Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

Pathfinder to pay Q4 dividend of 10 cents in early February

OSWEGO, N.Y. — Pathfinder Bancorp, Inc. (NASDAQ: PBHC), the bank holding company of Pathfinder Bank, has declared a cash dividend of 10 cents per share of its common stock for the fourth quarter of 2025. The dividend is payable on Feb. 6 to all shareholders of record as of Jan. 16, according to a Dec. […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

OSWEGO, N.Y. — Pathfinder Bancorp, Inc. (NASDAQ: PBHC), the bank holding company of Pathfinder Bank, has declared a cash dividend of 10 cents per share of its common stock for the fourth quarter of 2025.

The dividend is payable on Feb. 6 to all shareholders of record as of Jan. 16, according to a Dec. 22 announcement from James A. Dowd, president and CEO of Pathfinder Bancorp.

At Pathfinder’s current stock price, the payment yields about 2.8 percent on an annual basis.

Oswego–based Pathfinder Bancorp had total assets of nearly $1.5 billion, as of Sept. 30. Pathfinder Bank has 11 full-service branches located in its market areas of Oswego and Onondaga counties and one limited-purpose office in Oneida County.

MOST names six new directors to its boards of directors

SYRACUSE, N.Y. — The Milton J. Rubenstein Museum of Science & Technology (MOST) announced it has elected six new directors to its two boards of directors for a three-year term beginning in 2026. The museum’s two boards are the board of trustees, which is tasked with overseeing the day-to-day operations, and the MOST Foundation board

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE, N.Y. — The Milton J. Rubenstein Museum of Science & Technology (MOST) announced it has elected six new directors to its two boards of directors for a three-year term beginning in 2026.

The museum’s two boards are the board of trustees, which is tasked with overseeing the day-to-day operations, and the MOST Foundation board of directors, which raises funds for the museum’s operating budget.

Joining the 2026 MOST board of trustees are:

• Kim Cherry Burnett, who is the lead of social impact and community engagement at Micron Technology, where she has developed strategic programs to broaden participation in STEM and to bridge the gap of STEM Education..

• arah Weber, who is interim assistant dean for advancement for Syracuse University’s School of Information Studies (iSchool), creating strategic direction for the school and its Alumni Engagement and Advancement (AEA) team. Weber previously served on the MOST Foundation board of directors for nine years, and is immediate past chair.

Joining the 2026 MOST Foundation board of directors are:

• shley Brody, who is the VP of transformation for the newly combined CAI Software, where she leads enterprise integration and strategic initiatives following the companies’ recent merger with Print ePS (now Graphic Communications, a division of CAI).

• alvin Corriders, who is the real estate project manager for the Allyn Foundation. He works with the team to advance social purpose real estate projects that provide a community benefit.

• Michael Frame, who is executive VP at MACNY, the Manufacturing Association, serving as second-in-command and a key member of MACNY’s executive leadership team responsible for all policy and strategic decision-making.

• teve McGee, who is a project manager at C&S Companies. He built his career in construction, overseeing projects that strengthen communities across Central New York, including efforts that support and advance industrial manufacturing.

The MOST is a hands-on science and technology museum located in historic Armory Square in downtown Syracuse. The MOST is focused on dynamic science education that engages learners of all ages and abilities. It features 35,000 square feet of interactive permanent and traveling exhibits plus the state-of-the-art National Grid ExploraDome theatre. The museum operates numerous STEM education programs and community outreach events throughout the year.

Chemung Financial pays Q4 2025 dividend of 34 cents

ELMIRA, N.Y. — Chemung Financial Corporation (NASDAQ: CHMG), parent company of Chemung Canal Trust Company, recently paid investors a quarterly cash dividend of 34 cents per share for the fourth quarter. Common-stock shareholders of record as of the close of business on Dec. 19, received the payment on Jan. 2. At the banking company’s current

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ELMIRA, N.Y. — Chemung Financial Corporation (NASDAQ: CHMG), parent company of Chemung Canal Trust Company, recently paid investors a quarterly cash dividend of 34 cents per share for the fourth quarter.

Common-stock shareholders of record as of the close of business on Dec. 19, received the payment on Jan. 2. At the banking company’s current stock price, the dividend yields between 2.4 percent and 2.5 percent.

