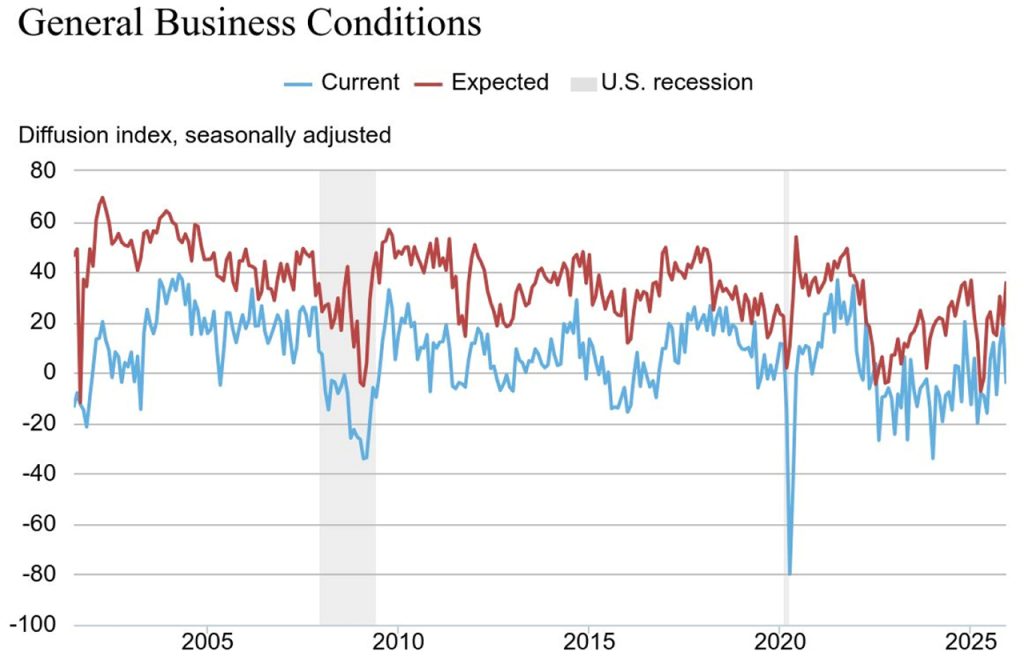

Respondents to the monthly Empire State Manufacturing Survey indicated unexpected contraction in the manufacturing sector with the general-business conditions index plunging 23 points to -3.9 in December. This breaks a run of several strong months, as the index had climbed 8 points to 18.7 in November, its fourth positive reading in the past five months […]

Already an Subcriber? Log in

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year's worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Respondents to the monthly Empire State Manufacturing Survey indicated unexpected contraction in the manufacturing sector with the general-business conditions index plunging 23 points to -3.9 in December.

This breaks a run of several strong months, as the index had climbed 8 points to 18.7 in November, its fourth positive reading in the past five months and highest in a year.

Based on firms responding to the survey, the December reading indicates business activity “declined slightly” in New York state, the Federal Reserve Bank of New York said in its Dec. 15 report. The consensus expectations of analysts was a December index number of 10.0, according to Seeking Alpha.

A negative reading on the index indicates a decline in the sector, while a positive index number points to expansion or growth in manufacturing activity.

The December survey found new orders held steady while shipments decreased modestly, the New York Fed said. Delivery times quickened, unfilled orders declined, and supply availability worsened.

However, going forward, New York manufacturing firms grew “increasingly optimistic” and expect conditions to improve in the months ahead.