Respondents to the monthly Empire State Manufacturing Survey reported increases in new orders and shipments, helping to boost the survey’s general-business conditions index by 11 points to 7.7 in January. Based on firms responding to the survey, January’s positive index reading indicates business activity “rose modestly” in New York state, the Federal Reserve Bank of […]

Respondents to the monthly Empire State Manufacturing Survey reported increases in new orders and shipments, helping to boost the survey’s general-business conditions index by 11 points to 7.7 in January.

Based on firms responding to the survey, January’s positive index reading indicates business activity “rose modestly” in New York state, the Federal Reserve Bank of New York said in its Jan. 15 announcement.

A positive reading indicates expansion or growth in manufacturing activity, while a negative index number shows a decline in the sector.

The January Empire State survey found new orders increased, and shipments grew at a “solid pace,” the New York Fed said. Delivery times were unchanged and inventories edged down, while supply availability worsened slightly.

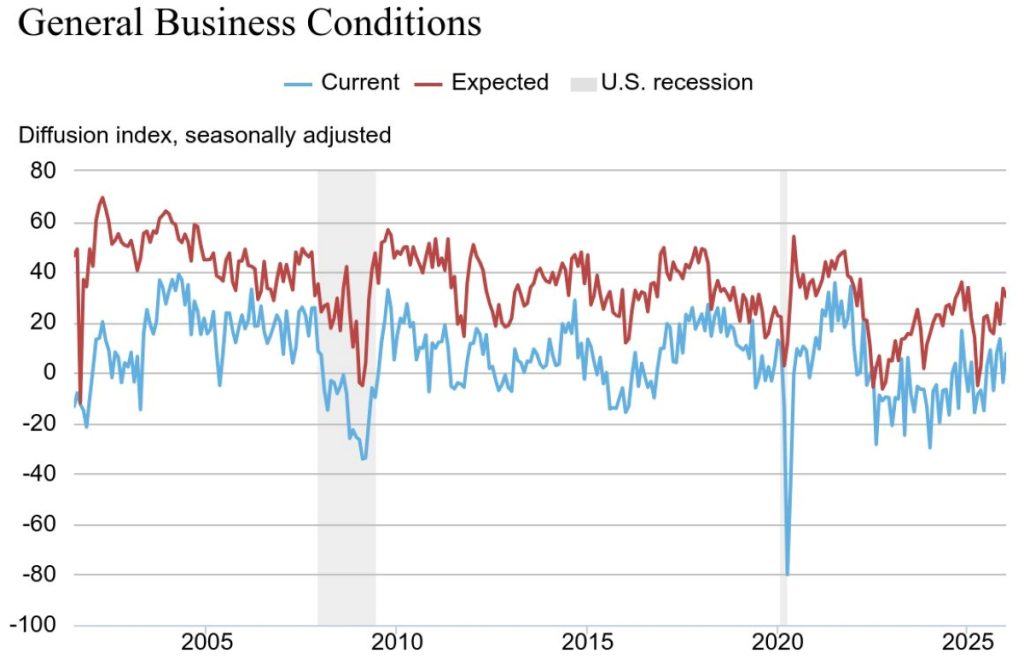

Manufacturing firms remained “fairly optimistic” about the outlook, with half expecting conditions to improve over the next six months.

Empire State Survey details

New orders and shipments increased, with the new-orders index rising 8 points to 6.6 and the shipments index climbing 21 points to 16.3, its highest level in over a year. Unfilled orders decreased, inventories edged down, and delivery times were unchanged. The supply-availability index came in at -4.1, suggesting supply availability was “slightly worse” than last month, the New York Fed said.

The index for number of employees fell 17 points to -9.0, its lowest reading in two years, while the average-workweek index slipped 8 points to -5.4, suggesting a decrease both in employment levels and in hours worked.

The prices-paid index held steady at 42.8, indicating input-price increases remained elevated, and the prices-received index dropped 11 points to 14.4, its lowest level since February 2025, pointing to slowing in selling-price increases.

New York manufacturing firms remained “fairly optimistic” about the outlook. The index for future business conditions came in at 30.3, with about half of respondents expecting conditions to improve over the next six months. New orders and shipments are expected to increase, and supply availability is anticipated to be unchanged.

Firms continue to foresee “significant” price increases, “though somewhat less so than in recent months,” the New York Fed said. The capital-expenditures index rose 3 points to 10.3, pointing to ongoing modest capital-spending plans.

The New York Fed distributes the Empire State Manufacturing Survey on the first day of each month to the same pool of about 200 manufacturing executives in New York. On average, about 100 executives return responses.