Unmarried women had lower levels of retirement confidence than their married counterparts and were more likely to have fewer resources and be less prepared for retirement. That’s according to a new study that the Washington, D.C.–based Employee Benefit Research Institute (EBRI) conducted. The EBRI is a private, nonpartisan, nonprofit research institute based in Washington, D.C., that […]

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year's worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

Unmarried women had lower levels of retirement confidence than their married counterparts and were more likely to have fewer resources and be less prepared for retirement.

Unmarried women had lower levels of retirement confidence than their married counterparts and were more likely to have fewer resources and be less prepared for retirement.

That’s according to a new study that the Washington, D.C.–based Employee Benefit Research Institute (EBRI) conducted.

The EBRI is a private, nonpartisan, nonprofit research institute based in Washington, D.C., that focuses on health, savings, retirement, and financial security issues.

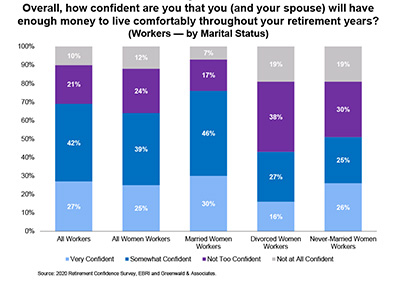

The study finds 76 percent of married women express being very or somewhat confident they will have enough money to live comfortably throughout their retirement years, with only 43 percent of divorced women workers and 51 percent of never-married women workers sharing this confidence.

EBRI and Greenwald & Associates recently conducted the Retirement Confidence Survey (RCS) to measure attitudes toward, preparations for, and understanding of the various issues and products for retirement by American workers and retirees.

The RCS is now in its 30th year, EBRI said. Greenwald & Associates is a Washington, D.C.–based public-opinion and market-research firm.

The report released June 8 titled, “Retirement Confidence Survey: Attitudes Toward Retirement by Women of Different Marital Statuses” examines the RCS results for women, since they face “particular challenges” in preparing for retirement — from “lower average earnings to higher likelihoods of taking time out of the labor force for raising children.”

Furthermore, women have longer life expectancies and are often younger than their spouses, “potentially” leaving them with more years in retirement. This study explores RCS findings across the array of possible marital statuses of workers and retirees, and their perceived and actual retirement prospects.

Other retirement aspects

Divorced and never-married women workers also had lower confidence in other aspects related to retirement.

In particular, 43 percent of never-married women workers were very or somewhat confident in knowing how much money they need to save by retirement to live comfortably in retirement compared with 47 percent of divorced women workers and 69 percent of married women workers.

When it came to feeling confident in choosing the right retirement products and investments for their situation, just 44 percent of divorced women workers were confident compared to 48 percent of never- married women workers and 69 percent of married women workers.

Given the disparities in retirement confidence among women of differing marital statuses, it “isn’t surprising” that the level of assets held by them is “substantially” different, EBRI said.

The divorced women workers were “markedly” more likely to have fewer assets, as 72 percent had less than $25,000 in assets compared to 54 percent of never-married women workers and 31 percent for married women workers.

Furthermore, debt was more likely to be a problem for divorced and never-married women workers, where 74 percent and 67 percent, respectively, considered debt a problem compared with 56 percent of married women.

Retirees

The survey also focuses on retirees and paints a “particularly grim” picture of divorced and widowed women retirees compared with married women retirees. One in 10 married women retirees has less than $1,000 in savings and investments, but more than half of divorced women retirees and nearly a third of widowed women retirees have such a minimal amount.

To lower the chances of this type of outcome, Craig Copeland, senior research associate at EBRI and author of the report, said the survey results indicate that women in differing situations could benefit from receiving more “specialized” information and assistance with retirement preparations and everyday financial issues.

“The approaches currently being used do not appear to be as effective for unmarried women workers, likely due to the resulting financial and life-circumstance upheaval of a divorce or death of a spouse. Employers may want to develop new targeted messages, methods, or materials to better reach these groups, in order to increase the chances of unmarried women having a financially successful retirement. Help from the financial sector in general could also be beneficial, as many of the unmarried women need help outside of employment,” said Copeland.