The momentum behind AI adoption and investment continues to grow, according to Citizens Financial Group’s third annual AI Trends in Financial Management Survey. It found that 82 percent of middle-market companies say they plan to boost AI spending over the next five years — up from 58 percent in 2023 and 69 percent in 2024. […]

The momentum behind AI adoption and investment continues to grow, according to Citizens Financial Group’s third annual AI Trends in Financial Management Survey.

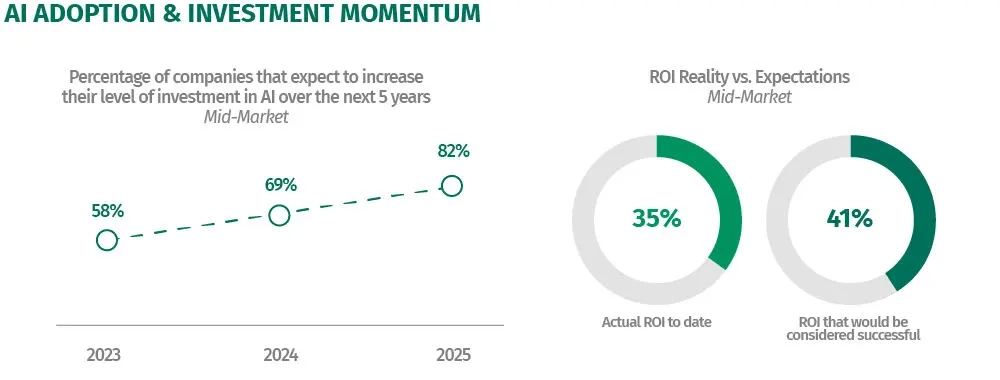

It found that 82 percent of middle-market companies say they plan to boost AI spending over the next five years — up from 58 percent in 2023 and 69 percent in 2024.

The growing enthusiasm is supported by tangible efficiency gains and measurable returns. The survey found 61 percent of middle market CFOs reporting that AI has made financial processes easier, an increase from prior years. On average, businesses are seeing a 35 percent return on investment, closing in on the 41 percent threshold that CFOs say would define success.

Investing in AI capabilities also makes strategic sense for companies considering a future sale. The survey found that private-equity firms are increasingly prioritizing AI when evaluating portfolio companies. Ninety-seven percent say a successful AI strategy is an attractive trait in potential acquisitions.

“Artificial intelligence isn’t just a buzzword, it’s a transformative technology that is delivering measurable results and shaping valuations,” Mark Lehmann, vice chair of Citizens Commercial Bank, said in the survey report. “Private equity firms are actively seeking companies with strong AI strategies. Businesses must carefully consider how to navigate this transition so they can maximize their value and attract the right partners.”

The Citizens survey of 134 CFOs at middle-market businesses (those generating $50 million to $1 billion in annual revenue) and 153 financial leaders at PE firms (fund size less than $1.5 billion) was conducted in October 2025 and focused on how companies and private-equity firms are thinking about AI processes and utilizing the technology to increase efficiencies within their organizations.

More survey results are available at: https://www.citizensbank.com/corporate-finance/insights/ai-trends-financial-management-2026.aspx

Citizens Financial Group (NYSE: CFG) is one of the nation’s oldest and largest financial institutions, with $223 billion in assets as of Sept. 30, 2025. Headquartered in Providence, Rhode Island, Citizens offers a range of retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions. Citizens operates 1,000 branches in 14 states and the District of Columbia. That includes 10 branches in the 16-county Central New York region, where it has a nearly 2.1 percent share of total market deposits, according to CNYBJ Research, citing FDIC data.