Chemung Financial is a $2.7 billion financial-services holding company headquartered in Elmira. It operates 30 retail branches through Chemung Canal Trust Company, a full-service community bank with trust powers. Established in 1833, Chemung Canal Trust says it the oldest locally owned and managed community bank in New York state. Chemung Financial’s CFS Group, Inc. financial-services subsidiary offers non-traditional services including mutual funds, annuities, brokerage services, tax-preparation services, and insurance.

Chemung Financial reported net income of $7.8 million in the third quarter — its most recent reporting period. That was up 37 percent from $5.7 million in the year-ago quarter as its balance sheet and margins improved.

Mohawk Valley EDGE announces 2026 board leadership, new appointments

ROME, N.Y. — The Mohawk Valley EDGE board of directors recently announced its leadership team and new appointments for 2026. John Buffa, executive VP and chief lending officer at Adirondack Bank, will continue to serve as chairman of the EDGE board for another year, providing steady leadership and guidance, the organization stated in its Dec.

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

ROME, N.Y. — The Mohawk Valley EDGE board of directors recently announced its leadership team and new appointments for 2026.

John Buffa, executive VP and chief lending officer at Adirondack Bank, will continue to serve as chairman of the EDGE board for another year, providing steady leadership and guidance, the organization stated in its Dec. 17 announcement. Alicia Dicks, president and CEO of the Community Foundation of Herkimer & Oneida Counties, who currently serves as chair-elect, will assume the role of chair at the beginning of 2027.

Geno DeCondo, executive director of Upstate Caring Partners, will take on the role of treasurer, succeeding Pat Becher, outgoing executive director of the Mohawk Valley Water Authority, who will step down from the EDGE board.

MV EDGE Board Chairman Buffa expressed gratitude for Becher’s long-standing service. “Pat has been a cornerstone of the EDGE Board for over two decades. His expertise and leadership, both as President of the Mohawk Valley Water Authority and as an active board member, have facilitated countless projects that strengthened our region’s infrastructure and economic vitality. We wish him the very best in retirement,” Buffa said.

The new MV EDGE board members are:

• William LeCates, Mohawk Valley Health System, replacing Darlene Stromstad

• Mark Romano, NYSTEC, replacing Nick Alger

• Phil Tangorra, Mohawk Valley Water Authority, replacing Pat Becher

• Terri Grates-Day, Herkimer College, replacing Nick Laino

MV EDGE board committee leadership for 2026 includes:

• Ryan O’Shaughnessy, Revere Copper — audit committee chair

• Geno DeCondo, Upstate Caring Partners — finance committee chair

• Brian Anderson, National Grid — loan committee chair

• John Buffa, Adirondack Bank — executive & nominating committee chair

• Shawna Papale, Mohawk Valley EDGE, president (Non-Voting)

• Marc Barraco, Mohawk Valley EDGE, secretary, (Non-Voting)

A full listing of the EDGE board is available at: https://mvedge.org/about/#board-of-directors.

Oswego Health appoints Lewis as director of med surg

OSWEGO, N.Y. — Oswego Health recently announced it has promoted Nicole Lewis, RN, to director of medical-surgical services (med surg). Oswego Health said it takes great pride in recognizing talent and promoting from within, and Lewis exemplifies this commitment through her steady growth, clinical excellence, and dedication to patient care. Lewis joined Oswego Health in

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

OSWEGO, N.Y. — Oswego Health recently announced it has promoted Nicole Lewis, RN, to director of medical-surgical services (med surg).

Oswego Health said it takes great pride in recognizing talent and promoting from within, and Lewis exemplifies this commitment through her steady growth, clinical excellence, and dedication to patient care.

Lewis joined Oswego Health in 2018, as a graduate nurse after earning her bachelor’s degree in nursing from Utica College. She obtained her New York State registered nurse license in July 2018 and began her nursing career on the med surg unit, where she quickly established herself as a dependable and compassionate clinician. In addition to her nursing background, Lewis holds a bachelor’s degree in education from Syracuse University.

