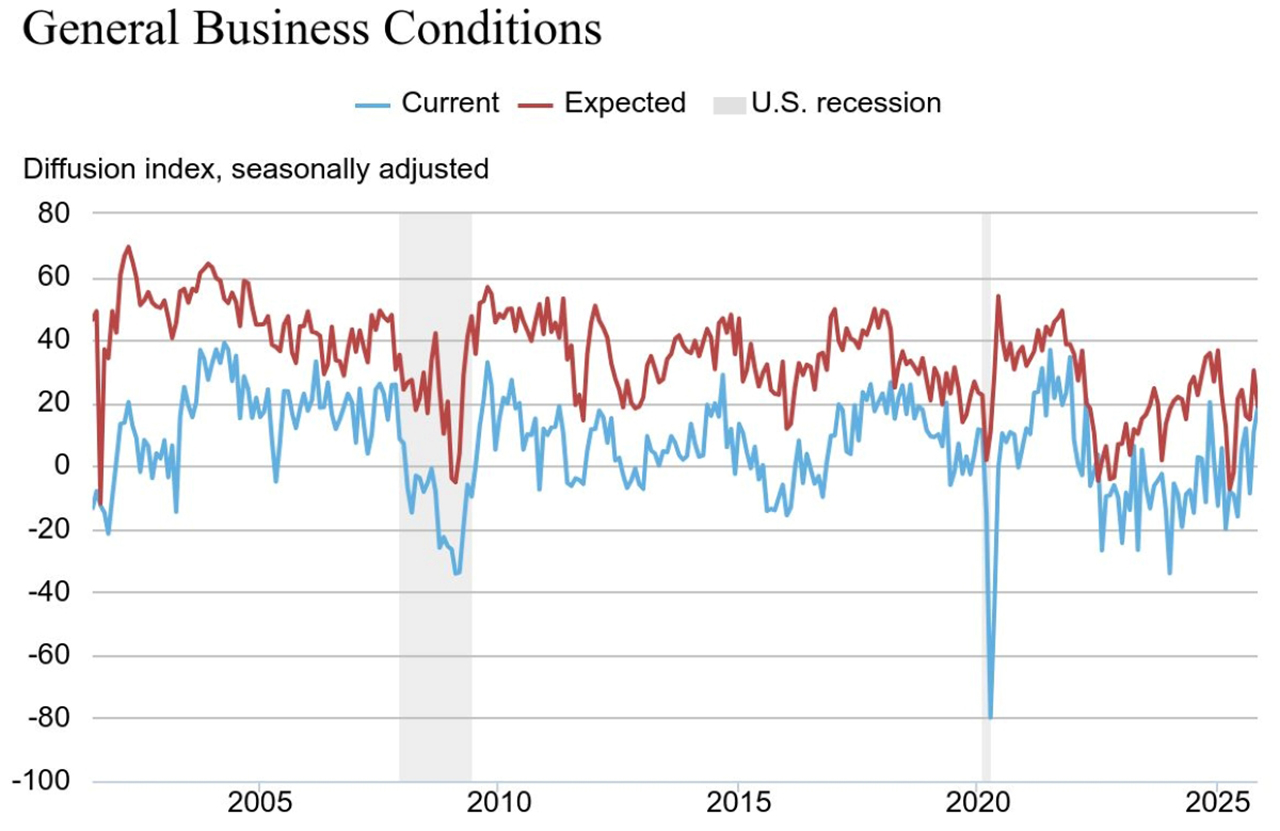

Respondents to the monthly Empire State Manufacturing Survey indicated gains in both new orders and shipments, and the survey’s general-business conditions index rose 8 points to 18.7 in November. The reading represented its highest since November 2024, and the fourth positive index number in the past five months. The index had climbed 19 points to […]

Already an Subcriber? Log in

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year's worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Respondents to the monthly Empire State Manufacturing Survey indicated gains in both new orders and shipments, and the survey’s general-business conditions index rose 8 points to 18.7 in November.

The reading represented its highest since November 2024, and the fourth positive index number in the past five months.

The index had climbed 19 points to 10.7 in October, after dropping 21 points to -8.7 in September.

Based on manufacturing firms responding to the survey, the November reading indicates business activity “increased at a solid pace” in New York state, the Federal Reserve Bank of New York said in its Nov. 17 report.

A positive index number indicates expansion or growth in manufacturing activity, while a negative reading on the index indicates a decline in the sector.

The November survey found new orders and shipments increased “significantly,” the New York Fed said. Supply availability “worsened somewhat,” and inventories expanded.

Firms expect conditions to improve in the months ahead, though firms were not as optimistic as last month.

The new-orders index rose 12 points to 15.9 and the shipments index increased 2 points to 16.8, pointing to “significant” gains in both orders and shipments.

After three months of negative readings, the inventories index rose 8 points to 6.7. The delivery-times index edged up to 7.7, and the supply-availability index ticked down to -11.5, continuing the trend of somewhat longer delivery times and worsening supply availability, the New York Fed said.

The index for number of employees ticked up to 6.6, while the average-workweek index rose to a multi-year high of 7.7, suggesting a modest increase in employment levels and hours worked.

Both price indexes declined slightly but remained elevated: the prices-paid index dropped 3 points to 49.0, and the prices-received index also dipped 3 points to 24.0.

Firms still expect conditions to improve in the months ahead, but the index for future general business conditions declined to 19.1, down 11 points from its recent high in October.

New orders and shipments are expected to increase, and supply availability is expected to be little changed. Firms continue to anticipate significant price increases ahead. Capital spending plans grew, with the capital-expenditures index rising 14 points to 11.5, the New York Fed said.

The New York Fed distributes the Empire State Manufacturing Survey on the first day of each month to the same pool of about 200 manufacturing executives in New York. On average, about 100 executives return responses.

Survey details

Survey details