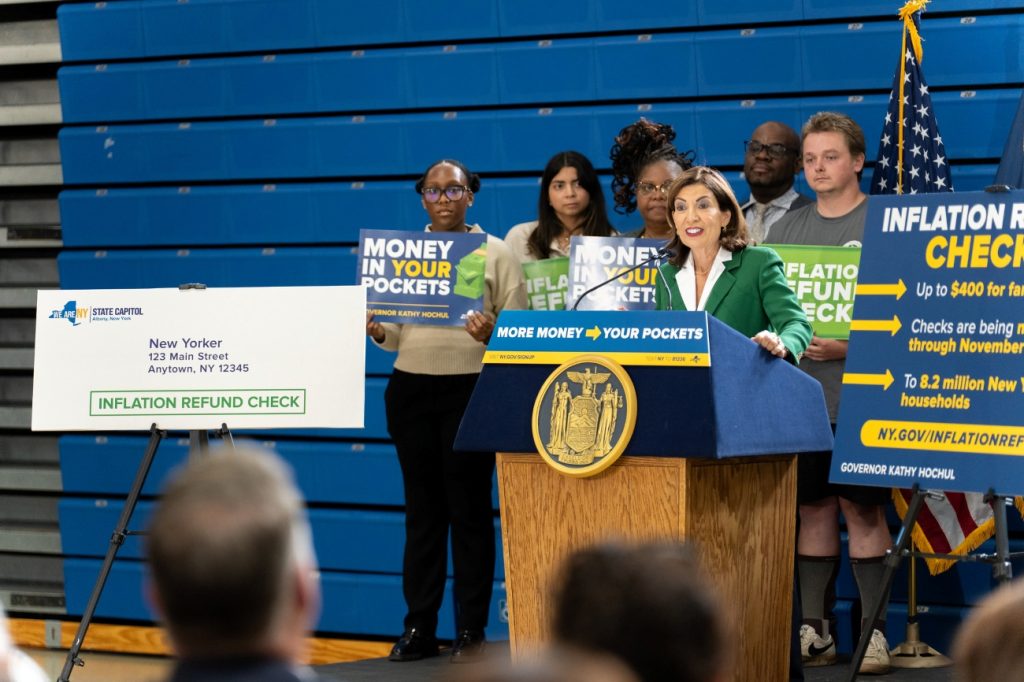

ALBANY, N.Y. — New York State is now sending its first-ever inflation-refund checks of up to $400 to 8.2 million households statewide.

As of Friday, the state is mailing checks directly to eligible New Yorkers, with deliveries to continue throughout October and November, Gov. Kathy Hochul announced on Friday.

Residents don’t need to apply, sign up, or do anything to receive a check.

(Sponsored)

National Labor Relations Board Bans “Captive Audience” Meetings

Since 1948, the National Labor Relations Board respected an employer’s right to hold mandatory paid employee meetings during company time so that its views about unionization could be directly communicated

Close the Skills Gap: Build Your Workforce with MACNY Registered Apprenticeship Program

In today’s competitive labor market, finding qualified candidates through traditional hiring methods has never been more challenging. As industries evolve and workforce demands shift, employers are facing a growing skills

Hochul secured and enacted this initiative as part of her “ongoing commitment to putting money back in the pockets of New Yorkers,” her office said.

“Starting today, we’re sending inflation refund checks to over 8 million New Yorkers because it’s simple — this is your money and we’re putting it back in your pockets,” Hochul said in Friday’s announcement.

Her office went on to explain that inflation has driven the costs of everyday necessities higher and as a result, the state’s revenue from the collection of sales tax has also increased. Hochul believes that money should be put back in the pockets of New York families as an inflation refund.

Who’s eligible

You are eligible for an inflation refund check if, for tax year 2023, you filed form IT-201, the New York State resident income tax return; reported income within the qualifying thresholds below; and were not claimed as a dependent on another taxpayer’s return.

Joint tax filers with income up to $150,000 will receive a $400 check, and joint tax filers with income over $150,000 but no greater than $300,000 will receive a $300 check.

Single tax filers with income up to $75,000 will receive a $200 check, and single tax filers with incomes over $75,000 but no greater than $150,000 will receive a $150 check.

The state didn’t place any age restrictions on this process. If you filed a tax return, are below the income thresholds, and no one else claimed you as a dependent, you will receive a check, Hochul’s office said.