Over the years, Lewis advanced through several key roles on the med surg unit, including admission/discharge RN in December 2020 and senior RN in September 2021. In November 2022, she transitioned into the role of clinical practice advisor, further expanding her leadership responsibilities and influence across clinical practice, per the announcement. In May 2023, Oswego Health promoted Lewis to med surg assistant manager, where she played a key role in supporting staff, advancing quality initiatives, and strengthening day-to-day operations within the unit.

As director of med surg, Lewis will oversee clinical operations, staff development, and patient-care delivery within the department. Her deep understanding of the unit, combined with her collaborative leadership style, positions her well to continue advancing high-quality, patient-centered care, Oswego Health contends.

“Nicole has grown into an exceptional leader through hard work, integrity, and a genuine commitment to her team and patients,” Katie Pagliaroli, SVP, COO, and chief nursing officer at Oswego Health, said in the announcement. “She brings both clinical expertise and thoughtful leadership to everything she does. We are confident in her ability to lead the Med Surg department forward and are excited to see her thrive in this role.”

As a nonprofit health-care system established in 1881, Oswego Health is Oswego County’s largest private employer. It has more than 1,400 employees spread throughout its 18 locations, which includes the 132-bed community Oswego Hospital, a 32-bed psychiatric acute-care facility with multiple outpatient behavioral-health service locations; The Manor at Seneca Hill, a 120-bed skilled-nursing facility; and Springside at Seneca Hill, an independent retirement community.

TC3 inks new transfer agreement with Hobart

DRYDEN, N.Y. — Tompkins Cortland Community College (TC3) has agreed on a new transfer agreement with Hobart and William Smith Colleges (HWS) in Geneva. It provides TC3 graduates guaranteed acceptance into bachelor’s degree programs at HWS, along with scholarship funding, according to a TC3 announcement. Amy Kremenek, president of Tompkins Cortland Community College, and Sarah

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

DRYDEN, N.Y. — Tompkins Cortland Community College (TC3) has agreed on a new transfer agreement with Hobart and William Smith Colleges (HWS) in Geneva.

It provides TC3 graduates guaranteed acceptance into bachelor’s degree programs at HWS, along with scholarship funding, according to a TC3 announcement.

Amy Kremenek, president of Tompkins Cortland Community College, and Sarah Kirk, provost of Hobart and William Smith Colleges, signed the pact during a Dec. 18 ceremony at the TC3 campus in Dryden in Tompkins County.

“This agreement is significant for TC3 because for many of our students, guaranteed acceptance with full junior status into a highly regarded institution such as Hobart and William Smith, right here in the Finger Lakes, while also receiving a very generous scholarship, is a tremendous, life-changing opportunity,” Kremenek contended in the announcement. “I’m thrilled for our students, and grateful for the efforts of everyone at TC3 and Hobart and William Smith to forge this partnership to the benefit of our entire community.”

The agreement covers all TC3 students, regardless of major, the school said. Students who complete a degree at TC3 with a GPA (grade-point average) of 3.0 or higher will be guaranteed acceptance into HWS along with a guaranteed scholarship of at least $30,500.

“This agreement reflects our shared commitment to expanding opportunity and supporting student success,” Mark Gearan, president of Hobart and William Smith Colleges, said. “We are proud to partner with Tompkins Cortland Community College to create a seamless pathway to HWS, where talented students can continue their academic journey, engage deeply in our community and achieve their career goals.”

New York home sales slide more than 9 percent in November

ALBANY, N.Y. — Realtors in New York state sold 8,207 previously owned homes in November 2025, down 9.1 percent from the 9,030 homes they sold in November 2024. At the same time, pending sales fell less than 1 percent, pointing to possible narrower declines in closed home sales in the next couple of months, according

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

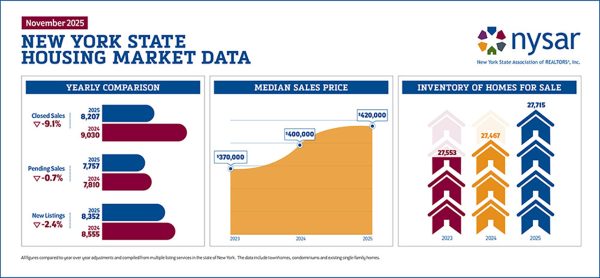

ALBANY, N.Y. — Realtors in New York state sold 8,207 previously owned homes in November 2025, down 9.1 percent from the 9,030 homes they sold in November 2024.

