That’s according to a Friday statement from

Click to View the 2020 Manufacturing Directory

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.