At the same time, pending sales fell less than 1 percent, pointing to possible narrower declines in closed home sales in the next couple of months, according to the November housing report issued on Dec. 19 by the New York State Association of Realtors (NYSAR).

“Home sales across New York State slowed in November, as closed sales declined and new listings and pending sales dipped slightly, while home prices continued to post strong gains,” NYSAR said to open its announcement about the November housing report.

Mortgage rates continued to hold steady in November. NYSAR cited Freddie Mac as indicating the average rate on a 30-year, fixed-rate mortgage was 6.24 percent in November, down slightly from 6.25 percent in October. In comparison, November’s average rate was down more than one-half of a percentage point from the average of 6.81 percent in November 2024.

Freddie Mac is the more common way of referring to the Virginia–based Federal Home Loan Mortgage Corporation.

New York sales data

New listings of existing homes for sale in the Empire State fell 2.4 percent to 8,352 in November 2025 from 8,555 a year earlier.

Statewide housing inventory reached 27,715 units this past November, up 0.9 percent from November 2024’s total of 27,467 available homes.

Pending sales in New York totaled 7,757 in November 2025, a decrease of 0.7 percent from the 7,810 pending sales in the same month a year prior, according to the NYSAR data.

The months’ supply of homes for sale at the end of November 2025 stood at a 3.1 month supply, unchanged compared to the end of November 2024, per NYSAR’s announcement. A 6 month to 6.5-month supply is considered a balanced market, the association stipulates.

Even though closed home sales dipped, home prices continued to rise in New York. The median home-sales price was $420,000 this past November, up 5 percent from the $400,000 price tag in November 2024.

All home-sales data is compiled from multiple-listing services in New York, and it includes townhomes and condominiums in addition to existing single-family homes, according to NYSAR.

OPINION: Extend the Spirit Of Giving Into the New Year

Each holiday season provides the opportunity for communities to come together for the greater good, and this past year was no different. While many may feel overwhelmed checking items off their holiday shopping lists, the spirit of giving consistently rises above the rush to buy more and do more. Looking into this new year doesn’t

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Each holiday season provides the opportunity for communities to come together for the greater good, and this past year was no different. While many may feel overwhelmed checking items off their holiday shopping lists, the spirit of giving consistently rises above the rush to buy more and do more. Looking into this new year doesn’t mean our sense of generosity should disappear. In fact, the winter months are often when people need support the most. It is my hope that we continue to show up for others with that same heart for service.

Right here in Oswego, I was fortunate to be a part of our annual “Stockings for Veterans” and “Tithe My Shoes” charity drives. Through the Stockings for Veterans initiative, residents donated essential personal-care items to ensure local veterans felt supported and remembered during the holiday season. It was a tremendous success —hundreds of items were collected, and none of it would be possible without the generosity of our community partners, including the Oswego County Clerk’s Office, Mexico Central School District, Town of Sterling, Central Square Library, and the Department of Motor Vehicles.

Beyond this effort, the Tithe My Shoes initiative once again delivered meaningful support to individuals and families in need. The annual drive, led by Millard (Mudd) Murphy, former mayor of Central Square and executive director of the Oswego County Conference of Mayors, brought together volunteers and donors from across the region with a shared commitment to helping others. Each year, Ralph Rotella’s Discount Shoe Repair plays an essential role in restoring and repairing the donated footwear. This past year alone, the initiative collected a record-breaking 45,201 pairs of shoes, including more than 1,300 pairs from Oswego County. Giving may be simple, but its impact is profound, and witnessing this level of generosity serves as a powerful reminder of the good that exists across our state and why I am proud to call New York home.

Now that we have moved beyond the holiday season, it is critical that we carry this momentum forward — because the need is real and ongoing. A 2022 report showed that poverty rates in New York state continue to surpass the national average. The need for support does not end when the decorations come down, and even the smallest act of giving can make a meaningful difference in someone’s life. Whether it’s donating a single item, volunteering time, or simply checking in on a neighbor, no contribution is too big or too small when it comes from a place of compassion.

Holidays are often hectic, and it’s easy to overlook opportunities to give. But when we commit to showing up for one another year-round, we strengthen the bonds that make our neighborhoods and our state so special. This shared dedication to kindness and service defines who we are, builds stronger and more resilient communities, and helps ensure no one is left behind — long after the holiday season has passed.

William (Will) A. Barclay, 57, Republican, is the New York Assembly minority leader and represents the 120th New York Assembly District, which encompasses all of Oswego County, as well as parts of Jefferson and Cayuga counties.

OPINION: Participating In Civic Life is Our Duty as Citizens

It’s a fundamental premise of American democracy that our elected representatives will do what we expect them to do. That doesn’t mean we can dictate every action they take. Overall, however, their job is to represent their constituents, not anyone else. But here’s the catch. Politicians can only do what we want if they know

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

It’s a fundamental premise of American democracy that our elected representatives will do what we expect them to do. That doesn’t mean we can dictate every action they take. Overall, however, their job is to represent their constituents, not anyone else.

But here’s the catch. Politicians can only do what we want if they know what that is. Representative government is only effective when we take seriously the duty of citizenship. That means we need to inform ourselves, articulate our views, and make clear what we value.

I have always been impressed that many Americans want to do this. We volunteer in our communities, vote in elections, and contribute to charities. Many of us attend government meetings, write letters to our representatives. and respectfully share our views with friends and strangers. This engagement is at the heart of our democracy. It’s what has made America a great nation and made our system of government a model for the world.

One of the great pleasures of my tenure in Congress was seeing how ordinary people could make a difference in their small towns and rural communities. In my southeastern Indiana district, residents often put a great deal of effort into improving infrastructure. Farmers took the lead in safeguarding the local watershed. Nurses, doctors, and patients collaborated to strengthen health care. These efforts were usually nonpartisan and were led by people who knew the community. They didn’t always succeed, but often they energized supporters and produced positive results.

They were a good example of public virtue, the idea that we have a duty to put the common good ahead of their own self-interest. America’s founders wrote often about public virtue and believed it was essential for citizens, not just for our leaders. Practicing citizenship can take work, however, and it’s getting harder. Most people, understandably, are focused on earning a living and caring for their families. They may not have time for much else.

Even being an informed voter, a cornerstone of citizenship, has become challenging in this era of partisan news, pervasive social media, and online rumors. Paradoxically, as news and opinion sources proliferate, it can be harder to find information that’s reliable. It’s gotten so bad that the fact-checking organization Politifact dropped its tradition of identifying a “lie of the year” and declared 2025 to be “the year of the lie.” Being a citizen also means understanding how government operates, and it’s concerning that many Americans seem uninformed about such basics as the three branches of government and the workings of Congress.

As I suggested, the duty of citizenship includes making our views known. If our representatives don’t hear from us, they are unlikely to do what we want. It may seem that politicians only listen to party insiders and lobbyists, or that they only hear those with the loudest voices or the most money. I can assure you that’s not the case.

You can see this in a recent example from Indiana. State lawmakers came under intense pressure from President Donald Trump to redraw congressional districts to give his party an advantage in the 2026 elections. The legislature is overwhelmingly Republican, but it rejected the idea. State legislators listened to the voters, who didn’t want mid-decade redistricting.

Those legislators and the constituents who contacted them were demonstrating public virtue, as were the local leaders whose efforts I described earlier in this column. They put mutual interest ahead of partisanship, just as the founders hoped that future Americans would do.

Engaging in civic life may seem like a burden, but it’s our duty as citizens. Active citizenship is essential for our system of government to work. Without it, there is no way we will find the public-spirited leaders that we need.

Lee Hamilton, 94, is a senior advisor for the Indiana University (IU) Center on Representative Government, distinguished scholar at the IU Hamilton Lugar School of Global and International Studies, and professor of practice at the IU O’Neill School of Public and Environmental Affairs. Hamilton, a Democrat, was a member of the U.S. House of Representatives for 34 years (1965-1999), representing a district in south-central Indiana.

Delta Air Lines reverses course, will keep offering flights at Greater Binghamton Airport

MAINE, N.Y. — After announcing plans to eliminate air service at the Greater Binghamton Airport (BGM), Delta Air Lines now says the flights will continue.

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.